Where Are the “Smart Money” Flows Heading in 2026? HTX Uses a Smarter Asset Strategy to Consistently Outperform Mainstream Exchanges of Comparable Scale

TechFlow Selected TechFlow Selected

Where Are the “Smart Money” Flows Heading in 2026? HTX Uses a Smarter Asset Strategy to Consistently Outperform Mainstream Exchanges of Comparable Scale

Listing tokens wisely means consistently generating tangible wealth effects for users across three dimensions: timing, judgment, and risk.

In the cryptocurrency market, “listing a token” is never a simple task.

It is both a test of trend judgment and a comprehensive balancing act involving risk control, time efficiency, and trade-offs between user interests. In 2025—a year marked by high market volatility and pronounced sectoral divergence—HTX delivered a clear, analyzable framework for token listings: be smart about listings—consistently generating realizable wealth effects for users across three dimensions: time, judgment, and risk.

First, the results: In 2025, HTX outperformed the broader market on “participable upside.”

Reviewing HTX’s new asset performance in 2025 reveals several standout metrics: HTX listed a total of 166 new assets, spanning core sectors including AI, Memes, Layer-1/Layer-2 protocols, BSC, Real-World Assets (RWA), stablecoins, and DeFi; 96 of these assets surged over 100% post-listing; nine gained over 1,000%; and the highest gain came from PIPPIN, which rose as much as 9,500%.

Yet HTX’s more distinctive competitive edge lies not in “peak gains,” but in the accessible time window available to ordinary users.

In 2025, among all newly listed assets on HTX, 17.47% achieved gains exceeding 20% within seven days—ranking first among mainstream exchanges of comparable scale. This metric reflects not just isolated outliers, but rather HTX’s consistent ability to generate positive early price momentum for newly listed assets.

How was this achieved? The answer lies in the “time dimension.”

A core principle underpinning HTX’s long-standing asset strategy is unequivocal: In the crypto market, time itself is return.

AI Sector: Anticipating the trend by an entire cycle

At the start of 2025, AI Agents and DeFAI projects began gaining traction en masse. Between January 18 and January 28—just 11 days—HTX launched 11 AI-related projects: NEUR, BUZZ, AVAAI, PIPPIN, ARC, GAMEBASE, AI16Z, GRIFFAIN, ELIZAOS, SWARMS, and DEGENAI. With the exception of AI16Z, nearly all were either first-time listings or extremely early listings.

While the broader market was still debating whether AI would become the dominant narrative, HTX had already completed its structural positioning—enabling users to establish positions before the trend fully materialized, rather than chasing prices at peak emotional intensity.

Listing ahead of mainstream exchanges: Wealth effects are not predicted—they’re secured through early positioning

In 2025, HTX achieved early positioning across multiple core sectors—listing numerous assets well before mainstream market consensus formed. This “early positioning” capability granted HTX a decisive time advantage across several structural opportunities.

HTX listed 18 assets ahead of other major exchanges. For example, PLUME, BANK, BIGTIME, USD1, and TRUMP were all made available for spot trading on HTX prior to widespread market attention—giving users significantly more time for price discovery and participation. By the time industry consensus solidified, HTX users had already established positions—not chasing emotional peaks.

This sharp judgment in timely identifying high-quality assets within promising sectors is especially evident in HTX’s BSC listings.

- DONKEY: Listed before the market had coalesced around broad discussion, later attracting capital inflows and surging up to 6,811%;

- M: Strategically positioned in an emerging structural sector; followed by sustained promotional efforts, achieving a phased gain of 4,186%;

- ASTER: Became the first centralized exchange (CEX) globally to list the asset, subsequently gaining wider market recognition and rising 340%;

- Binance Life: One of the earliest CEXs to support Chinese-language Memes—listed before the narrative went viral, then rose 438%.

These early listings were not merely about “racing to list first.” Rather, they were grounded in continuous monitoring of on-chain data, community activity, and capital flow trends. Being early in time is, at its core, a manifestation of acute judgment. In crypto markets, price surges are never sudden—they are rewards for foresight and early positioning.

True “smartness” means shielding users from wrong timing.

A “smart” listing strategy does not mean launching every project immediately. Waiting—or delaying listing—is also a responsible strategy for users. Some projects may not be suitable for user participation on Day One, yet remain worthy of attention at the right moment. For instance, when large batches of VC tokens unlock, initial sell pressure tends to be high. HTX anticipates the confluence of elevated selling pressure and short-selling sentiment, opting instead to delay listing until after the market completes turnover and confirms the project’s resilience. Such delayed listings have frequently delivered strong gains—validating the correctness of this approach.

