Speculation fades, infrastructure rises: NFT market shifts toward pragmatism in 2025

TechFlow Selected TechFlow Selected

Speculation fades, infrastructure rises: NFT market shifts toward pragmatism in 2025

In Q3 2025, the NFT market concluded with $1.58 billion in trading volume and 18.1 million sales, while the market structure continued evolving toward utility-driven applications.

Author: Blockchain Knight

NFT trading activity showed signs of recovery in Q3 2025, breaking the prolonged downtrend that followed the post-hype period.

After two years of market contraction and narrative shifts, on-chain markets have found new footing, with growth now driven not by blue-chip collectibles or speculative art, but by lower-cost infrastructure, loyalty programs, and sports-related assets.

The core value of these assets lies in utility, not status symbolism.

NFT Trading Volume Rebounds, Sales Hit Record Highs

With Ethereum's scaling upgrades driving transaction migration to L2s, Solana solidifying its position through high throughput and compression technology, and Bitcoin inscriptions evolving into a cyclical collectible culture tied to fee markets, the NFT landscape has shifted toward low-cost infrastructure and practical use cases.

Today, market growth is driven more by fee levels and distribution channels than by profile picture (PFP) NFTs.

The Dencun upgrade reshaped the economic landscape—Ethereum’s EIP-4844 proposal reduced rollup data costs, bringing L2 transaction fees down to mere cents and enabling gasless or sponsored minting processes for mainstream users.

Post-upgrade, L2 fees dropped over 90%, a change already reflected in minting behavior and helping establish Base as a key distribution channel.

In the Solana ecosystem, compression technology enables large-scale issuance of NFTs for loyalty programs and access control applications.

Deploying 10 million compressed NFTs costs about 7.7 SOL, and even under heavy load, median transaction fees remain close to $0.003.

Bitcoin inscriptions have carved out their own niche, closely linked to mempool cycles and miner income. As of February 2025, inscription count surpassed 80 million, ranking among the top three in historical NFT sales volume.

Demand Rebounds, But Risks Remain

Data from DappRadar shows that NFT trading volume nearly doubled quarter-on-quarter in Q3 2025, reaching $1.58 billion, with 18.1 million transactions—the highest quarterly transaction count on record.

Sports-related NFTs stood out, with trading volume surging 337% quarter-on-quarter to $71.1 million. Their cyclical utility, access rights, and loyalty benefits decouple consumption from floor prices.

The summer saw a rapid rebound followed by cooling: according to CryptoSlam, July 2025 sales hit $574 million (second-highest of the year), but September sales dropped around 25% quarter-on-quarter due to declining risk appetite across crypto markets.

This confirms the market has entered a new phase of "declining average sale prices" and indicates that even with stable unique user counts and utility-driven applications, total NFT trading volume still fluctuates with broader crypto market sentiment.

The role of distribution channels is increasingly critical. Wallets with built-in key management and sponsorship features eliminate friction that previously hindered user onboarding.

Coinbase Smart Wallet offers key-based login and gas fee sponsorship within supported apps; Phantom reported 15 million monthly active users in January 2025, providing traffic support for mobile and socialized minting channels.

In blockchain networks where culture and social traffic reinforce each other, this distribution reach is crucial—Base being a prime example.

This year, thanks to low-cost minting, Zora's batch minting rhythm, and Farcaster-linked distribution, Base has surpassed Solana in certain NFT volume metrics.

This trend implies creators are now modeling distribution data first, then selecting fee structures accordingly when choosing launch platforms.

Royalties No Longer Central to Revenue Models

After the 2022 market peak, competition among marketplaces made royalties optional in most platforms, leading to a sharp decline in creator royalty income.

According to Nansen, royalty revenue hit a two-year low in 2023 and has not recovered.

In contrast, marketplaces enforcing mandatory royalties have emerged. In late 2023, Magic Eden partnered with Yuga Labs to launch an Ethereum marketplace that enforces creator royalties, creating a protected channel for influential brands.

