Blend: A P2P NFT lending protocol co-developed by Blur and Paradigm, enabling NFT purchases through loans

TechFlow Selected TechFlow Selected

Blend: A P2P NFT lending protocol co-developed by Blur and Paradigm, enabling NFT purchases through loans

Qin Shi Huang unified the six states, standardized chariot axles, and unified writing.

Recently, Blur has partnered with Paradigm to launch Blend, a P2P NFT lending protocol, along with a feature enabling users to buy NFTs using loans.

What are the core features of Blend? What advantages does it offer as a product, and how are these achieved? This article will walk you through Blend—the next-generation NFT lending protocol—in an accessible yet comprehensive way.

The key features of Blend are:

-

Peer-to-peer, perpetual lending with no maturity date and no reliance on oracles;

-

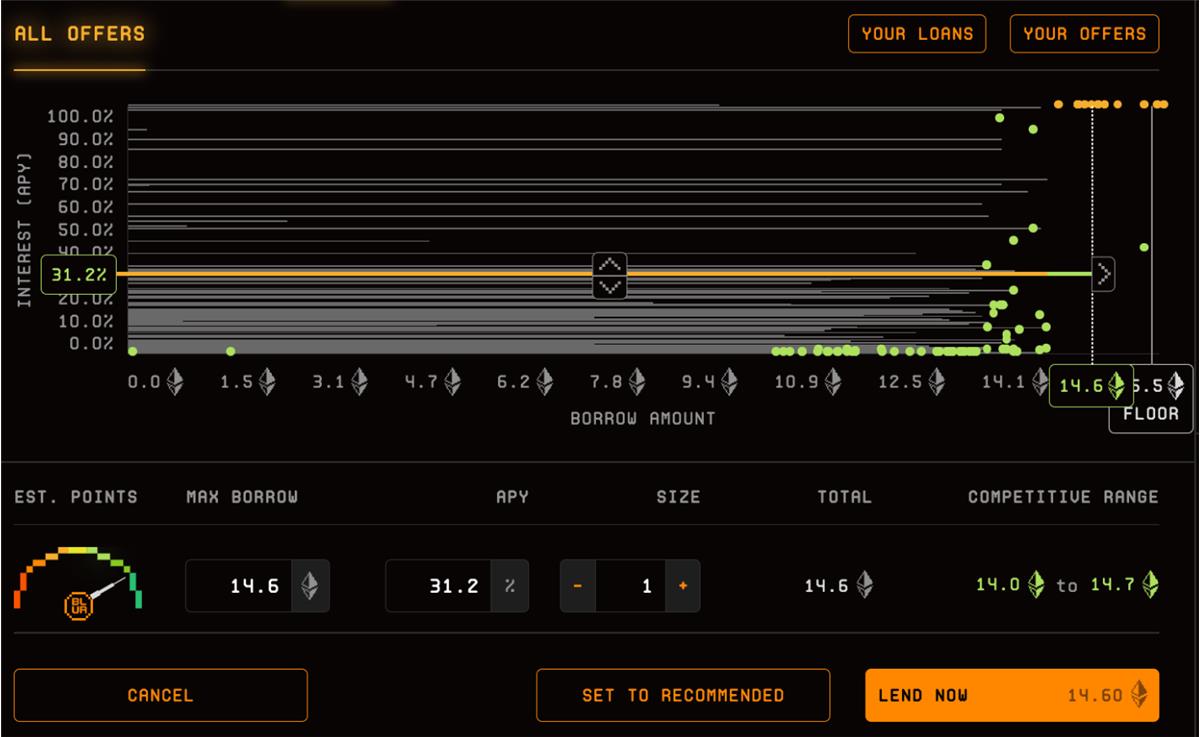

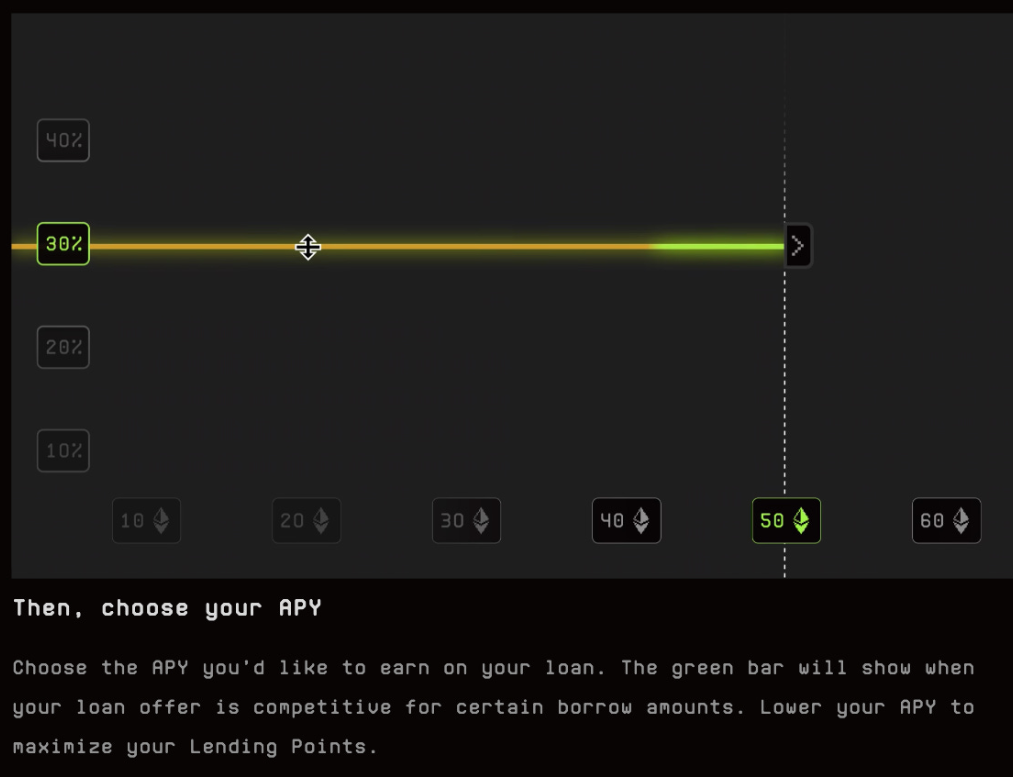

Lenders set their own loan amounts and APY when posting offers, which borrowers can then choose from;

