Underground Argentina: Jewish underground banks, Chinese supermarkets, disillusioned youth, and the downwardly mobile middle class

TechFlow Selected TechFlow Selected

Underground Argentina: Jewish underground banks, Chinese supermarkets, disillusioned youth, and the downwardly mobile middle class

The underground world built by Jewish money lenders, Chinese supermarkets, and countless individuals "immune to inflation" possesses strong inertia and vitality.

By: Sleepy.txt

In Argentina, even the U.S. dollar has failed.

Pablo has a unique identity. Ten years ago, he was an employee dispatched by Huawei to Argentina, living in this South American country for two years; ten years later, he returned as a Web3 developer to attend the Devconnect conference.

This decade-spanning perspective made him a firsthand witness to a brutal economic experiment.

When he left back then, one U.S. dollar could only exchange for a dozen pesos; today, the black-market exchange rate has skyrocketed to 1:1400. According to basic commercial logic, this means that if you carry dollars, you should enjoy king-like purchasing power in this country.

Yet, this "dollar superiority" lasted only until his first lunch.

"I deliberately returned to the ordinary neighborhood where I used to live and found a small restaurant I often visited," Pablo recalled. "I ordered a bowl of noodles, and it cost the equivalent of 100 RMB."

This wasn't a wealthy tourist district but a local eatery full of everyday life. Dining here a decade ago cost about 50 RMB per person; now, in this nation labeled by global media as a "failed state," prices directly match those in Shanghai's CBD or Paris in Western Europe.

This is classic "stagflation." Although the peso has devalued over a hundredfold, prices of goods denominated in dollars have actually risen more than 50%.

When a country's credibility collapses completely, inflation acts like an indiscriminate flood—even if you're sitting on the seemingly solid boat of U.S. dollars, the water will still rise above your ankles. This country magically transferred the cost of currency collapse to everyone, including those holding hard currencies.

Many believe that amid such intense turmoil, people would panic and hoard U.S. dollars—or embrace cryptocurrency as tech enthusiasts predicted. But we were all wrong.

Here, young people neither save money nor buy property because their wages lose value the moment they're paid. Here, the true controllers of financial lifelines aren't central banks, but a shadow financial network woven by Jewish moneylenders from Once district and over 10,000 Chinese supermarkets across Argentina.

Welcome to underground Argentina.

Youth Have No Future

To understand Argentina's underground economy, one must first grasp the survival logic of a particular group: the "live-for-the-moment" youth.

If you walk Buenos Aires' streets at night, you'll experience a severe cognitive dissonance—the bars are bustling, tango halls echo with music through the night, and young people in restaurants still generously pay 10% tips. This doesn't resemble a crisis-ridden nation undergoing "shock therapy," but rather appears prosperous.

But this isn't a symbol of prosperity—it's a near-desperate "doomsday party." In the first half of 2024, the country's poverty rate surged to 52.9%; even after Milei pushed radical reforms, 31.6% remained below the poverty line in Q1 2025.

In Web3 circles' grand narratives, Argentina is often portrayed as a "crypto utopia." Outsiders imagine that in this currency-failed nation, young people immediately rush to buy USDT or Bitcoin upon receiving salaries to hedge risks.

But during his field visits, Pablo coldly burst this elite bubble.

"This is actually a misconception," Pablo bluntly stated. "Most young people are typical paycheck-to-paycheck spenders. After paying rent, utilities, and daily expenses, there's hardly anything left—no savings to exchange for dollars or stablecoins."

It's not that they don't want to hedge—they simply can't afford to.

What prevents savings isn't just poverty, but the "devaluation of labor."

From 2017 to 2023, real wages in Argentina dropped by 37%. Even though nominal wages rose slightly after Milei took office, private-sector workers still lost 14.7% in purchasing power over the past year.

What does this mean? It means Argentine youth work harder this year than last, yet receive fewer bread and milk in return. Under these conditions, "saving" becomes an absurd joke. Thus, a nearly rational "inflation immunity" spreads among this generation.

If no amount of effort can accumulate enough for a down payment, if saving always lags behind currency evaporation, then immediately converting rapidly depreciating pesos into present joy becomes the only economically rational choice.

A survey shows 42% of Argentinians constantly feel anxious, 40% deeply exhausted. Yet simultaneously, 88% admit using "emotional spending" to combat such anxiety.

