Maverick Letter to Investors: Unscathed from FTX Bankruptcy, Outlook on Future Crypto Investment Opportunities

TechFlow Selected TechFlow Selected

Maverick Letter to Investors: Unscathed from FTX Bankruptcy, Outlook on Future Crypto Investment Opportunities

At Maverick, our top priority is always ensuring the safety of our own and our clients' assets, along with risk control. Manage risk before pursuing excess returns.

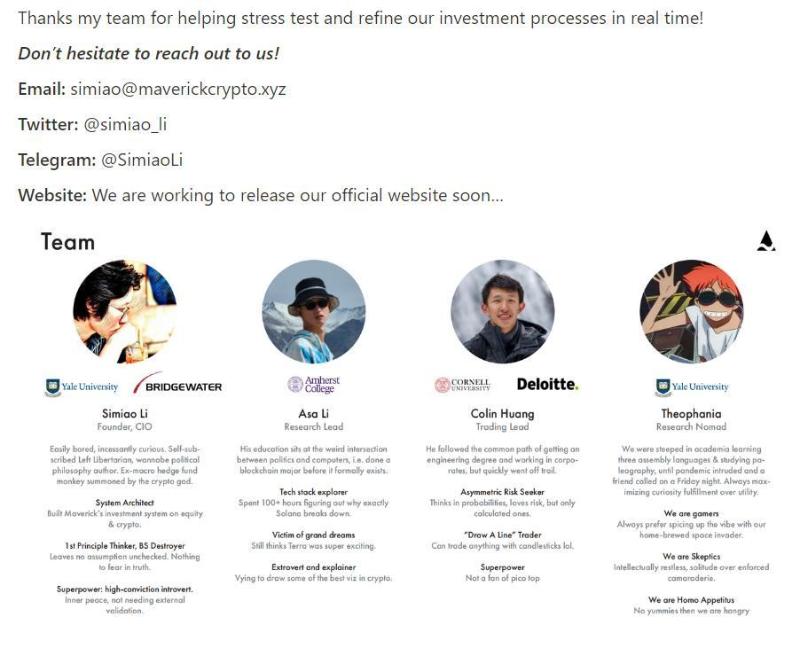

Author: Simiao Li, Maverick Crypto

Translation: Cookie, ChainCatcher

Authorized for publication by TechFlow.

The shockwaves from FTX’s collapse continue to ripple through the market, and uncertainty remains about how events will unfold. However, we now have sufficient time and information to:

1) Summarize the impact of this event on Maverick’s portfolio,

2) Review our investment framework/process in light of this market stress test,

3) Share forward-looking perspectives on the crypto market and industry.

This article avoids grandstanding on the origins or moral implications of the FTX collapse—matters best left to courts and journalists. As investors in the crypto market, our primary responsibility is to adopt a pragmatic, objective view of the market and act as “market mechanics,” not crypto morality preachers (though the ethical conclusions around FTX should be obvious enough).

Facts

Maverick was completely unaffected by the FTX bankruptcy.

1. No trading exposure:

Maverick had no trading exposure on FTX. We generally do not keep large amounts of assets deposited long-term on any single centralized platform.

2. No portfolio exposure:

- We were holding 100% cash before and throughout the entire incident. This was due to Maverick's proprietary indicators:

-

1) Strong bearish outlook on macro liquidity;

-

2) Assessment that current short-term trading dynamics in crypto did not align with our investment system, leading us to maintain an extremely cautious position recently (details below).

- Maverick chose not to actively short during the event and its aftermath, because highly idiosyncratic, news-driven shorting opportunities are not where our edge lies. Our investment horizon is medium- to long-term, and the factors we’re most confident in understanding are fundamentals of crypto assets, macro conditions, and structural shifts in capital flows. We calmly observed the legendary “short-term news traders” duel it out in this “Big Short” moment.

3. Regarding FTX/Alameda-related assets:

-

We studied FTT while researching CEX tokens and identified several red flags. Overall, we found FTT less attractive compared to BNB and other CEX assets (more details below).

-

In the first half of 2022, we had two opportunities to invest small amounts in secondary shares of FTX at valuations slightly discounted from prior VC rounds. We declined due to our belief that FTX was overvalued.

-

We maintain a constructive long-term view on Solana but held zero exposure before and at the time of the incident. We may accumulate Solana positions in the future if we see sustained new developer activity (see below).

-

We have no exposure to any other ecosystem assets related to FTX/Alameda.

