Why can't cryptocurrency grow long-term value?

TechFlow Selected TechFlow Selected

Why can't cryptocurrency grow long-term value?

Most things in the crypto industry that can truly exist long-term were born in an era when no one paid attention to cryptocurrency.

By: rosie

Translation: Luffy, Foresight News

Most crypto founders I know have already gone through three pivots.

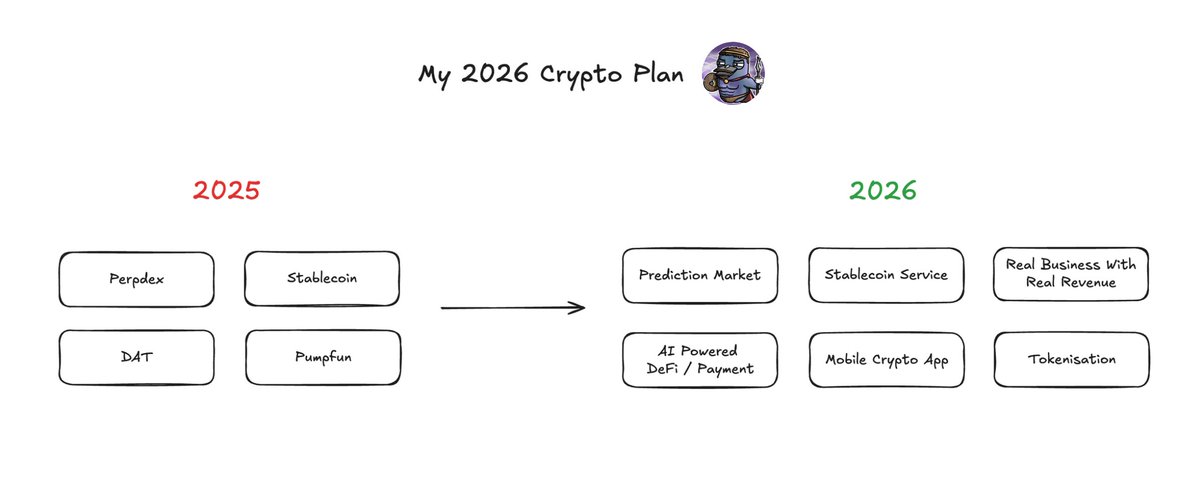

The people who built NFT platforms in 2021 shifted to DeFi yield projects in 2022, jumped on AI agents from 2023 to 2024, and now they’re rushing into the latest trend (perhaps prediction markets?).

There's nothing inherently wrong with their constant pivoting—it’s often a rational move within the game. But the problem is that the rules of this game structurally make any long-term building impossible.

An 18-Month Product Cycle

Narrative emerges → capital floods in → everyone pivots → spend 6–9 months building → narrative fades → pivot again.

This cycle used to be 3–4 years (ICO era), then shortened to 2 years, and now, if you're lucky, it's just 18 months.

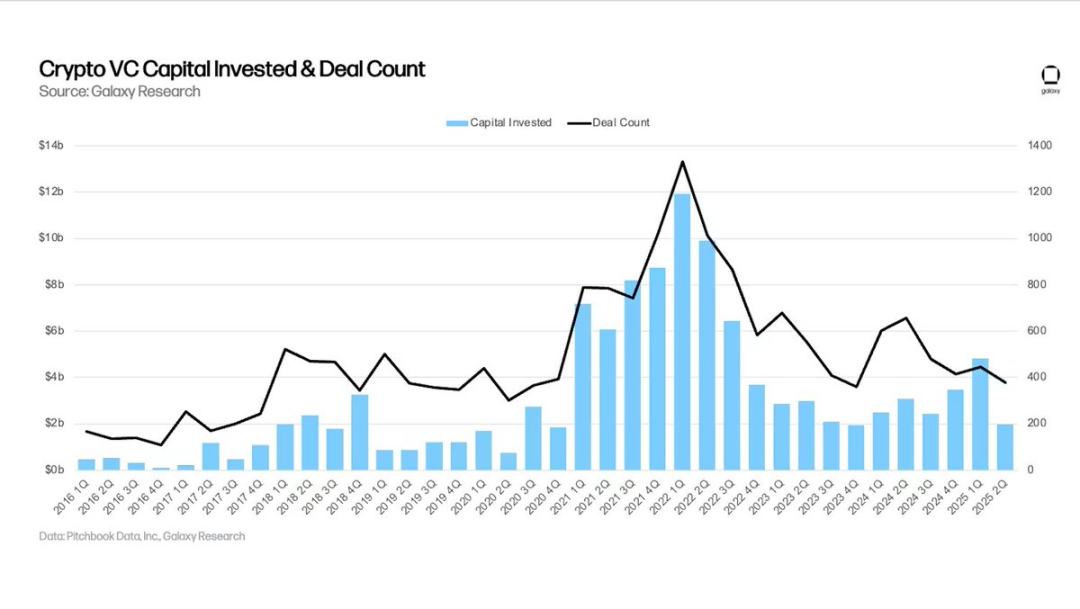

In Q2 2025, crypto venture funding dropped nearly 60% quarter-on-quarter. Founders now have even less time and capital before the next trend forces them to pivot once more.