This collective psychological contradiction perfectly mirrors the nation's century-long rollercoaster—using tango steps to resist future uncertainty, numbing inner helplessness with grilled meat and beer.

But this is merely the surface of underground Argentina. Where do the billions of pesos spent wildly by youth ultimately flow?

They don't disappear. Under Buenos Aires' cover of darkness, these cash flows move like underground rivers, eventually converging into the hands of two exceptional groups.

One is Argentina's largest "cash vacuum," the other the "underground central bank" controlling exchange rates.

Chinese Supermarkets and Jewish Moneylenders

If Argentina's central bank suddenly shut down tomorrow, the country's financial system might face brief chaos; but if 13,000 Chinese supermarkets closed simultaneously, Argentina's social operations could instantly collapse.

In Buenos Aires, the true financial heartbeat doesn't beat in grandiose bank buildings, but hides in street-corner cash registers and deep courtyards of Once district.

This is a secret alliance forged by two immigrant communities: Chinese supermarket owners and century-deep Jewish financiers.

In Argentina, nothing permeates urban fabric like capillaries more than "Supermercados Chinos (Chinese supermarkets)." By 2021, Chinese supermarkets exceeded 13,000, accounting for over 40% of national totals. They may not be as large as Carrefour, but their ubiquity prevails.

For Argentina's underground economy, these stores aren't just places selling milk and bread—they're essentially 24/7 "cash deposit hubs."

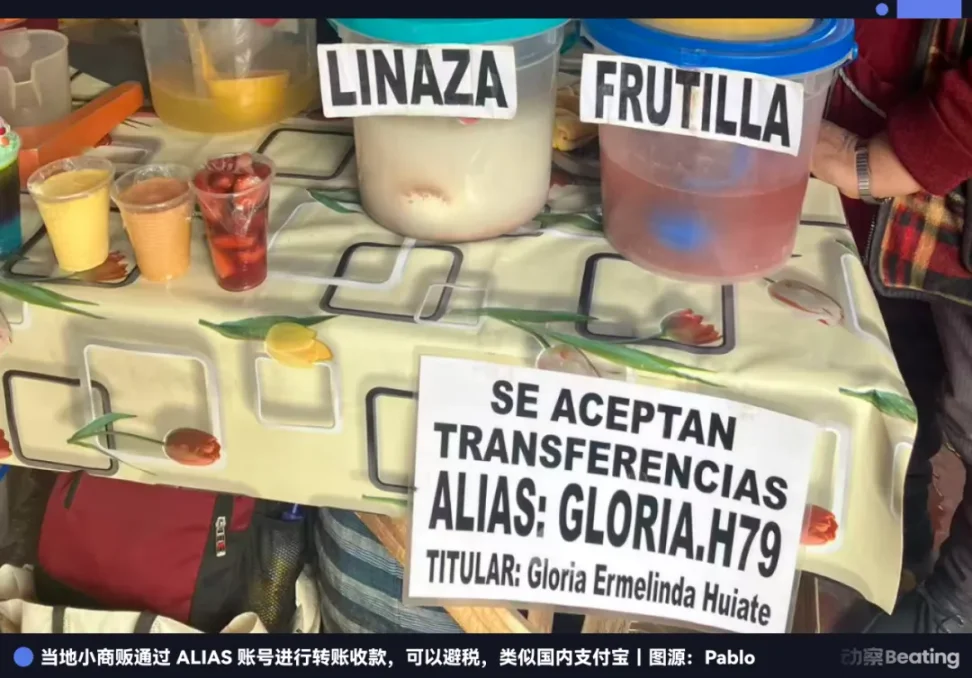

Most Chinese supermarkets encourage cash payments; some restaurants offer discounts for cash, while others post notices: "10–15% discount for cash payments."

This is primarily tax avoidance. With Argentina's consumption tax reaching 21%, merchants willingly sacrifice margins to keep massive revenues outside official financial systems.

"The tax bureau certainly knows, but hasn't cracked down strictly," Pablo said in an interview.

A 2011 report showed tens of thousands of Chinese supermarkets already generated annual sales of $5.98 billion. Today, decades later, this figure is undoubtedly larger. But here lies a fatal problem: pesos are "hot potatoes"—they depreciate every second under triple-digit annual inflation.