-

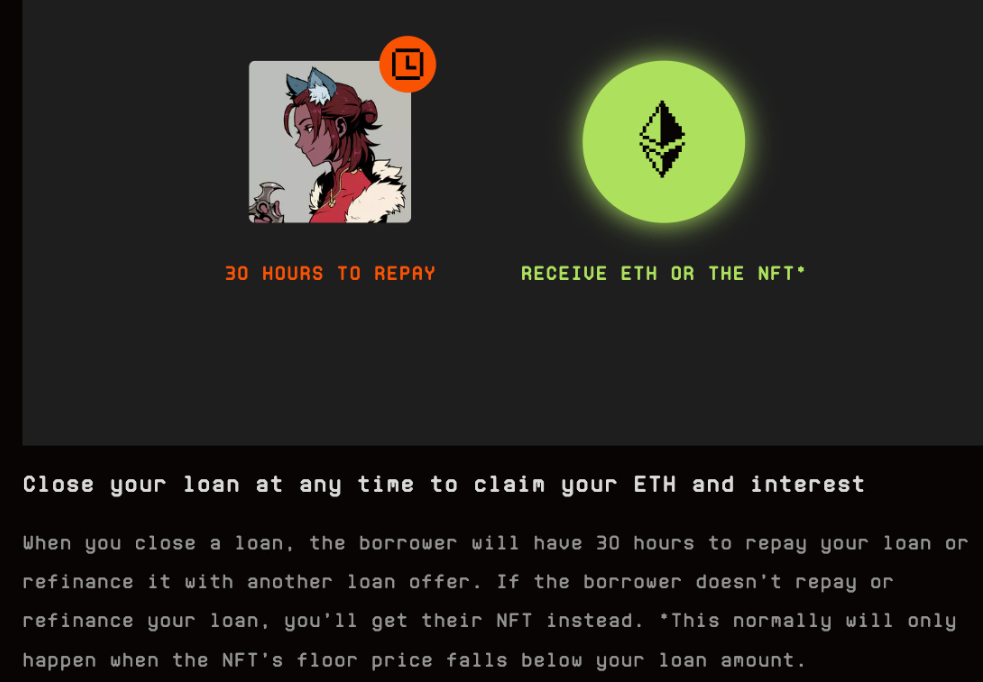

When a lender exits, the borrower must repay the loan or refinance within 30 hours, otherwise liquidation occurs;

-

Borrowers may repay at any time;