Start of 2026: What are “smart money” investors doing on HTX before Chinese New Year?

The period before Chinese New Year has historically been the most revealing window into authentic capital behavior. Current market data shows experienced capital is already establishing early positions on HTX—with highly discernible characteristics: preference for structurally sound assets that are early-stage yet validated; preference for projects where risks have already been released but value remains underappreciated; avoidance of highly uncertain, purely emotion-driven short-term speculation.

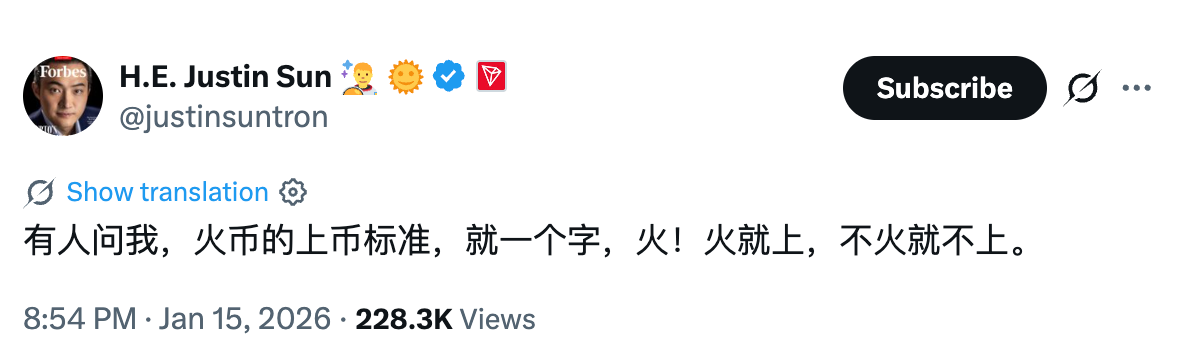

Looking back at 2025, Sun Yuchen, Global Advisor to HTX, summarized the platform’s underlying asset strategy as “list whatever is hot”—a principle that guided HTX’s entire annual asset strategy. Over the past year, HTX’s asset strategy consistently revolved around three core questions:

First, is it early enough? True “hotness” often emerges *before* consensus forms. By proactively tracking on-chain data, community engagement, and capital structure, HTX positions itself ahead of trend explosions—shifting the “hotness” timeline forward.

Second, is the judgment accurate? Among trending themes, HTX selects only those with sustainable fundamentals—avoiding purely emotion-driven or structurally imbalanced assets—and binds “hotness” to longevity.

Third, is it user-centric? The ultimate goal of listing is not traffic-chasing, but creating tangible, actionable participation windows. Through early positioning, phased observation, and risk filtering, HTX transforms “hotness” into real wealth effects.

Data, timelines, and demonstrable wealth effects have already provided the answers. As we enter 2026, this logic will be further strengthened and validated. On one hand, HTX will continue adhering to its “value reversion” strategy—tightening listing criteria and prioritizing assets with genuine revenue streams, regulatory compliance foundations, and sustainable business models, thereby anchoring “hotness” in fundamental value. On the other hand, HTX will retain its market sensitivity—“listing whatever is hot”—with focused emphasis on high-conviction sectors such as RWA, prediction markets, perpetual DEX infrastructure, and mobile PayFi.

2026 has begun. As the next market cycle unfolds, HTX is deploying a more mature, disciplined, and intelligent asset strategy—to steadily accompany global users through bull and bear cycles, delivering abundant, long-term wealth returns to principled holders.

About HTX

Founded in 2013, HTX has evolved over 12 years from a cryptocurrency exchange into a comprehensive blockchain ecosystem, encompassing digital asset trading, financial derivatives, research, investment, incubation, and other services.

As a leading global Web3 gateway, HTX pursues a strategic vision centered on global expansion, ecosystem prosperity, wealth generation, and security & compliance—delivering comprehensive, secure, and reliable value and services to cryptocurrency enthusiasts worldwide.

To learn more about HTX, please visit https://www.htx.com/ or HTX Square, and follow us on X, Telegram, and Discord. For further inquiries, please contact glo-media@htx-inc.com.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News