From AI to Labubu, from gold to cryptocurrency: why are global speculative bubbles everywhere?

TechFlow Selected TechFlow Selected

From AI to Labubu, from gold to cryptocurrency: why are global speculative bubbles everywhere?

Are we in a state of "irrational exuberance"?

By Brad Stone, Bloomberg

Translated by Saoirse, Foresight News

Two months before the stock market crash of "Black Monday" that triggered the Great Depression, Roger Babson, an economist from Massachusetts, expressed deep concern over the surge of retail investors borrowing money to buy stocks. In a speech, he declared: "A crash is coming, and it could be devastating." The market promptly fell 3%, a drop then dubbed the "Babson Break." But as Andrew Ross Sorkin writes in his compelling new book, *1929: The Story of the Wall Street Collapse That Destroyed a Nation*, in the following weeks, "the market shook off Babson’s dire prediction," partly due to optimistic expectations around new mass-market consumer goods like radios and automobiles, and "imaginative" investors regained the upper hand.

Today, many modern-day Babsons are warning of risks in artificial intelligence (AI), especially regarding valuations of public and private tech companies and their blind pursuit of artificial general intelligence (AGI)—systems capable of performing nearly all human tasks, even surpassing human abilities. Data from analytics firm Omdia shows that by 2030, tech companies will spend close to $1.6 trillion annually on data centers. The AI hype is immense, yet its potential as a profit-generating tool remains entirely hypothetical, leaving many clear-headed investors puzzled. Yet, much like a century ago, the fear of missing out on the next big thing drives many companies to ignore these doomsday warnings. Advait Arun, climate finance and energy infrastructure analyst at the Center for Public Enterprise, said: "These companies are playing Mad Libs, believing these bold technologies can solve all existing problems." His recent report, styled after Babson’s views and titled *Either a Bubble or Nothing*, questions the financing models behind data center projects and notes, "We are undoubtedly still in a phase of irrational exuberance."

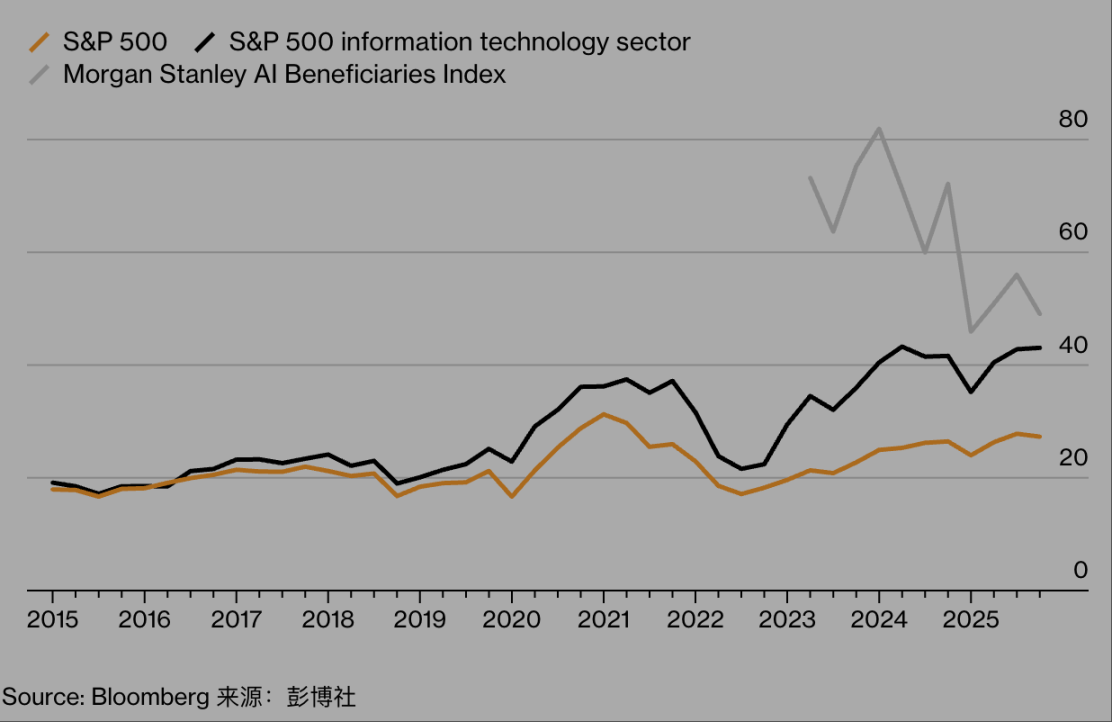

Tech stocks soar:

Source: Bloomberg

(This chart uses three indices—S&P 500, S&P 500 Information Technology sector, and Morgan Stanley AI Beneficiaries Index—to show how AI-related stocks in the U.S. market surged on hype between 2015 and 2025, then declined as the bubble cooled, diverging from broader market and traditional tech sector trends, reflecting speculative boom and bust risks in AI.)

Journals typically avoid arguing whether a resource or technology is overvalued. I don’t have a strong stance on whether we’re in an "AI bubble," but I suspect the question itself may be too narrow. If a speculative bubble is defined as "an unsustainable rise in asset value detached from identifiable fundamentals," then bubbles appear almost everywhere, and they seem to inflate and contract in sync.

