Dissecting STBL: Stablecoin + NFT Yield Rights, Hype or Innovation?

TechFlow Selected TechFlow Selected

Dissecting STBL: Stablecoin + NFT Yield Rights, Hype or Innovation?

Pioneering the separation mechanism between stablecoins and yields, users hold NFTs to obtain returns from underlying assets.

Author: Alea Research

Translation: TechFlow

Stablecoins have become an integral part of decentralized finance (DeFi), but they also come with numerous trade-offs and challenges.

For example, over-collateralized crypto-backed stablecoins (such as DAI) face volatility risks; centralized stablecoins (such as USDC and USDT) offer little assurance in terms of reserve transparency; algorithmic stablecoins (such as UST or FRAX) have proven difficult to maintain stability. Additionally, stablecoin issuers typically capture the yield generated by the underlying assets, leaving users unable to benefit from it.

STBL proposes a fourth approach: allowing users to mint stablecoins fully collateralized by real-world assets (RWA) while retaining the yield generated. STBL splits user deposits into spendable stablecoins and a yield-bearing NFT position, providing holders with liquidity and predictable returns.

In this article, we will delve into STBL's architecture, the market problems it addresses, and how the product works in practice.

What is $STBL

$STBL is a non-custodial stablecoin backed by U.S. Treasuries or private credit. The key difference from other solutions lies in its three-token design: $STBL, $USST, and $YLD. $STBL serves as the governance token, while the two primary stablecoin instruments are:

-

USST: A fully collateralized stablecoin pegged 1:1 to the U.S. dollar, issued under ERC-20/4626 standards, usable for on-chain payments, swaps, and lending. USST can be used for on-chain payments, liquidity provision, lending, or staking into the protocol’s Liquidity and Minting Pool (LAMP). Users can redeem their underlying collateral assets at any time without penalties.

-

YLD: An ERC-721 NFT representing the holder’s right to the yield generated by deposited assets. Each YLD token accrues interest in real-time based on coupon payments from tokenized treasuries, private credit, or other fixed-income instruments. The NFT structure enables yield isolation and OTC transferability while discouraging retail speculation.

(Previously, STBL was known as Pi, where USI corresponded to YLD and USP to USST.)

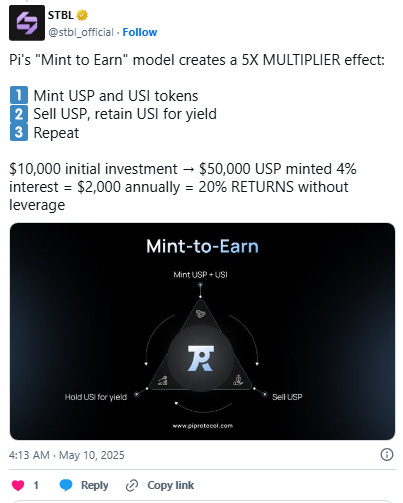

STBL adopts a "Mint-to-Earn" model, distributing the governance token STBL proportionally to early minter activity to bootstrap liquidity. This model allows users to earn passive yield through holding YLD tokens—yield derived from real-world assets (RWA), not inflationary emissions or leveraged operations. Users can choose among multiple vaults, including low-risk Treasury vaults offering predictable annual yields of 4–5%, or high-yield private credit vaults offering 10–12% APY.

STBL also maintains a transparent fee structure, allocating 20% of all yield towards sustainability. These fees are distributed toward development treasury reserves, loss-reserve pools to absorb defaults, rewards for USST stakers, and additional yield for long-term lockers (sUSST).

Stablecoin Market Landscape and Adoption of Real-World Assets (RWA)

Stablecoins are among the most widely used assets in digital finance, with a circulating supply exceeding $290 billion in 2025. However, the yield from their reserves continues to be captured by issuers.

