Burning is Uniswap's final trump card

TechFlow Selected TechFlow Selected

Burning is Uniswap's final trump card

Hayden's new proposal may not necessarily save Uniswap.

Author: BlockBeats

Waking up to find UNI up nearly 40%, dragging the entire DeFi sector into a broad rally.

The reason for the surge? Uniswap has finally played its last card. Uniswap founder Hayden released a new proposal centered around the long-debated "fee switch" topic. In fact, this proposal has already been brought up seven times over the past two years—nothing new to the Uniswap community.

This time is different, though. The proposal was initiated personally by Hayden and includes not only the fee switch but also token burning, merging Labs and Foundation, and other measures. Some large holders have already voiced support, and prediction markets show a 79% probability of approval.

Failed 7 Times in 2 Years: The Repeated Defeat of the "Fee Switch"

The fee switch is actually quite common across the DeFi space. Take Aave as an example—it successfully activated its fee switch in 2025, using a "buyback + distribution" model to redirect protocol revenue toward AAVE token buybacks, driving the price from $180 to $231 with a 75% annualized gain.

Beyond Aave, protocols like Ethena, Raydium, Curve, and Usual have also achieved notable success with their fee switches, setting sustainable tokenomic examples for the broader DeFi industry.

Given so many successful precedents, why has it consistently failed at Uniswap?

a16z Backs Down, But Uniswap's Troubles Are Just Beginning

This brings us to a key player—a16z.

With historically low quorum turnout in Uniswap governance, proposals typically require only around 40 million UNI to pass. However, this venture capital giant controls approximately 55 million UNI tokens, giving it decisive influence over voting outcomes.

They've been consistent opponents of such proposals.

As early as July 2022, during two temperature checks, they abstained while voicing concerns on forums. But by December 2022, during the third proposal—when pools like ETH-USDT and DAI-ETH were preparing to activate 1/10 fee rates via on-chain vote—a16z cast a clear veto with 15 million UNI votes. The vote ended with 45% support; although supporters were in the majority, the proposal failed due to insufficient quorum. On the forum, a16z stated explicitly: "We ultimately cannot support any proposal that does not consider legal and tax implications." This marked their first public opposition.

In subsequent attempts, a16z maintained this stance. In May and June 2023, GFX Labs launched two consecutive fee-related proposals. Despite gaining 54% support in June, both failed due to a16z’s 15 million opposing votes and lack of quorum. The same script repeated in March 2024’s governance upgrade proposal—around 55 million UNI voted in favor, yet the motion collapsed under a16z opposition. Most dramatically, between May and August 2024, proposers attempted to establish a Wyoming-based DUNA entity to mitigate legal risks. The vote, scheduled for August 18, was indefinitely postponed due to “new issues raised by unnamed stakeholders,” widely believed to be a16z.

So what exactly is a16z afraid of? Legal risk is the core issue.

They argue that activating the fee switch could classify UNI as a security. Under the U.S. Howey Test, if investors reasonably expect profits derived from the efforts of others, the asset may qualify as a security. The fee switch creates precisely such an expectation—protocol generates income, token holders share in the returns—mirroring traditional securities' profit distribution models. As a16z partner Miles Jennings bluntly commented on the forum: "DAOs without legal entities expose individuals to personal liability."

Tax complications are equally thorny. Once fees flow into the protocol, the IRS might demand corporate taxes from the DAO—estimated back payments could reach $10 million. The problem? A DAO is a decentralized organization without a traditional legal or financial structure. Who pays, and how, remains unresolved. Without clear solutions, activating the fee switch could expose all participating token holders to tax liabilities.

To date, UNI remains a16z’s largest single crypto holding, with about 64 million UNI, still capable of unilaterally swaying governance votes.

But we all know that with Trump’s election win and SEC leadership changes, the crypto industry has entered a period of political stability—reducing Uniswap’s legal risks and signaling a softening stance from a16z. Clearly, this is no longer an insurmountable obstacle, significantly increasing the chances of this proposal passing.

That said, other conflicts remain. The Uniswap fee switch mechanism still faces several contentious points.

You Can't Have Your Cake and Eat It Too

To understand these new controversies, let’s briefly explain how the fee switch works.

From a technical standpoint, the proposal makes nuanced adjustments to the fee structure. In V2, total fees remain at 0.3%, but 0.25% goes to LPs while 0.05% goes to the protocol. V3 offers more flexibility: protocol fees range from one-fourth to one-sixth of LP fees. For example, in a 0.01% pool, the protocol takes 0.0025% (25% share); in a 0.3% pool, it takes 0.05% (~17% share).

Under this structure, Uniswap could conservatively generate $10–40 million in annual revenue, reaching $50–120 million during bull market conditions based on historical peak volumes. Additionally, the proposal includes immediate burning of 100 million UNI tokens—about 16% of circulating supply—and establishes an ongoing burn mechanism.

In essence, the fee switch would transform UNI from a "valueless governance token" into a real yield-bearing asset.

