Bankless: Five Projects Combining NFT Utility and DeFi Solutions

TechFlow Selected TechFlow Selected

Bankless: Five Projects Combining NFT Utility and DeFi Solutions

"NFTfi," the combination of DeFi solutions and NFT use cases, is currently one of the fastest-growing areas in the cryptocurrency economy.

Written by: William M. Peaster

Translated by: TechFlow

"NFTfi," the convergence of DeFi solutions with NFT use cases, is currently one of the fastest-growing areas in crypto.

Yet this space already hosts numerous projects, making it overwhelming. Bankless has therefore curated five lesser-known projects that could present opportunities for newcomers to NFTfi.

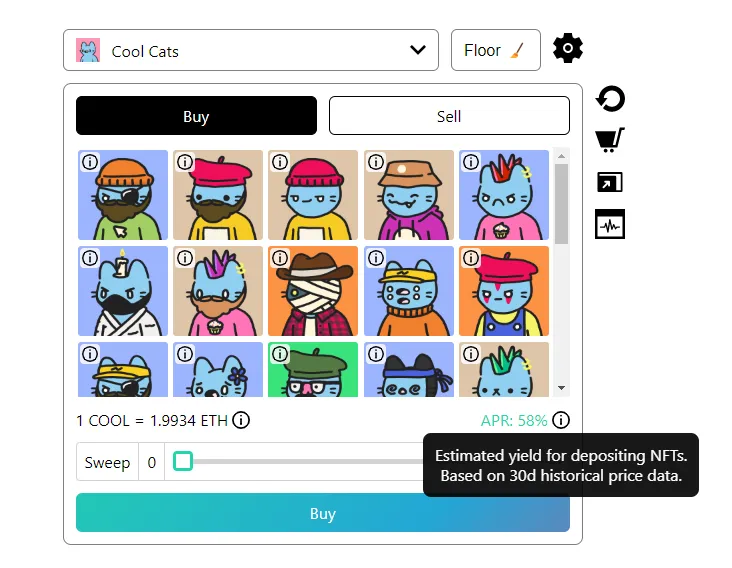

1) Caviar LPing

Caviar is an NFT AMM protocol for trading NFTs. It supports fractionalizing NFTs via the ERC20 token standard and features a unique "Desirability Classifier" system that organizes NFT collections into sub-pools. As a result, each main Caviar pool has multiple independent price curves representing liquidity across an entire NFT collection. Through this sub-pool system, the protocol aims to increase liquidity for rare NFTs and incentivize liquidity provider (LP) trading activity.

Caviar's LPs earn yield from the 1% fee charged on every Caviar NFT swap. As more people trade through a specific pool, the LPs of that pool earn proportionally more. Thus, the strategy here is to provide liquidity using ETH and NFTs in active pools to profit from ongoing trading activity. For example, as seen in the screenshot below, Cool Cats LPs are currently earning a 58% annualized return on Caviar based on trading activity over the past 30 days.

2) Papr

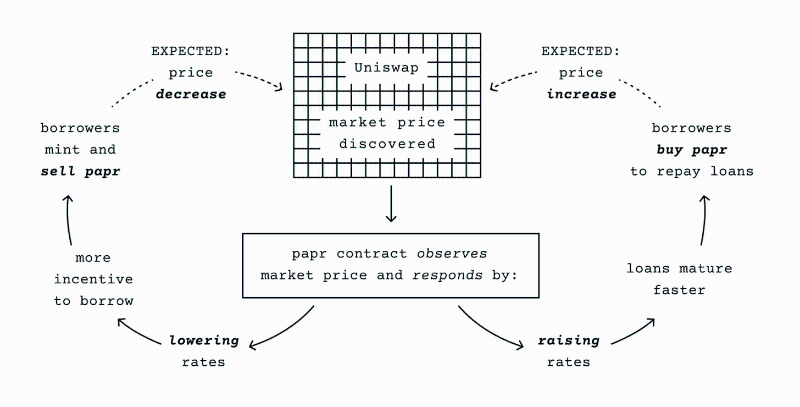

Inspired by Squeeth and created by Backed, Papr is a novel NFT lending protocol characterized by flexibility, elasticity, and no lock-up periods. This new approach centers around papr tokens ("perpetual APR"), which borrowers mint after sending an NFT as collateral to the papr controller smart contract. Borrowers can then sell these tokens on DEXs like Uniswap as needed, creating a continuous feedback loop between market activity, the trading price of papr, and the protocol's interest rate.

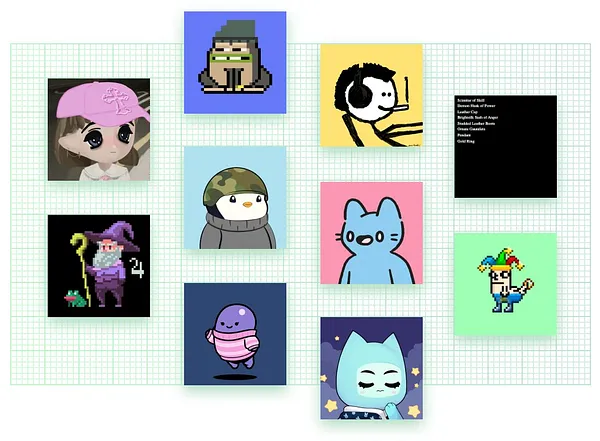

Papr tokens offer holders and LPs a "buy-and-hold" method to gain exposure to multiple NFT collections and loans simultaneously. For instance, one such token, $paprMEME, provides loan risk exposure across 10 series, including Cool Cats, Forgotten Runes Wizard's Cult, and Mfers.

