Blur Launches Blend: Accelerating the NFTFi Revolution or a Tool for Whales to Harvest Retail?

TechFlow Selected TechFlow Selected

Blur Launches Blend: Accelerating the NFTFi Revolution or a Tool for Whales to Harvest Retail?

Blend platform: Creating liquidity or serving the big players?

Authors: zf857.eth, R3PO

Over the past month, the NFT market has seen significant attention and traffic diverted to the booming BRC20 Ordinal NFTs and memecoins. Many veteran NFT players are now actively chasing trends in the BRC NFT market and trading speculative on-chain "dog" projects. Meanwhile, the original NFT market has gradually cooled down. The only notable development is that Blur, an emerging NFT aggregator marketplace, launched Blend—a peer-to-peer perpetual lending protocol using NFTs as collateral—on May 2, officially entering the NFT lending space.

Many are optimistic about Blur's aggressive move into NFT lending, believing it will enhance NFT liquidity. However, R3PO argues that this momentum in liquidity and capital activity is currently driven primarily by points incentives, and its long-term sustainability remains questionable.

What is Blend? How does it differ from existing lending protocols?

Blend’s mechanism was designed directly by Paradigm, with co-authors of its whitepaper such as Dan Robinson being seasoned contributors to leading DeFi protocols like Compound and Uniswap. Furthermore, Blend continues the DeFi tradition of permissionless access and composability.

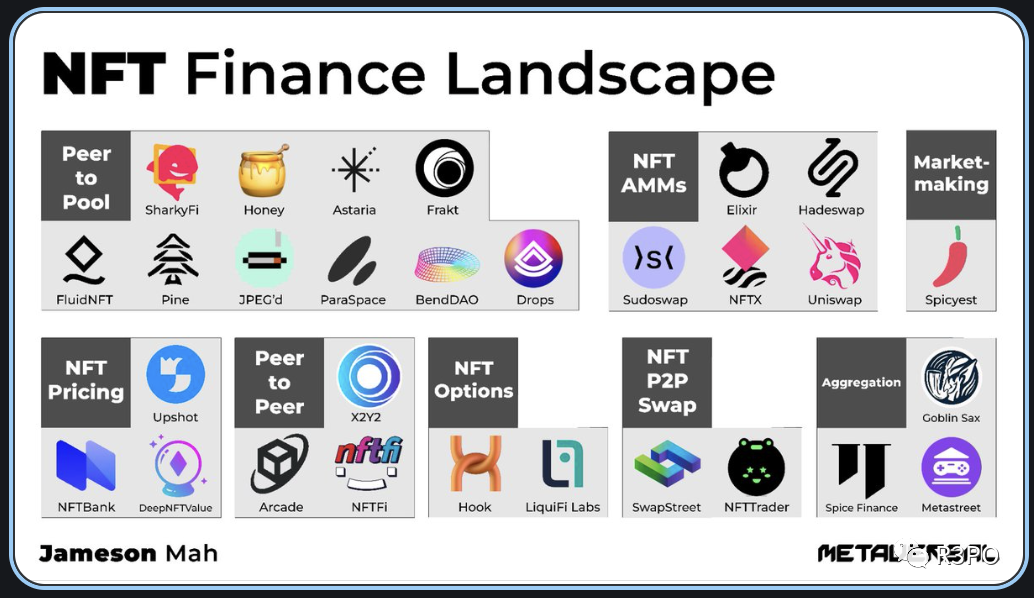

Blend employs P2P (peer-to-peer) lending, which essentially matches NFT holders with capital providers to facilitate direct loans secured by NFT collateral. Unlike pool-based models like BendDAO and ParaSpace, Blend functions solely as a third-party platform for matching P2P loans. Like NFTfi and X2Y2, Blend adopts a peer-to-peer lending model, offering greater customization flexibility for both borrowers and lenders. Since automatic liquidations are not involved and the platform only serves as a matchmaker, capital security is relatively high.