This is clearly great news for UNI holders—but here lies the problem. Because the "fee switch" fundamentally represents a redistribution of earnings between LPs and the protocol.

Total fees paid by traders don’t change; only now, part of what previously went entirely to LPs will go to the protocol. The cost is passed directly to liquidity providers. As protocol revenue increases, LP income inevitably decreases.

You can't have your cake and eat it too. When faced with the choice between LP incentives and protocol revenue, Uniswap has clearly chosen the latter.

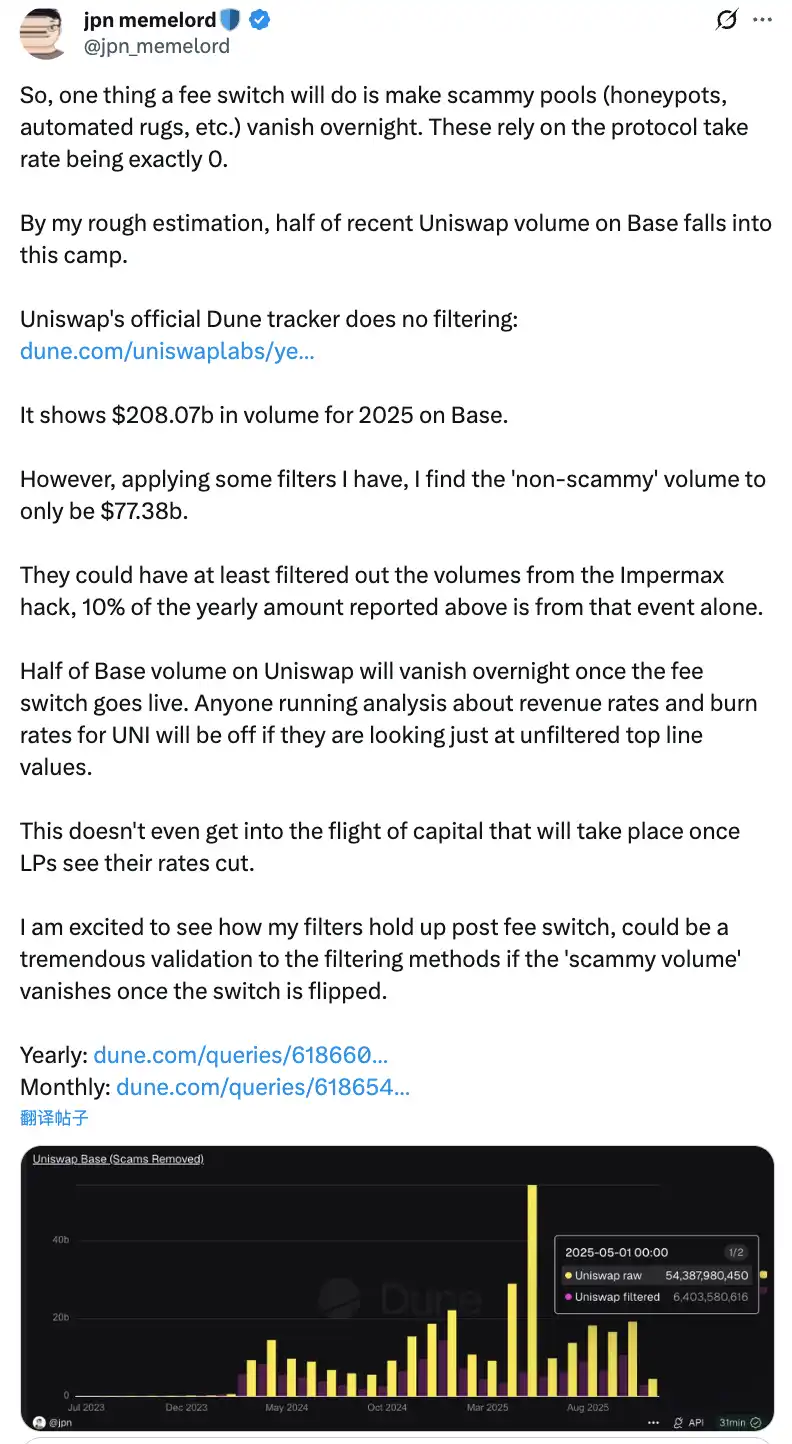

Community discussions suggest that once the "fee switch" activates, half of Uniswap’s trading volume on Base chain could vanish overnight

The potential negative impacts of this redistribution are significant. In the short term, LP revenues could drop 10–25%, depending on the fee split ratio. More critically, modeling suggests 4–15% of liquidity may migrate from Uniswap to competing platforms.

To mitigate these downsides, the proposal introduces innovative compensation mechanisms. For instance, MEV internalization through PFDA could deliver additional LP returns of $0.06–$0.26 per $10,000 traded. V4’s Hooks functionality enables dynamic fee adjustments, while aggregator hooks open new revenue streams. Moreover, the proposal adopts a phased rollout—starting with core liquidity pools, monitoring impact in real time, and adjusting based on data.