The core issue is that 18 months isn’t enough to build anything meaningful. Real infrastructure takes at least 3–5 years to build. True product-market fit requires years of iteration—not a few quarters.

But if you stick with last year’s narrative, you become an “inactive asset.” Investors ignore you, users leave, and some investors may even pressure you to chase the current trend. Meanwhile, your team members start interviewing at projects that just raised funds based on today’s hot narrative.

Sunk Cost Fallacy as a Survival Mechanism

Traditional business advice says: don’t fall for the sunk cost fallacy—pivot when something isn’t working.

The crypto industry has taken this to the extreme: it now favors “maximizing sunk costs.” No one sticks with an idea long enough to actually test whether it can work.

Pivot at the first sign of resistance, pivot when user growth slows, pivot when fundraising stalls.

Every founder faces this calculation:

-

Keep building the current product—might take 2–3 years to see results, maybe another round if we’re lucky;

-

Pivot to a hot narrative—immediate funding, paper gains, exit before anyone realizes it doesn’t work.

In most cases, the latter is simply the better option.

The Dilemma of Never Finishing

Few crypto projects ever truly complete what they set out to build. Most remain perpetually “almost done,” always just one feature away from product-market fit.

But they never actually finish, because halfway through development, the narrative shifts. Suddenly, your nearly completed DeFi protocol means nothing—everyone’s talking about AI agents now.

The market punishes completion: a finished product has clear limitations, while an unfinished one holds infinite potential.

Capital Chases Attention, Not Results

Funding patterns are telling:

-

New narrative + no product: raises $50 million;

-

Established narrative + mature product: struggles to raise $5 million;

-

Old narrative + product + real users: can’t raise at all.

Venture capital isn’t investing in products—it’s investing in attention. And attention flows to new narratives, not completed old projects. Most teams today are “maximizing narrative value,” optimizing purely for fundable stories, regardless of what they’re actually building. Completion means self-imposed limits; staying unfinished preserves all possibilities.

Team Retention Challenges

Your best developer gets an offer with double the salary from a hot narrative project. Your marketing lead gets poached by a team that just raised $100 million.

You can’t compete—because six months ago, you chose to stick with your current project instead of chasing the then-hot trend.

Nobody wants to work on boring, stable projects. They’d rather join chaotic, overfunded ventures that might collapse tomorrow—or deliver 10x returns.

Scarcity of User Attention

Crypto users only engage with your product because it’s new, everyone’s talking about it, or there’s a chance of an airdrop.

Once the narrative shifts, they leave immediately—regardless of whether your product improved or added the features they requested.

You can’t build a sustainable product for “unsustainable users.”

I know founders who’ve pivoted so many times they’ve forgotten what they originally wanted to build.

Decentralized social network → NFT platform → DeFi aggregator → gaming infrastructure → AI agent → prediction market. Pivoting is no longer a strategy—it has become the business model itself.

The Infrastructure Paradox

The things in crypto that truly last were mostly built when no one was paying attention.

Bitcoin emerged when nobody cared, with no VC, no token sale. Ethereum launched before the ICO craze, when no one knew smart contracts would evolve into what they are today.

Most things born during hype cycles die with them. Things built in between cycles have a higher survival rate.

Yet no one builds during those gaps—because there’s no funding, no attention, and no exit liquidity.

Why Is This So Hard to Change?

Token-based incentives enable flexible exits. If founders and investors can cash out before a product matures, they will.

Information spreads faster than products get built. By the time you finish, everyone already knows if it works. The core ethos of crypto is “move fast”—asking it to slow down is asking it to abandon its nature.

This means if you spend 3 years building, someone else can copy your idea, launch a cruder but better-marketed version in 3 months, and beat you.

So Where Do We Go From Here?

Crypto struggles to create long-term value because its structure contradicts long-term thinking.

You can be a principled founder: refuse to pivot, stay true to your original vision, spend years—not months—crafting a product. But you’ll likely run out of funds, be forgotten, and replaced by someone who pivoted three times while you were releasing your first version.

The market doesn’t reward “completion”—only “launching,” over and over. Perhaps crypto’s real innovation isn’t technical at all. Maybe its true innovation is figuring out how to extract maximum value with minimum completion. Or perhaps, the pivot itself is the product.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News