After such blow-up events, more important than discussing specific investment outcomes is deep reflection and optimization of our investment and risk management systems (“investment machine”). The crypto market has a short history, and these tail-case samples are rare. Thus, the FTX bankruptcy serves as a valuable stress test for refining our repeatable investment framework and risk processes.

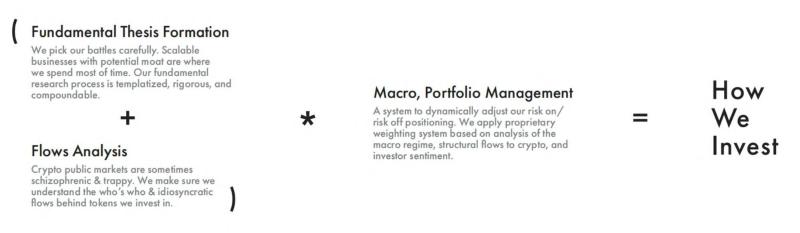

Investment Framework Explained

Maverick’s investment framework rests on three pillars:

-

Fundamental analysis;

-

Liquidity/market structure analysis;

-

Macro environment and portfolio risk management.

We only increase overall risk exposure when asset targets and market conditions meet all criteria across these frameworks.

Top-Down Risk Exposure Management

We combine:

1) Macro indicators;

2) Liquidity-based market metrics;

3) Investor sentiment tracking—to understand the prevailing market environment and trading regime.This ensures top-down control over total portfolio risk exposure at all times.

Prior to the FTX collapse, markets rallied, yet we remained in cash, because:

- We were strongly bearish on the macro front, especially after hawkish FOMC meetings. We’ve repeatedly stated that given high inflation, a hot labor market, and the Fed operating under a Volcker-style hardline hawkish framework, a macro turning point hasn’t arrived. The Fed is data-dependent, and data lags reality. The Fed clearly prioritizes bringing inflation down significantly—even at the cost of recession and further equity drawdowns. It’s not worth trying to front-run the Fed’s pivot as a public market investor.

(Note: Our tweet thread on overall market direction.)

- Maverick’s proprietary liquidity dashboard indicated that crypto was in a deeply unfavorable short-term PvP “meta-game,” so we maintained 100% cash exposure.

- “Little new capital flowing into crypto. Stablecoins have dry powder, but no major catalysts to deploy it. Plus, significant token unlocks expected over the next 6–12 months.”

- “This is a clear PvP market. No strong trends, tight-range volatility, and increasingly difficult theme rotation. Rallies don’t last beyond brief news cycles—like Instagram NFT support spikes or Twitter acquisition rumors.”

- “Current market conditions don’t suit our investment timeframe or style.”

Considerations on (Not) Shorting

Our system does not shy away from hedging or deploying capped net short positions when necessary. But in this downturn, we chose zero net exposure. For various reasons, shorting in this environment was exceptionally dangerous—all volatility driven by unpredictable news flow:

1. Highly unique, news-driven event:

- Before the event: Without insider knowledge, it was nearly impossible to predict how such a singular event would unfold. Frankly, we considered the likelihood of FTX collapsing in this manner relatively low.

- During the event: As developments accelerated and new information emerged, bankruptcy became increasingly likely—but the timeline moved extremely fast (from FTX run, potential Binance acquisition, to official bankruptcy in under 48 hours). Throughout, shorting FTT, SOL, or related assets carried high risk, as price movements were heavily influenced by negotiations among key players (Binance, Justin Sun), where we had no informational edge.

- After the initial phase: As volume normalized and prices completed the first leg down, the risk-reward profile of shorting deteriorated sharply. While we believe the fallout will continue—dominoes will fall—such dynamics are inherently hard to capture in real time, as insolvent actors have strong incentives to fake solvency until they can’t anymore.

2. Extraordinary counterparty risk:

- Under extreme conditions, all centralized exchanges carry additional counterparty risk. Profits from short positions could easily be wiped out by principal loss on exchange.

There are many skilled news-event traders in the market—we prefer to wait and watch them battle it out. This wasn’t our moment to act. Even if we profited from shorts, it would’ve been luck, not skill.

Due Diligence on FTT

We previously conducted in-depth research on exchange tokens (and equities), ultimately favoring other opportunities (e.g., BNB, Coinbase equity) over FTT for the following reasons:

- Opaque value capture: FTT lacks significant native demand (unlike BNB) and transparent, long-term cash flow mechanisms (unlike Coinbase stock), relying instead on opaque “burns” conducted by FTX.