-

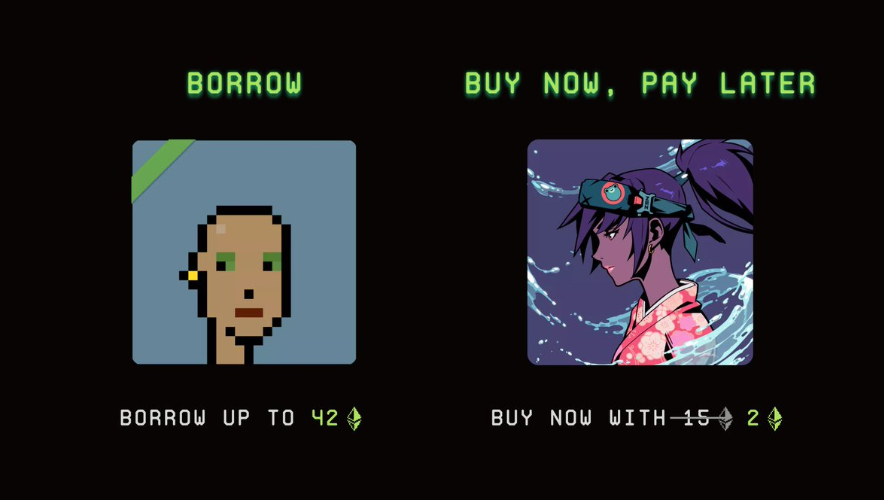

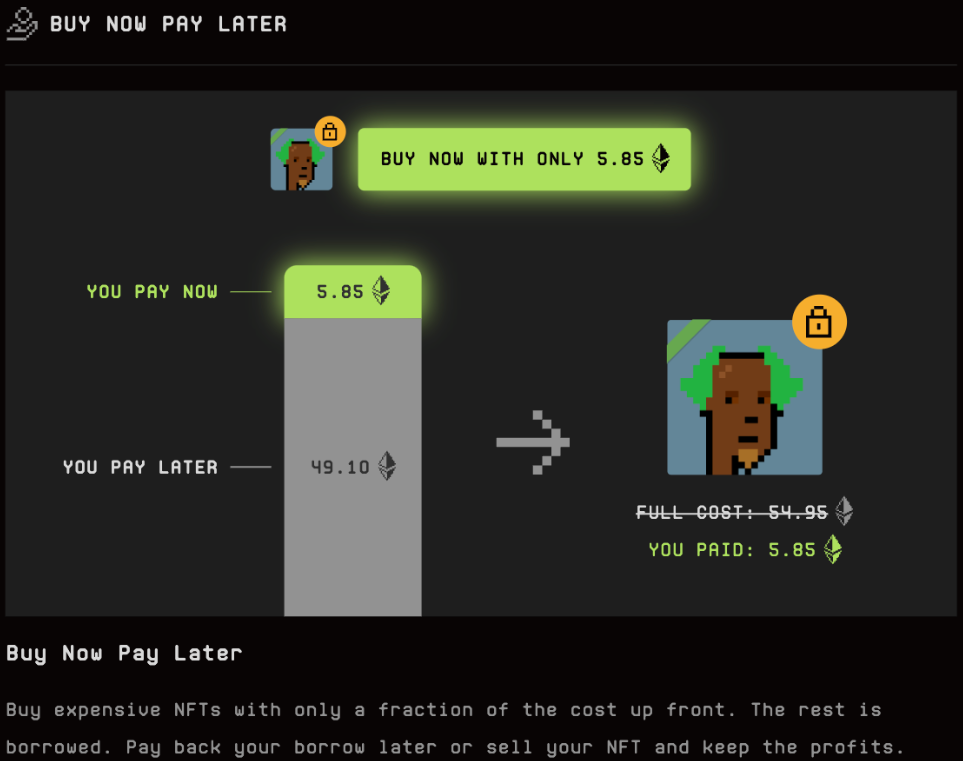

Supports "buy now, pay later," allowing down payments plus loans to purchase NFTs.

Product Advantages

The core advantage of Blend lies in standardizing non-essential elements, reducing system complexity, and enabling flexible migration of lending relationships within the system. It leverages market dynamics to price risk and returns, maximizing user needs. In a sense, Blend embodies the spirit of Emperor Qin Shi Huang’s “uniform axle widths, uniform script.”

-

Compared to traditional peer-to-peer models like X2Y2, Blend unifies the three borrowing parameters—collateral ratio, interest rate, and term—by making the term perpetual and flexible, significantly improving lenders’ liquidity;

-

Blend consolidates lender exit and liquidation mechanisms, since liquidation fundamentally means no one is willing to take over the position;

-

Oracles serve to determine timing for liquidations; Blend instead centralizes exit decisions with lenders, giving them full flexibility.

Although Blend appears to fix terms (collateral ratio and interest rate), its highly flexible exit mechanism ensures that active terms naturally align with market averages. If the terms are significantly worse than market rates, borrowers have an incentive to repay and switch to another offer; if they're significantly better, lenders are incentivized to exit and post new offers to lend elsewhere.

For borrowers, higher collateral ratios, lower interest rates, and greater term flexibility are ideal. Regarding the first two points, as explained above, effective terms follow market levels. Additionally, Blend allocates incentive points to lenders—more points are awarded for higher loanable amounts and lower interest rates. For the third point, Blend achieves full term flexibility for borrowers via its perpetual + anytime repayment structure.

For lenders, both collateral ratio and interest rate adapt to market conditions and Blur's incentives, minimizing downside risks. Terms are also highly flexible—lenders can exit anytime, enjoying the customization benefits of P2P models while gaining liquidity advantages close to pool-based systems, all while maintaining control over their own risk management and exit strategies.