The current market operates on a dual-track model: in open markets, low platform fees, primary sales, IP collaborations, and retail integrations form the main revenue streams; closed ecosystems enforce royalties via contracts and host premium NFT launches.

In sectors where incentives drive capital flows, marketplace shares remain fluid.

In the Solana ecosystem, Magic Eden and Tensor dominate in a duopoly, with their market shares fluctuating between 40% and 60% depending on reward programs and protocol adjustments.

This isn't structural change but rather the effect of incentive cycles—market share charts may suggest shifts, but they tend to revert to the mean.

For creators, the key takeaway is to negotiate distribution strategies upfront, rather than defaulting to a single platform.

User Trends Reveal Short-Term Trajectory

Sports, ticketing, and loyalty programs scale because their benefits are recurring and cyclical, with core on-chain functions now embedded into existing ticketing and e-commerce workflows.

DappRadar’s Q3 2025 data shows sports NFT transaction growth has outpaced the overall market—even before factoring in full-season or league-level partnerships.

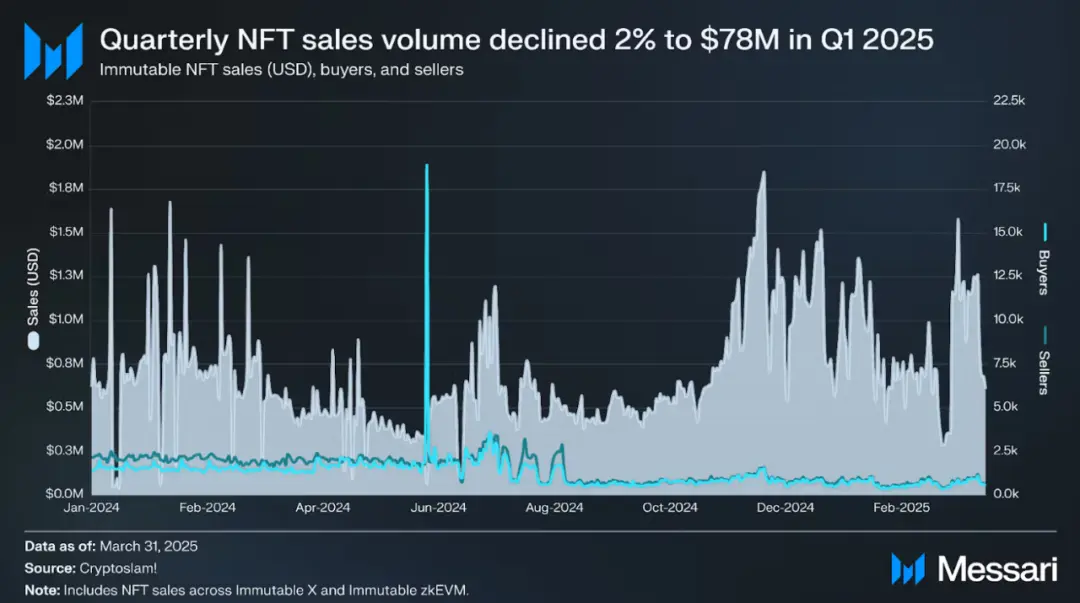

Growth in gaming is more steady. According to Messari, Immutable’s zkEVM architecture and real-time data show consistent transaction growth. Its design—“security at Ethereum layer, UX optimized at L2”—aligns well with asset custody and sustained secondary market fee generation.

Intellectual property (IP) and licensing represent another key bridge from digital collectibles (JPEGs) to consumer channels. Pudgy Penguins has entered over 3,000 Walmart stores, building a path from NFTs to physical retail and licensing revenue.

For creators, cost and user experience across blockchains are now clearly defined:

Ethereum L1 continues to dominate provenance verification and high-value art, though gas fees vary widely across platforms and royalties are typically optional;

Post-Dencun, Ethereum L2s like Base offer transaction fees of just a few cents, support sponsored or gasless transactions, and Base’s integration with the Farcaster ecosystem provides socialized distribution;

Solana’s compression tech keeps the cost of issuing millions of NFTs under $10, with broad reach enabled by mobile-first wallet ecosystems;

Bitcoin inscriptions focus on scarce collectibles, where rising fees are a market feature, not a flaw.

