Uniswap Labs' Prospects and Opportunities

TechFlow Selected TechFlow Selected

Uniswap Labs' Prospects and Opportunities

Short-term volatility driven by significant positive catalysts, medium-term upward spiral amid value revaluation and intense competition, and long-term development deeply tied to the success or failure of Unichain and the fate of the entire DeFi industry.

Author: Bruce

Introduction

@Uniswap's founder released a new proposal late last night, concerning the 7 failed fee switches over the past 2 years. Here we borrow content from @Michael_Liu93 to explain this proposal and the buyback mechanism:

-

Burn 100 million tokens, 10% of total supply, approximately $950 million (to compensate for previous lack of burns);

-

Use 1/6 of trading fees for buyback and burn (5/6 goes to LPs). Over the past 30 days, fee income was $230 million; annualized, that’s $2.76 billion. 1/6 of that means $460 million annually would be used to buy back and burn UNI on the market. At current market cap, this implies an annual token supply contraction of less than 5%;

-

Valuation multiples for $UNI: $9.5 billion market cap corresponds to ~21x P/E and ~3.5x P/S;

-

Compare with Hyperliquid: Hyperliquid has $42.1 billion FDV, $1.29 billion annual revenue, $1.15 billion annual buyback, 37x P/E, 33x P/S;

-

Compare with Pump: Pump has $4.5 billion FDV. Revenue from meme business is volatile—recent months fluctuated between $1-3 million. Assuming $1.5–2 million daily income, annualized revenue is $550–730 million (100% buyback), corresponding to P/E and P/S of around 6x–8x.

-

Original post here: https://x.com/Michael_Liu93/status/1988031857653674417

PE/PS of U.S. listed companies

🧙♂️Let me guide you through the future outlook of @Uniswap?

Will the Proposal Pass?

✅ Very high probability of passing (over 80%)

1️⃣ Dominance of favorable configurations in core palaces:

The Value Significator falls in Kun Palace. The Value Significator represents the highest decision-making body and final outcome. The configuration "Azure Dragon Returns to Head" is highly auspicious, indicating an inevitable trend and assured success. This clearly points to the proposal's eventual approval.

Both day stem and time stem are supported by auspicious deities and stars, indicating strong internal momentum within the community, with the proposal well-timed and well-structured.

2️⃣ Transformation of opposition forces:

Critical opposing roles (investors) have influence in the chart, but their palace configuration shows softened positions. Tian Rui and Jiu Tian co-located indicate concerns have shifted from "firm opposition" to "how to mitigate risks during implementation." Their energy will focus more on finding solutions rather than outright obstruction.

⚠️ Core issues to face during the process

Despite high likelihood of passage, the process won't be smooth. Three major challenges lie ahead, each corresponding to a palace in the Qimen chart:

1️⃣ Final confirmation of legal and tax risks (core obstacle)

Chart sign: Dui Palace with Tian Rui + Jing Men + Jiu Tian, suggesting a process requiring extensive negotiation.

Real-world counterpart: This is precisely the core concern of investment firms like @a16z. Legal debates over securities classification and DAO tax liabilities will peak before and after voting. Additional legal opinions or minor adjustments to proposal terms may be needed to fully alleviate institutional concerns—the most time-consuming phase.

2️⃣ Backlash and reassurance from LP (liquidity provider) community

Chart sign: Zhen Palace with Liu He + Xiu Men + Tian Ren.

Real-world: Some LPs will be dissatisfied with reduced earnings and may threaten to move liquidity to competitors. Governance must effectively communicate compensation mechanisms (e.g., PFDA) and the rationale for phased implementation to calm tensions and maintain protocol stability.

3️⃣ Exploitation and舆论 interference by competitors

Chart sign: Li Palace with Teng She + Shang Men + Tian Fu Star.

Real-world: Competitors will seize on "UNI sacrificing LPs" to generate negative narratives on social media, attempting to undermine community consensus and divert users and liquidity.

What Does the Future Hold?