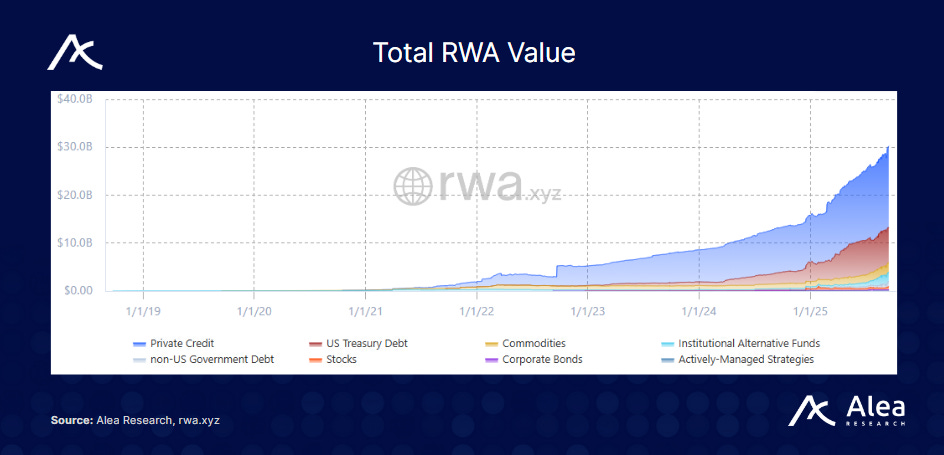

Meanwhile, the total value locked in tokenized treasuries and other real-world assets (RWA) has surpassed $30 billion, reflecting growing demand on-chain for regulated, yield-generating instruments. STBL channels predictable cash flows from real-world assets directly to stablecoin users, creating a sustainable alternative to volatile algorithmic coins and opaque custodial models.

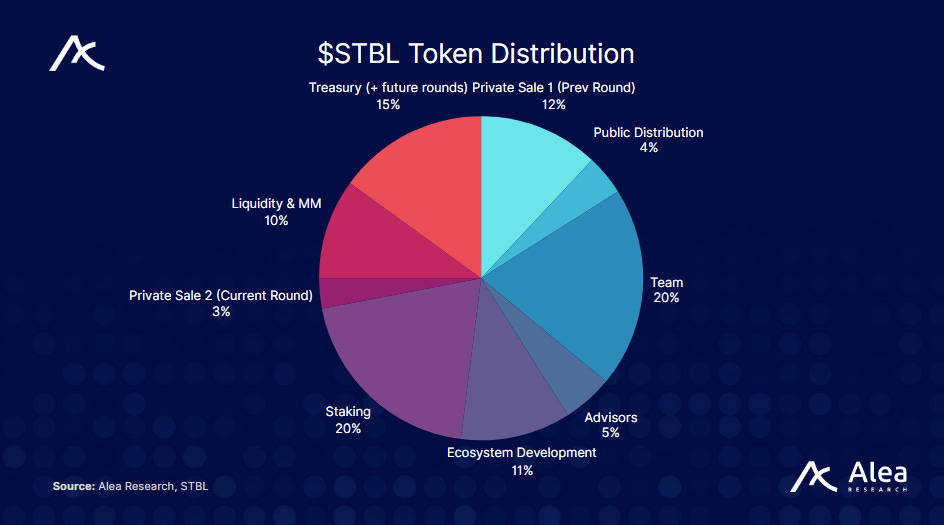

$STBL Tokenomics

$STBL is the governance/fee token of a three-asset system that separates money ($USST) from yield ($YLD). In principle, protocol fees (such as minting/redeeming, yield routing, or auctions) and parameter changes (such as oracles, collateral types, token issuance) are governed by STBL.

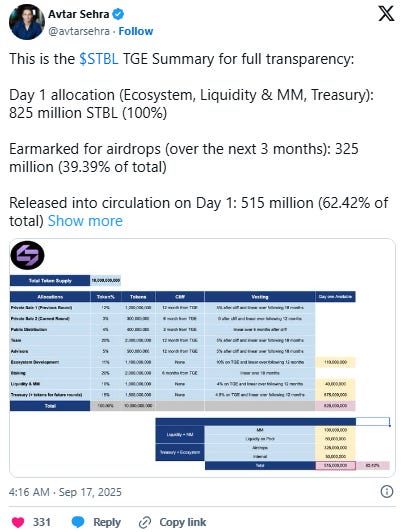

The total supply of $STBL is 10 billion, with 825 million (8.25% of total supply) unlocked on day one.

Token unlock schedule is as follows:

-

Private Sale 1 / Team / Advisors: 12-month cliff (5% released immediately after cliff, followed by linear release over 18 months)

-

Private Sale 2: 6-month cliff → linear release over 12 months.

-

Public: 3-month cliff → linear release over 6 months.

-

Staking: 6-month cliff → linear release over 18 months.

-

Ecosystem: 10% released at TGE, followed by linear release over 12 months.

-

Liquidity & Market Making: 4% released at TGE, followed by linear release over 12 months.

-

Treasury Reserve: 45% released at TGE, followed by linear release over 12 months.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News