Staying Committed to Long-Termism Amidst the Noise: HTX’s First New Year Class—Six Industry Leaders Jointly Guide Crypto Investors

TechFlow Selected TechFlow Selected

Staying Committed to Long-Termism Amidst the Noise: HTX’s First New Year Class—Six Industry Leaders Jointly Guide Crypto Investors

The launch of Huobi HTX’s “First Class of the New Year” sends a clear signal: during periods of complex market conditions and volatile sentiment, leading exchanges must serve as “anchors of stability.”

At the dawn of 2026, the digital asset industry is undergoing an unprecedented structural transformation.

From Bitcoin’s pullback following its all-time high to the substantive implementation of regulatory policies, the market is rapidly shifting from “wild, unregulated growth” toward “mainstream compliance.” At this pivotal moment, Huobi HTX Growth Academy has launched its highly anticipated “First Class of the New Year,” bringing together top-tier experts in law, security, and investment research—aiming to help investors cut through the fog and build a cyclical-resilient cognitive framework.

Upon launch, the course immediately sparked widespread participation and discussion: cumulative learners across platforms reached 66,591; 14,566 completed the post-class challenge; 3,830 scholarships were awarded; and the top-performing “scholar” alone claimed 38.88 million $HTX tokens. These figures not only reflect strong alignment between the “First Class of the New Year” and user needs but also underscore the real-world value of systematic investment education during a transitional phase in the industry cycle.

The “First Class of the New Year” closely matches user needs and has received broad recognition.

Review and Outlook: Navigating Cyclical Uncertainty, Identifying Core Sectors

To address the market’s most pressing questions on cycles and trends, Yu Jialing—President of Hong Kong Uweb Business School and Director of the Hong Kong Registered Digital Asset Analysts Association—Chloe Zheng, Senior Researcher at HTX Research—and Cloud, Head of Huobi HTX’s Investment Research Team, conducted a comprehensive review and forward-looking analysis.

From a macro-industrial perspective, Yu Jialing forecasts that 2026 will accelerate the digital asset industry’s transition toward “institutionalization” and “mainstream adoption.” He notes that AI agents will be deeply embedded into finance and the real economy, driving the emergence of programmable payments and automated asset management systems. Meanwhile, real-world assets—including gold, equities, and even autonomous vehicles—will achieve on-chain ownership verification, trading, and revenue distribution via tokenization. Real-World Assets (RWA), prediction markets, and U.S. equity tokenization will continue expanding.

He further emphasizes that investors must shift from short-term speculation to long-term asset allocation thinking. Blockchain and digital assets are no longer fringe innovations—they are becoming critical components of future financial infrastructure.

In her report “2025 Market Review & 2026 Investment Outlook,” Cloud highlights that the crypto industry experienced intense and volatile narrative shifts throughout the year. Market fatigue and skepticism accumulated steadily, with most hot topics remaining confined to short-term attention contests. Yet a select few narratives matured into genuine use cases and sustainable market structures—becoming key drivers of industry evolution. Concurrently, market participant composition evolved: beyond the dominant speculative cohort, narratives better suited for retail participation continued expanding, fueling extensive growth in the user base.

She identifies several high–long-term-value sectors worth close attention in 2026: payment and stablecoin infrastructure, RWA, privacy, scalable prediction markets, zkVMs and verifiable computing, tokenized private markets, and on-chain wealth management.

In her session “Surge! Early Positioning in 100x Sectors,” Chloe Zheng analyzes how 2025 marked a watershed year—the transition from “wild, unregulated growth” to “mainstream compliance.” Bitcoin surged past $120,000; the U.S. established a national Bitcoin strategic reserve; the SEC dropped multiple industry lawsuits; and the Stablecoin Transparency Act was enacted—signaling a regulatory pivot from confrontation to full-fledged friendliness. On the institutional front, Wall Street giants entered the space en masse, and a wave of crypto company IPOs began. Yet the four-year cycle curse held true: Bitcoin retreated over 50% from its $120,000 peak; Ethereum halved after breaking $4,900; and altcoin liquidity dried up.

Although the four-year cycle remains intact, Chloe believes 2026 may unfold as an “atypical bear market.” Macroscopically, expectations of Fed rate cuts and global monetary expansion provide market floor support—suggesting downside risks smaller than in 2022. Microscopically, sustained corporate Bitcoin accumulation forms a new pillar of demand.

The Alchemy of Information: Extracting Wealth Signals from Chaos

So how should investors actually make decisions in practice? Taran, Head of Huobi HTX Growth Academy, introduced the “Information Alchemy” methodology in his session “Identifying Profit Signals Amid Information Chaos”—a framework designed to extract high-value signals from overwhelming noise.

