Cryptocurrencies continued their "bloodbath" on Monday, with some tokens falling back to the lows seen during the October flash crash

TechFlow Selected TechFlow Selected

Cryptocurrencies continued their "bloodbath" on Monday, with some tokens falling back to the lows seen during the October flash crash

The analysis suggests that the shadow of market turmoil in October still lingers, and investors will not easily enter the market until there is a clear signal of price support.

By Ye Zhen, Wall Street Insights

Under the shadow of October's historic deleveraging event, the cryptocurrency market is facing renewed selling pressure, with a key indicator showing weakening demand from large institutional investors, exacerbating market caution.

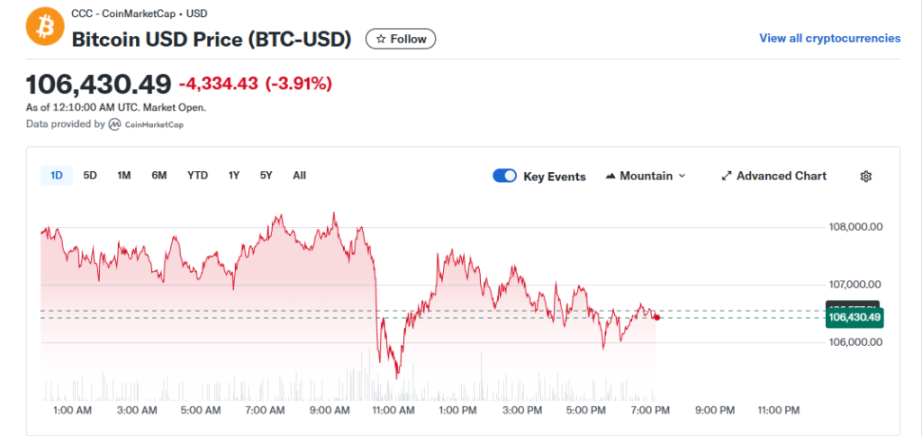

On Monday, the crypto market remained under pressure as Bitcoin fell below $107,000. The broader altcoin market performed even more weakly, with some tokens retreating to lows last seen during the October flash crash, when hundreds of billions of dollars in leveraged positions were liquidated.

A warning sign emerged as Charles Edwards, founder of Capriole Investments, noted that institutional demand for Bitcoin has slipped below the rate of new coin mining for the first time in seven months. This shift suggests large buyers may be pulling back, aligning with other market signals pointing to a risk-off tone across the cryptocurrency sector.

Market Sentiment Cautious, Institutional Demand Cools

Bitcoin dropped as much as 4.3% on Monday to around $105,300—still up about 14% since last December, but recently showing clear signs of weakness. Meanwhile, the MarketVector Index, which tracks the performance of the bottom 50 assets among the top 100 digital assets, fell for a third consecutive trading day by as much as 8.8%, bringing its year-to-date decline to approximately 60%.

Market participants say it has been three weeks since the violent market swing wiped out around $19 billion in long positions, yet the "aftermath" persists. Jordi Alexander, CEO of cryptocurrency trading and market-making firm Selini Capital, said the crypto market is currently in a "hangover phase" following the October liquidations. He believes rebuilding the destroyed capital base will take time, and investor sentiment remains cautious.

Alexander added, "The market must first demonstrate a compelling price bottom is forming before any renewed attempt at an upward breakout." In his view, investors won't re-enter until there's a clear signal that prices have found support.

Beyond fragile sentiment, a critical technical indicator has also turned red. Charles Edwards of Capriole Investments pointed out that large institutions' appetite for Bitcoin has slowed, falling below the rate of new coin production for the first time in seven months. This data suggests one of the key forces previously driving the market rally may now be weakening.

Additional Sources of Selling Pressure? Profit-Taking and Awakening 'Dormant' Bitcoin

Not everyone attributes this downturn solely to the October market shock.

Matthew Kimmell, digital asset analyst at CoinShares, described the current pullback as "somewhat puzzling." While he acknowledged the market "is still feeling some aftershocks from the liquidation event," he emphasized that other factors deserve attention.

Kimmell noted that public Bitcoin transaction records show wallets that had been inactive for extended periods are now being activated. "These coins are beginning to move and are likely re-entering the market, adding some selling pressure as investors take profits," he said. "This is something I'm closely monitoring."

Jake Hanley, managing director at Teucrium ETFs, also believes the price decline stems from "people taking profits." He pointed out that current technical charts reflect a fragmented market. "Since summer, prices led by Bitcoin have been trending lower, and XRP has clearly been on a downtrend since mid-summer," Hanley said. "Throughout this process, the price action itself is telling you that people are cashing in gains."

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News