Has short-termism become unworkable in the crypto world?

TechFlow Selected TechFlow Selected

Has short-termism become unworkable in the crypto world?

Overall, those predatory and speculative projects appear to be gradually collapsing.

Author: washed

Translation: TechFlow

The Retreat of Short-Term Speculation?

First, let me clarify—this article is written from the perspective of someone who loves speculation. I'm an avid enthusiast of cryptocurrency and real-world gambling, as well as sports betting, crypto trading, and so on. These activities have been part of my life for as long as I can remember, and likely will continue in a more responsible way going forward. However, I’m not someone who lost everything in the past month, so this piece isn’t born out of resentment, but rather a sense of fatigue? Not fatigue from losing money, but from other factors.

Since 2020, it feels like we've been in a perpetual speculative bull market, with memecoins appearing as the perfect climax of this era. This form of speculation has arguably been one of the most profitable ways to make money, and one of the few methods that could radically change your life in a short period with relatively high success rates.

I think part of speculation's appeal lies in its rebellious nature—doing something typically looked down upon. Yet over the past few years, attitudes have flipped 180 degrees. What was once avoided has rapidly become ubiquitous. Today, we're essentially force-fed speculation, which naturally diminishes its appeal—it no longer feels like a choice, but rather an imposition.

Cryptocurrency / Stock Markets

While writing this, I came across a tweet by TJR that aligns perfectly with my view. I see short-cycle trading styles (in both stocks and crypto) as a quick-cash pursuit—a crude way of making money. Recent market volatility (one might call it "market critical hits") has opened many people’s eyes, and we’re beginning to see how these short-term games end. For over three years, we’ve been in an “extremely left-skewed” market (where even mindless actions yielded profits), and often “beginner” investors outperformed seasoned ones. But perhaps it’s time for truly skilled players to reclaim dominance? A return to models like Julian Petroulas’s? This trend may be grim for those not yet successful or whose capital size is too small to generate meaningful returns. Overall, though, I sense the market is moving in this direction.

Prediction markets also fit into this discussion, as they’re built on cryptographic infrastructure. Broadly speaking, I feel prediction markets are overhyped. That said, I do like Polymarket and care little for other overly marketed versions (e.g., certain unnamed projects). Betting via Polymarket may make more sense than using traditional sportsbooks.