3) Insrt Finance

Insrt Finance is an NFT protocol focused on long-term yield strategies, with its first product called Shard Vaults. Users can gain low-cost ownership of blue-chip NFTs through fractionalized NFTs, where the underlying fractional NFTs represent partial ownership of NFTs held within a Shard Vault—such as a Bored Ape.

The NFTs within the vaults are deployed into NFTfi to capture yield, generating returns for Shard Vault holders. For example, Insrt’s first Shard Vaults (for CryptoPunk #9620 and BAYC #1369) are already delivering over 15% annual percentage yield to their Shard Vault holders.

4) MetaStreet

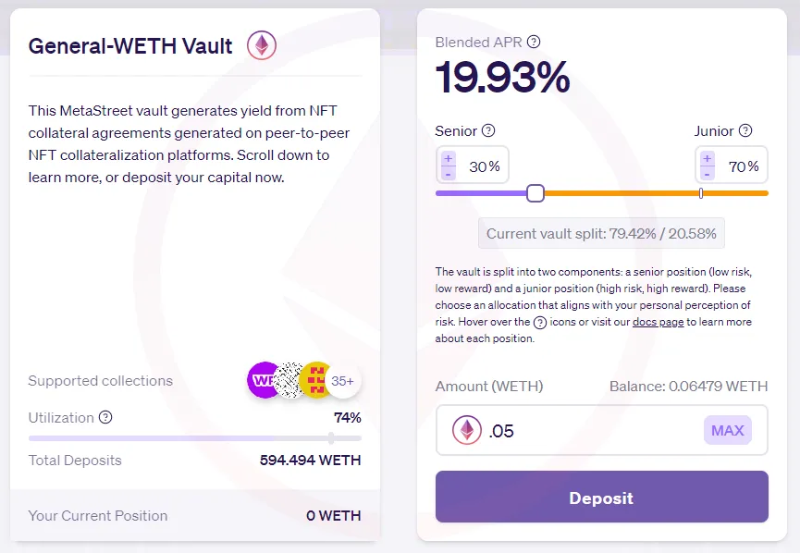

MetaStreet is a decentralized interest rate protocol for the metaverse. Its initial flagship product is Capital Vaults, which allow users to deposit ETH, DAI, and later other cryptocurrencies to earn yield from NFT-backed vault strategies.

Specifically, Capital Vaults use these deposited funds to acquire NFT-backed peer-to-peer notes facilitated by lending platforms like nftfi.com, enabling users to earn returns through interest payments and liquidations.

5) Hook Earn

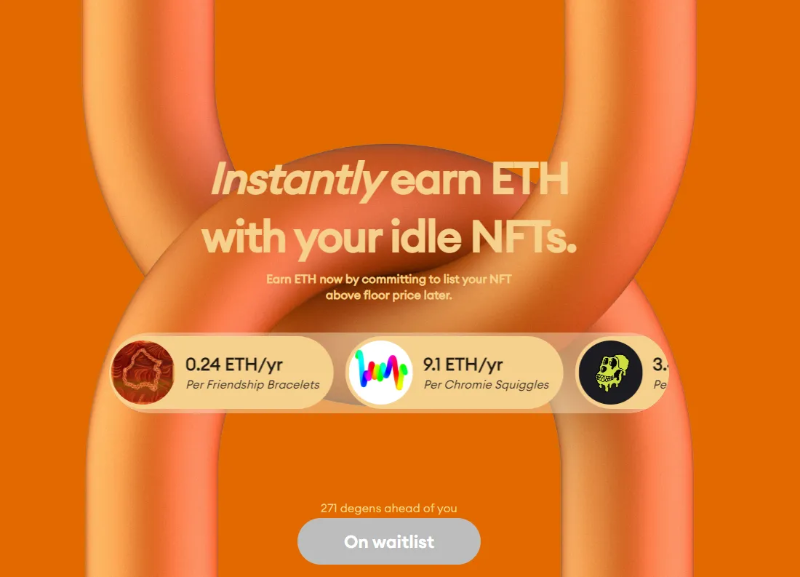

Hook is a decentralized NFT derivatives protocol focused on European-style call options, allowing participants to speculate on NFT prices within a specific timeframe without paying the full price of the NFT.

In simple terms, Hook enables NFT holders to earn premiums or sell at optimal prices, while also offering traders opportunities to profit from bullish or bearish speculation.

Hook’s latest product is Hook Earn, which leverages the protocol’s call options as its underlying mechanism. This new product allows NFT owners to earn immediate yield on their idle NFTs—simply by agreeing to list them at a specific price on a future date. If the NFT isn’t purchased by that target date, you retain ownership and can re-deposit it into the yield system. If the NFT sells above the listed price, the relevant trader captures the spread.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News