Real cryptocurrency has long been dead

TechFlow Selected TechFlow Selected

Real cryptocurrency has long been dead

Once, it was such a pure, liberating, and hopeful thing.

Author: hitesh.eth

Translation: TechFlow

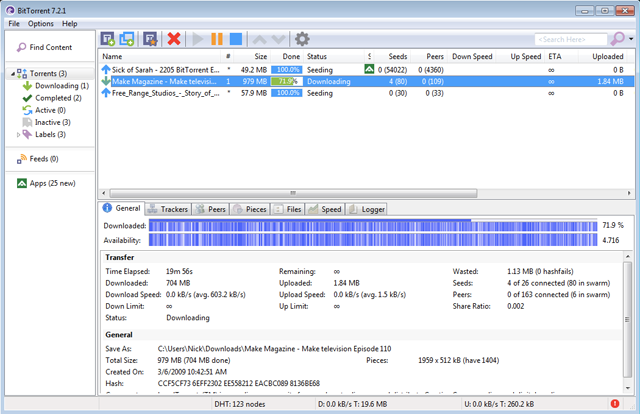

Since the birth of cryptocurrency, it has been rooted in altruism. Early users of any crypto-based product weren't driven by money. In fact, they happily contributed resources to early encrypted networks like BitTorrent, helping a vast community thrive.

In those days, before OTT platforms became widespread, watching a high-quality movie online was extremely difficult—a shared global struggle. We had to wait months for television broadcasts to see films we couldn’t afford to watch in theaters every weekend.

Film culture has continuously grown and evolved, and I believe it's the only culture that consistently draws in more and more people. Those drawn to film culture often stay with it for life, and cryptocurrency played a role in this evolution. It connected more people globally via the internet, making film culture more inclusive and diverse.

Many people shared movie files through their computer systems using seeds and peers, while we downloaded from them via peer-to-peer (p2p) connections. It felt like magic—free and entirely fueled by a shared love for cinema.

This collective sentiment of challenging centralized systems and returning power to the people was the core spirit of those who participated, knowingly or unknowingly, in early crypto products.

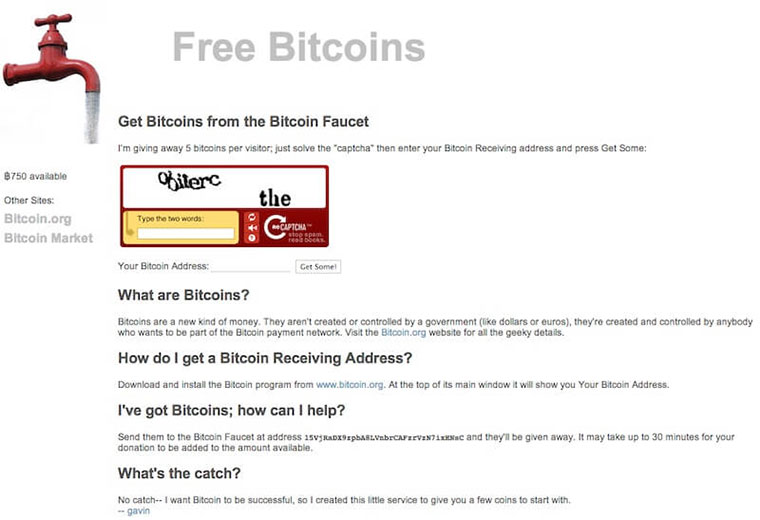

Then Bitcoin emerged, marking a turning point in the crypto space. In Bitcoin’s early days, those joining the network didn’t care about its price. They focused on building the network, educating others, and driving early adoption. They even gave away Bitcoin for free through forums, meetups, events, and mailing lists.

Between 2009 and 2010, thousands of Bitcoins were given away freely, when Bitcoin had virtually no market value. But with the emergence of exchanges, Bitcoin became tradable and gradually gained market value. Everything changed. The spirit of altruism took a back seat as fear and greed crept in, slowly polluting the network’s consciousness.

Mt. Gox, Bitconnect, OneCoin—these became textbook cases where malicious actors extracted millions of Bitcoins from ordinary people filled with dreams and hope. We always think we were early participants in the game. We weren’t, brother.

