Welcome to the golden age of creating asset bubbles

TechFlow Selected TechFlow Selected

Welcome to the golden age of creating asset bubbles

A bigger fool meets stronger dopamine.

Author: Rasheed Saleuddin

Compiled by: TechFlow

A good speculative bubble at least leaves behind infrastructure.

But our bubbles leave only screenshots of price spikes, not even as much as a cheap tulip bulb (TechFlow note: the 17th-century Dutch tulip mania—even that early speculative bubble had actual tulip bulbs as its underlying asset). Hollow bubbles, nothing but air, beyond the reach of any regulator. And it's addictive.

All of this exists within a frenzied, influence-driven world of manic behavior, where these hyperactive self-promoters take pride in unsettling traditional investors with the worthless crypto assets they champion.

Yet, we seem willingly to let insiders capture risk-free gains every time, while latecomers are left on average with risky bets yielding no returns—just lottery-like odds.

When Headlines Become Investments

Marshall McLuhan once said: "The medium is the message." A shooting makes news, and within hours, crypto players who hire influencers launch a memecoin called RIPCharlieKirk. It’s one of over 10,000 scams bearing variations of "Charlie/Kirk." The coin started near zero on September 10, closed the day near $5 million, then fell to about 1/15th of its peak. This is today’s product: a screenshotable piece of code, no yield, no value—just a name and a JPEG.

Source: Pump.fun

Evan Rademaker, a trader from Florida, told Bloomberg he bought $30,000 worth of RIPCharlieKirk, sold out at a $17,000 loss, then chased higher prices again—losing more.

Originators and paid promoters light the fuse; market sentiment and social media do the rest. Most of these tokens are now near zero, many will vanish. Those barely surviving cling to "hopium" and sunk-cost fallacy, while early insiders have already cashed out.

Sometimes, "uselessness" is the entire point.

Useless Coin surged 40x in days and still holds a market cap near $320 million. It has no real utility—that’s exactly what defines a memecoin: a cryptocurrency token with no practical use case.

In truth, Useless Coin does have one function: enriching insiders.

Despite their fruit-fly lifespans, thousands of investors like Evan Rademaker remain ready to gamble again via Robinhood accounts or crypto wallets. Why?

Not All Bubbles Are Created Equal

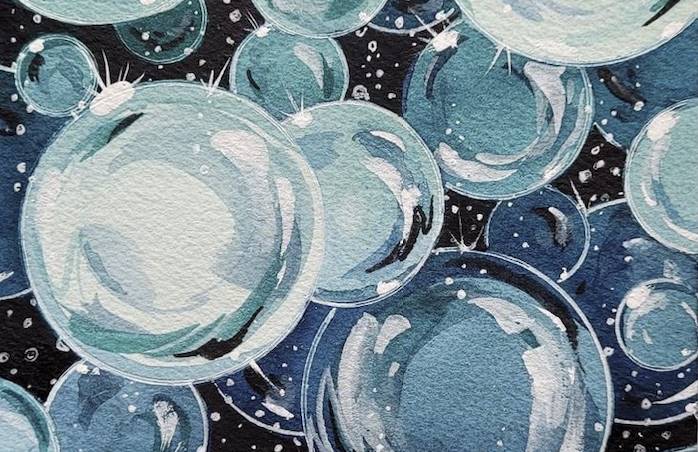

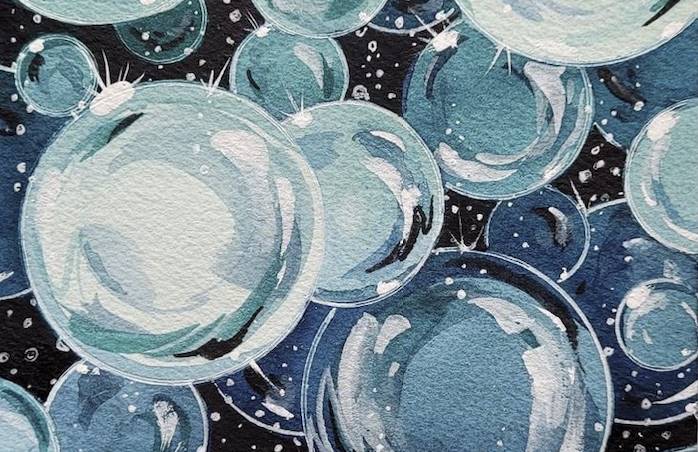

A soap bubble is filled with the air we breathe. But an asset price bubble means something entirely different.

