The Evolution of Crypto Awareness: The Double Helix of Speculation and Adoption

TechFlow Selected TechFlow Selected

The Evolution of Crypto Awareness: The Double Helix of Speculation and Adoption

This cycle will last longer than anyone expected.

Author: hitesh.eth

Translation: AididiaoJP, Foresight News

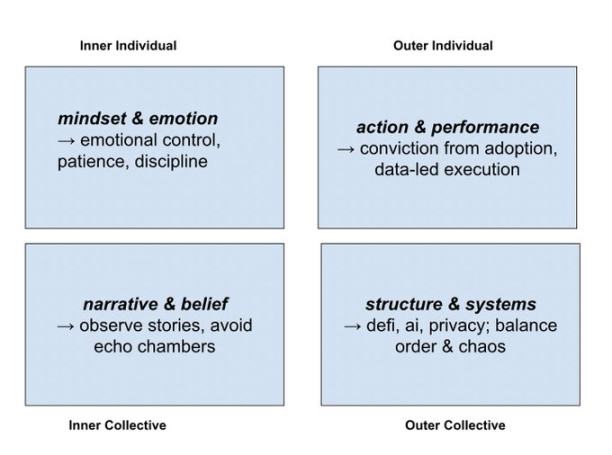

Integral theory is a method for understanding complex systems through multiple perspectives—inner and outer, individual and collective. It's about integration, not simplification, originally proposed by Ken Wilber.

Translator’s note: Integral theory specifically refers to the integrative framework developed by Ken Wilber. It is not an investment model, but a philosophical framework for understanding any complex system. Its core idea is that to truly understand anything, it must be examined from multiple, complete perspectives—not reduced or simplified into a single dimension.

Within the context of crypto, an integral perspective helps you see that markets are more than charts and numbers. They are living systems composed of emotions, actions, narratives, and structures. Every token, every narrative, every cycle passes through these four quadrants of consciousness: individual interior, exterior behavior, shared beliefs, and collective infrastructure.

The crypto world is a perfect case study for integral thinking. Here, human emotion meets machine logic, chaos meets order, individual greed meets collective collaboration.

An integral investor does not merely buy tokens or narratives. They observe all four levels of reality, integrating data with intuition, logic with feeling, order with anarchy. They understand that capital flows themselves reflect consciousness.

What follows is a framework for how an integral investor navigates a crypto supercycle.

The Four Quadrants of the Market

Upper Left (Interior Individual): Mindset and Emotion

Radical individuals have the lowest probability of success. The market over the next five years will favor those who maintain emotional clarity. The more desperate you are, the less likely you are to achieve meaningful results—even if you catch a bull run. Control your emotions. Act rationally. Confirmation bias is the real enemy.

You need patience and discipline—not for one pump, but for the entire cycle. You're not trading prices; you're trading your emotional state.

Upper Right (Exterior Individual): Action and Performance

You should build conviction based on actual use, not hype.

Make long-term investments that can survive the next decade, not those promising 10x returns in one month.

Follow adoption curves, study data, and understand fundamentals.

Learn how to identify speculative value, but recognize it as just the starting point—fundamentals are what guide exits.

Lower Left (Interior Collective): Narrative and Belief

Tokens are tokenized beliefs. Narratives are not just stories—they are collective consciousness encoding price. The public doesn’t care about fundamentals; they care about who tells the story. Algorithms amplify certain voices, creating echo chambers around them.

Your role as an integral investor is to step outside echo chambers, observe belief patterns, and treat them as inputs—not anchors.

Lower Right (Exterior Collective): Structure and System

The market itself is a superstructure of extraction and evolution. DeFi infrastructure scores 3 out of 10. Crypto capital velocity scores 5. Degree of extraction scores 4. This means we are still in early stages, still evolving.

New capital will continuously create opportunities. Authoritarian systems will shape DeFi, stablecoins, and RWA tokenization. Anarchic systems will shape prediction markets, perpetuals, and privacy. The ecosystem needs both.

Authoritarianism and Anarchy as Poles of Evolution

Crypto is evolving as a dual system: authoritarianism and anarchy.

Authoritarian systems represent order: structured, regulated, backed by capital allocators. These include DeFi infrastructure, blockchain infrastructure, and applications generating real cash flows. These projects create sustainable yields, attract institutions, and form the pillars of the next financial order. This side preserves capital and compounds slowly.

