Bankless co-founder Ryan's letter to his son: Don't keep money in banks, put it into cryptocurrency

TechFlow Selected TechFlow Selected

Bankless co-founder Ryan's letter to his son: Don't keep money in banks, put it into cryptocurrency

Banks seem safe, but are actually a triple "scam."

Author: Ryan Adams, Co-founder of Bankless

Translation: Luffy, Foresight News

Editor's note: This article is a letter written by Ryan Adams, co-founder of Bankless, to his son. In it, Ryan offers advice on wealth management, with the core message being "Don't keep your money in banks," as banks are actually a triple "scam." His ultimate recommendation is to keep some U.S. dollars for daily expenses and allocate long-term wealth into assets like Bitcoin, gold, and stocks—vehicles that can preserve value across time. Below is the full translation:

Dear Son,

Don’t keep your money in banks. Banks may seem safe, but they’re actually a three-layer "scam."

Scam One: They steal your returns

At any time, the U.S. dollar has a risk-free return available—and that’s government bonds. Treasury bonds are essentially “dollars dressed in short-term government debt,” offering a fixed 4.2% yield.

No extra risk involved—it’s free money, practically tailor-made for you.

But banks won’t give you this return in savings accounts. Instead, they pocket it themselves. They don’t tell you this return exists, they don’t help you convert your dollars into Treasuries, and they even lobby the U.S. government to block regular savers from accessing these returns.

Banks earn 4.19% but only give you back 0.01%

The wealthy don’t keep their cash in bank accounts. They park it in Treasuries instead. But the middle class and those lacking financial literacy have their returns stolen every day by the friendly neighborhood bank—without even realizing it.

Bank lobbying groups also target stablecoin yields in crypto, blocking your access. They spread fear, claiming that if this "bloodsucking" savings business collapses, the entire financial system will fall apart!

Rates change, so watch what the Fed chair says—but as long as yields remain positive, put your dollars into short-term Treasuries and money market funds, not bank accounts.

Scam Two: The returns aren't real

Now here’s the next secret: Those returns are fake.

You think today’s 4.2% yield offsets your loss of purchasing power? That’s just the “nominal yield.” The dollar’s purchasing power erodes every year—that’s inflation. Even in good times, inflation is expected; in bad times, it gets worse.