We comfort ourselves with macroeconomic narratives: foolish money funds real things—canals, railways, power grids, transatlantic fiber, perhaps next, AI. The rocket boosters in bubbles are often genuine believers. Even failed rockets, like Global Crossing (TechFlow note: a former telecom giant that rose during the dot-com bubble and collapsed shortly after, becoming one of the largest corporate bankruptcies in U.S. history), can deliver a "slingshot effect" for society.

But recently, memecoins and memestocks have taken center stage. Bubbles filled with air, leaving nothing behind. No infrastructure. No intellectual property for other Silicon Valley garage startups to build upon. No future business to reorganize under Chapter 11. And financial firms holding just one asset you could buy yourself—and cheaper.

This is merely wealth transfer from outsiders to insiders. The asset itself is the joke; exiting is the business: freely minted for oneself and friends, then promoted and sold to ever-greater fools.

The supply of these wealth-destroying machines is easily explained—and always has been.

A Brief History of Stock Manipulation

History is a record of stock pumps and dumps.

-

From Howe Street on the Vancouver Stock Exchange (VSE), teeming with phone scam centers, to Stratton Oakmont in *The Wolf of Wall Street*.

-

To the spam email era, where “APPM TO A DOLLAR!!!” messages doubled or tripled a worthless stock before lunch, then halved it by afternoon.

