Will Blend impact Web3 gaming?

TechFlow Selected TechFlow Selected

Will Blend impact Web3 gaming?

Can Blur's newly launched lending feature have an impact on gaming NFTs?

Written by: apix

Compiled by: TechFlow

The financialization of Web3 gaming NFTs has long been a hot topic in the industry. Could Blur's newly launched lending feature have an impact on gaming NFTs? While the effect may seem minimal now, as Web3 games continue to grow, this possibility becomes increasingly real. In this article, crypto researcher apix shares his insights on the matter.

Most people’s initial reaction to this topic might be “lending won’t affect gaming NFTs.” But if all NFTs are fundamentally similar, why wouldn’t it? Let’s take a longer-term view:

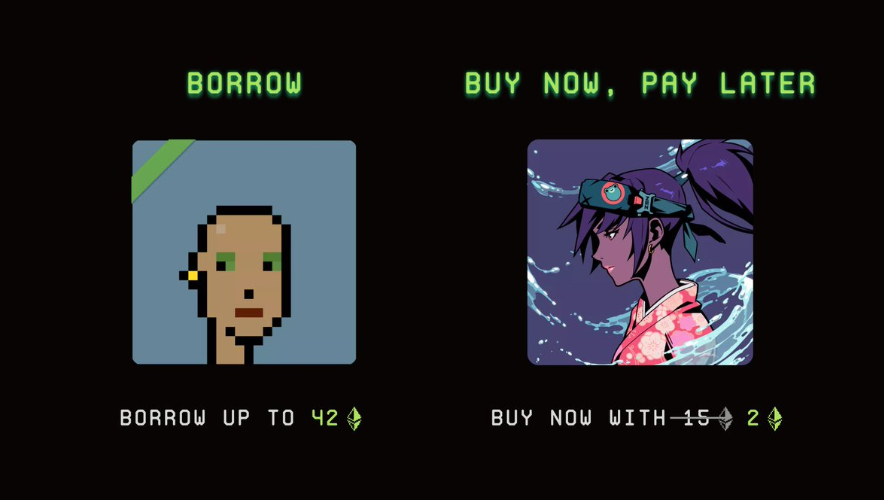

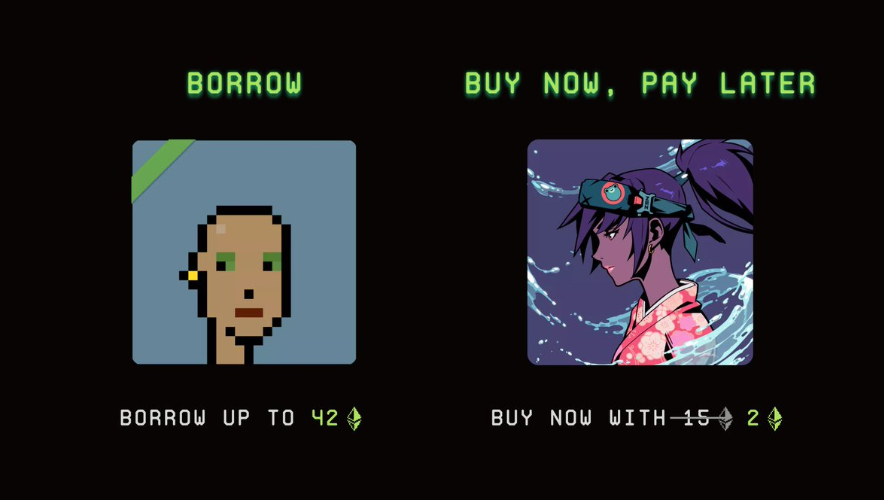

First, let me explain what Blend actually does:

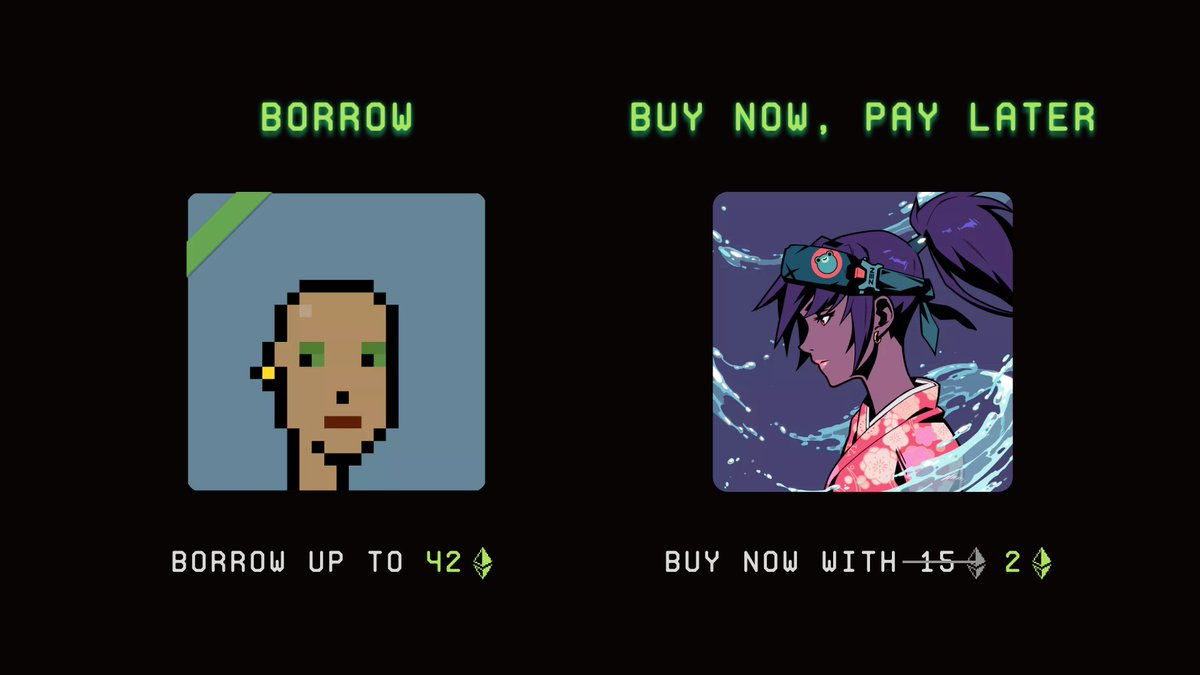

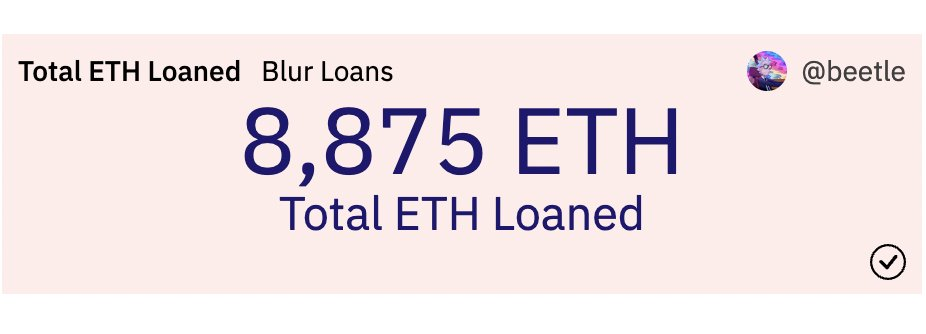

1. Traders can use their NFTs as collateral to borrow ETH.

2. Traders can lend out their NFTs at prices significantly below the floor price.

Indeed, we already have large gaming collections like Digi, Dimensionals, and Treeverse—collections whose current floor prices may already be suitable for Blend.

But these are genesis series. Once new games launch, they will build larger ecosystems with cheaper NFTs.

Yuga has been doing this for a while—BAYC → MAYC → BAKC → Otherside → HV-MTL → Vessels.

There are over 200,000 items in the Yuga ecosystem, with the cheapest priced at $560. I expect they’ll go even further, eventually making Yuga assets very affordable. So let’s examine the core challenges facing lending and gaming NFTs.

1. They’re too cheap

No one is going to take out a loan for a $1 game skin and pay 15% annual interest on it. That’s unrealistic, and players simply aren’t interested.

2. No trait-based lending for game NFTs

Blur is optimized for traders, meaning each NFT is treated as a floor-priced asset.