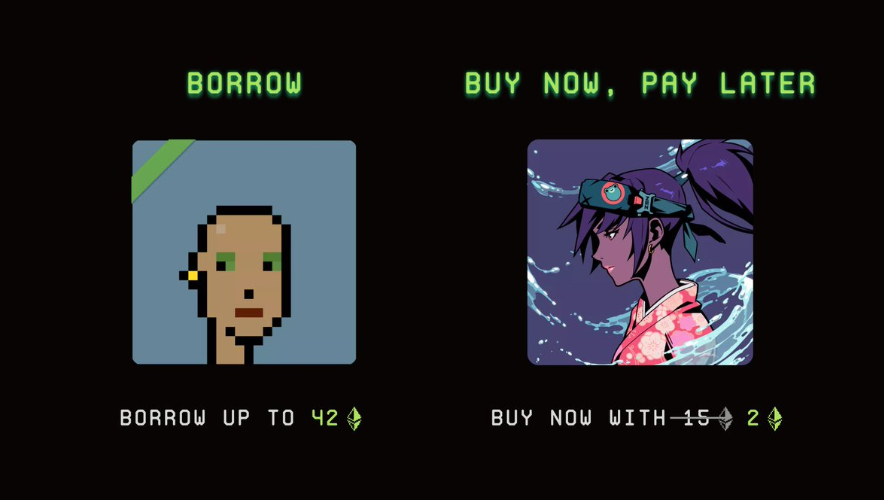

On top of this foundation, Blend introduces further innovations: it operates without relying on oracles, imposes no maturity dates, allows loan positions to remain open indefinitely until liquidation, thereby offering greater flexibility for users, and lets interest rates be determined entirely by the market. Blend offers two main products: NFT-collateralized lending and "Buy Now, Pay Later" (BNPL). NFT holders can borrow ETH against their NFTs without selling them. Additionally, BNPL enables users to prepay a portion of funds to purchase an NFT and repay the loan at any time to gain full ownership.

Currently, Blend supports three NFT collections: Punks, Azukis, and Miladys, with DeGods recently added.

