CoinW Research Hot Topic Report: Analysis of Uniswap's Major Buyback Proposal, Can UNI Trigger a Revaluation?

TechFlow Selected TechFlow Selected

CoinW Research Hot Topic Report: Analysis of Uniswap's Major Buyback Proposal, Can UNI Trigger a Revaluation?

A multi-hundred-million-dollar annual buyback program, equivalent to initiating ongoing "shareholder returns." This not only aims to catch up with competitors but also represents the protocol's value returning to its token holders.

Author: CoinW Research

Uniswap's latest buyback proposal has drawn significant market attention, but public discourse is heavily focused on the buyback mechanism within the proposal. If the buyback mechanism is activated, will it lead to a long-term parabolic rise in the UNI token price?

1. Uniswap's Major Proposal: In-Depth Analysis

Uniswap CEO Hayden Adams recently unveiled his first governance proposal, which includes enabling protocol fees, burning UNI tokens, and increasing Unichain fees—measures that shift the UNI token toward a deflationary model. If approved, Uniswap could generate approximately $460 million to $510 million annually for UNI buybacks, providing strong support for the token’s price. The specific components of the proposal are as follows:

1. Activate protocol fees, with all protocol-side revenue used for buying back and burning UNI.

This is the core value capture mechanism of the proposal. It fundamentally changes UNI's token model, transforming it from a pure governance token into a "productive asset" backed by direct cash flows. This is analogous to a listed company using profits to repurchase shares, offering long-term and solid value floor support for the token price—the key engine driving the "deflationary appreciation" flywheel. UNI will transition from a non-cashflow governance token to a "productive asset" supported by direct income, similar to stock buybacks.

2. Integrate Unichain sequencer fees into the burn pool.

The goal is to channel all value generated across the entire Uniswap ecosystem back to the UNI token. Sequencer fees are inherent revenue from Unichain, a Layer 2 blockchain. By including them in the burn mechanism, UNI's value is no longer solely tied to DEX trading activity but deeply linked to the prosperity of the broader Uniswap ecosystem—including its blockchain—thereby broadening its value foundation.

3. One-time burn of 100 million UNI (retroactive burn for historical fee-free periods).

This sends a strong deflationary signal and boosts market confidence. Burning 16% of the total supply immediately increases the scarcity of remaining tokens. The logic of "retroactive compensation" aims to fairly reward early supporters and symbolically "pay back" past periods when holders did not receive returns, expected to deliver a powerful short-term psychological boost to the market.

4. Launch PFDA: Offer traders "fee discounts" via auction while retaining MEV revenue within the protocol.

This is an innovative two-in-one mechanism. By auctioning off fee discount rights, it cleverly recaptures MEV value previously captured by third-party searchers and brings it back into the protocol. Ultimately, this revenue will feed into UNI buybacks, enhancing the robustness of the overall economic model.

5. v4 Aggregator Hook: Aggregate external DEX liquidity and collect protocol fees.

This signifies Uniswap’s evolution from a "liquidity provider" to a "liquidity aggregation layer and toll gate." Even if trades don't occur in Uniswap’s own pools, as long as they are routed through its Hook, the protocol can still capture fees. This dramatically expands Uniswap’s addressable fee-generating market—an important strategic breakthrough in lifting its revenue ceiling.

6. Unified fee structure: Interfaces/wallets/APIs will no longer charge extra fees; revenue collection is unified at the protocol layer.

This move strengthens the core position of the protocol layer and protects its business model moat. It prevents various front-ends (e.g., official site, third-party interfaces) from engaging in "zero-fee" wars to compete, which would erode the ecosystem’s overall revenue base. A unified fee structure ensures visibility, predictability, and stability of protocol revenue—critical for the long-term health of the economic model.

7. Governance and organization: Merge Labs and Foundation, allocate an annual budget of 20 million UNI for growth initiatives.

This reflects Uniswap’s effort to balance short-term financial returns with long-term ecosystem development. Merging the teams improves decision-making efficiency, while setting a clear growth budget signals that the team is not just focused on immediate token price movements but will continue investing in developers, liquidity, and other ecosystem-building efforts to maintain competitiveness and leadership over the next decade.