In reality, we arrived too late—even later than those taxi drivers in remote corners, smiling broadly, who lost 10 Bitcoins to the Bitconnect scam. Those were the real early adopters. They believed in Bitcoin but never truly understood its significance.

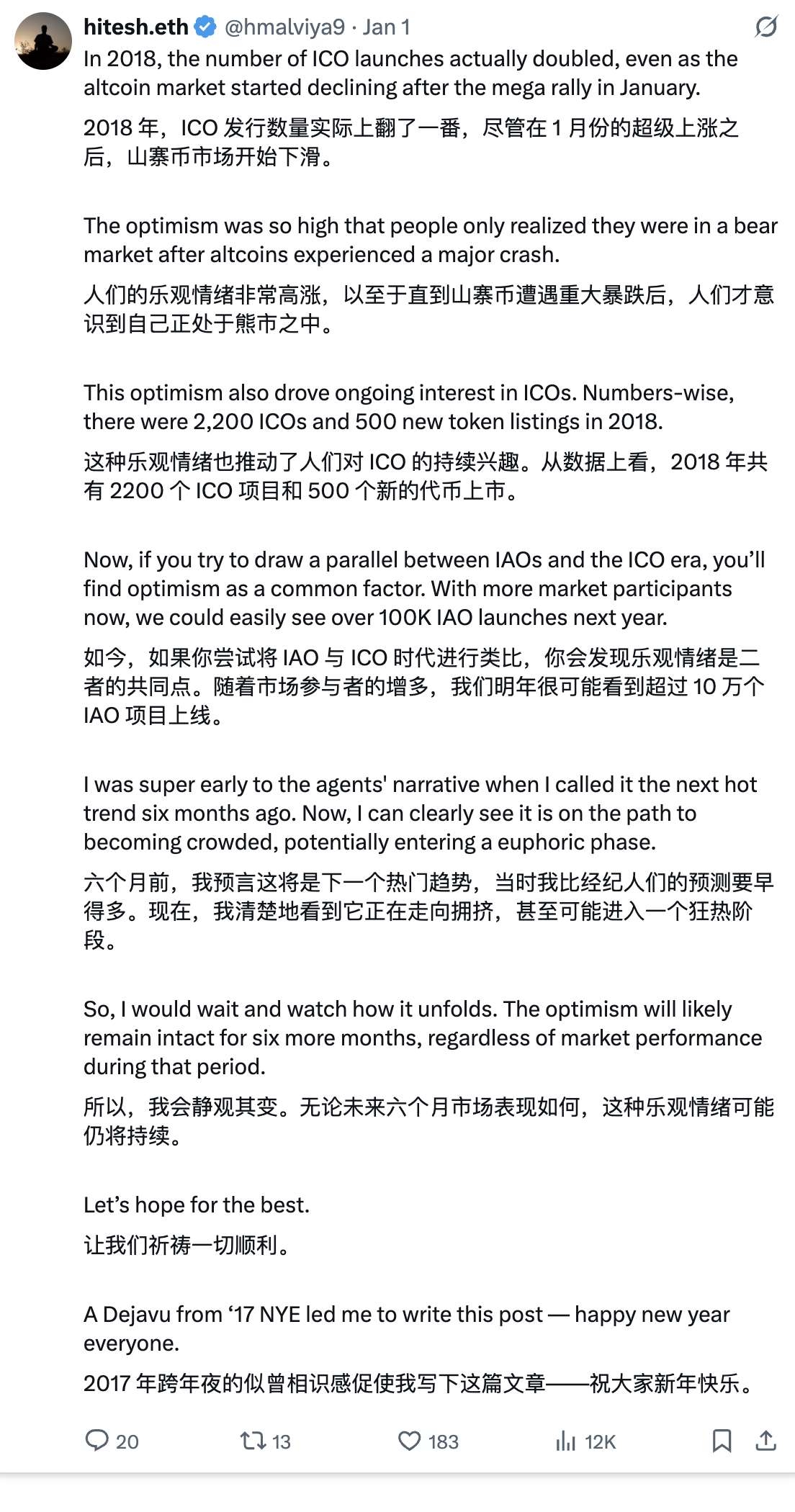

Perhaps everything changed once money became tied to cryptocurrency. Those who decided to build the crypto markets after 2012 adopted "profiting from information asymmetry" as their new agenda. They achieved massive success, especially in 2017, when hundreds of tokens traded on a few exchanges, fueling the rise of ICOs (Initial Coin Offerings). Within the next 12 months, over 500 tokens entered the market through ICOs. Projects raised billions of dollars. Yet most tokens never received proper listings, and nearly all ICO tokens eventually collapsed within three years.