Anarchic systems represent chaos: permissionless, fast, emotional. Prediction markets, perpetuals, meme coins, privacy, and intelligent agents exist here. This side is highly volatile but spiritually pure. It represents innovation before consensus, freedom before control.

The integral investor rejects neither side.

They integrate both.

They allocate capital to order for longevity, and engage with chaos for learning, innovation, and liquidity.

The question is not “Which side will win?”

The question is “Can you evolve with both without losing yourself?”

Evolution Through the Spiral of Speculation and Adoption

Crypto evolves like consciousness—through a spiral.

Each phase brings new tools, narratives, and lessons.

Phase One: Speculation

Early projects emerge from collective hope. Their value comes from dreams and emotional attachment. Augur launched eight years before Polymarket. EtherDelta came before Uniswap. Crypto AI appeared before the world was ready—these are asymmetric bets. Engage them for exposure, not conviction.

Phase Two: Adoption

Speculation matures into fundamentals. Adoption becomes measurable. Appeal turns into trust. DeFi and blockchain infrastructure are now at this stage. Privacy and AI are next—this is where belief compounds.

Phase Three: Integration

Adoption and speculation merge. Fundamentals drive price, but narratives amplify it. The integral investor sees both. They hold conviction while respecting the pulse of collective emotion.

In this phase, you learn to time the spiral. You know altseason is a designed exit opportunity. You know whales always move first. You know retail follows dopamine. You know your duty is to stay detached, data-driven, and patient.

Cycles, Capital, and Collective Belief

We are still within a supercycle—of course, big cycles contain smaller ones. Top capital allocators and market makers control the rhythm. Retail still has dry powder; sidelined capital will return when macro conditions improve.

This cycle won't end until the divide between authoritarianism and anarchy becomes clear. That divide will mark the birth of the next financial order—regulated DeFi competing with banks, decentralized systems competing with states.

New capital will always create new stories.

Stablecoins, lending, Web3 super apps, prediction markets, privacy, decentralized AI—all are reiterating ideas from 2018, but now with infrastructure and regulatory support.

But not every project with adoption will see its token rise—belief determines that.

Belief builds price, but only adoption sustains it.

The integral investor studies both.

You track adoption through data, belief through culture.

You learn how algorithms shape perception.

You find where technology and narrative intersect.

That intersection is where outsized returns happen.

An Integral Framework for Navigating the Supercycle

Stage 1: Observe

Study adoption metrics and narrative shifts. Map the direction of capital rotation. Clarify your personal inclination: authoritarianism or anarchy.

Stage 2: Allocate

-

Anchor 60–70% of capital in long-term conviction plays: DeFi, AI, privacy, infrastructure.

-

Use 20–30% for asymmetric exploration: early hype projects, unproven tech, narrative seeds.

-

Keep 10% as a liquidity buffer for narrative shocks or macro disruptions.

Stage 3: Detach

Your greatest risk is emotional attachment. Exit when data indicates—don’t expect every token to pump, don’t assume sustained rallies lasting months. Selective exiting is a survival tool.

Stage 4: Integrate

-

Combine rational conviction with narrative intuition.

-

Use both left brain and right brain—logic and feeling.

-

Know when to let data lead, and when to sense collective emotion.

Stage 5: Evolve

Move from speculation to adoption, from reaction to observation, from fear to patience.

The goal isn't to predict the cycle—but to transcend it.

What the Integral View Reveals

DeFi infrastructure is still early.

Retail liquidity is gradually being harvested.

Capital velocity has room to expand.

Narratives are tools of manipulation—but also signals of cultural attention.

Privacy, AI, and DeFi form the trinity of the next decade.

Belief is the only advantage that can scale beyond noise.

The market reflects consciousness. It tests patience, self, greed, and awareness.

The integral investor sees the market as a mirror.

The better you know yourself, the clearer you see the cycle.

Final Reflection

Crypto is not just a game of capital—it is a field of consciousness.

It moves through chaos and order, speculation and adoption, emotion and logic.

The integral investor resides at the center, observing both sides, participating without attachment, integrating both states.

This cycle will last longer than anyone expects.

Those who remain aware, patient, and consistent will not only accumulate wealth—but also wisdom.

Stay grounded. Stay integral. Play the long game.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News