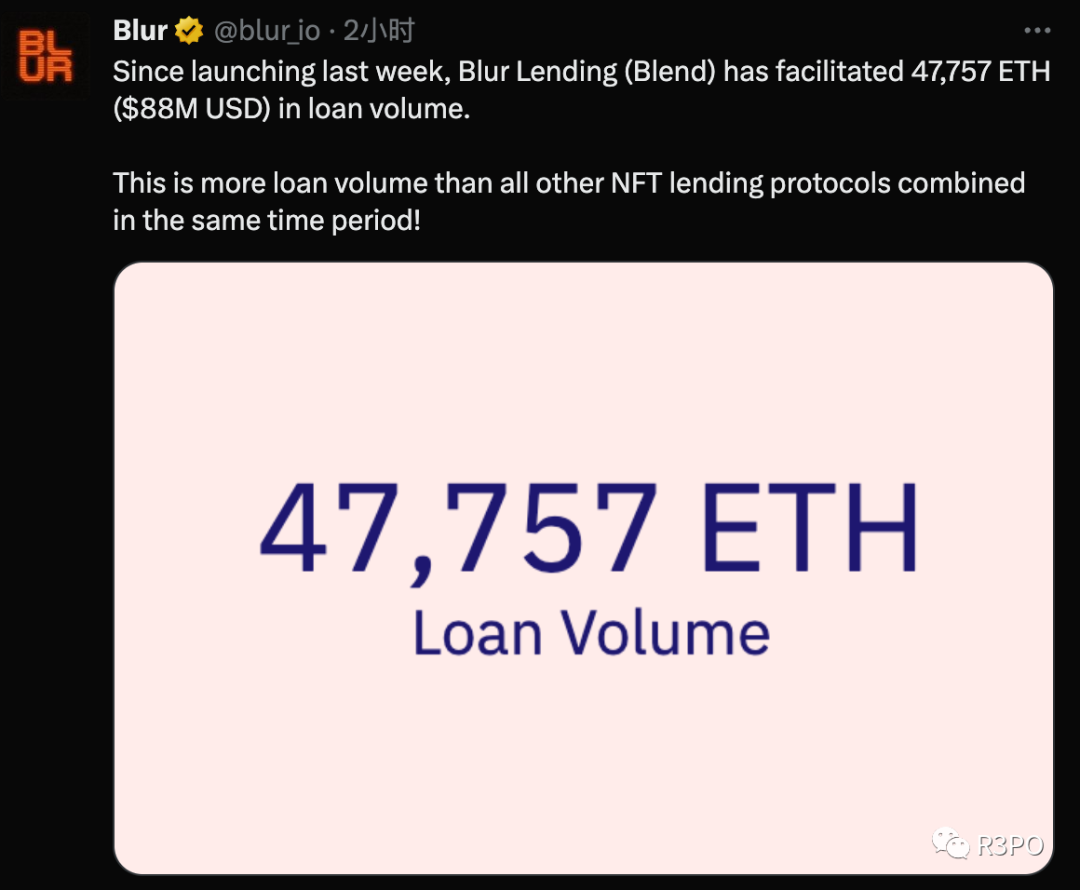

According to the latest data from Dune Analytics on May 10, one week after Blur launched Blend, the lending market had already facilitated over 47,000 ETH in loans.

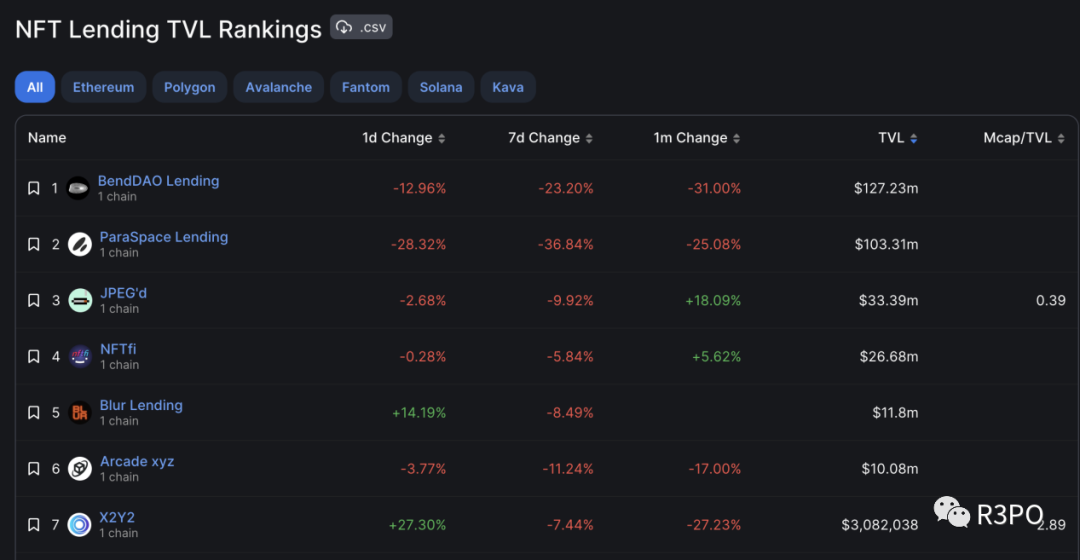

Data from DefiLlama shows that within a week of launch, Blend reached a total TVL of $11.8 million, ranking fifth among all lending protocols—an aggressive start. The top two on this list, BendDAO and ParaSpace, use a different operational model known as peer-to-pool (P2Pool), which is more efficient than user-to-user agreements but carries inherent risks. Last August, when the NFT market cooled and blue-chip NFT prices fell continuously, a subprime-like crisis triggered cascading liquidations in BendDAO’s lending pools. More recently, turmoil at ParaSpace caused panic-driven withdrawals from its NFT-backed liquidity pools. Liquidity crises and trust issues in pool-based models remain potential black swan risks.

