February NFT Market Review: Web2 Industries and Professionals Enter the NFT Space — Is Blur's Liquidity Fake?

TechFlow Selected TechFlow Selected

February NFT Market Review: Web2 Industries and Professionals Enter the NFT Space — Is Blur's Liquidity Fake?

The article summarizes the major events that occurred in February, the most interesting trends, and perspectives on the BLUR token launch.

Author: Teng Yan, NFT Researcher at Delphi Digital

Translation: TechFlow

Time flies—Q1 2023 is already coming to a close. If you haven’t had time to keep up with the NFT market, don’t worry—Delphi Digital’s NFT researcher has got you covered. The author recaps major events from February, highlights key trends, and shares thoughts on the BLUR token launch.

1. More Museums Begin Accepting and Exhibiting NFT Art

This is an important trend. In February alone, two museums made notable announcements. While they aren't MoMA or Tate, their actions still carry significance.

-

Centre Pompidou, Europe’s largest modern and contemporary art collection, welcoming over 1.5 million visitors annually, announced a permanent exhibition of NFTs—including CryptoPunks, Autoglyphs, and works by several French artists.

-

The Los Angeles County Museum of Art (LACMA), the largest art museum in the western United States, received a donation of 22 NFT artworks from Cozomo de'Medici. The collection includes CryptoPunks, Dmitri Cherniak’s Ringers, and AI-generated artworks by Claire Silver and Pindar Van Arman.

Traditional art institutions have adopted NFTs slowly, partly because many traditional art collectors are older, wealthy individuals who may not be familiar with new technologies. Mindsets are shifting, but change takes time. Centre Pompidou embracing NFT art marks only the beginning of a new trend where museums begin collecting and showcasing NFTs. While museums may hesitate to be first movers, once they see early adopters succeed, they’re likely to follow. As more NFT artworks are displayed in physical exhibitions, their cultural value will grow accordingly.

2. Pro Gamer Mongraal Wins Dookey Dash Key and Sells It for $1.6M

Another significant event this month was professional gamer Mongraal winning Yuga Labs’ skill-based NFT competition, Dookey Dash Key, then selling it for $1.6 million.

The prize pool of 1,000 ETH (approximately $1.6 million) exceeded the total prize money Mongraal had earned throughout his entire Fortnite career. While this may be an outlier, it will undoubtedly spark greater interest among professional gamers in NFTs. Additionally, pro gamers bring their own audiences with them (Mongraal has over 2 million Twitter followers).

Overall, I view this as a positive development for Web3 gaming.

3. Spotify and Reddit Take Early Leads in Web3

Two developments stood out to me regarding the integration from Web2 to Web3:

First, Spotify is launching its token-gated playlist feature. Users holding specific NFTs can access exclusive playlists. The pilot partners are KINGSHIP, a virtual band under Universal Music, and Overlord (in collaboration with Seth Green).

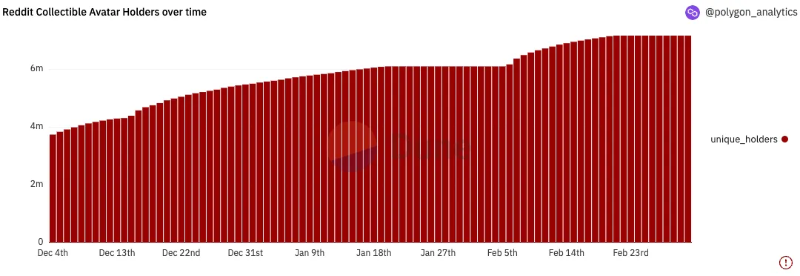

Second, Reddit partnered with the NFL to launch Super Bowl LVII commemorative avatars in February. Within weeks, over 1 million Super Bowl NFT avatars were created. This brought Reddit’s total avatar count above 10 million, with 6 million unique holders.

While most people claiming these avatars may not realize they are NFTs, this is still a noteworthy achievement. What matters is how Reddit leverages blockchain to create unique experiences for avatar holders in the coming months—such as rewarding loyal users or unlocking access to certain subcommunities.