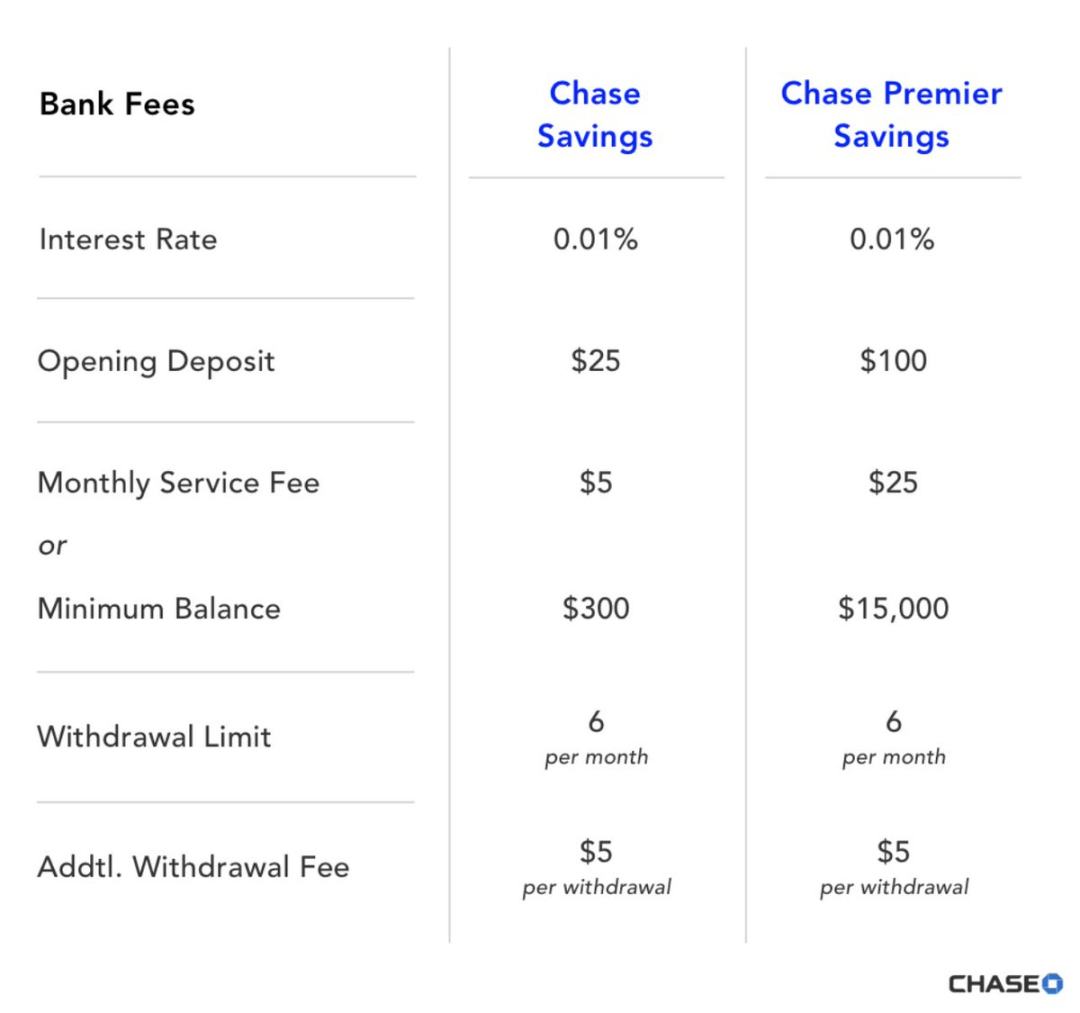

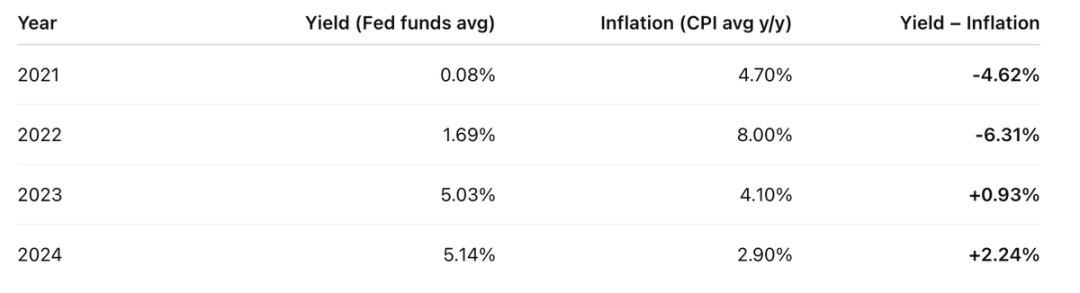

Over the past four years, your real returns looked like this:

Subtract annual CPI from your account yield—the result isn’t impressive

So over the past four years, in two of them you lost far more than you gained.

But it’s even worse: You still pay income tax on those “fake returns.”

Assume your tax rate is 20%. You must first pay 20% tax on those “phantom gains.” So your actual return looks like this:

Before inflation “tax,” you already paid income tax—your dollars face double taxation

Real yield = Nominal yield – Inflation.

They want you to believe inflation is a natural force, like gravity or physics. It’s not. It’s an intentional design of modern governments and central banking systems.

Inflation is just a tax—no different from other taxes—except it’s hidden.

I know you don’t mind paying your fair share of taxes. Public services matter, and you believe in the common good. But what about this hidden tax? One that specifically targets middle-class savers trying to save for the future—is that fair?

Learn from the rich: They avoid this “savings tax” by holding assets, not dollars. Which brings us to the third and most insidious layer of the scam.

Scam Three: Money itself isn’t “real”

Okay, I’m exaggerating a bit. The dollar exists, but only as a “temporary thing.” It works for short-term payments, not for storing wealth across time or passing it to the future. It’s a medium of exchange, not a store of value.