-

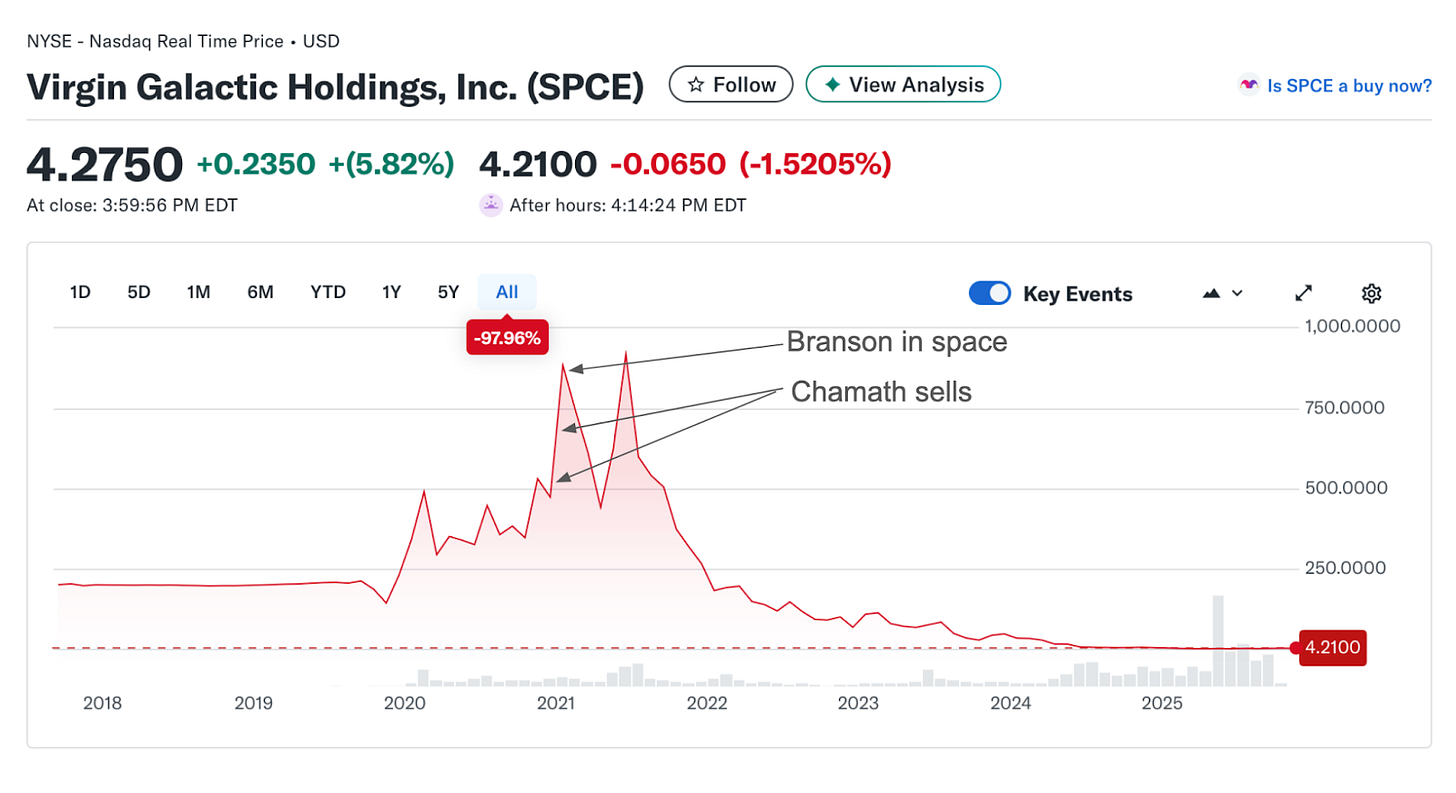

SPAC sponsors pocket eight-figure profits, making tens of millions while the stocks they promote fall over 99%. Virgin Galactic had its glory moment sending Richard Branson to space, setting dazzling records. Chamath walked away with $315 million. See how ordinary shareholders fared:

Source: Yahoo Finance

The difference between past and present bubbles is that past buyers were "suckers." They couldn’t see their ignorance, believing sincerely in the value of what they bought. Some went to jail, and retail investors collectively learned lessons—though only temporarily.

Now They’re Back—Where’s Chamath?

SPACs are back, now joined by Crypto Treasury Companies—sometimes both together, like Cantor Equity Partners, whose shares once traded at 25x intrinsic value, now back to fair levels, down 96% from highs. Meanwhile, Bitcoin—the main asset it holds—is at all-time highs.

Source: Yahoo Finance

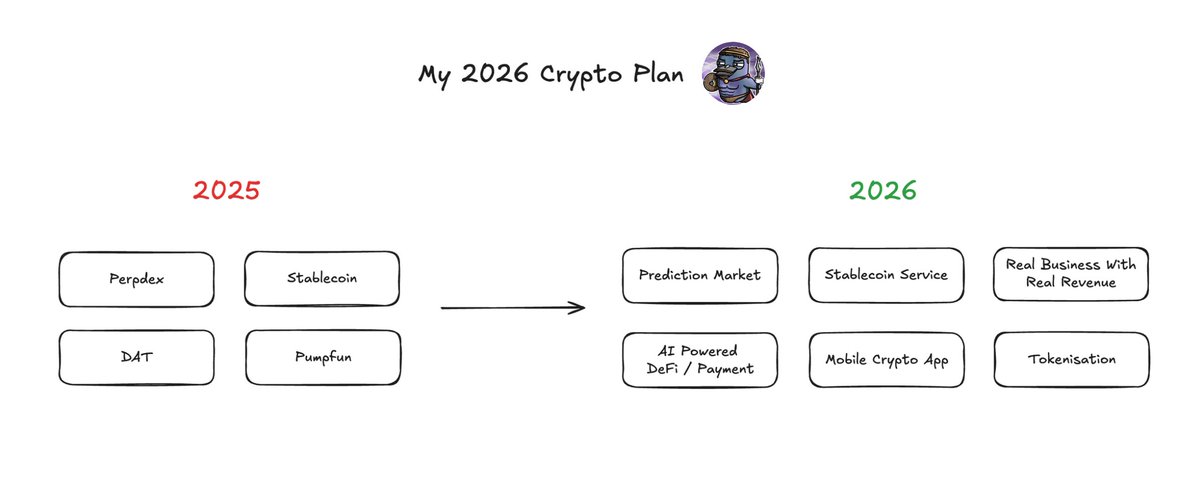

Same Meme, New Meme? Not Quite.

Memestocks are also returning. Entering "meme 2.0," even some old operators are back. Keith Gill, aka Roaring Kitty, returns three years after Memestock 1.0. But GameStop now has fundamentals to anchor prices, making overt manipulation harder.

So promoters adapted. Today’s “investments” are designed to be inherently worthless—eliminating debate over intrinsic value.

