Growth and Innovation: Argentina's Crypto Moment

TechFlow Selected TechFlow Selected

Growth and Innovation: Argentina's Crypto Moment

In Argentina, cryptocurrency is a tangible reality.

Author: David Hoffman, Founding Partner at Bankless Ventures

Translation: TechFlow

Dear Bankless Nation, I spent all of August in Argentina attending the crypto event 'Aleph' in downtown Buenos Aires.

Aleph is an event that combines elements of both Zuzalu and Devconnect.

Protocol Labs provided significant support and coordination, bringing together hundreds of volunteers, community leaders, and ecosystem partners to foster an environment for the next generation of crypto startups in Argentina.

At the Aleph Hub—a 1,000-person co-working space—crypto startups, venture capitalists, and the Argentine government gathered for a month-long collaboration and exchange to promote mutual growth.

Although Aleph lasted only one month, the spark it ignited has the potential to spread across Argentina and throughout Latin America, creating a wave of growth known as 'Crecimiento.'

Why Argentina?

Argentina is a pioneer in cryptocurrency adoption.

While risk investors and crypto Twitter enthusiasts in developed countries are still debating use cases, mass adoption, and how to “bring in retail,” millions of people in Argentina have already adopted crypto out of urgent need for its value and services.

Argentina is an ideal place for developing a crypto economy. Affordable internet access, high inflation, capital controls, and friction in traditional commerce have collectively created an environment where cryptocurrency can thrive.

A recent tweet from Gwart made me chuckle—but ironically, in Argentina, millions of “9-to-5 working adults with monthly expenses and responsibilities” have already discovered that crypto is a way to live better.

Retail is coming. The 9-to-5 working adults with monthly bills and responsibilities—they’re about to join us trading digital goods. Be patient, retail is on the way.

The crypto economy in Argentina differs significantly from the assumed "use cases" and "trends" often discussed on crypto Twitter. In Argentina, locals don’t always have the luxury to speculate on the next hot alt-L1 or memecoin; their currency might devalue by 1% today and another 1% tomorrow.

Of course, Argentina has its share of crypto fanatics, but these activities pale in comparison to the millions of Argentines who aren't deeply involved in crypto. They may not care about the virtual world of crypto Twitter zealots, but they still use their preferred crypto apps (like Lemon, Belo, BuenBit, or Ripio) to fight inflation, buy coffee, and protect their wealth.