Compared to the much-criticized liquidity and trust issues associated with pool-based models, Blend uses a liquidation mechanism that activates only upon consensus from lenders, helping prevent chain reactions caused by sudden floor price drops. Borrowers also retain the right to conduct re-auctions for refinancing and can match with different lenders.

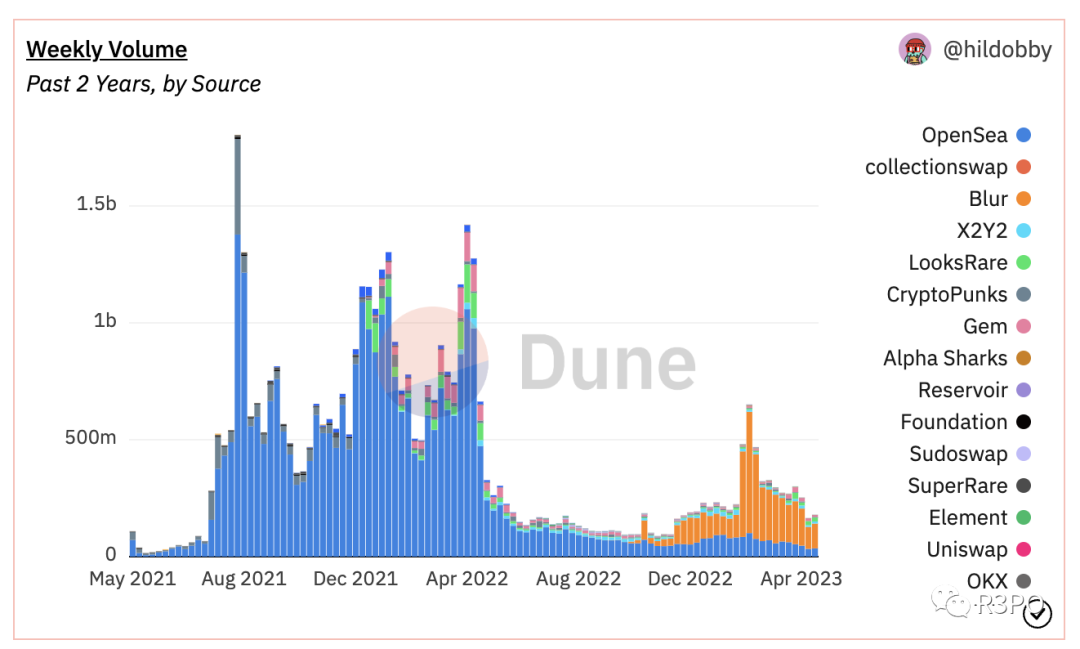

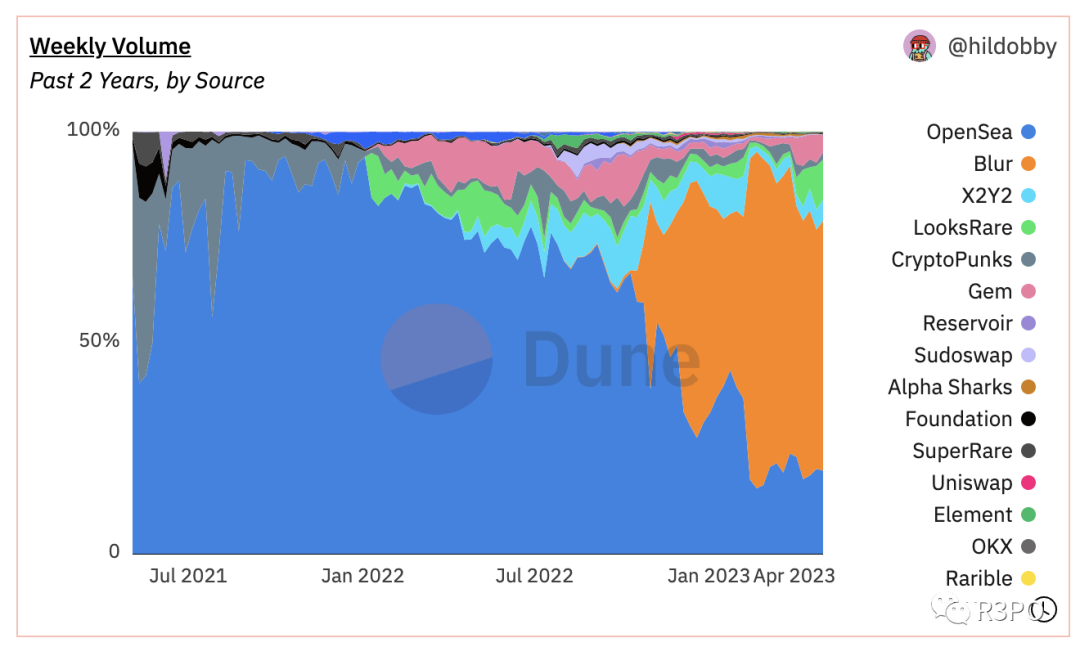

Blur’s Past “Liquidity” Was Likely a False Boom

Blur’s launch once brought a “false boom” to the NFT market. Since early 2023, signs of recovery have emerged in the broader crypto market, yet the NFT sector overall remains stagnant. According to Dune data, after the NFT aggregation platform Blur launched at the end of last year, its airdrop incentive program quickly captured market share and temporarily revived trading volume in what had been a dormant NFT market. However, shortly after distributing its airdrop rewards on February 14, overall NFT market trading volume sharply declined. The BLUR token price also dropped nearly 70% from its peak within just three months.