8. Asset migration: Move Unisocks liquidity to Unichain v4 and burn the LP position.

This action carries strategic symbolic weight. It shows the team is cleaning up legacy assets and fully redirecting resources and focus toward the next-generation strategy centered on Unichain and v4. It can be seen as an "新陈代谢" (metabolic renewal) of the ecosystem—symbolizing a break from old models and a full commitment to building the future.

Image source: Uniswap founder (Hayden Adams)

Researcher Insight: The core of this proposal lies in establishing a value flywheel of “protocol revenue → buyback & burn → token deflationary appreciation.” If successfully implemented, it will provide UNI with continuous cash flow discounting and price floor support.

2. Proposal Approval: Buyback Projections and Protocol Revenue Analysis

We conduct projections based on historical data and publicly disclosed proposal parameters. The proposal directly burns 100 million tokens (16% of total supply), with a key assumption: daily buyback rate of 0.05%. That is, protocol fee (0.3%) minus LP rewards (0.25%) equals buyback (0.05%).

1. Core Revenue Sources Analysis

1. Core DEX business: Based on V2 and V3 combined annualized trading volume of ~$1 trillion, applying a 0.05% fee yields an estimated $500 million in annual protocol revenue.

2. v4 aggregator business: As an incremental source, expected to contribute 10%-20% of core trading volume, generating potential annual revenue of $50–100 million.

3. PFDA and MEV capture: Though important innovative revenue streams, they are currently difficult to quantify precisely and thus excluded from this projection. Unichain sequencer fees: Still in early development and small in scale, also excluded for now.

2. Annualized Buyback Fund Summary

Conservative scenario (core DEX only): Annual buyback fund ~$500 million.

Optimistic scenario (including v4 aggregator revenue): Annual buyback fund projected between $550–600 million.

Researcher Insight: Combining market consensus and our analysis, allocating 0.05% of daily protocol fees to buybacks could achieve a 1.5%-2% annual deflation rate. At current trading volumes, Uniswap is expected to generate $500–550 million annually for UNI buybacks—a relatively conservative estimate. This equates to a sustained monthly market buy-side support of $35–42 million, forming solid medium-to-long-term value support.

3. Market Reaction: Massive Buy-Side Expectations Drive Price Surge

The market responded swiftly and positively to the proposal. Alexander, CEO of Dromos Labs—the team behind Base ecosystem’s leading DEX Aerodrome—pointed out that based on Uniswap’s current trading volume, approximately $460 million in fees per year could be allocated to buybacks and burns, creating strong and sustainable buy-side pressure for $UNI.

CryptoQuant CEO Ki Young Ju also noted that the fee conversion mechanism could drive Uniswap’s price into a parabolic rise. He analyzed that even considering only v2 and v3, the protocol’s annual trading volume reaches $1 trillion, implying around $500 million worth of UNI burned annually. Additionally, exchanges hold only $830 million in UNI, meaning future unlock sell pressure is relatively limited. Driven by this optimistic outlook, UNI surged nearly 50% within hours of the proposal announcement.

Data source: DefiLlama

Researcher Insight: This proposal undoubtedly establishes a "hard floor" for UNI’s long-term value. Its core mechanism involves: short-term deflationary shock via one-time burn of 100 million UNI (16% of circulating supply); long-term sustained buybacks of ~$38 million/month (~$400–500 million annually) providing stable buy-side demand. This dual-deflation model offers strong price support.