"Chinese merchants earn vast amounts of peso cash and need to convert to RMB to return home, so they seek various exchange methods," Pablo explained. "For Chinese tourists, the most convenient and favorable exchange channel is Chinese supermarkets or restaurants, since they urgently need RMB to hedge their peso holdings."

However, scattered tourists can't absorb such massive cash volumes. Chinese supermarkets require another outlet—and in Buenos Aires, only underground moneylenders represented by Once district's Jewish community have the capacity to handle such scale.

"Historically, Jews gathered in a wholesale district called Once. If you've seen films about Argentine Jews, some scenes are based on Once," Pablo introduced. "There are Jewish synagogues there—it's also the only place in Argentina where terrorist attacks occurred."

He referred to the AMIA bombing on July 18, 1994.

That day, a car bomb attacked the AMIA Jewish community center, killing 85 and injuring over 300—the darkest page in Argentina's history. Afterward, a massive wall rose outside the synagogue, inscribed with "peace" in multiple languages.

This disaster fundamentally changed the Jewish community's survival philosophy. From then on, the entire community became extremely closed and vigilant. These walls didn't just block bombs—they fostered an intensely inward-looking, highly united circle.

As times changed, Jewish merchants gradually exited physical wholesale, turning to their stronger domain—finance.

They operate underground moneylenders known as "Cueva (caves)," leveraging deep political and economic connections to build a fund-transfer network independent of official systems. Today, some have moved out of Once district, and people of other ethnicities—including Chinese—have entered the underground moneylending business.

Under Argentina's long-term foreign exchange controls, gaps between official and black-market rates once exceeded 100%. This meant anyone exchanging through official channels instantly lost half their asset value—forcing both enterprises and individuals to rely on the underground financial networks built by Jews.

Chinese supermarkets generate massive peso cash daily, urgently needing hard currency conversion; Jewish moneylenders hold dollar reserves and global transfer channels but require substantial peso cash to maintain high-interest loan cycles and exchange operations. Their needs perfectly align, creating a flawless commercial loop.

Thus, specialized armored vehicles (or several inconspicuous private cars) shuttle nightly between Chinese supermarkets and Once district. The cash flow from Chinese businesses provides continuous blood to Jewish financial networks, while Jewish dollar reserves offer Chinese wealth the sole escape route.

No cumbersome compliance checks, no bank queues—relying solely on cross-ethnic tacit understanding and trust, this system has operated efficiently for decades.

In eras when state machinery failed, this non-compliant underground system supported the most basic survival needs of countless families and merchants. Compared to the crumbling official peso, Chinese supermarkets and Jewish moneylenders were clearly more trustworthy.