Macro Landscape Evolution

The 2025 NFT market is projected to achieve annualized trading volume between $5 billion and $6.5 billion, with average sale prices holding steady at $80–$100 in the first half—forming the baseline for next year’s scenarios.

Using CryptoSlam’s monthly sales as the core metric, combined with DappRadar’s category breakdown:

Bear Case: If the broader crypto market stagnates and average prices fall, total NFT trading volume could drop to $4–5 billion. Fee-sensitive use cases will concentrate on Solana and Ethereum L2s. Ethereum L1 art markets remain stable, while inscription markets follow Bitcoin fee cycles.

Base Case: If embedded wallets and social minting channels continue expanding, sports and live event projects scale across seasons, and brands experiment with mandatory-royalty platforms, total NFT trading volume could reach $60–90 billion.

Bull Case: If mobile distribution sees breakthrough growth (Base and key-based login making minting mainstream, Phantom surpassing 20 million MAUs, ticketing pilots becoming standard, game assets generating sustained trading), total NFT volume could reach $100–140 billion.

In all three scenarios, Ethereum L2s and Solana will dominate market share, Ethereum L1 will serve niche segments, and Bitcoin inscriptions will remain a stable category for scarce collectibles.

Six Key Variables That Determine Growth Pace

1. Wallet UX and distribution capacity: Key metrics include key adoption rate, sponsorship usage, and MAU numbers for Phantom and Coinbase Smart Wallet.

2. Scope of enforced royalties: Impacts premium NFT launches, including OpenSea’s policy shifts and the health of creator-focused marketplaces in the Ethereum ecosystem.

3. Scaling of sports and ticketing partnerships: Expanding from pilots to full-season deals transforms one-off sales into recurring revenue.

4. Base and Zora issuance rhythm: Monthly mint volume, Base’s share of total NFT trading volume, and integration with Farcaster Frames will indicate sustainability of social distribution.

5. Solana compression adoption: Measured by volume of compressed NFT mints and deployment cost per million assets, indicating whether loyalty and media apps move from pilot to routine use.

6. Bitcoin fee cycle: Its link to inscriptions and Runes will continue shaping collectible pricing as mempool congestion fluctuates.

Yet two risks persist. Wash trading and spam can still distort GMV and sales figures—reviewing average sale prices and dashboards filtered by organic search is a safer approach.

Marketplace incentive programs may create illusions of “structural shifts” in market share (actually driven by airdrop cycles), especially within Solana’s duopoly.

Therefore, creators should factor in such volatility from the start of their launch planning.

Another operational constraint is revenue design: in open markets where royalties are mostly optional, primary sales, IP licensing, and retail partnerships carry greater revenue weight.

Mandatory-royalty closed platforms only serve a select few brands with premium launches, leaving most creators unable to benefit.

Industry Shift: From “Endgame” to “Migration”

The JPEG hype is over. NFT infrastructure costs have plummeted, use cases have pivoted to ticketing, sports, gaming, and IP, and wallet and distribution systems are integrating into users’ existing environments.

Blue-chip flagship project “Bored Ape Yacht Club” remains precarious for investors who once spent six-figure sums on AWS-hosted JPEGs.

An NFT from this collection sold for over 74 ETH in 2021 is now worth just 9 ETH—a staggering 87% drop over three years.

The speculative frenzy around non-fungible tokens may be over—but will this allow the underlying technology to gain recognition in real-world utility?

The answer remains to be seen, but current signals are promising—though this hope offers no relief to those still trapped at peak prices.

The NFT market closed Q3 2025 with $1.58 billion in trading volume and 18.1 million sales, with market structure continuing to evolve toward utility-driven models.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News