New crypto memecoins launch daily—sometimes 100, sometimes 1,000. Even the White House is involved. $TRUMP debuted below $1, surged past $40, then crashed back to earth. Insiders still made ~8x. The Trump family cashed out ~$350 million early. A "supercharged" version of SPACs and treasury firms.

Source: Coingecko.com

This story repeats endlessly across major crypto launch platforms. On Solana’s Pump.fun, Dune analytics show over 60% of wallets are losing money, only 0.4% profit over $10,000, and 81% of tokens are down over 90% from highs. In terms of wealth destruction, it surpasses SPACs—both in scale and proportion.

Industry ethics around launches are alarming. Solidus Labs found signs of fraud in 98.6% of Pump.fun launches and 93% of Raydium pools.

Yet scams like $TRUMP endure. So do MELANIA, and LIBRA, where 86% of traders lost $251 million total. DOGE, SHIB, and other billion-dollar memecoins remain active. We're in Dogecoin’s third surge, hitting a $40 billion market cap. Will the third time be lucky? $TRUMP still trades above $1.5 billion.

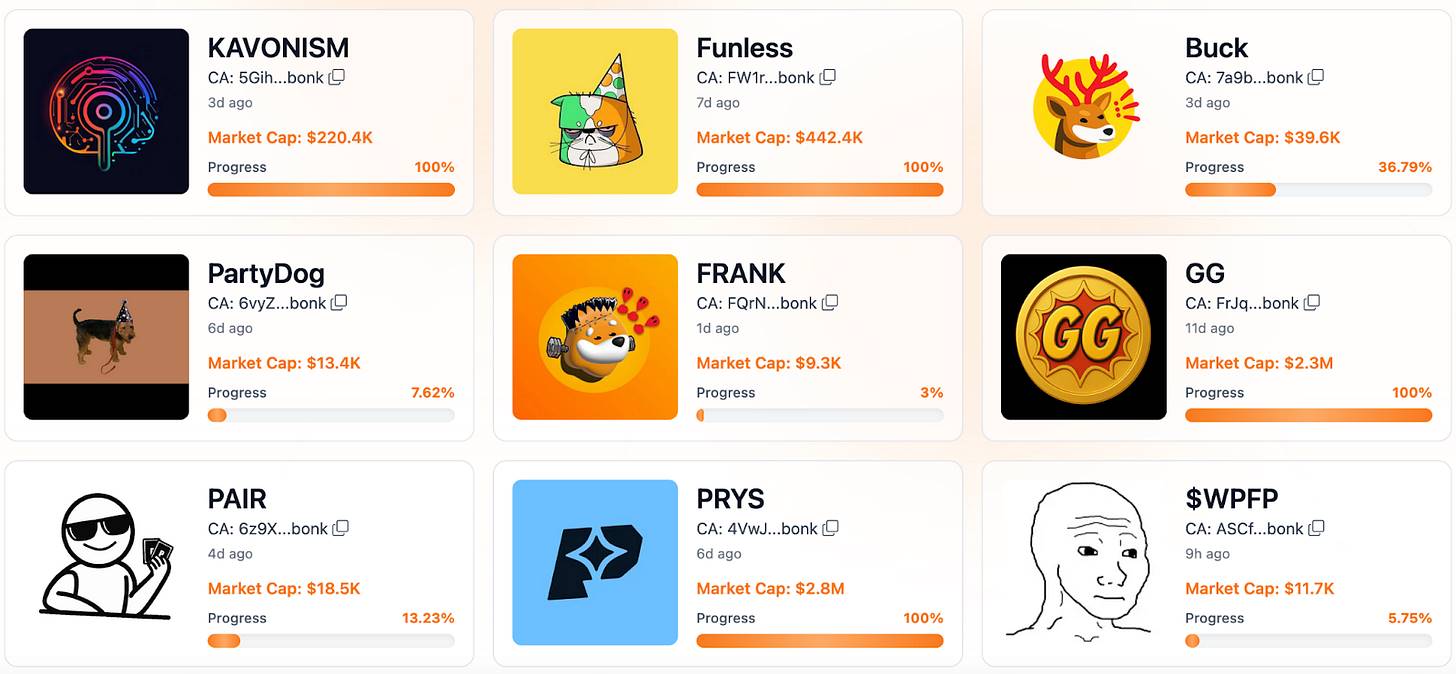

Many bubbles are small and short-lived, like the aforementioned fruit flies. Most tokens never cross $1 million in market cap. Here are recent examples, like Bonk.fun’s $FUNLESS, which promises investors about as much "fun" as $USELESS offers "use." Truly a textbook case of "advertising is the truth."