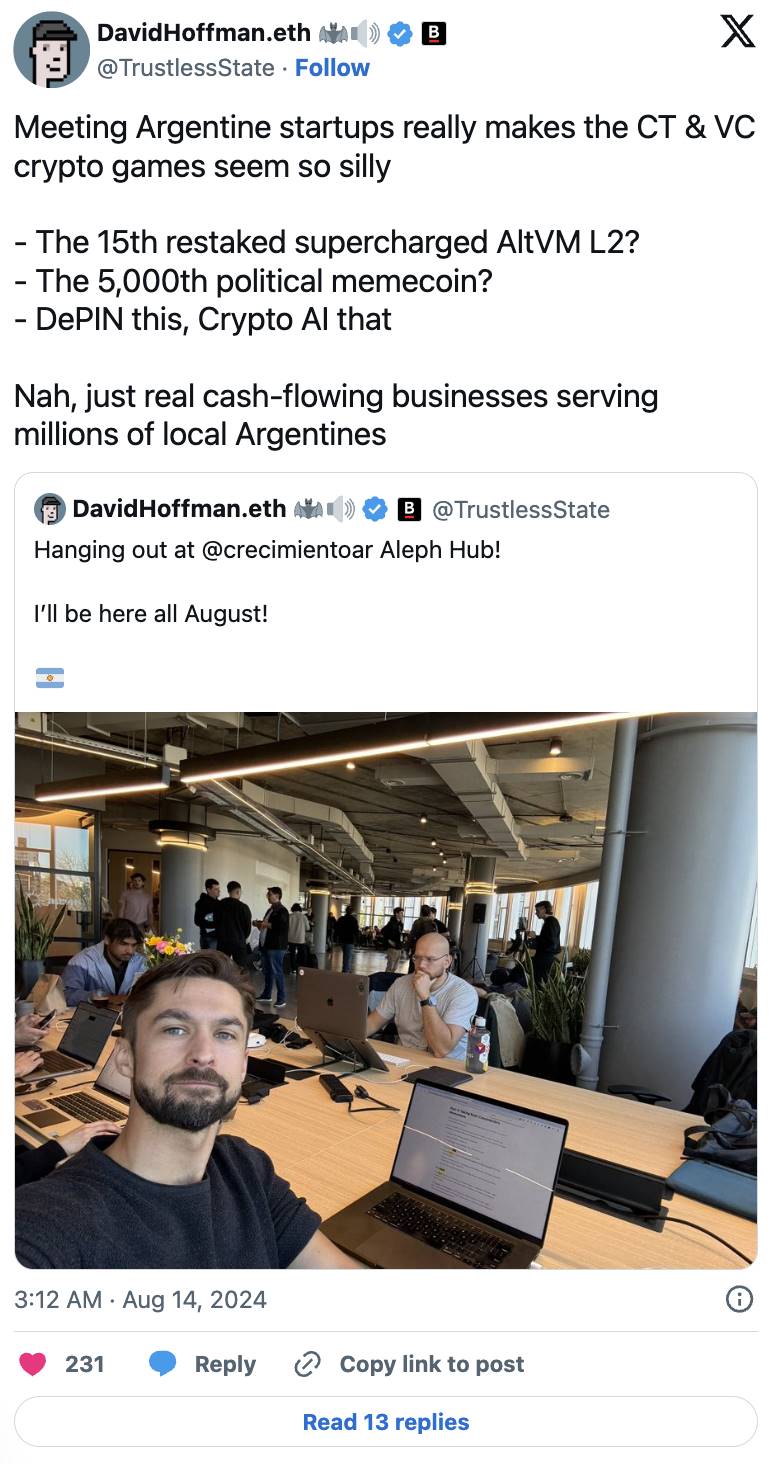

Talking to startups in Argentina really makes the game of crypto Twitter and venture capital seem absurd.

The 15th supercharged AltVM L2 with restaking?

The 5000th political memecoin?

This DePIN, that crypto AI

No—what’s here are real cash-flow businesses serving millions of local Argentines.

In Argentina, cryptocurrency is real.

Bottom-Up Power: Rebuilding 100 Startups

While El Salvador's government has been praised by Bitcoin enthusiasts for its pro-Bitcoin stance, its citizens are not enthusiastic about the government’s top-down Bitcoin investments.

In contrast, Argentinians show enthusiasm—or at least neutrality—toward cryptocurrency. While not every Argentine uses crypto, its use is widely accepted and culturally embedded. Ordinary Argentines either directly benefit from crypto through easier access to USD, payment services, and banking without banks, or know someone who does.

In Argentina, grassroots support for and acceptance of cryptocurrency is stronger than anywhere else in the world.

The core belief behind Crecimiento and the temporary city of Aleph is that Argentina needs only “100 great startups” to ignite nationwide economic growth and prosperity driven by cryptocurrency.

With approximately 100 more startups creating around 5,000 crypto-related jobs and embedding crypto value into Argentina, the country could become the first to reach crypto “escape velocity”—the world’s first fully crypto-driven nation.

At Aleph, 67 seed-to-Series A crypto startups shared a co-working space, collaborating to solve problems and supporting each other through growth. Twenty-two mentors—from venture capital firms, crypto teams, and successful entrepreneurs—dedicated their time, advice, and perspectives at this hub, passing their wisdom to the next generation of startups.