Overall trend summarized: Short-term volatility driven by major positive news, medium-term spiral growth amid value re-rating and fierce competition, long-term trajectory deeply tied to the success of @unichain and the fate of the entire DeFi sector. The path is not smooth, but rather one where potential as a "blue-chip DeFi leader" is gradually realized after overcoming multiple obstacles.

🌊 Core Trend Evolution

1️⃣ Short-term (next 3 months): News-driven, consolidation phase

High volatility: Bing Qi in Dui Palace (Jing Men + Jiu Tian) indicates a sudden spike due to proposal news. However, sharp rallies will inevitably lead to pullbacks and consolidation.

Critical milestone: The 22-day voting period ahead is key. With Jing Men as the time ruler in Dui Palace, $7–$7.5 is the short-term lifeline. Holding this range increases chances of another upward move post-approval.

Market sentiment and voting progress will dominate price action, characterized by wide swings to accumulate energy for the next directional breakout.

2️⃣ Medium-term (6 months – 2 years): Value re-rating, upward trend

Expansion of格局: Jia Shen Geng in Kun Palace, under Value Significator and Tian Ying, suggests that once approved, mainstream capital attention will be attracted, initiating a value discovery cycle.

6 months: Target price $15–$25, market cap $15–25 billion, baseline scenario.

1–2 years: If protocol captures stable revenue and maintains deflation, it could challenge historical highs of $44.5 and advance toward $50–$75. In 2026 (Bing Wu year), Li Palace fills completely, potentially aligning policy and ecosystem tailwinds.

3️⃣ Long-term (3–10 years): Ecosystem supremacy, destiny fulfilled

Success path: If @Unichain successfully builds its ecosystem, integrating protocol revenue with on-chain value capture, $UNI will evolve beyond a DEX token into a core asset of Web3 financial infrastructure. The Qimen configuration "Value Significator守Kun, Azure Dragon Returns to Head" supports long-term leadership, with price targets of $100–$200.

Mediocre path: If unable to break through competitively and only maintains current market share, $UNI becomes a high-quality "DeFi bond," valued on steady buyback/burn, trading in the $30–$60 range.

Competitive Landscape: Moats and Breakthrough Points

Moat: @Uniswap sits in Kun Palace under Value Significator, representing unmatched brand strength, liquidity, and user habits—barriers rivals cannot quickly overcome.

Breakthrough point: Competitors in Dui Palace, with Tian Rui + Jiu Tian, use aggressive token incentives (ve(3,3)) that are powerful but unsustainable. @Uniswap’s key lies in leveraging technical upgrades like V4 Hooks and @Unichain to create new value streams without severely harming LP returns—achieving both fish and bear paws.

Key Risk Warnings

Governance risk: The biggest uncertainty remains the vote. Despite high passage odds, Du Men signifies obstacles—watch for last-minute legal concerns raised by large holders like @a16z.

Competition risk: Zhen Palace with Liu He + Xiu Men suggests other protocols may collude to steal liquidity. Significant LP outflows triggered by fee switch could undermine fundamentals.

Macro and regulatory risk: Kan Palace with Xuan Wu + Jing Men warns of potential regulatory black swans post-2026 and systemic crypto bull-bear cycle risks.

Outlook Scenarios: Success Lies in Ecosystem Integration

🔄 Uniswap: The Return and Defense of a DeFi Titan

Core outlook: The protocol will transform from a "governance tool" into a "yield-bearing asset," completing the value capture loop—but its throne as liquidity leader faces unprecedented threats.

