Understanding SteakHut: A Liquidity Management Solution Based on Trader Joe

TechFlow Selected TechFlow Selected

Understanding SteakHut: A Liquidity Management Solution Based on Trader Joe

SteakHut provides automated liquidity management solutions and delivers generous rewards for $STEAK token holders.

Author: Fungi Alpha

Translation: TechFlow

Trader Joe has recently grown increasingly dominant in the DeFi space, capturing trading volume on Avalanche and Arbitrum, and is now beginning to emerge on BNB Chain as well. While concentrated liquidity can enhance the trading experience, it presents a nightmare for liquidity providers (LPs)—when volatility strikes, liquidity must be adjusted, but doing so manually and in a timely manner is nearly impossible.

To address this, SteakHut offers an automated liquidity management solution while delivering substantial rewards to $STEAK token holders. In this article, crypto KOL Fungu Alpha analyzes and interprets the project from the perspectives of APR, tokenomics, and roadmap, sharing his personal insights.

What is SteakHut?

SteakHut is a relatively new project designed to assist LPs on Trader Joe. To understand this project, we must first examine Trader Joe and its position within DeFi. Today, it accounts for over 60% of DEX trading volume on Avalanche.

Simultaneously, it's gaining traction on Arbitrum. Currently, it ranks as the second-largest DEX by trading volume on Arbitrum, capturing approximately 6% of total volume—surpassing even Curve.

They've also recently launched on BNB Chain. With the arrival of JoeV2 and UniV3 on BNB Chain, a new era of capital efficiency has begun on-chain. In such a short time, Trader Joe has already become one of the top 15 DEXes by trading volume on BNB Chain.

The success of Trader Joe also signals potential success for SteakHut. Several factors currently favor JoeV2:

-

Dominance on Avalanche;

-

Growing influence on Arbitrum;

-

Delivering much-needed capital efficiency on BNB Chain.

As JoeV2 continues to grow, effective liquidity management will become crucial—this is where SteakHut steps in.

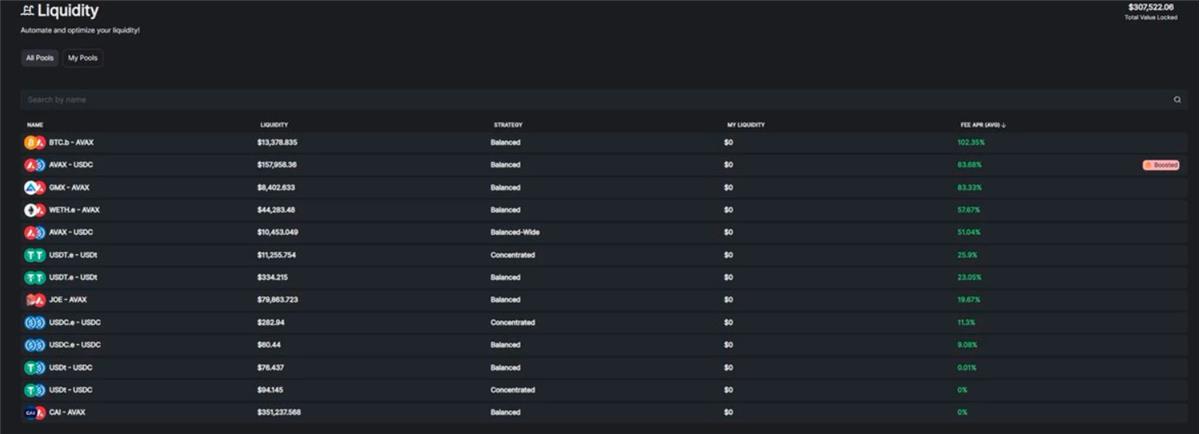

Most users do not want to constantly adjust their price ranges for providing liquidity. With SteakHut Liquidity, users can deposit tokens into liquidity vaults (specific price ranges).

This essentially automates the process of keeping liquidity within relevant price zones, and most importantly, enables users to maximize their returns.

These returns are substantial—not only does the platform offer a valuable service, but users receive tangible yields in return. (And don't forget, these yields come from providing services—i.e., being an LP—not from token emissions.)