The Dilemma of the Fee Switch

Despite these mitigation strategies, whether they can truly reassure LPs and ensure the proposal’s success remains to be seen. After all, even Hayden stepping in personally may not resolve Uniswap’s longstanding dilemma.

A more immediate threat comes from market competition—particularly its head-to-head battle with Aerodrome on the Base chain.

After Uniswap's proposal announcement, Alexander, CEO of Dromos Labs (Aerodrome’s dev team), sarcastically remarked on X: "I never thought our biggest competitor would hand us such a major blunder the day before Dromos Labs’ most important milestone."

Aerodrome Is Dominating Uniswap on Base Chain

Data shows that over the past 30 days, Aerodrome recorded ~$20.465 billion in trading volume, capturing 56% of Base chain’s market share. Meanwhile, Uniswap’s volume on Base stood at ~$12–15 billion, with just 40–44% market share. Aerodrome leads by 35–40% in volume and surpasses Uniswap in TVL—$473 million vs. $300–400 million.

The root cause? Vast differences in LP yields. Take the ETH-USDC pool: Uniswap V3 offers ~12–15% annualized returns purely from trading fees. In contrast, Aerodrome delivers 50–100% or higher yields through AERO token incentives—3 to 7 times that of Uniswap. Over the past month alone, Aerodrome distributed $12.35 million in AERO rewards, strategically directing liquidity via the veAERO voting system. Uniswap relies mostly on organic fees, occasionally launching targeted incentive programs, but at a much smaller scale.

As one community member pointed out: "Aerodrome dominates Uniswap in Base trading volume because liquidity providers care only about return per dollar of liquidity deployed. And Aerodrome wins hands down." A sharp observation.

For LPs, brand prestige won’t keep them loyal—they follow yield. On emerging L2s like Base, Aerodrome, as a native DEX, has built a strong first-mover advantage through its optimized ve(3,3) model and generous token incentives.

In this context, if Uniswap activates the fee switch and further cuts LP returns, it may accelerate liquidity migration to Aerodrome. Models predict 4–15% liquidity loss from the fee switch—potentially higher on fiercely competitive chains like Base. Once liquidity drops, slippage rises, trading volume declines, triggering a downward spiral.

Can the New Proposal Save Uniswap?

From a pure numbers perspective, the fee switch could indeed bring substantial revenue to Uniswap. According to detailed calculations by community member Wajahat Mughal, results from just V2 and V3 versions are already impressive.

V2 generated $503 million in total fees year-to-date in 2025, with Ethereum mainnet contributing $320 million and recent 30-day volume hitting $50 billion. At a 1/6 fee split, Ethereum-based activity alone could generate $53 million in protocol fees for 2025. V3 performs even stronger—$671 million in total fees YTD, $381 million from Ethereum mainnet, and 30-day volume reaching $71 billion. Considering variable splits—low-fee pools pay 1/4 to protocol, high-fee pools pay 1/6—V3 may have already generated $61 million in protocol fees YTD.

Combining V2 and V3, estimated protocol revenue YTD reaches $114 million—with six weeks still left in the year. Crucially, this figure doesn’t capture Uniswap’s full revenue potential. It excludes remaining 20% of V3 pools, fees from all non-Ethereum chains (especially Base, which generates nearly as much as Ethereum), V4 volume, fee discount auctions, UniswapX, aggregator hooks, and Unichain sequencer revenue. Factoring in all these, annualized revenue could easily exceed $130 million.

Paired with the plan to immediately burn 100 million UNI (worth over $800 million at current prices), Uniswap’s tokenomics would undergo a fundamental transformation. Post-burn, fully diluted valuation drops to $7.4 billion, with a market cap around $5.3 billion. With $130 million in annualized revenue, Uniswap could repurchase and burn roughly 2.5% of circulating supply each year.

This implies a P/E ratio of about 40x—not cheap by conventional standards, but with multiple growth levers still untapped, there’s room for this ratio to decline. As one community member mused: "This is the first time the UNI token genuinely looks attractive to hold."

Yet behind these appealing figures lie serious concerns. First, 2025’s trading volume is significantly higher than previous years—largely driven by bull market conditions. Should the market enter a bear cycle, volume and thus protocol fees would sharply decline. Basing long-term valuations on bullish volume data is inherently misleading.

Second, the exact mechanics of the buyback program remain unclear. Will it use an automated system like Hyperliquid, or another method? The frequency, price sensitivity, and market impact of buybacks will all affect the burn mechanism’s real-world effectiveness. Poor execution could trigger price volatility, leaving UNI holders caught in a “wash trade” scenario.

When platforms like Aerodrome, Curve, Fluid, and Hyperliquid Spot are aggressively incentivizing liquidity, will Uniswap’s move to cut LP rewards accelerate capital outflows? The numbers look good—but without liquidity as a foundation, even the most optimistic revenue projections are just castles in the air.

The fee switch will undoubtedly provide value support for UNI. But whether it can truly “save” Uniswap and restore the former DeFi leader to its former glory will require rigorous testing by both time and the market.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News