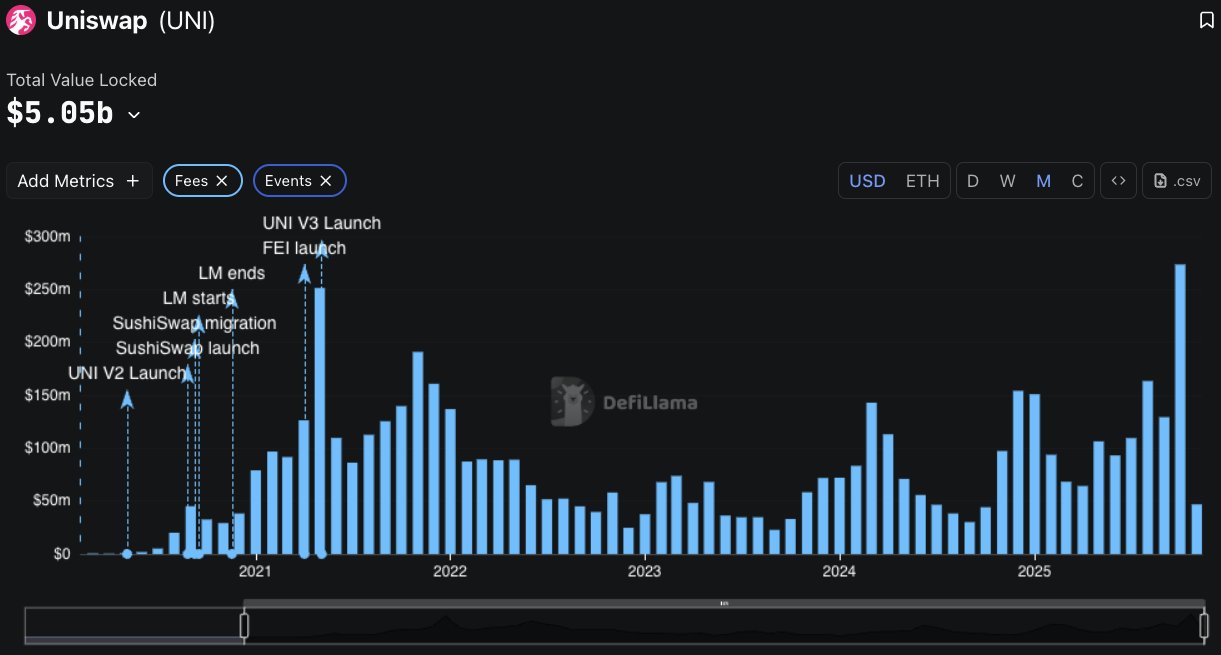

Uniswap Protocol Revenue

1️⃣ Value Reformation (1–2 year golden window)

Positioning: Kun Palace "Value Significator + Wu Bing Azure Dragon Returns to Head"—a sign of王者return and value re-rating. Activating the fee switch is the catalyst. $UNI will shed its "valueless governance token" label and become a core asset with clear cash flows and deflationary expectations.

Valuation target: With hundreds of millions in annual buyback/burn, its PE will shift from current 2.2x (fee basis) toward traditional tech stocks (20–30x). Retesting all-time highs ($44.5) within 1–2 years is likely; mid-to-long term, $75–$100 is achievable.

2️⃣ Moat Defense (core conflict)

Risk: Dui Palace with Tian Rui + Jiu Tian—competitors are aggressively attacking using high capital efficiency (ve(3,3) model). Uniswap’s strategy of sacrificing some LP yield for protocol revenue is a double-edged sword.

Make-or-break: Whether innovations like V4 Hook and PFDA auctions can generate new LP revenues sufficient to offset fee cuts. Success strengthens the moat; failure triggers a negative spiral of liquidity loss.

⛓️ Unichain: High-Stakes Ecosystem Breakout

Core outlook: A high-risk bet—if successful, unlocks trillion-dollar valuation potential; if failed, becomes just another mediocre "backup chain."

Unichain Revenue Situation

1️⃣ Opportunity and Ambition

Positioning: Gen Palace "Kai Men + Bai Hu + Tian Peng." Kai Men signals massive market opportunity and new narrative. Tian Peng reflects bold speculation and expansion, suggesting @Unichain aims to solve mainnet performance bottlenecks and value capture via dedicated chain, building new ecosystem barriers.

Potential: If @Unichain tightly integrates sequencer revenue, V4 native advantages, and $UNI tokenomics, it transcends being just a chain—it becomes the value settlement layer for @Uniswap’s entire ecosystem, far surpassing a mere DEX protocol.

2️⃣ Risks and Challenges

Hazardous格局: Bai Hu signifies fierce competition and pressure, meaning @Unichain will directly confront dominant L2 ecosystems like @base, @Arbitrum, and @Optimism. Tian Peng also hints at "excessive speculation" and "security vulnerabilities."