This methodology comprises three core processes: First, source tiering and cross-verification—categorizing information sources by credibility into four tiers (primary data, smart-money/institutional footprints, professional media/deep communities, social noise) and applying “triangulation verification” to ensure authenticity. Second, narrative structuring and signal prioritization—distinguishing grand narratives (e.g., AI, RWA), project-specific narratives, and market noise—and using a “Signal Quadrant” (horizontal axis = certainty, vertical axis = impact) to identify high-certainty, high-impact “golden signals.” Third, on-chain behavior analysis and intent translation—emphasizing that “behavior is more honest than words, and code more reliable than promises”—by tracking smart-money flows, token distribution, developer activity, and other on-chain metrics to pierce through surface appearances and reach the essence of projects, ultimately building a scientific, replicable investment decision-making system.

Security, Compliance, and Rule of Law: Building a “Dual Shield” for Assets

If trend insight serves as the offensive spear, then compliance and security function as the defensive shield. While seizing market opportunities, mitigating legal risk and technical vulnerabilities remains a constant priority for crypto investors.

Xiao Sa, Supervisory Partner and Senior Partner at Dentons China, analyzed global attitudes toward digital assets, regulatory frameworks, and landmark judicial cases in her session “Navigating the Dark Forest: Domestic and International Judicial Remedies and Dispute Resolution for Crypto Asset Disputes.”

She pointed out that the Central Political and Legal Affairs Commission’s Work Conference held in January 2026 proposed: “We must proactively study and propose legislative recommendations for emerging issues such as autonomous driving, low-altitude economy, artificial intelligence, virtual currencies, and data ownership rights.” This major initiative marks China’s formal entry into a new era of rule-of-law-based, standardized, and precise virtual currency governance—accelerating both financial risk prevention and protection of legitimate innovation.

Regarding stolen or frozen assets, Xiao Sa outlined a systematic remediation pathway based on practical experience: For theft, prioritize filing criminal reports and pursuing on-chain freezing; for freezes, pursue parallel approaches—including non-litigious communication, law enforcement coordination, and international arbitration—and stressed that cross-border law enforcement communications must maintain strict consistency between statements and evidence; otherwise, permanent asset freezes or even criminal liability may result.

Zhou Yajin, Co-Founder of BlockSec, sounded the alarm for users in his session “Web3 User Security and Compliance,” underscoring the absolute confidentiality required for private keys and mnemonic phrases.

He urged users to safeguard private keys and mnemonics rigorously—never entering them on any website or disclosing them to others—and recommended a tiered asset management strategy: storing the majority of assets in cold wallets (main wallets), allocating only small amounts to interactive wallets for DeFi or NFT activities, and designating separate “risk wallets” for testing new projects. He specifically warned against token approval (approve) risks—advising against unlimited approvals and recommending regular revocation of outdated permissions using dedicated tools.

Leadership Responsibility: Becoming Long-Term Builders of the Crypto World

Market conditions fluctuate endlessly—but education and infrastructure-building must never pause. Huobi HTX’s “First Class of the New Year” sends a clear message: precisely when market complexity and emotional volatility peak, leading exchanges must act as “anchors of stability.”

Notably, the “First Class of the New Year” earned high praise for both content depth and practical applicability.