There’s no bidding or lending based on traits. Yet traits play a huge role in gaming NFTs—different skins, resource-rich land, etc., greatly influence value.

3. Chains and tokens

Another key issue: Blur only supports transactions in ETH.

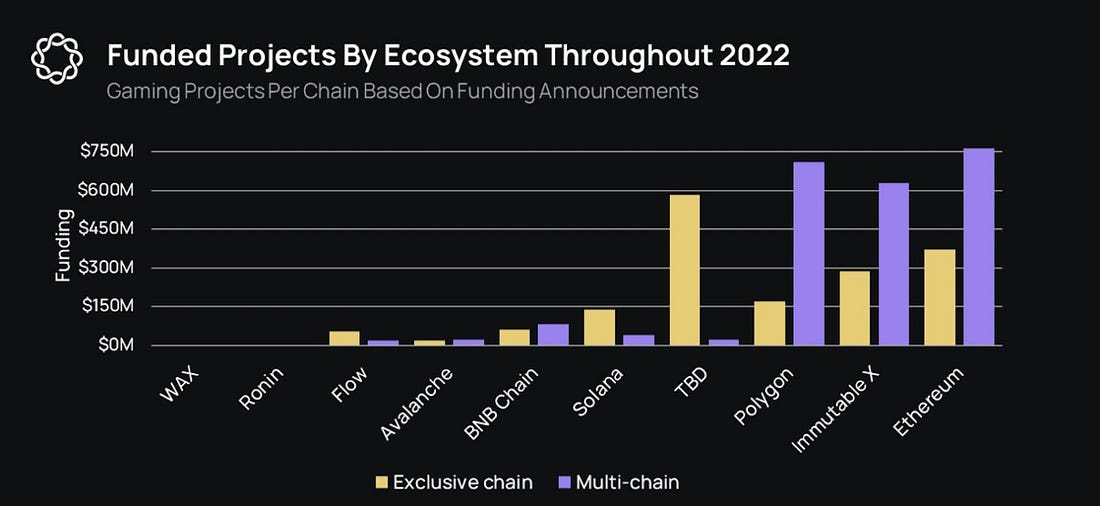

Yet 99% of gaming collections have major ecosystem components on other chains—chains with lower fees and better technical support.