Buying NFTs with Loans

Buying NFTs with a loan works similarly to buying property with a mortgage—users initiate a collateralized loan at the same time as purchasing an NFT, enabling them to acquire the asset after paying only a down payment, thereby enhancing capital efficiency. While technically similar to using a flash loan (ETH → borrow ETH against NFT as partial repayment), launching this functionality natively helps Blend attract many new users and accelerate growth. Moreover, it demonstrates Blur’s potential to unify and integrate ecosystem components, achieving synergistic 1+1>2 effects.

Others

Additionally, according to Paradigm’s design document, when a lender exits, a Dutch auction is initiated—interest rates start at 0% and gradually rise to 1000% over time. New lenders can step in at any point during the auction. If no one takes over by the time the rate hits 1000%, the borrower is liquidated, and the collateralized NFT is transferred to the exiting lender.

However, on Blur’s interface, we see that the borrower must either repay or refinance—this difference is not hard to understand. The current implementation includes two variables: loan amount and interest rate, whereas Paradigm’s original design considered only interest rate. In practice, both approaches aim to transition toward the most favorable terms for the borrower; the only difference is whether borrower action is required.

It’s worth noting, however, that Blend currently provides limited utility for $Blur. While $Blur holds governance rights over parameter settings and the ability to activate fee collection after six months, much remains uncertain.

Summary

Building upon traditional peer-to-peer lending models, Blend standardizes non-essential elements to achieve efficiency gains akin to “uniform axle widths, uniform script,” while deeply integrating with Blur’s trading module. This results in significant product-level improvements, though token utility remains relatively modest.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News