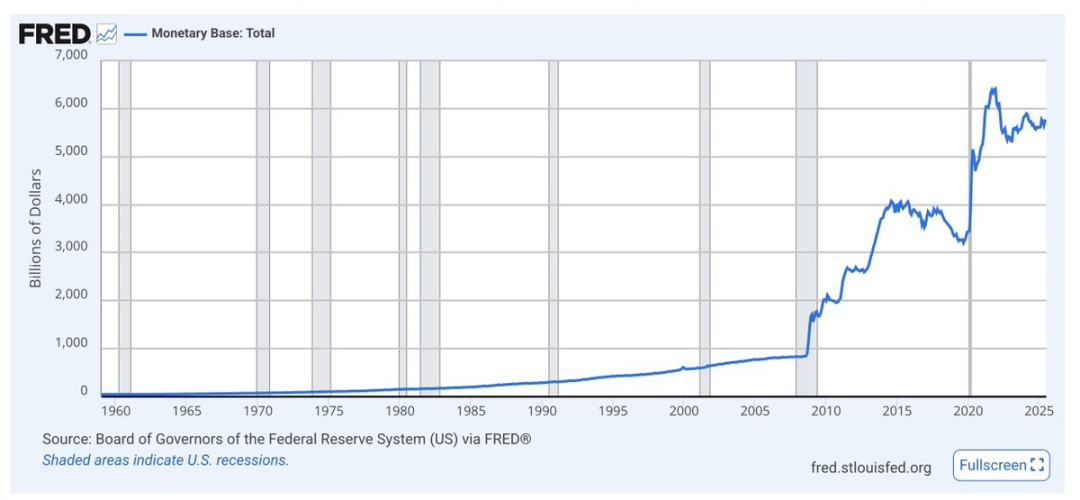

Base money supply (M0) consists of cash and bank reserves. See how sharply it spikes during crises, with an overall upward trend

The dollar has no long-term scarcity constraint—its supply keeps growing. The share of total supply that your dollars represent shrinks faster than any yield can compensate, because they keep printing.

Dollar issuance is rarely discussed. Economists focus on inflation and purchasing power, but over the long term, increasing money supply causes the dollar to depreciate against assets. The more dollars printed, the less your money is worth.

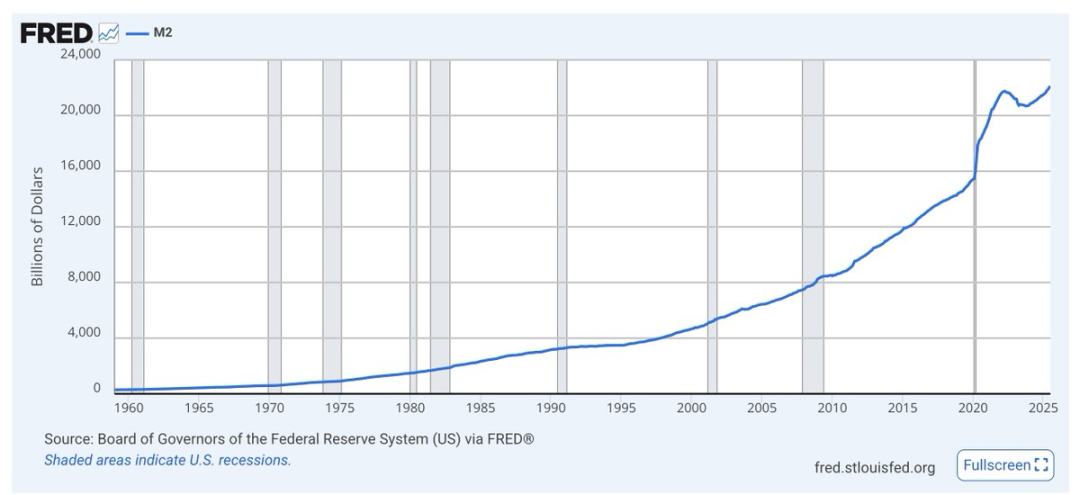

M2 (M1 plus short-term savings) follows the same pattern—spiking during crises, trending sharply upward

Don’t get lost in economists’ debates—just look at the charts. No matter who’s in power, governments use dollar printing as economic and political “lubricant.” That’s what the dollar is for—not saving.