- Conflict with FTX equity holders: FTT contributes nothing to FTX’s operations but represents a net non-cash expense equal to one-third of exchange revenues. There’s a strong conflict of interest between FTX shareholders and FTT holders.

- Doubtful commitment to FTT: Given FTX’s heavy VC backing and apparent ambition to become a public company, maintaining FTT wouldn’t serve their interests post-IPO.

Why would FTX continue running a token that provides no meaningful benefit to the exchange and consistently drags on revenue? Why would shareholders allow this? We were puzzled. We saw enough red flags to avoid FTT entirely. See our original internal notes here: [CEX Token Economics Research]

As it turns out, things were far worse than we imagined. FTT now appears more like a token purely designed to manipulate prices, inflate collateral value, and keep FTX’s Ponzi machine running. In hindsight, perhaps we now understand why FTX kept this seemingly irrational token alive.

Due Diligence on Other Related Tokens

Solana (SOL)

We had no exposure to Solana or its ecosystem assets.

However, our long-term fundamental view on the Solana ecosystem deserves separate discussion. Forward-looking commentary on Solana follows later in this piece.

SRM and other FTX/Alameda-related projects

We never touched these assets and don’t plan to spend much time on them going forward.

Low float/FDV has always turned us off. Generally, we don’t focus heavily on hyped VC-backed assets, as average quality in the primary market is questionable—and ironically, early-stage hype often inversely correlates with public market returns.

That said, we remain highly interested in orderbook-style DEXs (CLOBs) built on high-performance blockchains (whether Solana or others), as we believe this is the next evolution of DEXs.

Forward-Looking Views

Macro Level: Resist the Temptation to Catch Falling Knives

This is crypto’s Lehman moment—the spark for the “ultimate bomb” we’ve internally anticipated over the past year. The domino effect isn’t fully revealed yet, so now is not the time to play hero. Don’t try to catch falling knives.

We’ll publish a longer piece with more historical analogs (from both crypto and TradFi), but for now, a simple argument suffices.

We don’t know the full extent of public losses from FTX’s collapse, but multi-billion dollar liquidity gaps won’t be easily absorbed by the young crypto financial system. Especially amid already-thin liquidity in a bear market, market makers and prop shops will likely pause rebuilding after heavy losses. Liquidity crises will be widespread; credit will tighten both within and beyond crypto.

Crypto has no Fed to bail us all out. While some hope CZ and Binance step in, this contradicts CZ’s philosophy (“let markets function naturally; short-term prices don’t matter”). Even if CZ wanted to be a savior, there’s no precedent or “deep market memory” to establish a consensus around “CZ as crypto Powell” capable of rallying markets like the Fed does.

Our view: Markets may consolidate in narrow ranges, experience one or two more crashes—likely tied to spillovers from FTX and final drops in traditional markets amid recession fears. Then, expect months of range-bound, low-volatility “nothingness,” internally termed “the nothingness stage,” until a catalyst reignites the next bull cycle (possibly linked to a Fed policy pivot).

In any case, the risk-reward of getting long too early is very poor right now. Even if we’re wrong and this is the bottom, we won’t see a V-shaped recovery because:

1) Macro and liquidity conditions (bearish);

2) Structural liquidity pressures in crypto (bearish);

3) Lack of transformative innovation catalysts to excite institutions or retail;

4) High likelihood of negative regulatory catalysts within the next six months.

Solana

Frankly, staying bullish on Solana now seems difficult, but often when sentiment swings to extremes, independent thinking can shine and generate outsized returns. If we observe sustained development activity in the Solana ecosystem over the next 12 months, we believe holding SOL could once again offer an attractive risk/reward profile. Right now, we assign no 90% confidence judgment on anything Solana-related. We’ll keep monitoring. But at this juncture, cautiously waiting with an open mind for positive developments offers far better expected returns than perpetual bearishness.

- This is a long-overdue cleansing for the Solana ecosystem, removing opportunists who hijacked the narrative. In the short term, pain will persist—prices may fall further, capital flows dry up, and some projects migrate to other chains.

- Solana’s technology itself remains differentiated and promising. The founding team emerged from the last bear market—not crypto tourists, but a group of committed, talented engineers. Now is the time for Solana’s native developer community to step up and shape their own ecosystem.