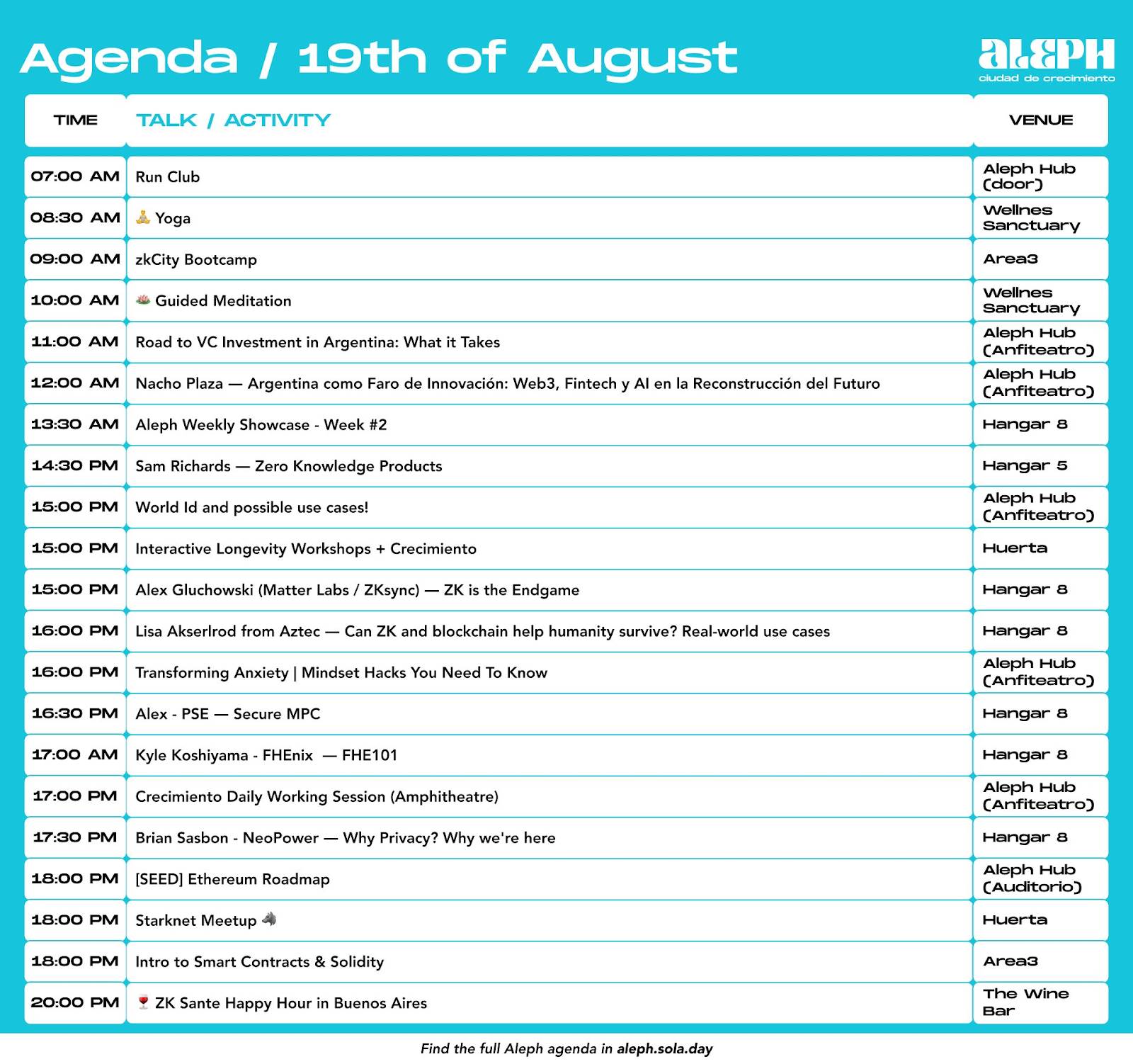

Every day brought renowned speakers and experts to interact face-to-face with startups at Aleph—from Seba Serrano (Ripio), Alec Oxenford (OLX), Nico Berman (Kaszek), to Marta Cruz (NXTP Ventures). University-level skill-building sessions in Web3 were held daily at the Aleph center, featuring workshops, lectures, and mentorship highlighting some of the most technically advanced areas in the industry.

Special thanks to ZKsync—builders and hackathon participants consistently praised the ZKsync team for their exceptional support at Aleph. Week three was “ZK Week,” during which the ZKsync LATAM developer relations team delivered outstanding educational content in both English and Spanish for builders on-site.

Top-Down: Milei’s Digital Transformation

Argentina is the only country in the world with a strong grassroots crypto industry and simultaneously a government that supports crypto from the top down.

This is exactly the potential that Crecimiento aims to unleash.

Argentina’s new leader, Javier Milei, has demonstrated deep interest in cryptocurrency in many ways. As the new government undertakes sweeping reforms, leaders in Argentina’s crypto sector see an opportunity to permanently integrate crypto into the country’s growth plans for the next decade and beyond.

