Compared to Uniswap V3, what problems does Trader Joe's Liquidity Book solve?

TechFlow Selected TechFlow Selected

Compared to Uniswap V3, what problems does Trader Joe's Liquidity Book solve?

DEX, a fundamental building block of DeFi, is facilitating cryptocurrency trading without intermediaries.

Author: Kingsley Bowen

Compiled by: TechFlow

Introduction

Decentralized exchanges (DEXs) are a fundamental component of DeFi and are driving the elimination of intermediaries in cryptocurrency trading. DEXs serve as the primary medium for price discovery of new cryptocurrencies, as traders exchange established currencies for tokens from emerging projects. At the same time, DEXs provide native exchange rates between two or more cryptocurrencies.

Generally, the largest projects deployed on blockchain networks are Automated Market Maker (AMM) DEXs. AMM-style DEXs act as an alternative to order book-based DEXs, where buyers and sellers are matched one-on-one.

In AMMs, financial participants known as liquidity providers (LPs) supply cryptocurrencies to asset pairs or pools and receive a share of the fees generated from trades within the pool. With LPs supplying assets to the pool, buyers and sellers can exchange cryptocurrencies.

Naturally, this reliance on LPs requires strong incentive mechanisms to encourage participation through maximizing returns and minimizing risks.

This article will introduce the current industry-standard AMM protocol—Uniswap V3—and examine a novel AMM offered by Trader Joe called Liquidity Book. Liquidity Book introduces new utilities and mitigates some impermanent loss issues inherent in the current standard.

Uniswap V3

Over the past year, Uniswap V3 on Ethereum has processed monthly trading volumes between $35 billion and $70 billion, with $11.94 billion currently locked in Uniswap V3 smart contracts, making it one of the largest sources of liquidity in the crypto industry.

The key innovation of Uniswap V3 compared to Uniswap V2 is concentrated liquidity.

Concentrated liquidity allows LPs to allocate their liquidity within a specified price range rather than spreading it evenly across the entire price curve of the pool.

LPs or pool providers can direct liquidity toward price ranges they believe will generate the highest trading fees while also providing depth at price levels most useful to traders.

This makes Uniswap V3 up to 4,000 times more capital efficient than Uniswap V2.

Market participants seek maximum capital efficiency to achieve low fees, reliable pricing, and optimal trading experiences. Due to low capital efficiency, DEX traders face illiquid markets, high slippage, and high transaction costs, while LPs face greater risks of impermanent loss.

Despite improvements over V2, Uniswap V3’s main drawback is increased impermanent loss for liquidity providers.

According to research conducted by Topaze.blue, about 50% of depositors in Uniswap V3 suffer negative returns due to impermanent loss.

In Uniswap V3, once the price moves outside the range set by the liquidity provider, the asset pair is no longer used for swaps. This means LPs stop earning trading fees but still bear the risk of impermanent loss. Moreover, for LPs to resume earning fees, they must rebalance their assets into a new range, incurring additional gas costs.

When gas fees are high, many retail providers cannot actively manage their positions. This leads to centralization of liquidity provision, as only large-scale LPs can continuously absorb the costs of rebalancing and remain profitable. Since LPs are profit-driven, when large players shift between markets seeking higher yields, it may lead to unstable and illiquid markets.

Liquidity Book

Structure

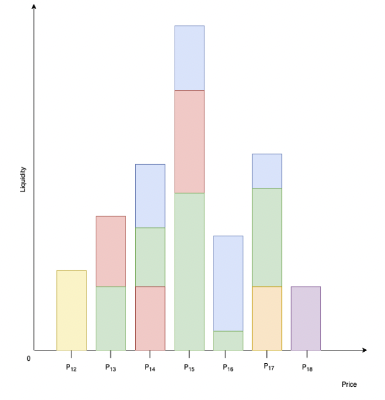

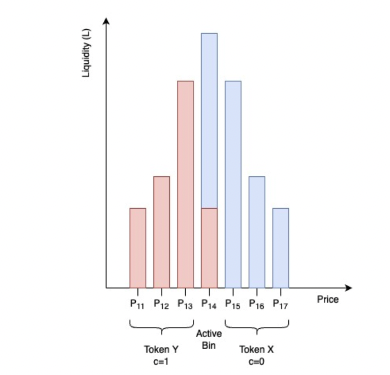

Liquidity Book is a new AMM designed by Trader Joe, the largest DEX on Avalanche. The Liquidity Book protocol uses a form of concentrated liquidity they call "binned liquidity," which arranges the liquidity of asset pairs into different "bins," each with a specific price. Users can provide liquidity across multiple bins simultaneously. Below is an example of a liquidity structure contributed by various LPs:

The market price exists only within one active bin; it is determined by the lowest-priced bin that contains both asset reserves. In Liquidity Book, any bin above the active bin contains only one asset, while any bin below the active bin contains only the other asset.

If an LP anticipates that the market price might move toward a certain bin, they can provide liquidity in that bin using just one asset. The higher the proportion of an LP’s liquidity in the active bin, the more fees they earn. Therefore, selecting the right price range and liquidity composition is crucial to maximizing investment returns.

Each bin operates its own constant-sum market with its own invariant curve. This means that as the asset composition changes within a bin, the price remains unchanged until only one asset remains. Thus, as long as sufficient liquidity exists in the active bin, trades of any size can be executed without affecting the price. When the assets in a bin are depleted, the bin directly above or below becomes active. Additional token swaps then occur at the price of the new bin. The overall market for the trading pair is formed by aggregating all bins.

