What projects in the Avalanche ecosystem are worth paying attention to and participating in today?

TechFlow Selected TechFlow Selected

What projects in the Avalanche ecosystem are worth paying attention to and participating in today?

The AVAX ecosystem is heating up with numerous life-changing opportunities and innovations.

Author: Viktor DeFi

Compiled by: TechFlow

Avalanche is an L1 blockchain solution designed to achieve fast finality and high throughput without sacrificing decentralization. Launched in 2020 by Ava Labs under the leadership of a former Cornell University professor, it has evolved into one of the largest public blockchains in the crypto space, with a TVL of approximately $1.39 billion—ranking among the top four in DeFi—and over 260 dApps within the AVAX ecosystem.

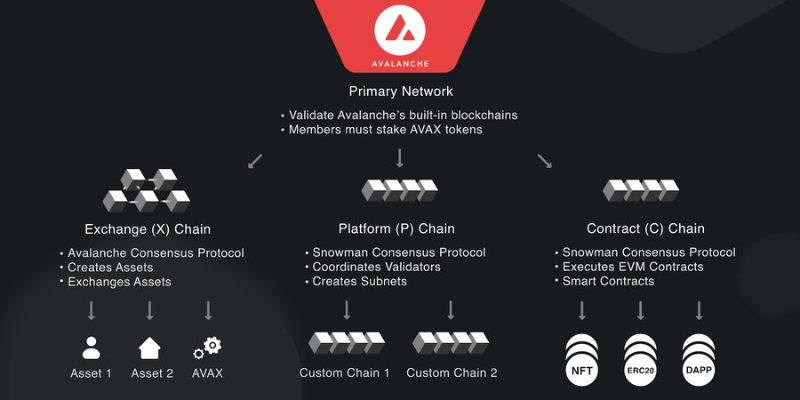

The Avalanche mainnet consists of three primary chains: the Platform Chain (P-Chain), the Contract Chain (C-Chain), and the Exchange Chain (X-Chain):

- The P-Chain uses the Snowman consensus protocol to coordinate validators and create subnets.

- The C-Chain handles the creation and execution of EVM-compatible smart contracts.

- The X-Chain uses Avalanche's DAG-based consensus to create, manage, and exchange assets and tokens.

The P-Chain, C-Chain, and X-Chain are like the Three Musketeers of Avalanche.

Subnets could be considered one of DeFi’s biggest innovations. Subnets are Avalanche’s solution to blockchain space limitations and rising transaction fees. Based on subnets, developers can launch their own independent blockchains. A subnet consists of validators that work together to reach consensus on one or more blockchains.

In March, the Avalanche Foundation launched Multiverse, a $290 million incentive program aimed at accelerating the growth and adoption of subnets. DefiKingdoms and Swimmer have already successfully launched their subnets on Avalanche.

Now, let’s take a look at five projects I’m excited about on Avalanche:

1/ Trader Joe

Trader Joe is the leading DEX on Avalanche.

The platform enables users to trade (via AMM), and explore yield farming, staking, and lending opportunities.

By integrating DEX and DeFi lending services, Trader Joe offers leveraged trading.

Recently, Trader Joe’s Liquidity Book went live on testnet.

Essentially, the Liquidity Book represents the next evolution of AMM protocols, allowing users to execute any liquidity provision strategy.

2/ BENQI

BENQI is a DeFi liquidity protocol built on Avalanche, offering two main products:

- BENQI Liquidity Market (BLM)—permissionless lending.

- BENQI Liquid Staking (BLS)—efficient DeFi staking.

On BLS, users can stake AVAX and receive sAVAX, a yield-bearing token. Currently, it offers around a 7.20% annual yield, with a 15-day unstaking cooldown period and a 2-day redemption window.

3/ Beefy

Beefy Finance is a multi-chain yield optimizer.

Beefy has deployed its products across 16 blockchains, enabling users to earn attractive APYs on their crypto assets. Most importantly, you retain full control over your cryptocurrency.

BIFI is Beefy’s utility token:

- BIFI stakers receive a portion of platform revenue.

- BIFI holders and stakers also have voting rights on governance proposals.

Finally, BIFI stakers can earn additional BIFI, ETH, BNB, and other tokens in yield pools.

4/ Ribbon

Ribbon is a DeFi protocol.

Using Theta Vaults—commonly known as DOVs (DeFi Options Vaults)—Ribbon generates yield through options and other yield-focused strategies.

Ribbon recently announced Aevo, an order-book-based DEX that will support trading of over 100 options.

5/ Vector Finance

Vector Finance is a yield-enhancing protocol built on Avalanche.

They are the largest holders of $vePTP and $veJOE.

As such, they allow users to deposit stablecoins and LP tokens to achieve higher yields on Platypus and Trader Joe.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News