4. Competitor Comparison: Buyback Scale Enters Top Tier

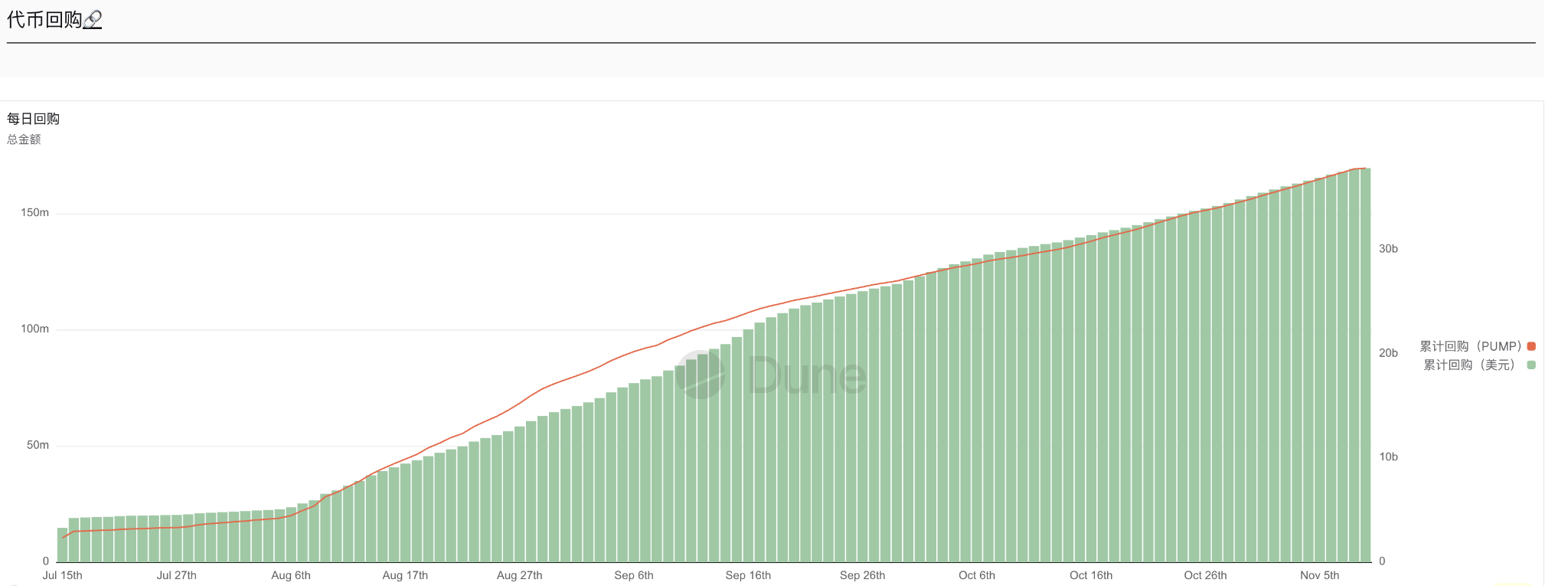

Under the proposed mechanism, Uniswap plans to split its existing 0.3% LP fee, leaving 0.25% to liquidity providers and allocating 0.05% to the protocol for UNI buybacks. Based on its estimated annual fee income of ~$2.8 billion, this translates to approximately $38 million in dedicated buyback funds per month. This scale places Uniswap favorably among peers with buyback mechanisms: significantly surpassing PUMP ($35 million/month) and approaching HYPE, the current leader at $95 million/month.

Image source: DUNE (HYPE)

Image source: DUNE (PUMP)

Researcher Insight: Previously, Uniswap’s massive trading volume did not directly benefit its token holders. An annual buyback program worth hundreds of millions of dollars is equivalent to initiating ongoing "shareholder returns." This not only positions Uniswap to catch up with competitors but represents a return of value to its token holders.

5. Outlook: Success Hinges on the Anchor—Liquidity Providers (LPs)

If approved, Uniswap’s proposal will bring long-term benefits, effectively establishing a "floor mechanism" for the token price. However, its success entirely depends on one critical factor: whether liquidity providers (LPs) stay.

Success Path: The proposal reduces LP fees from 0.3% to 0.25% (a 17% cut). LPs will remain only if new revenue sources like PFDA and internalized MEV fully compensate for their losses. Stable LPs ensure pool depth and trading experience, allowing protocol fee income to continue flowing, so the buyback-and-burn "floor" mechanism can operate sustainably.

Risk Path: Conversely, if LPs leave due to reduced yields, liquidity will shrink, trading volume will decline, and both protocol revenue and buyback funds will dwindle—rendering the floor mechanism ineffective.

Therefore, ordinary users should closely monitor two aspects. Short-term: governance vote outcome and contract deployment timeline. Long-term: LP retention rate and pool depth, stability of the $38 million monthly buybacks, actual performance of PFDA and MEV internalization, and shifts in competitor market share.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News