Source: Bonk.fun

Even small bubbles can be highly profitable. For instance, a student I advised quit consulting this summer to launch and "dump" a Solana memecoin.

Bigger Fools Meet Stronger Dopamine

Why buy from insiders during a pump? It’s not because everyone is deceived. Many buyers know full well these tokens lack real value, yet they participate for several reasons:

-

Momentum / Greater Fool Theory: Ride the uptrend, try to exit before the music stops. Sometimes it works.

-

Ignorance: Some truly believe the stories. Really?

-

But mostly gambling addiction:

-

Small stakes (unit bias toward tokens priced at $0.0000030);

-

Instant "returns" (lifespans as brief as fruit flies);

-

Lottery bias (20-to-1 odds occasionally paying 20x);

-

Addictive, gamified UX (zero commissions, one-click swaps, 24/7 dopamine hits);

-

Social identity and FOMO ("Someone in your group chat made life-changing money on $MELANIA—can you really sit out the next one?").

-

No Dump, No Pump

Yes, these small bubbles have "reasons" to exist. But given so many people lose so much money, why are they so widespread?

The key is our need for "the dump." Near-misses activate the same brain circuits as slot machines. Intermittent rewards keep pulling the lever. And there are always enough winners to refill the pond. When one opportunity vanishes, another replaces it. The dump fuels the next pump. If everyone profited (like with NVIDIA), there’d be no need for new gambling to say "let’s go again."

Like sports betting, you lose—and lose often. Sports bettors know this harsh reality; so do crypto memecoin players.

But there are always new tables, new coins, new codes. Society pays the price: dopamine debt and financial nihilism. If you need a home down payment, lottery bias seems rational: $1,000 in an index fund changes little over years; one 100x return might happen tomorrow.

Lack of Value Is a Feature, Not a Bug

Modern bubbles require buyers who knowingly trade air yet still participate. Real businesses have ceilings, gravity from cash flows. Memecoins don’t. If the only "fundamental" is the next buyer, then upside is limited only by influencer reach and joke half-life.

Insiders, market makers, and platforms always get first dibs. Late buyers aren’t fooled. This isn’t investing, nor about CAGR. It’s about a shot at 10x, or 100x. If it works, you’ve got a down payment. If not, another pump comes tomorrow.

Old Gamble, New Gamble

Casinos once had chips, drinks, and carpets. Today, the casino is in your phone, with flashy UI and social feeds. Expected returns haven’t improved, but delivery has changed. We replaced velvet ropes with push notifications (TechFlow note: traditional casino barriers marking entry into the gambling world, now replaced by digital access).

Casinos need ever more betting options. Wall Street insiders and crypto players excel at providing them.

We’ve turned financialized memes into meme-ified finance. Cryptocurrency, stocks, sports betting, even wagers on the next president—all are the same. Every minute, every day, there’s a bet to join. Fast results, chasing the next thrill.

This explains why on the same day Robinhood entered the S&P 500, Caesars Entertainment exited. That day, two ships passed in the night—Caesars valued at just $5.3 billion, Robinhood over $100 billion. Then on October 7, ICE, the world’s largest futures exchange, announced investment in Polymarket, a pioneer in sports betting and prediction markets.

The money is there. Because every day, every trade feels like shouting "Las Vegas"—and somehow "better."

Morality (If You Can Call It That)

Past bubbles mispriced projects but occasionally accidentally advanced the future. Today’s meme-driven, low-liquidity, options-fueled frenzy mainly misprices statements and builds exit ramps. They dramatically shift wealth, leaving behind highlight reels. Insiders start from zero and always make money. Just like SPACs. Like past boiler rooms and bucket shops—only now, it’s legal.

Outsiders are just playing whack-a-mole.

It sounds fine—until you realize it’s an addiction. It brings all the harms of other gambling forms, while revealing our failure in finance.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News