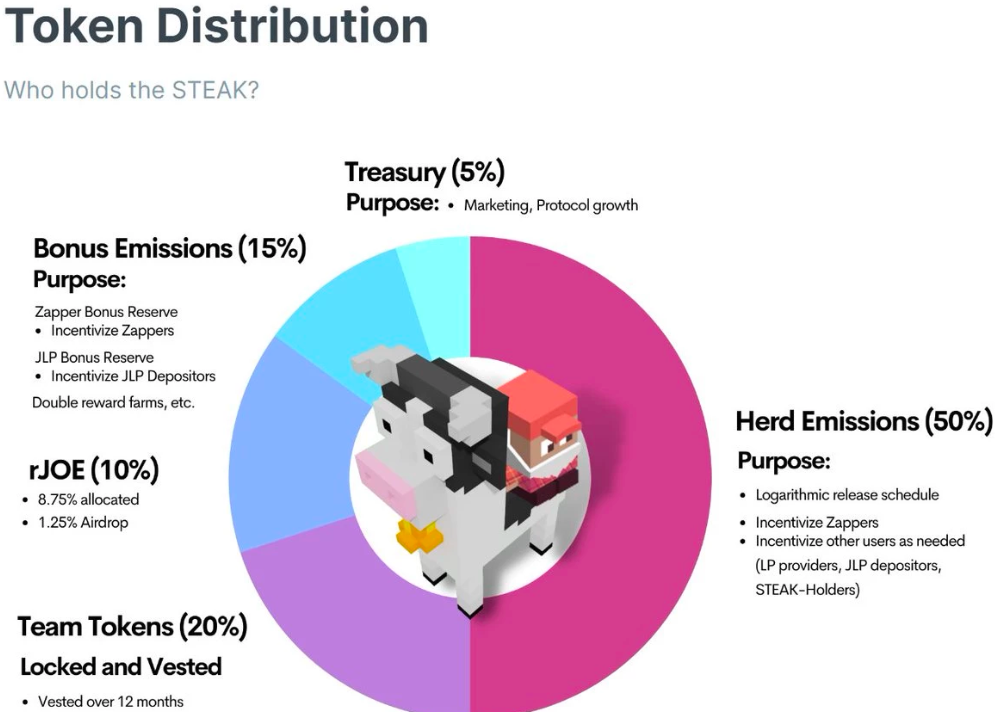

Tokenomics

A significant portion of these rewards consists of real yield. Specifically, users who deposit LP tokens into SteakHut receive 80–97% of the platform’s total revenue. The remainder goes to users staking $STEAK tokens.

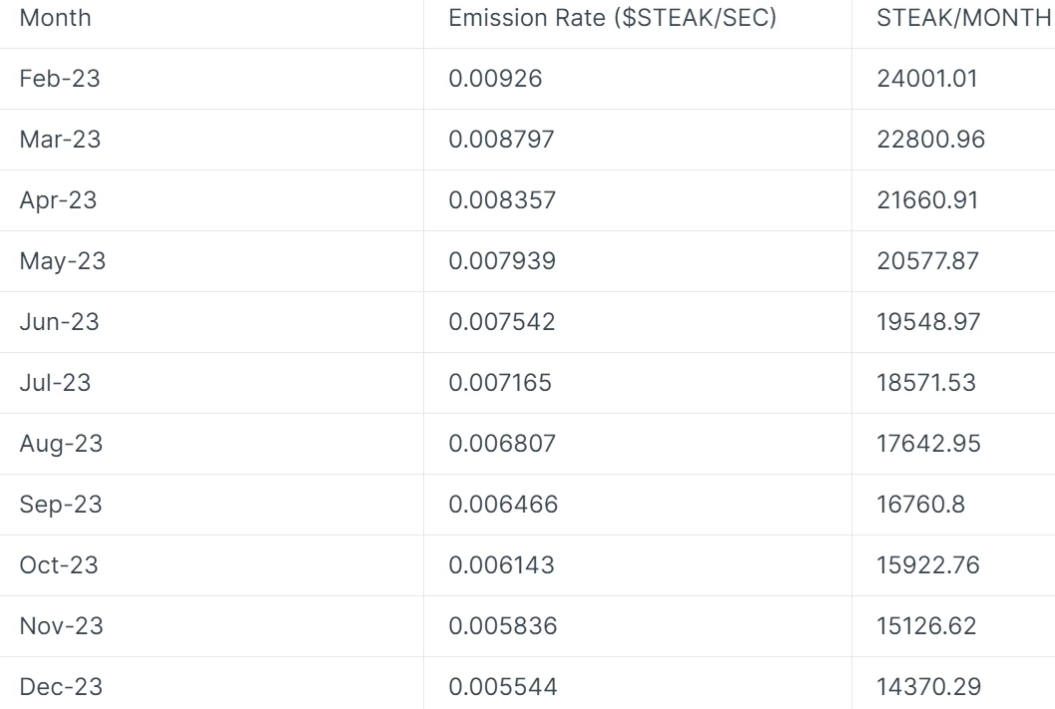

The team is acutely aware of the negative impact excessive issuance can have on token value, so the maximum supply of $STEAK is kept very low at just 5 million tokens.

With that in mind, all rewards distributed to $STEAK holders will be paid out in $JOE tokens:

By the end of 2022, around 3.2 million $STEAK were in circulation. Starting in 2023, only about 0.3–0.5% of the total supply is released each month.

If that isn’t scarce enough for you, $STEAK will follow $JOE’s path to become an omnichain fungible token (OFT). This means the supply will be distributed across Avalanche, Arbitrum, BNB Chain, and any other chains where JoeV2 is likely to expand in the future.

Roadmap, Plans, and My Thoughts

What lies ahead for SteakHut?

Earlier this month, I hosted an AMA with the team and learned some interesting things.

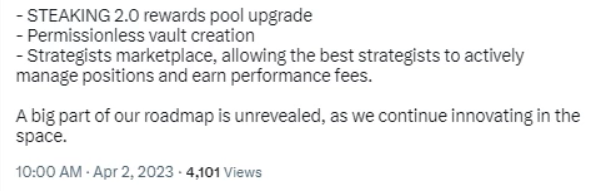

- First, the team is internally excited about their new contract, which will bring numerous significant upgrades, including some form of integration with STEAK DAO NFTs.

- Second, the team is actively developing a new SteakHut model—one that makes me even more bullish.

SteakHut is moving further toward permissionless access and usability—and it's better than you might think;

Their next platform version will include fully customizable, permissionless vaults and strategies. For example, a DAO could create a custom strategy exclusively for its members. Moreover, these vaults are part of SteakHut’s “Liquidity-as-a-Service” (LAAS) initiative, through which the team aims to collaborate with as many prominent DeFi projects as possible.

This opens up infinite possibilities for SteakHut’s product suite and creates opportunities to attract a broader user base.

My view is simple: given that Trader Joe and its Liquidity Book have already demonstrated strong performance (and are still in early stages), we’ve chosen $STEAK. I believe that once the LB narrative gains more momentum, $STEAK’s position will become even stronger.

Project link: https://twitter.com/steakhut_fi

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News