- Counterintuitively, the collapse of FTX and its allies might indirectly benefit Solana. The “VC/giant-backed L1” narrative is shattered, hitting Solana’s direct competitors (other high-performance monolithic chains like Aptos and Sui) just as hard—if not harder—yet those lack a genuine, battle-tested community to endure the coming bear market. In crypto, path dependency matters. What ultimately determines project and asset trajectories (especially L1s) is the people/community behind them—their incentive to be “diamond hands.” And in human nature, what unites people more than fleeting glory is shared hardship, followed by rebirth. Ethereum’s path may be one Solana walks again.

In sum, we’re watching closely to see how this unfolds. This could be a generational buying opportunity—or a fragile ecosystem’s quiet exit. Until the epic conclusion arrives, there’s little more to say.

Beneficiaries of the FTX Collapse

Not all hope is lost. Some crypto assets will clearly benefit from FTX’s implosion. Setting up relative-value trades here could be highly interesting.

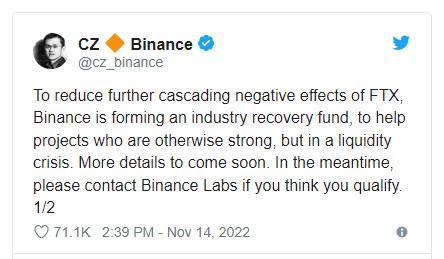

Binance Chain (BNB):

Binance solidified its leading brand and market share. Projects previously built on Solana and/or funded by FTX/Alameda will migrate under Binance’s umbrella—onto BNB Chain and under Binance Labs (we’ve already seen the shrewd CZ move swiftly after FTX’s fall).

Overall, we’ve long believed the BNB ecosystem is underrated by crypto-native investors. It’s the Eastern Ethereum—backed by a benevolent dictator, with strong execution power and grassroots crypto support.

We’ve been long-term bulls on BNB—this event simply accelerates that thesis.

Source: https://twitter.com/simiao_li/status/1568176304780091392

Polygon (MATIC)

Polygon currently needs little help from anyone, having led other L1s by a wide margin in execution and business development.

The downfall of FTX and its allies is absolutely another strong tailwind for Polygon amid a bear market.

Once dust settles, a trade pairing (long MATIC, short SOL) could be compelling for the medium term.

Native Infrastructure

Code must replace trust. This is the only way crypto can break monopolistic intermediaries and thwart antisocial actors. It’s also the emerging consensus among mainstream funds post-FTX. Rebuilding a better, scalable on-chain financial system requires robust, high-performance infrastructure.

We will seek to invest in key decentralized infrastructure assets where:

1) Teams demonstrate commitment and resilience under pressure;

2) The project can become a core component of the next-gen crypto tech stack;

3) Valuation becomes attractive during the bear market.

We’ll update and publish our internal deep dives on key infrastructure in due course.

Next-Gen Non-Custodial Wallets with Improved UI/UX

If you don’t hold the keys, you don’t own your crypto! But don’t expect ordinary users to patiently go through 20-step processes to become expert wallet users. We must cater to mainstream needs—security and usability must coexist. As token investors, we don’t expect to directly capture this trend, but we’ve noticed promising next-gen wallets like OneKey offering viable solutions.

DEXs (Especially Derivatives)

FTX was a dominant crypto derivatives exchange—its collapse is unequivocally positive for DEXs, especially derivatives. Markets reacted immediately—GMX and Dydx performed strongly. We view this more as a critical long-term investment thesis. Uniswap has >10x upside in the next cycle. We’d researched this well before the FTX saga. We plan to release a paper on derivative DEXs in the coming months.

NFT Marketplaces

This one isn’t obvious, but we believe NFT marketplaces will benefit significantly. Regulators will crack down hard on token trading and DeFi, making NFTs (less directly financial, and historically non-custodial) relatively more attractive to users and speculators. We’ll dive deeper into NFT markets, but currently we’re intrigued by 1) mobile-first platforms; 2) gaming-related NFT marketplaces, especially if built in less saturated regions in the Eastern hemisphere.

Final Thoughts

Every so often, a catastrophic event strikes the crypto market, sounding alarms across the industry and for everyone involved. The FTX bankruptcy is one such event.

At Maverick, our top priority is always safeguarding our clients’ and our own capital through rigorous risk control. Manage risk before chasing returns. Long-term, we’ll continue refining our investment system, using such events as valuable stress tests and case studies.

Crypto will endure, but as an industry, we all have overdue “housecleaning” to do. Let’s face it, overcome it, and move forward.

Yours Sincerely,

Simiao Li

Founder & CIO, Maverick

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News