Peer-to-Peer Tax Avoidance

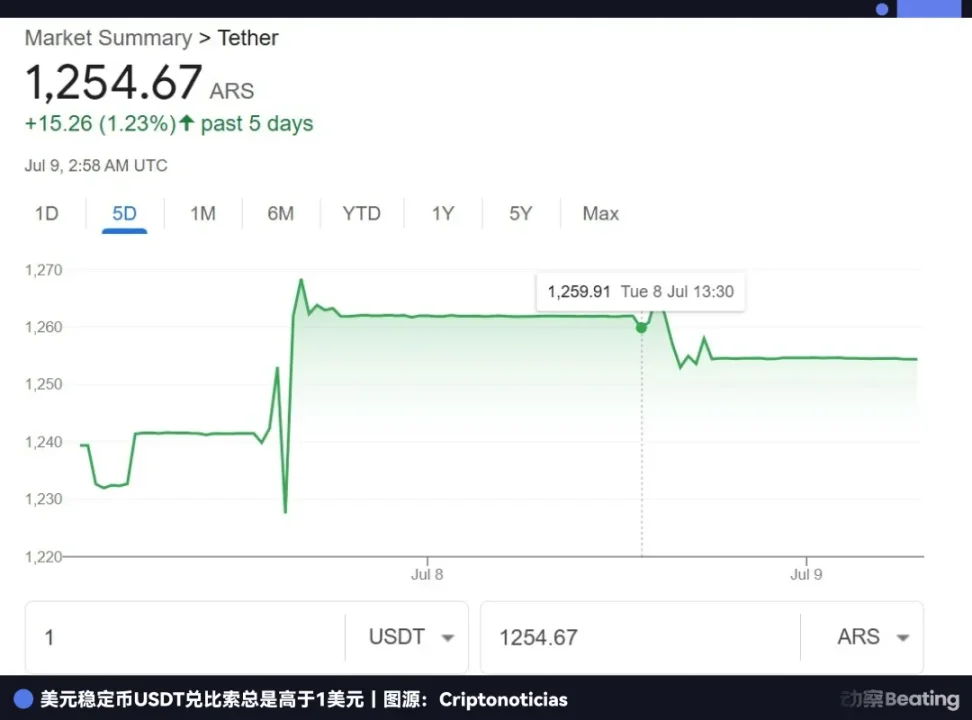

If Chinese supermarkets and Jewish moneylenders form the arteries of Argentina's underground economy, then cryptocurrency serves as its more secretive veins.

In recent years, the global Web3 community has spread a myth: Argentina is a cryptocurrency sanctuary. Data seems to support this—among its 46 million population, crypto ownership reaches 19.8%, ranking first in Latin America.

But when you dive deep into this land like Pablo, you find the truth behind the myth isn't glamorous. Few discuss decentralized ideals or care about blockchain technological innovation.

All enthusiasm ultimately points to one raw verb: escape.

"Outside crypto circles, ordinary Argentinians know little about crypto," Pablo said. For most Argentine users, this isn't a revolution about financial freedom—it's merely a self-defense battle for asset preservation. They don't care about Web3; they only care about one thing: Can USDT stop my money from shrinking?"

This explains why stablecoins account for 61.8% of Argentina's crypto trading volume. For freelancers, digital nomads, and affluent classes with overseas business, USDT functions as their digital dollar.

Compared to hiding dollars under mattresses or risking black-market exchanges, clicking a mouse to convert pesos into USDT appears far more elegant and secure.

But safety isn't the only consideration—the deeper motive lies in concealment.

For the underclass, their "cryptocurrency" is cash itself.

Why do Chinese supermarkets prefer cash? Because cash payments avoid invoices, directly saving 21% tax. For salaried workers earning only hundreds of dollars monthly, each crumpled peso note becomes their "tax haven." They don't need to understand blockchain—they only need to know cash payments save 15%.

For middle-class, freelancers, and digital nomads, stablecoins like USDT play the same role. Argentina's tax bureau can't track on-chain transfers. A local Web3 practitioner described crypto as a "digital Swiss bank." A programmer in Argentina taking overseas projects—if paid via banks—must not only convert at forced official rates but also pay high personal income tax. But receiving payments in USDT makes the money completely invisible.

This "peer-to-peer tax avoidance" logic permeates every class in Argentine society. Whether corner vendors' cash transactions or elites' USDT transfers, they're fundamentally expressions of distrust toward state credibility and efforts to protect private property. In a high-tax, low-welfare nation with constantly depreciating currency, every "gray transaction" represents resistance against institutionalized exploitation.

Pablo recommended a WebApp called Peanut—usable without download, offering exchange rates close to black-market levels and even supporting Chinese identification verification. This app is now rapidly growing within Argentina. Its popularity precisely proves the market's hunger for "escape routes."

Though tools are now accessible, this Noah's Ark still carries only two groups: the彻底 Underground (poor using cash, rich using Crypto) and digital nomads with overseas income.

When the poor use cash to avoid taxes and the rich use Crypto to transfer assets, who becomes the sole loser in this crisis?

The answer is heartbreaking: the law-abiding "honest people."

Compliance Kills the Honest

We usually believe having a taxed, compliant decent job is the ticket to middle-class status. But in a nation with dual exchange rates and runaway inflation, this "compliant ticket" becomes a heavy shackle.

Their dilemma stems from an unsolvable arithmetic problem: income pegged to official exchange rates, expenses pegged to black-market rates.

Suppose you're a multinational executive earning 1 million pesos monthly. On official records, at the 1:1000 official rate, your salary equals $1,000. But in reality, when buying milk at supermarkets or fueling at gas stations, all prices follow black-market rates (1:1400 or higher).

Immediately upon receiving your salary, your actual purchasing power is halved.