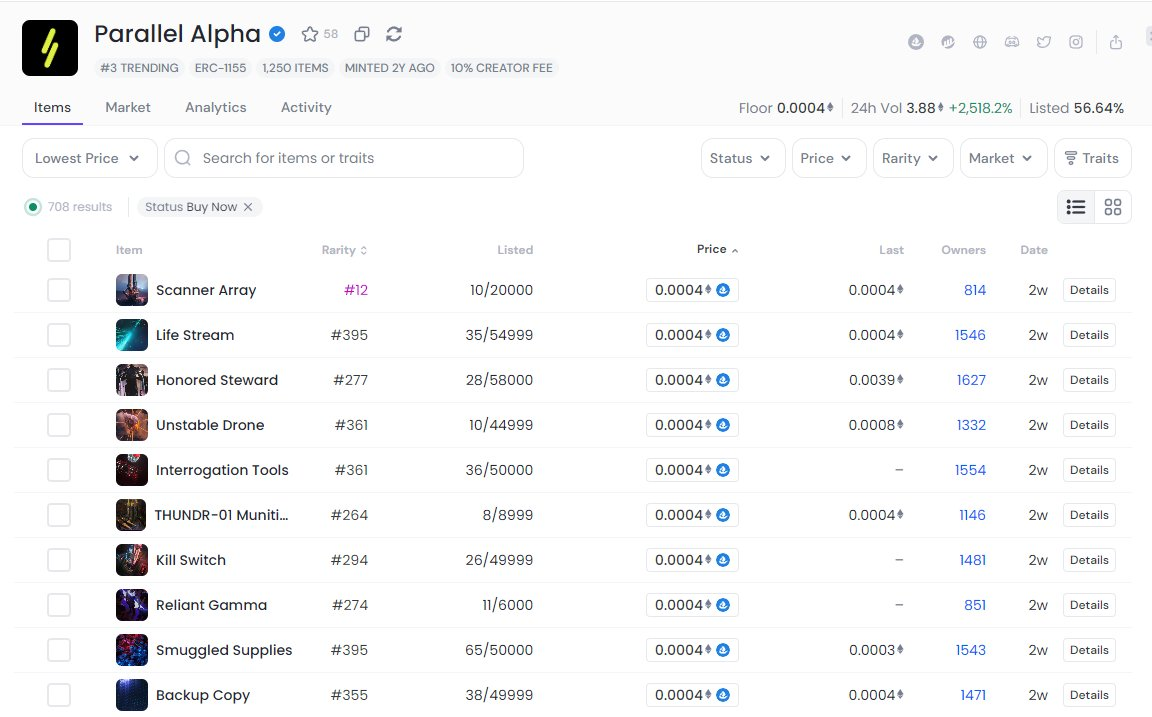

Moreover, gaming NFTs are typically ERC-1155, which Blur does not support.

For example, Otherside Plots have 1,804 different traits, and all Parallel Cards are ERC-1155.

Therefore, the lack of trait-based lending, multi-chain support, and ERC-1155 compatibility excludes gaming NFTs from this form of financialization. But something made me reconsider.

Blur clearly believes NFTs will play a major role in our digital future. Yet we’ve seen widespread skepticism about PFP projects, with many arguing that PFPs will never see another boom. While I disagree, it’s clear that current NFT market participation remains low.

This means we need a major catalyst to boost attention, demand, and utility for digital collectibles.

The obvious answer: gaming.

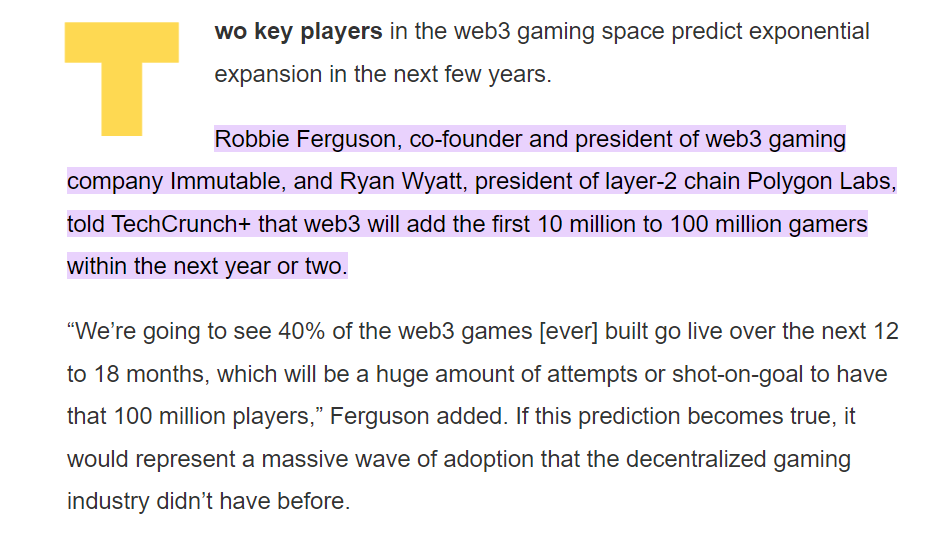

Gaming could serve as the catalyst that drives the next bull run and mass adoption. Perhaps in the future, we’ll see Blur develop trait-based bidding, multi-chain support, and other features—because they don’t want to miss out on Web3 gaming, and they certainly don’t want to miss the next 100 million to 1 billion Web3 gamers.

And there are real-world examples proving this point—we keep seeing new highs in CS:GO skin valuations. Players can even lend them out temporarily… or gain liquidity without giving up ownership of their skins.

These use cases make perfect sense to me, which is why I believe platforms like Blend and other lending protocols could eventually impact gaming NFTs. Of course, in the short term, no Web3 game will reach CS:GO’s scale—but these mechanisms can still work on a smaller level.

And Web3 degens might drive prices up purely through speculation, creating space for products like Blend to thrive.

Tl;dr

Will lending platforms like Blend immediately impact Web3 gaming? — Not yet.

Could this change in the future? — Possibly. If Web3 gaming succeeds, the likelihood increases significantly.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News