Core challenge: Cold start of ecosystem—its survival depends on attracting top-tier apps beyond @Uniswap itself to create network effects.

Value proof: Can initial sequencer revenue (~$7.5M annualized) justify massive chain development and maintenance costs while delivering value back to $UNI holders?

🌐 Symbiotic Relationship: Shared fate, shared fortune

Success Scenario (70% probability): @Uniswap leverages brand and liquidity to stabilize its base and feed early users/reputation to @Unichain; @Unichain reciprocates with lower transaction costs and flexible Hook applications, reinforcing @Uniswap’s leadership and unlocking new revenue streams. A flywheel forms, making $UNI the master key to the entire ecosystem’s value.

Failure Scenario (30% probability): @Uniswap loses liquidity due to fee switch, eroding market share; @Unichain stagnates due to barren ecosystem. They drag each other down, and $UNI’s value revival story collapses.

🔭 Key Indicators for Future Evolution

-

Early December 2025: Final vote result on fee switch and immediate market reaction.

-

Mid-2026: V4 adoption rate and early deployment status on @Unichain.

-

2027: Unichain’s standalone TVL and number of native apps—can it build an independent ecosystem?

Uniswap Labs’ Ultimate Fate: Spin-off and IPO?

In the future, Uniswap Labs may spin off parts of its operations (e.g., @Unichain development, frontend services) into an independent company and pursue a public listing—a highly plausible path.

✅ Favorable factors supporting IPO (probability: ~60–70%)

1️⃣ Chart indicates "Kai Men" is open

The Gen Eight Palace, representing Uniswap Labs' initiative, inherently carries "Kai Men," symbolizing new organizations, opportunities, and partnerships. Spinning off businesses into a company aligns perfectly with this sign.

Tian Peng in this palace signifies bold capital moves and expansion, indicating Labs has the ambition and drive to pursue massive fundraising initiatives.

2️⃣ Clear value carrier, avoids core conflict

This move skillfully separates "protocol governance rights" (belonging to $UNI token) from "technical service and development rights" (belonging to listed equity). The listed entity can be valued based on technical capabilities, software revenue, and future @Unichain sequencer income—decoupled from the contentious securities classification of $UNI, resolving the most critical regulatory conflict.

3️⃣ Precedents exist

Like the relationship between @Coinbase and @Base, or earlier @ethereum and @Consensys. @Consensys, as a core Ethereum developer, has completed multiple funding rounds and frequently surfaces in IPO rumors—providing a clear blueprint for Uniswap Labs.

⚠️ Challenges and risks (obstacles remain)

1️⃣ Market competition and pressure

Gen Palace sees Bai Hu, meaning even if spun off and listed, the process will face intense competition and external pressure. Capital markets will compare it with @Coinbase and rigorously assess profitability and growth.

2️⃣ Delicate balance of格局

The listed company still heavily relies on @Uniswap protocol’s brand and ecosystem. Ensuring alignment between corporate interests and decentralized community goals is a major governance challenge. If corporate actions harm protocol (e.g., excessive fees), $UNI community backlash could shake foundations.

3️⃣ Business independence and valuation basis

Capital markets will ask: What is this company’s core moat? If it’s merely a frontend provider for @Uniswap, its value is limited. It must prove independent technical advantages and revenue streams (e.g., exclusive @Unichain operating rights, cross-chain patents) to command high valuation.

Final Thoughts ✍️

At a DeFi crossroads, Uniswap Labs is using the fee switch as a key to unlock a golden era of value capture: the proposal will likely pass, $UNI will evolve from governance tool to yield-bearing asset, teaming up with @Unichain for ecosystem breakout, creating a symbiotic flywheel effect. Further, if Labs successfully spins off and goes public, it could resolve regulatory constraints, inject mainstream capital vitality, and propel $UNI to new heights. Yet success or failure hinges entirely on community consensus, competitive defense, and the guidance of fate.

Are you ready to witness the return of the DeFi king and the rise of a Web3 financial empire?

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News