Worse, you lack "invisibility" privileges. You can't offer cash discounts like Chinese supermarket owners to evade taxes, nor receive payments in USDT like digital nomads to hide assets. Every cent of your income falls within the tax bureau's (AFIP) range—fully transparent, nowhere to hide.

Thus, a cruel sociological phenomenon emerges. From 2017 to 2023, Argentina saw an explosion of "new poor (Nuevos Pobres)."

They were originally respectable middle class—highly educated, living in good neighborhoods. But squeezed between rising living costs and depreciating incomes, they watched helplessly as they slid below the poverty line.

This is a society of "reverse selection." Those adept in the underground economy—Chinese supermarket owners, Jewish moneylenders, freelancers receiving USDT—master the codes for surviving ruins. Meanwhile, those trying to "work properly" within the official system become the ones paying for institutional costs.

Even the smartest among this group merely engage in "defensive" struggles.

Pablo mentioned Argentine middle-class "financial wisdom," such as using platforms like Mercado Pago offering 30–50% annual yields for current accounts.

Sounds impressive? But Pablo calculated: "Accounting for inflation and exchange rate erosion, such APY only allows pesos to maintain dollar value under stable exchange rates—but rates are often unstable, so overall returns still lag behind peso depreciation."

Besides, many savvy Argentinians, anticipating peso crashes, withdraw credit card cash without regard for fees, convert to USD, and arbitrage using inflation time gaps.

But these are merely "defense," not "offense." In a nation with collapsed monetary credibility, all finance and arbitrage aim merely to "not lose" or "lose less," rather than achieve real wealth growth.

Middle-class collapse is often silent.

They won't protest by burning tires like the underclass, nor emigrate like the rich. They quietly cancel weekend dinners, switch children from private schools, and anxiously calculate next month's bills late into every night.

They're the nation's most obedient taxpayers—and the most thoroughly harvested group.

The Nation's Gamble

Pablo's return to Argentina revealed a microcosm of change at a wall socket.

Previously, Argentina enforced an almost absurd trade protectionism—every electrical appliance had to meet "Argentine standards," forcibly removing the top of universal three-prong plugs, otherwise banned from sale. This wasn't just a plug issue—it symbolized mercantilist barriers, using administrative orders to force citizens to pay premium prices for inferior domestic products.

Now, Milei is dismantling this wall. This "madman" president, a believer in Austrian economics, wields a chainsaw in a world-shocking social experiment: cutting 30% of government spending, lifting multi-year foreign exchange controls.

The effects were immediate. Fiscal surplus emerged for the first time in years, inflation dropped from a frenzied 200% to around 30%, and the previously 100% gap between official and black-market rates narrowed to about 10%.

Yet, reform comes at excruciating pain.

With subsidies cut and exchange rates freed, the aforementioned new poor and paycheck-to-paycheck youth bore the first wave of impact. Surprisingly, despite hardships, most people Pablo encountered still supported Milei.

Argentina's history is a cycle of periodic collapse and reconstruction. From 1860 to 1930, it was one of the world's wealthiest nations; afterward, it fell into prolonged decline, swinging repeatedly between growth and crisis.

In 2015, Macri lifted foreign exchange controls attempting liberalization reforms, ultimately failing and leading to reimposition of controls in 2019. Will Milei's reform break this cycle, or bring deeper despair after another fleeting hope?

Nobody knows. But one thing is certain—the underground world built by Jewish moneylenders, Chinese supermarkets, and countless "inflation-immune" individuals possesses strong inertia and vitality. It provides shelter when official order collapses, chooses dormancy and adaptation when official order rebuilds.

At the end, let's return to Pablo's lunch.

"At first, I thought prices were so high that servers must earn well, so I gave only 5% tip. Later, friends corrected me—I should still give 10%," Pablo recalled.

In a nation with skyrocketing prices and collapsed currency, people still maintain tipping habits, still dance in tango halls, still chat and laugh in cafes. This savage resilience is the country's true essence.

For a century, the Pink House in Buenos Aires has seen master after master, pesos invalidated again and again. But ordinary people, relying on underground trades and gray-area wisdom, stubbornly carved paths out of dead ends.

As long as the nation's desire for "stability" remains less than its yearning for "freedom"; as long as public trust in government stays lower than trust in the corner Chino store—underground Argentina will forever exist.

Welcome to underground Argentina.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News