Børge Brende, CEO of the World Economic Forum, points to possible bubbles in gold and government bonds. He recently noted that overall national debt levels have never been this severe since WWII; and as of December 12, gold prices had surged nearly 64% in one year. Many financial professionals believe private credit is also in a bubble. This $3 trillion market involves loans provided by large investment firms—many funding AI data center construction—operating outside the tightly regulated commercial banking system. Jeffrey Gundlach, founder and CEO of asset manager DoubleLine Capital, recently called this opaque, unregulated lending spree "junk loans" on Bloomberg’s *Odd Lots* podcast; JPMorgan CEO Jamie Dimon labeled it a "recipe for a financial crisis."

The most absurd phenomena occur in areas where intrinsic value is hard to assess. For example, from the start of the year to October 6, BTC’s total market cap rose by $636 billion, but by December 12, it had not only erased all gains but fallen further. According to crypto media company Blockworks, meme coins—digital currencies created to commemorate internet trends—peaked at $170 billion in trading volume in January, plummeting to $19 billion by September. Leading the decline were TRUMP and MELANIA—coins launched by the U.S. First Family two days before the presidential inauguration, which have lost 88% and 99% of their value, respectively, since January 19.

Many investors evaluate these cryptocurrencies not based on their potential to generate intrinsic value for shareholders and society (as one would assess a traditional earnings-reporting company), but purely on the chance to "get rich quickly." Their attitude toward crypto resembles stepping up to a craps table in Las Vegas—purely speculative.

There may be demographic reasons behind investors (especially those drawn to crypto, sports betting, and online prediction markets) trying to "game" financial markets like casinos. A recent Harris Poll survey found that today, 60% of Americans desire massive wealth; among Gen Z and Millennials, 70% say they want to become billionaires, compared to just 51% among Gen X and Baby Boomers. A 2023 study by financial firm Empower showed Gen Z defines "financial success" as requiring nearly $600,000 in annual income and $10 million in net worth.

Thanks to TikTok videos, group chats, Reddit, and the internet’s "immediate and inescapable" nature, people worldwide now learn about money-making opportunities simultaneously. In principle, this may seem harmless, but in practice, it triggers copycat waves, fierce competition, and "groupthink"—a phenomenon making Apple TV’s new series *Pluribus* feel especially timely. Traditional economics, with its complex dimensions, has been replaced by the attention economy: what everyone on Earth is collectively obsessed with at any given moment.

In business, that collective obsession is AI; in pop culture, after the "Pedro Pascal craze" came the "Sydney Sweeney craze," followed by the "6-7 craze" (if you don’t have a teenager at home, just Google it). Over the past year, thanks to celebrities like Lisa from the Korean pop group BLACKPINK, Pop Mart International Group, a Chinese toy maker, has seen global success with "cute but functionally useless animal plush toys"—let’s call it the "Labubble" (referring to the Labubu craze).

The food industry clearly has a "protein bubble": from popcorn makers to breakfast cereal producers, everyone touts "high protein content" to attract health-conscious consumers and users of GLP-1 drugs (a diabetes medication often used for weight loss). In media, Substack newsletters, celebrity-hosted podcasts (like Amy Poehler’s *SmartLess* or Meghan Markle’s *Archetypes*), and nearly weekly releases of authorized celebrity documentaries (Netflix’s latest include *Eddie Murphy: I Am What I Am* and a Victoria Beckham biopic) may also be in bubbles. W. David Marx, author of *Status and Culture: A Brief History of Everything*, said: "Today, everyone’s reference group is global, far beyond visible peers, transcending actual social class and status. In these markets, 'globally synchronized movements' impossible in the past may now emerge."

Of course, the stakes in AI are far higher than in Labubu-related products. No company wants to fall behind, so every industry giant is racing forward, building computing infrastructure through "complex financing arrangements." In some cases, this involves special-purpose vehicles (remember those from the 2008 financial crisis?)—debt-laden entities purchasing Nvidia graphics processing units (i.e., AI chips), which some observers believe may depreciate faster than expected.

Tech giants can afford the fallout from this FOMO-driven frenzy: they primarily fund data centers through strong balance sheets, and can weather the storm even if white-collar workers widely agree that "current versions of ChatGPT are sufficient for writing annual self-reviews." But other companies are taking riskier steps. Oracle—a traditionally conservative database provider unlikely to be an AI challenger—has raised $38 billion in debt to build data centers in Texas and Wisconsin.

Other so-called "new cloud providers" (such as younger firms CoreWeave and Fluidstack) are constructing specialized data centers for AI, Bitcoin mining, and similar uses, also taking on heavy debt. At this point, the cumulative impact of the AI bubble begins to look increasingly severe. Gil Luria, managing director at investment firm D.A. Davidson & Co., echoes Babson a century ago: "When institutions borrow billions to build data centers without even having real customers, that’s when I get worried. Lending to speculative investments has never been a wise move."

Carlota Perez, a British-Venezuelan researcher who has studied cycles of economic booms and busts for decades, shares these concerns. She warns that technological innovation is being turned into high-risk speculation within an "over-leveraged, fragile casino economy vulnerable to collapse once doubt spreads." In an email, she wrote: "If the AI and crypto bubbles burst, the resulting global crisis could be unimaginably large. Historically, truly productive golden ages only emerge when the financial sector pays for its own mistakes—not constantly bailed out—and society imposes sensible regulation." Until then, hold tight to your Labubu plush toy.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News