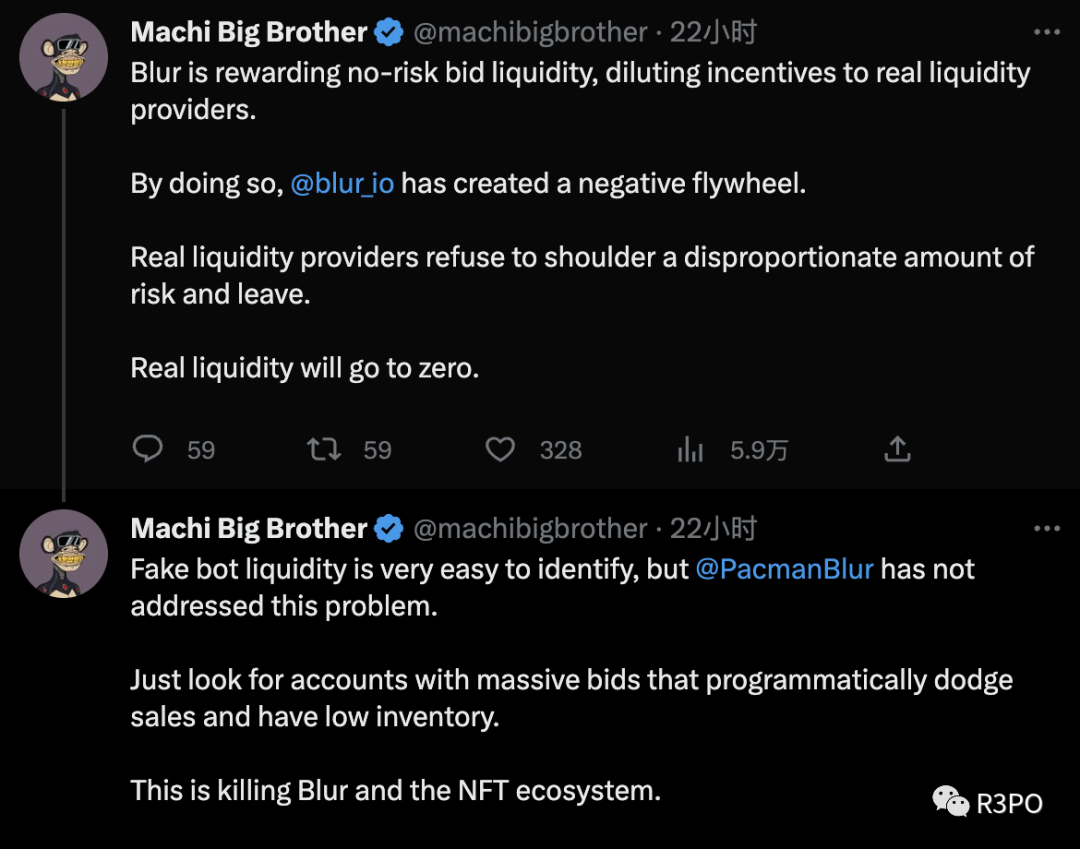

Moreover, floor prices of most NFTs continued to fall repeatedly. For example, the floor price of Bored Ape Yacht Club (BAYC), the flagship collection in the NFT market, dropped steadily from a February high of 80 ETH, falling below 44 ETH last week—the lowest level in nearly six months. During this period, well-known NFT OG “Majie Brother” suffered heavy losses in the game orchestrated by Blur and even announced his exit from the NFT space. He commented on Blur’s mechanism: “Blur’s design tolerates fake liquidity and disregards the rights of genuine liquidity providers. True liquidity providers, who often bear disproportionate risks, will gradually leave. Eventually, real liquidity will drop to zero. This is killing both Blur and the entire NFT ecosystem.” Clearly, the liquidity generated by Blur may have been nothing more than a false boom.

Is Blend Creating Liquidity—or Serving Whales?

In traditional financial markets, borrowing needs are ubiquitous—mortgages, auto loans, bank loans, etc. In the NFT market, NFT holders similarly seek to improve capital efficiency by leveraging their assets to obtain cash flow, maximizing capital utilization. Additionally, choosing to pledge NFTs instead of selling them helps alleviate oversupply pressures. Thus, lending in the NFT market holds practical significance.

However, whether Blend represents the optimal model for NFT lending remains debatable. After the first round of Blur airdrops created numerous overnight millionaires, the second-phase bid reward mechanism attracted a group of so-called “miners” who aren’t genuinely interested in collecting NFTs, turning the entire NFT market into a “minefield.” These large players and algorithm experts continuously optimize automated scripts and scale up capital solely to exploit others, introducing