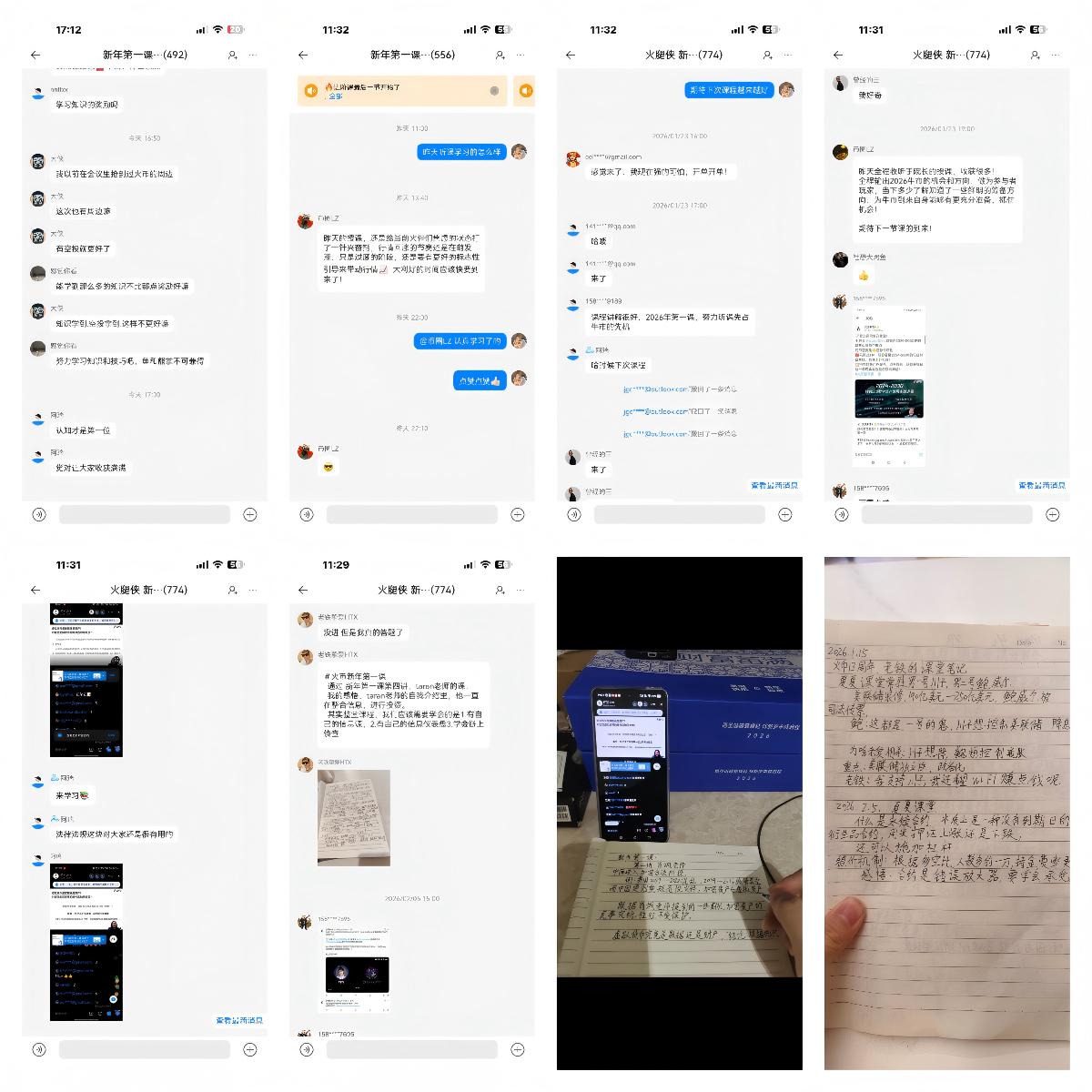

During the course, numerous participants voluntarily shared detailed notes and mind maps within community groups—systematically organizing macro-trend insights, core sector logic, and on-chain analytical methods. Post-course, many users submitted structured summaries, transforming the course framework into personalized investment checklists and risk-control models.

One user noted the course helped unify the complete logical chain—from “macro → sector → project → execution”—turning fragmented information into a coherent structure. Another participant reported markedly improved efficiency in identifying quality projects and filtering noise using the triangulation verification method. Overall, the course not only elevated knowledge acquisition quality but also strengthened users’ confidence in long-term asset allocation and compliance-driven risk management.

Multiple participants shared learning reflections in community groups.

Unlike the clamor typical of bull markets, Huobi HTX chose to focus inward—delivering high-quality, systematic courses to help users identify risks, understand compliance, and master security skills. This “teach-a-man-to-fish” commitment to long-termism serves not only to protect investors’ legitimate rights and interests but also to steer the entire crypto industry toward greater maturity and health.

The “First Class of the New Year” is merely the beginning. Going forward, Huobi HTX will remain true to its mission—launching more customized, hands-on courses tailored to users at every stage of their journey. Regardless of market cycles, Huobi HTX will accompany every user on their steady, far-reaching exploration of the crypto world.

About Huobi HTX

Huobi HTX was founded in 2013. After 12 years of development, it has evolved from a cryptocurrency exchange into a comprehensive blockchain business ecosystem encompassing digital asset trading, financial derivatives, research, investment, incubation, and more.

As a globally leading Web3 gateway, Huobi HTX adheres to a development strategy centered on global expansion, ecosystem prosperity, wealth creation, and security compliance—providing comprehensive, secure, and reliable value and services to cryptocurrency enthusiasts worldwide.

For more information about Huobi HTX, please visit https://www.htx.com/ or HTX Square, and follow us on X, Telegram, and Discord. For further inquiries, contact glo-media@htx-inc.com.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News