Milei supports technology, investment, and rapid development. His cabinet even includes a “blockchain advisor,” Sergio Morales. Milei’s interest in Bitcoin and crypto is part of his broader economic philosophy, including pushing for dollarization (with stablecoins as an option) and reducing government intervention.

Milei has drafted regulations balancing crypto innovation with investor protection, collaborating with the crypto industry to provide clear regulatory guidance. His initial “mega decree” included eliminating legal tender laws, allowing contracts to be denominated in any currency.

These measures represent positive steps toward legitimizing crypto in Argentina, but more work remains.

The real challenge facing the crypto industry in Argentina is whether the country can establish a solid, supportive regulatory framework that provides long-term legal security for crypto entrepreneurs and ensures the legality and protection of crypto for decades to come. Can protective measures for crypto be enacted that survive changes in government? What happens if a new administration comes in and tries to roll back the progress made under Milei’s pro-crypto policies? This has happened repeatedly in other industries in Argentina.

Roberto Silva, dubbed the “Argentine Gary Gensler,” said at the @crecimientoar Regulatory Day:

“We fully support the formalization of crypto technology.”

“The SEC model claims crypto is non-compliant through lawsuits. We do not adopt that model.”

On August 22, Aleph hosted a “Regulatory Day,” where leaders from Milei’s government came to the Aleph Center for a full day of discussions and workshops focused on what crypto businesses and startups expect and need from the Milei administration.

It’s not just Milei—former presidents of Argentina have also visited the Aleph co-working space.

ZKsync’s ELI5 (Explain Like I’m 5) guide to zero-knowledge proofs is for everyone.

Whether you're the founder of @lemonapp_ar, the President of Argentina, or the Secretary of Innovation of Buenos Aires City.

It’s as surprising as Bill Clinton attending an ETH Denver hackathon.

Unlike in the United States, Argentina’s crypto industry receives high praise and encouragement from national officials.

Aleph: A Network State

Aleph is pioneering crypto-native technologies that have already been widely used by over 2,300 Aleph citizens.

QuarkID is an app incubated by the City of Buenos Aires that leverages verifiable credentials, decentralized identifiers, and zero-knowledge cryptography to create a self-sovereign identity system for all Aleph citizens.

After purchasing my Aleph ticket (citizenship), I received a verifiable credential that allows my iPhone to unlock the doors of the Aleph Center and access the co-working space. As a citizen of Aleph, I am entitled to a weekly allowance of 100 MORFI tokens.

MORFI is an ERC20 token running on ZKsync Era, redeemable for 1,000 Argentine pesos at local merchants accepting MORFI as payment—for food, coffee, or other services around the Aleph Center. 1,000 pesos is roughly equivalent to $1 USD (depending on when you read this). All of this runs on the ZKsync Era mainnet, showcasing a real prototype of a Balaji-style network state built on crypto technology.

You might wonder: “How did they get over 50 local merchants to accept crypto payments?” When you learn that fintech channels for receiving regular peso payments require 2–3 months to settle, it becomes clear why it wasn’t difficult… meaning merchants could lose a significant portion of value before receiving pesos.

Last month, Argentina experienced its lowest monthly inflation rate in five years—4%. Note: that’s 4% in one month, not per year. Do you think a 2.9% credit card fee is high? Imagine losing 10% in value simply because the banking system takes months to deliver funds to merchants. When Argentine merchants learned they could receive payments instantly, it became an easy sell.

Later this year, QuarkID will build its own independent Elastic Chain on ZK Stack and join the ZKsync Hyperchain. QuarkID plans to add more traditional services to its app, including driver’s licenses and other government-issued credentials, along with user-controlled wallets. It could effectively become Argentina’s L2.

For a deeper dive, check out my January interview with Diego Fernandez, Secretary of Innovation for Buenos Aires.

Conclusion

As Aleph concludes, foreigners, venture capitalists, and mentors must now leave. We all have homes to return to. The Aleph co-working space has a three-year lease and will remain open, continuing to serve as a shared hub for crypto startups. Support networks have been established, and numerous connections, friendships, and investments have already formed.

Will Aleph be the catalyst that propels Argentina’s crypto industry forward?

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News