Understanding the Professional NFT Marketplace Blur: Background, Royalty Settings, and Potential Risks

TechFlow Selected TechFlow Selected

Understanding the Professional NFT Marketplace Blur: Background, Royalty Settings, and Potential Risks

The current NFT market focuses too much on retail experiences and pays insufficient attention to professional traders.

Author: Russian Defi

Compiled by: TechFlow

The current NFT market is overly focused on retail experiences while paying insufficient attention to professional traders. Blur is actively addressing these issues, pushing the NFT space toward institutionalization while enhancing decentralization.

Background of Blur

Blur is a new NFT marketplace backed by prominent investors such as Paradigm, 6529, Cozomo Medici, and Bharat Krymo. The team consists of developers from renowned institutions including MIT, Citadel, Five Rings Capital, Twitch, Brex, Square, and Y Combinator.

Before officially launching on October 19, 2022, Blur spent approximately 276 days in private development. Today, Blur’s aggregator already ranks second in trading volume within the sector!

Royalty Mechanism and Fee Structure

Blur charges no marketplace fees, allowing users to trade freely without worrying about commissions. Additionally, advanced trading tools on Blur are completely free for users. Traders are encouraged to set royalty rates above zero, which may increase their eligibility for incentive-based airdrops.

Blur's royalty system differs significantly from most NFT marketplaces. Here, NFT traders set their own royalty rates, meaning original creators receive no income from secondary sales if traders choose not to pay royalties. However, the incentive program favors those who do use royalties—for example, traders paying higher rates will receive larger airdrop allocations.

Blur Combines Marketplace and Aggregator Functions

A comprehensive comparison of NFT aggregators including Blur has yet to be completed. Based on testnet trading data, Blur claims its transaction speed is ten times faster than Gem’s.

According to a recent tweet from the Blur team, they are now the largest aggregator by trading volume.

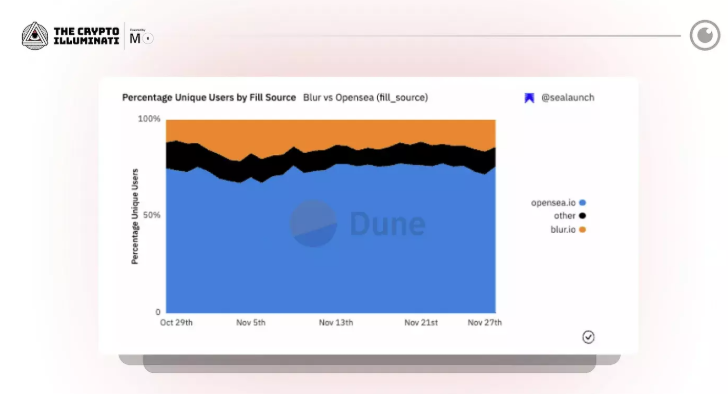

Designed for professional traders, Blur functions similarly to other aggregation services. Floor sweeping—buying large quantities of NFTs in a single transaction—is a common use case for aggregation trading. Beyond bulk purchases, aggregation trading demands rapid transaction processing and cost efficiency.

Blur Airdrops

Two announced airdrops from Blur have been key drivers behind its growth. The first airdrop was a package that NFT traders had to claim within 14 days after launch, available only to users who traded within the past six months.

The airdrop included an unspecified amount of BLUR tokens, which will serve as governance tokens. To qualify, traders were required to list at least one NFT on the Blur marketplace. Users could only claim rewards once BLUR tokens became available in January 2023.

In November, a second Blur airdrop targeted active traders. According to the Blur team, traders listing blue-chip NFTs would be eligible for more valuable BLUR rewards.

Blur Again Surpasses OpenSea in Trading Volume

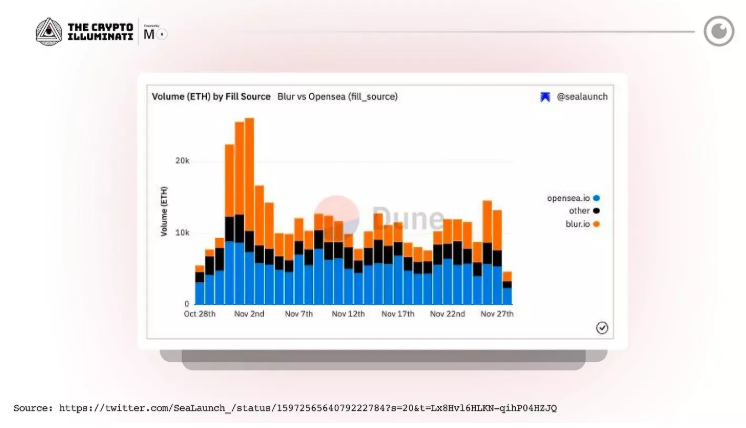

On November 27, Blur surpassed Opensea in trading volume, recording 5.5K ETH (Blur) versus 5.3K ETH (Opensea).

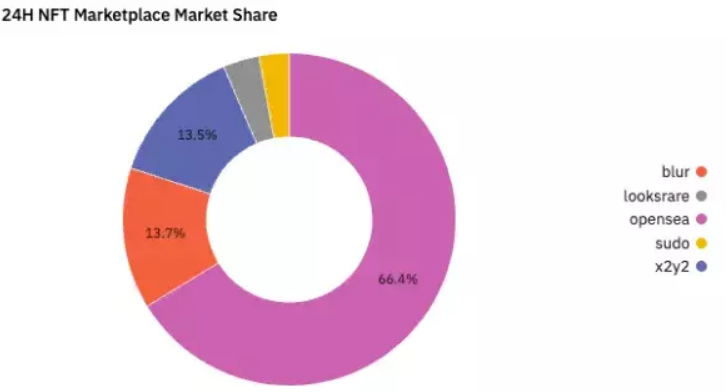

Although OpenSea continues to dominate with over 70% market share, Blur has attracted many active traders, signaling strong recognition of Blur’s potential value.

What Are the Risks?

According to user feedback, Blur's drawback is that it may not be as secure as it appears. Users executing trades on platforms like OpenSea or LooksRare require a high degree of trust. However, one Blur user identified a significant issue with the application.

The problem lies in a line of code within their system that merely checks whether the caller is authorized to transfer tokens—meaning the smart contract owner could continuously withdraw tokens and add new addresses into the mapping.

As a newly established NFT marketplace, Blur has not yet undergone rigorous market testing.

Final Thoughts

Time will tell what lies ahead for this NFT trading platform, but Blur’s competition with industry giants like OpenSea is commendable, and its cutting-edge approach to NFT trading is the primary reason for its success so far.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News