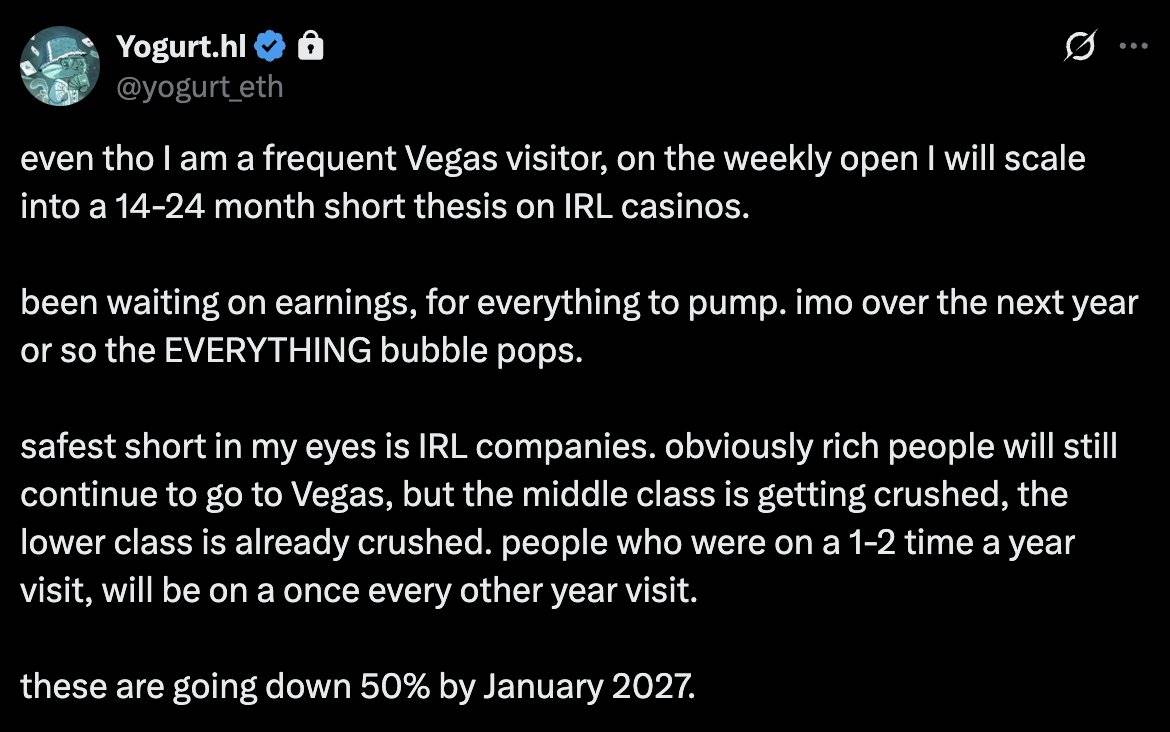

Traditional Speculation

A brilliant long-form post by Yogurt closely matches my thinking. I won't delve into physical casinos here, as he’s covered it better than I ever could. If you follow him, I highly recommend reading his piece.

As for online gambling, crypto casinos, and sports betting, they seem to have peaked for similar reasons. The prosperity of crypto casinos typically depends on the performance of the broader crypto market—when crypto does well, gamblers have extra cash to spend on recreational speculation. Currently, however, the overall state of the crypto market isn’t strong, so I expect that if we enter a bear market, crypto casinos will follow suit into decline.

In terms of attention, I don’t see how sports betting can meaningfully expand further or attract new users. They’ve already aggressively pushed sports betting into everyone’s lives through every possible channel—those who want to participate mostly already are. While current users remain engaged and will keep placing bets, I anticipate this trend will gradually fade. Users will either exit due to boredom or continue only with trivial, low-stakes wagers for entertainment.