substantial risk to the market. In this high-risk environment, many ordinary users previously provided real liquidity out of passion and love for NFTs. Now, when purchasing NFTs, they must also contend with hidden battles among powerful whales. Over time, people will grow increasingly disillusioned with the market. Blur’s incentive system and relentless pursuit of liquidity have gradually exposed serious flaws.

Now that Blur has aggressively entered the NFT lending arena, many express optimism, claiming it will boost NFT liquidity. But is this so-called liquidity truly important? After the second-phase rules were released, many low-quality NFT projects experienced a temporary revival through collusion between whales and founders, becoming mere tools for farming points. What value does such artificially inflated liquidity hold? Once Blur’s points incentive campaigns end, will this inflated, grind-driven liquidity still exist?

Will Blend eventually become another tool for whales to exploit retail users? Perhaps Blur’s original intention was strategic—to integrate its existing bid-funded pools into a unified NFT liquidity market combining lending, interest, and installment payments, enhancing capital efficiency and accelerating the financialization of NFTs. But in practice, it may simply add a new gameplay option for “Blur points miners.”

The NFTfi sector is still in its early stages. Many believe that in the future, NFTfi protocols could evolve into a protocol matrix similar to DeFi, integrating trading, lending, and stablecoins into one ecosystem. While Blur’s launch of the Blend lending platform has indeed stimulated capital activity, the current driving force behind this activity is mainly points incentives. Its long-term sustainability remains uncertain.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News