But when these projects were hot, people believed they would change the world. They bought into the vision without realizing the infrastructure wasn’t ready. A few genuinely concerned voices kept warning others, but no one listened. All they saw were others making money and sharing success stories online—enough to convince them that crypto would transform their lives. They believed—and then they lost. And the bad actors won again. Some even successfully disguised themselves as "good guys," still operating at higher levels today.

The New Face of Crypto

Crypto tokens have become strings of promissory data with limited supply, controlled and distributed by project teams. These teams strategically release token supply into the market at calculated rates—partly creating artificial demand, then designing incentives to attract early participants, tying their identities and reputations to the tokens.

These incentives aren't just financial; they're psychological triggers designed to spark belief, tribalism, and FOMO (fear of missing out). The real product isn’t the token—it’s the illusion. The narratives built around these data strings are not only false but carefully engineered emotional manipulations. The target is always the "reactive mind"—the millions trapped in survival cycles, seeking meaning and craving belief.

Once you reach that mindset, you don’t need evidence—just a story, a symbol that feels like a "last chance." The human mind, conditioned for decades by scarcity, shame, or missed opportunities, clings tightly to these narratives. And the people behind these data strings know this perfectly. They’re not selling products—they’re selling hope—hope wrapped in numbers, trends, and community jargon. They exploit information asymmetry with surgical precision because hope is the easiest drug to sell and the hardest to quit.

What we’re seeing isn’t new—just faster. Wealth concentration has always relied on such asymmetry. A few know the rules of the game, while the majority cling to dreams. But in the world of tokens, belief spreads far faster than reflection. Victims don’t even have time to pause and think—because the next promise appears: shiny, trending, full of potential, just credible enough to feel like salvation.

The Truth of Extraction

We’ve reached a point where we feel cheated but can’t accept it. For newcomers, there’s still hope. But for veterans who’ve lived through two or three market cycles, the current market structure is incomprehensible. They simply can’t accept it. They can’t keep up with shifting narratives, track rapidly moving catalysts, or act quickly because they’re stuck in outdated notions of simpler markets.

But if you reflect deeply, markets were never truly "simple" or "complex"—it’s all about scale. In the past, an "extractor" targeted a hundred thousand users. Today, an extractor needs only a hundred.

Your chances of being extracted have skyrocketed. Even among extractors, competition exists—so they can’t focus on one thing too long without exposure. They constantly throw new narratives into the market, sparking excitement.

People oscillate between winning and losing—some stay, some leave—but extraction never stops. In fact, it keeps scaling. Even if you’re caught in the extraction cycle, there’s always a window to exit profitably—depending on your discipline, risk management, and lessons learned. The smart ones profit by exiting at the right time, while others become "exit liquidity." This cycle will continue because extractors know they’ve only scratched the surface of human greed.

As mainstream adoption grows, more people will be drawn in. And when that happens, governments will step in under the guise of regulation to "save" us—ultimately redirecting extracted wealth into their own hands through taxation.

Reflection

When you realize all this and begin reflecting, comparing it to crypto’s altruistic origins, you might find yourself shedding tears at what we’ve done to cryptocurrency.

It was once such a pure, liberating, and hopeful thing—showing us the possibility of alternative systems.

It was supposed to return power to us.

Now, we seem to have power—but it’s the power of loss.

We followed the ideal of altruism, yet handed over our peace of mind and money to the market, while some scammer hides in the corner, laughing at our foolishness.

Dreams turned into illusions, illusions turned into extraction—and this, perhaps, is the real story of cryptocurrency.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News