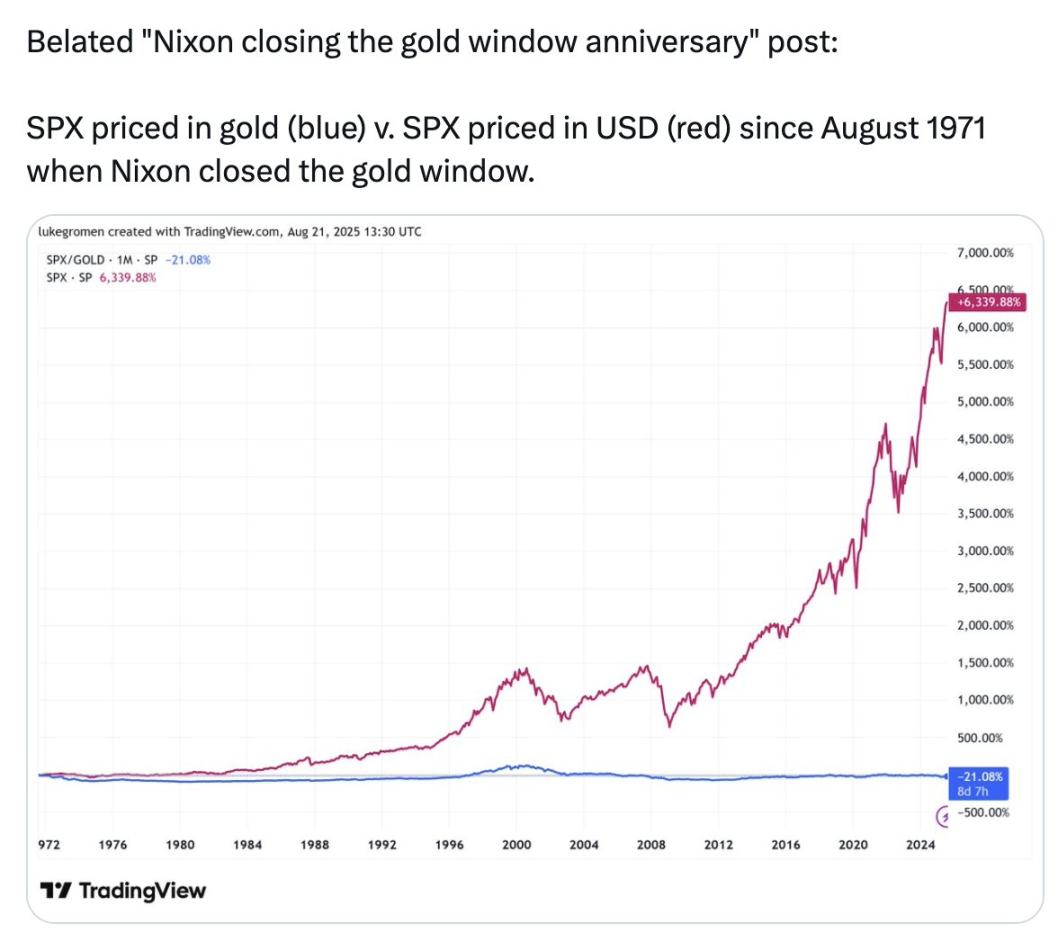

Look at the blue line in this chart:

S&P 500 in USD terms rose 6339% since 1971; priced in gold, the S&P 500 has actually fallen 21%

Over the past 54 years, holding wealth in gold outperformed holding it in America’s 500 largest and best-performing companies.

This chart isn’t telling you to buy gold. It’s showing you that what they call “money”—what we use to measure everything—what sits in your bank account—isn’t real “money” at all. It can’t store value, never could, and never will.

What they call “money” isn’t a store of value. So here are the three layers of the scam:

-

Scam One: Stealing your returns;

-

Scam Two: Returns aren’t real;

-

Scam Three: Money itself isn’t “real.”

So what should you do?

Keep some dollars for short-term needs—daily spending, taxes, emergencies. Earn yield via Treasuries.

Put all long-term wealth into asset portfolios that preserve value across time: Stocks and real estate work too, but Bitcoin, Ethereum, and gold are excellent. The latter three have scarce supply and won’t be diluted by inflation. These assets seem risky due to volatility, but volatility isn’t risk.

Medium-term wealth can sit in Treasuries, ready to deploy when long-term value-preserving assets drop in price. That’s the art of investing—buy when others are fearful, sell when others are greedy, as Buffett said. No rush—wait for big dips, thinking in terms of years or even decades.

Use crypto tools and exchanges where possible. Avoid cutting-edge risks—this way you stay on the frontier while avoiding the fallout when crypto disrupts traditional finance.

Schools won’t teach you this. But you must learn, dig deeper, and protect your future.

Stop keeping money in banks. Turn your money into assets. Put it into crypto.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News