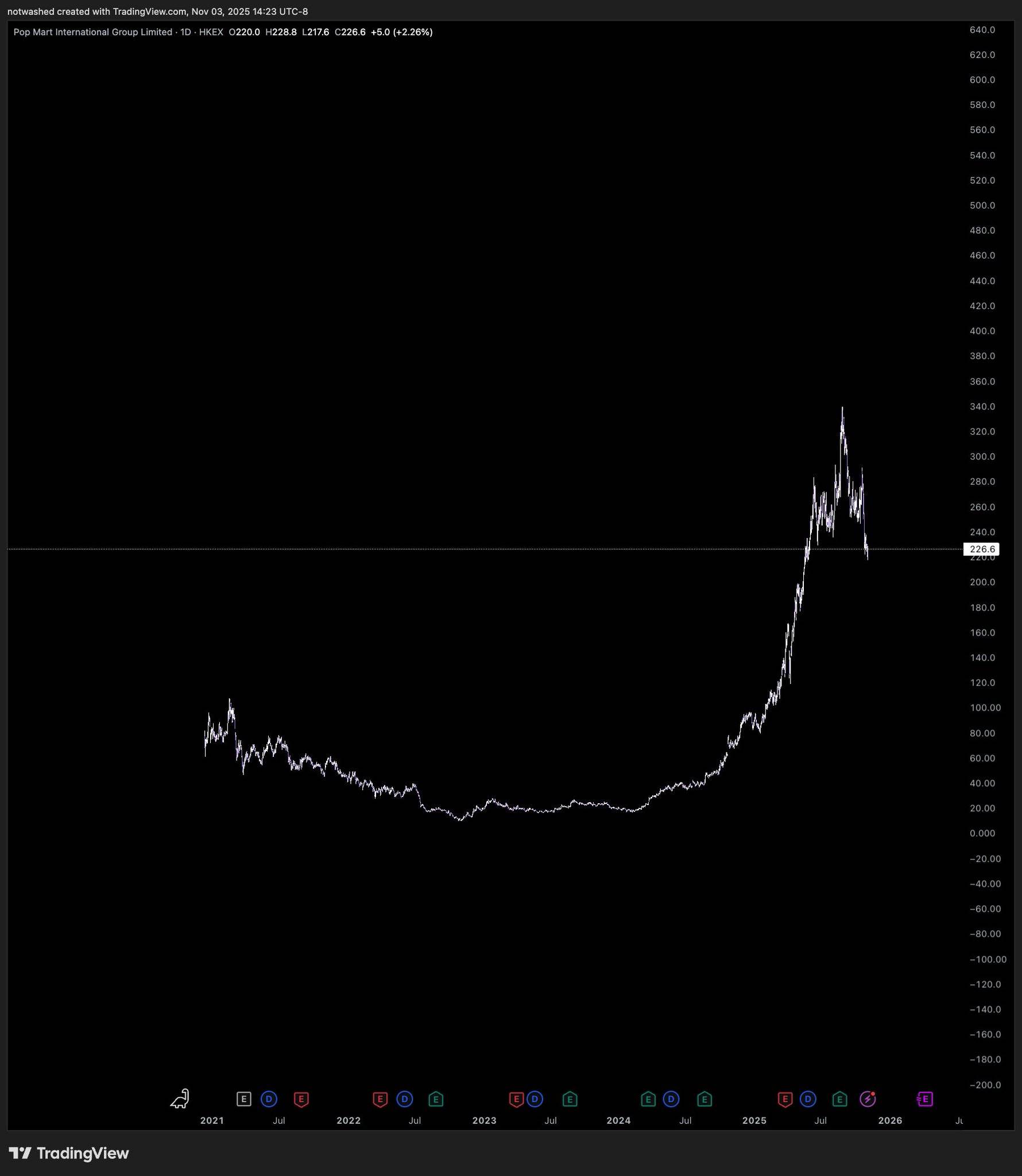

Stealth Speculation

I categorize collectible card games (TCGs), Labubus, and similar things as forms of stealth speculation—essentially speculative, yet less obvious, primarily targeting unsuspecting groups. This past summer, Labubu reached its “bubble peak,” but since then I’ve heard almost nothing about it. I don’t believe Pokémon has peaked yet, though it might reach a local high during the holiday season. Pokémon is a unicorn-level phenomenon, so I wouldn’t short it regardless. There may be new trends emerging in the coming years, as always, but overall, this space seems to have peaked alongside the retreat of Labubu.

Overall, predatory and overtly speculative projects appear to be gradually unraveling. This is actually an extension of a tweet I posted a few days ago. Though the headline is clickbaity, I have no intention of shorting anything mentioned—on the contrary, I’d prefer to shift focus toward long-term investments in the “good guys” who build interesting things, or strive to become one of them.

Legitimate products and teams like Hype, Robinhood, and Polymarket, I believe, will still emerge as big winners—and win cleanly at that. What truly sets these “good guys” apart is their clear intent, fundamentally different from projects designed solely to empty your wallet. While Robinhood faced heavy criticism during the GME episode, they now appear to have corrected their behavior. Hype can be seen as a blockchain-based version of Robinhood (though that analogy is broad). As for Polymarket, it seems to be challenging the “old money” of traditional sports betting.

On the other hand, I’m pessimistic about projects like Pump. They continuously launch new speculative products, lack sustainability, and ultimately exist only to drain your funds into their own pockets. Still, I’m an optimist—I believe consumer intelligence is usually underestimated by corporations. Over time, consumers will gradually move away from predatory and speculative products.

Perhaps my current stance is too ahead of the curve, so I’ll continue participating in speculation with smaller capital allocations. After all, it would be foolish to miss current opportunities simply because of my long-held market biases.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News