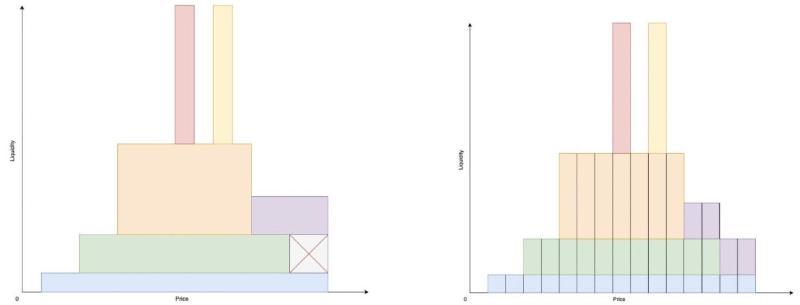

Using this bin structure, LPs can distribute liquidity vertically across the market, unlike Uniswap V3, which distributes liquidity horizontally. This difference is best illustrated in the figure below.

Vertical distribution gives LPs greater flexibility. If an LP wants to adjust their position, they can add or remove liquidity to new bins without altering their existing positions. In contrast, horizontal adjustments under Uniswap V3 require LPs to rebalance within their defined price range.

Positions in Liquidity Book are represented by LBTokens, which are compatible with the ERC-20 standard. Because LBTokens are functionally effective and fungible, they become foundational building blocks for complex strategies. Not only can protocols and users develop customized liquidity structures matching their risk profiles, but they can also easily manage them according to changing market conditions.

Mitigating Impermanent Loss

The primary improvement of the Liquidity Book model for LPs comes from its fee structure, which helps counteract impermanent loss caused by volatility. Liquidity Book uses bin intervals—or jumps from one bin to another—to measure instantaneous price movements.

The total swap fees collected by LPs consist of two parts: a base fee and a variable fee. The base fee represents the minimum fee rate applied to all swaps, capped at the bin interval. The variable fee fluctuates based on market conditions and depends on a volatility accumulator.

The volatility accumulator records instantaneous volatility based on trade frequency and impact. Since each bin change represents a fixed price increase or decrease, the accumulator can simply count how many bins a swap crosses to calculate its real-time impact on the pool, without relying on external oracles.

When multiple large swaps occur within a short period—indicating market volatility—the volatility accumulator increases. It decays if activity slows down significantly and resets entirely if no swaps occur after a certain period. The variable fee scales with the accumulator up to a predefined cap.

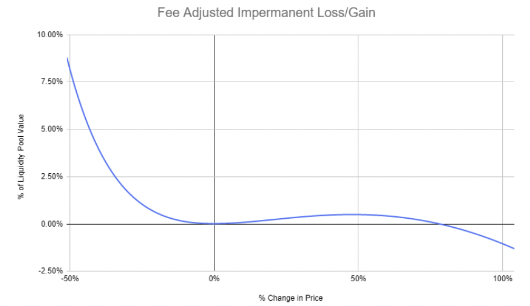

Variable fees make providing liquidity more attractive to LPs during volatile markets, helping maintain liquidity depth when it's most needed. Additionally, thanks to the volatility accumulator and variable fees, LPs have the potential to exceed expected returns. The chart below illustrates impermanent loss/gains after fee adjustments, depicting potential changes in pool value under different volatility scenarios.

This data indicates that under most market conditions, LPs can profit even after accounting for impermanent loss, provided the liquidity pool is sufficiently large. During extreme volatility, LPs still face impermanent loss, which could be a bigger factor in smaller markets.

Capital Efficiency and Market Depth Comparison

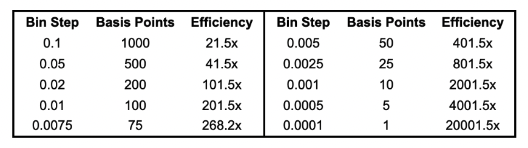

By comparing the price impact of swaps from Trader Joe V1 to Trader Joe V2, we can identify the maximum capital efficiency limit for each market at a given bin, as shown below:

Between these two models, we observe improved capital efficiency over Uniswap V3.

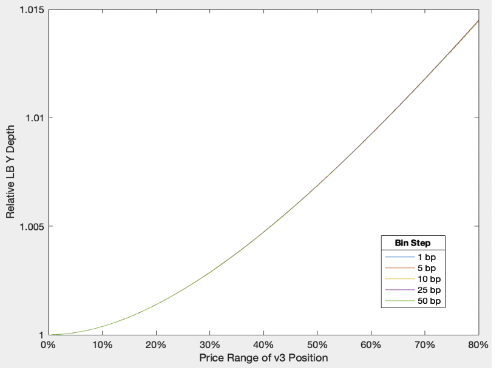

Assuming liquidity is evenly distributed across bins, we can plot the relative differences in market depth between the Liquidity Book model and Uniswap V3 across various Uniswap V3 price ranges.

The chart shows that under this assumption, the choice of price range in Uniswap V3 has a greater impact on market depth than the bin structure. It also shows that when Uniswap V3 price range coverage is below 60%, the difference in relative market depth stays within 1%. As the price range increases, the disparity grows larger.

Conclusion

The Liquidity Book protocol represents a partial solution to one of the biggest risks faced by LPs in AMM DEXs.

While impermanent loss can never be fully eliminated due to inherent volatility risks, Liquidity Book DEXs may offer a way to minimize impermanent loss under normal market conditions. Capital flows toward areas of highest return and lowest risk, and Liquidity Book offers potentially higher returns and lower risks than the current industry standard.

However, widespread industry adoption may face obstacles, as Liquidity Book might not be a viable option for retail LPs on blockchains due to gas cost concerns.

For now, the first implementation of Liquidity Book is undergoing smart contract audits, and the Trader Joe team will soon release further research on it.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News