Is Blur a Liquidity Trap?

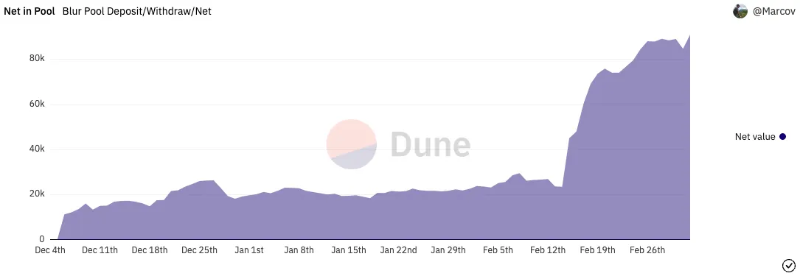

One of the most striking developments in the NFT market in February was the launch of the BLUR token, intensifying the competition between Blur and OpenSea. Over 110,000 users received the BLUR airdrop, totaling $240 million in value. This massive, newly created value triggered intense speculation around the next BLUR airdrop, with users aggressively placing bids (“bid mining”) to qualify. Currently, there is $140 million worth of ETH in Blur’s bid pool:

For certain collections like Rektguy or Moonbirds, you could sell 30–40% of the total supply (over 3,000 NFTs in a 10k collection) near floor price with almost no impact on pricing. I believe this level of liquidity is unmatched by any fungible token today.

But let’s think deeper: the current liquidity conditions in the NFT market are highly unusual. This is an anomaly. So don’t expect it to last forever—actual underlying demand for NFTs remains limited.

I believe Blur’s massive liquidity may start to taper off from here. Some may not realize that these exceptional liquidity conditions come at a cost. Conceptually, BLUR tokens are being paid out daily to sustain these levels—even if distributions are periodic.

Assume Blur Season 2 lasts six months and distributes 300 million tokens:

300 million / 180 days = 1.66 million tokens per day = ~$1.3 million at current prices.

Essentially, the market has priced in the cost of providing NFT liquidity—the sum of everyone’s expected risk-return on Blur mining. The market says you need to pay $1.3 million per day to maintain ~$130 million in liquidity. That’s roughly 1% per day, or a staggering 365% APR. By any measure, this is an enormous fee. (Note: These are approximate calculations, as Blur has not yet disclosed the length of Season 2—it could be longer or shorter.)

Here’s the good news (or bad news, depending on your perspective):

Blur “pays” for all this liquidity using its own tokens. It’s magic: not a single dollar leaves their treasury, yet they’ve used their token as leverage to surpass OpenSea in trading volume. All this liquidity is subsidized by those buying BLUR tokens on the secondary market.

However, if Blur believes significant future value will accrue to its token—and that BLUR will be worth much more in the future—then freely distributing it to mercenary capital will inevitably be painful. Giving up ownership is expensive. It’s a tough dilemma.

A Few Other Thoughts:

-

I think it was wise for the Blur team to keep the next airdrop allocation details confidential and disclose little. This contrasts with the transparent APY models of many DeFi yield farms. It introduces additional uncertainty and risk for liquidity providers.

-

Additionally, when regular BLUR users no longer receive 2X rewards, they may reduce their capital commitments, potentially leading to lower liquidity.

-

If the BLUR token price declines (due to approaching unlock dates, waning attention, or market sentiment shifts), the reward-to-risk ratio worsens further, causing more liquidity to flee.

-

Finally, Gem could emerge as a competitor to OpenSea among advanced traders and may launch its own token to boost liquidity.

I believe the most important takeaway is that Blur has shown us the competitive moat in the NFT market is far lower than we thought. Switching costs are low, user retention is hard—users go where the incentives are.

Has Blur achieved product-market fit? Perhaps—but let’s clarify what “market” we’re talking about. It’s not the entire NFT market, but rather a niche audience of professional traders and NFT whales. Long-tail users remain on OpenSea.

The future is uncertain, but one thing is clear: to maintain these liquidity levels, Blur will have to continuously drive demand for its token. The token becomes another product to manage. I’m eager to see what trick they pull out of the hat next.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News