Analyzing Trader Joe's New Whitepaper: How the New AMM Model Solves Uniswap V3's Issues?

TechFlow Selected TechFlow Selected

Analyzing Trader Joe's New Whitepaper: How the New AMM Model Solves Uniswap V3's Issues?

TraderJoe has just released their brand-new AMM whitepaper! The AMM, called "Liquidity Book," aims to address the issues encountered by Uniswap V3.

Written by: The DeFi Investor

Translated by: TechFlow

Trader Joe has just launched their brand-new AMM whitepaper! This AMM, called "Liquidity Book," aims to address the issues encountered by Uniswap V3—here’s everything you need to know about it.

The whitepaper is quite technical, but I’ll try to simplify it and walk you through the core mechanics of their new AMM.

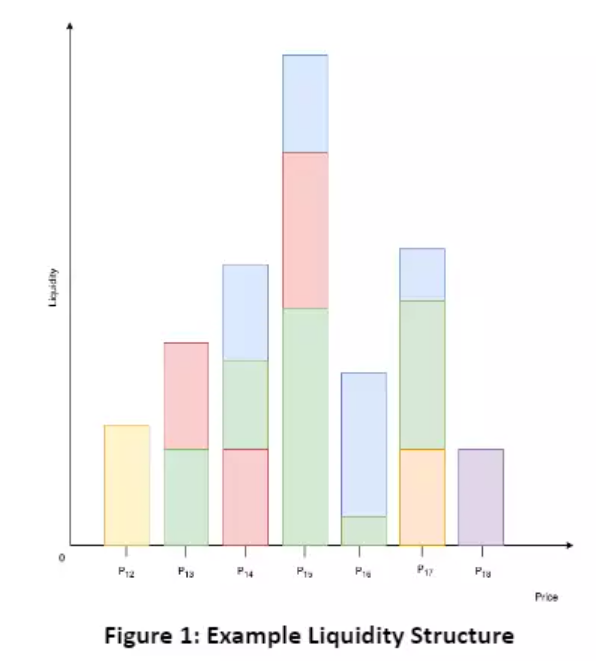

Liquidity Book (LB) organizes liquidity for asset pairs across price ranges.

During token swaps, available funds within a liquidity range are exchanged at a constant price. If a swap requires more liquidity than is available in the current range, it moves to the next one. Liquidity Providers (LPs) can concentrate liquidity within price ranges defined by two bounds.

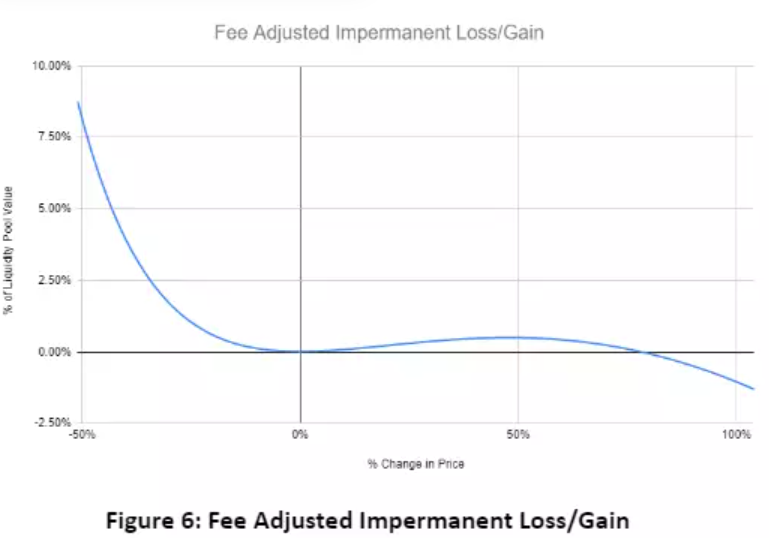

One of the most critical problems with Uniswap V3 is that impermanent loss often exceeds trading fees. A study conducted by the Bancor team showed that 50% of Uniswap V3 LPs face losses. Liquidity Book addresses this issue by introducing variable swap fees.

Swap fees consist of two components:

- Base fee;

- Variable fee;

The variable fee depends on the volatility of each asset pair. It is designed to compensate LPs for short-term price fluctuations and incentivize them to actively manage liquidity around moving prices.

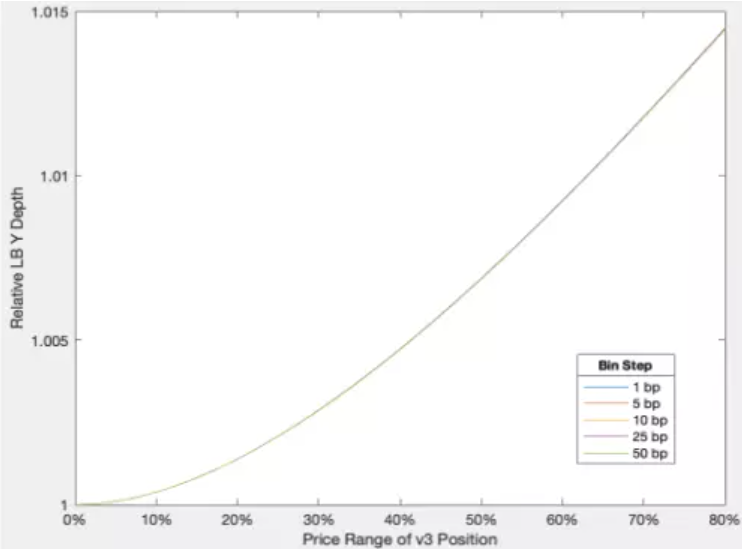

It is well known that the greater the liquidity deposited in a trading pair, the lower the slippage. Market depth measures how much of one asset can be exchanged for another at a given price level. Higher market depth → Lower slippage.

By incentivizing LPs to actively manage their liquidity ranges through variable swap fees, LB could achieve increased market depth. As shown in the figure below, for positions spanning up to a 60% price range, LB achieves market depth within 1% of Uniswap V3.

Other notable features:

- Trade routing — Swaps will be routed through traditional AMM pairs when better prices are found.

- Protocol fees — A portion of swap fees will be retained by the protocol.

According to the whitepaper, the Liquidity Book AMM aims to solve two major issues:

- Impermanent loss (swap fees exceed impermanent loss unless there is a large price movement).

- Slippage (due to liquidity being structured across price ranges).

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News