Polygon zkEVM Explained: A Rollup Technology Guide, Token Economics, and Ecosystem

TechFlow Selected TechFlow Selected

Polygon zkEVM Explained: A Rollup Technology Guide, Token Economics, and Ecosystem

Although there are risks and competition, Polygon has proven its strength and capabilities in ecosystem development, fundraising, and team building.

Written by: Louround

Compiled by: TechFlow

In July 2022, Polygon Labs, zkSync, and Scroll began a race for the best zkEVM. The Polygon zkEVM mainnet will launch on March 27. The author, together with ChaosDAO, has written the most comprehensive guide on Polygon, which could become the biggest narrative in the next bull market.

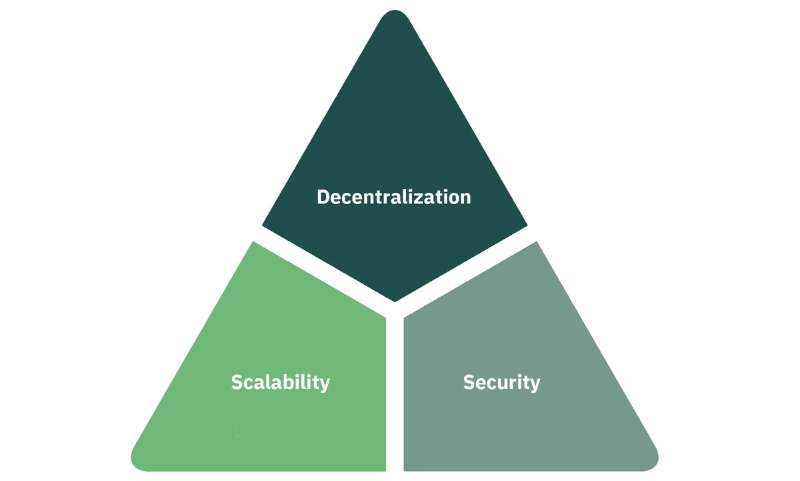

Ethereum's scalability issues led to the rise of alternative Layer 1 chains that sacrificed decentralization and security for scalability.

This trade-off stems from the popularized concept of the blockchain trilemma—balancing decentralization, security, and scalability.

The concept suggests that a blockchain cannot simultaneously maximize scalability, security, and decentralization.

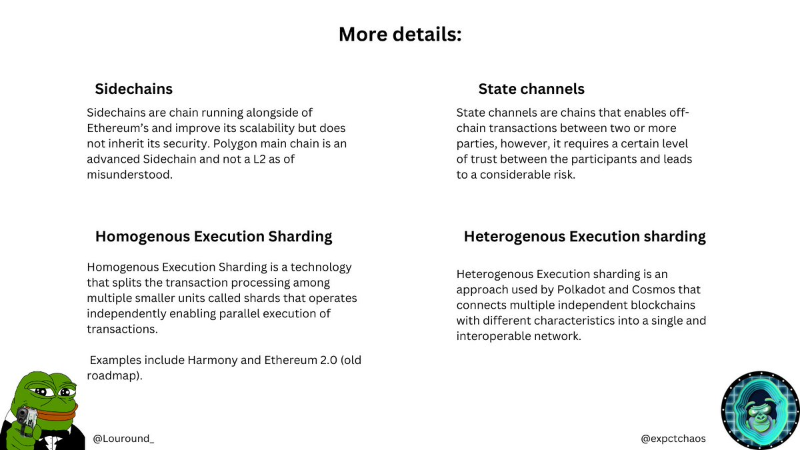

To solve this trilemma, developers within and outside the Ethereum ecosystem have built various scalability solutions—from Layer 2 solutions (like sidechains or state channels) to new Layer 1 architectures (such as homogeneous or heterogeneous execution sharding).

However, all these solutions come with their own drawbacks.

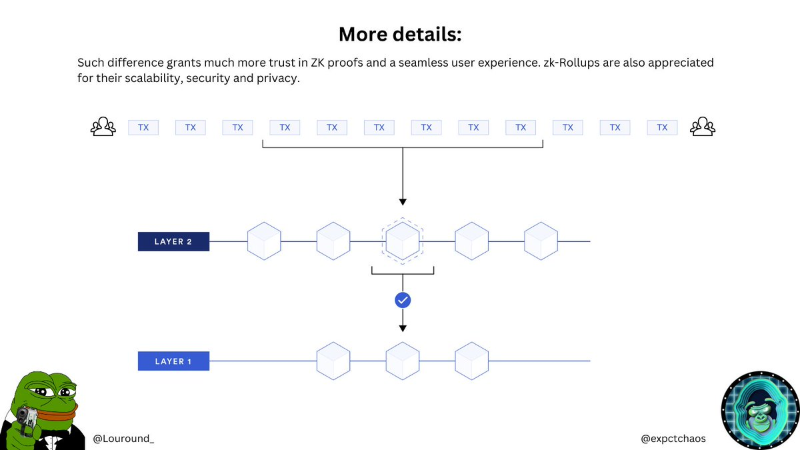

Rollup scaling technology aims to overcome these limitations by achieving extremely high scalability on a separate off-chain execution layer while inheriting security guarantees from Layer 1 as the settlement and data availability layer.

Rollups process transactions off-chain and bundle them into large batches (rolled up).

After transactions are processed on Layer 2, only the resulting state changes—or in the case of zk-rollups, validity proofs of the batch—are published (and verified) on Ethereum Layer 1.

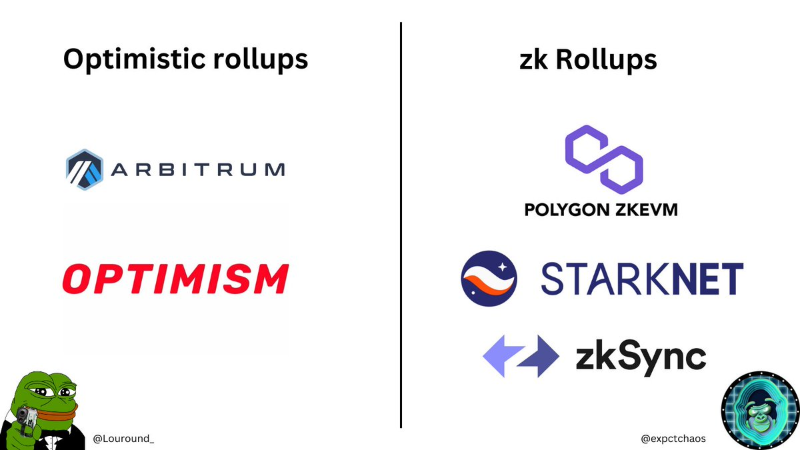

There are two types of rollups:

• Optimistic-based, relying on validators to initiate fraud proofs if invalid data is submitted to Layer 1.

• Zero-Knowledge-based, using zk-proof systems to ensure verifiability of transactions and state changes on Layer 1.

zk-rollups adopt a “trustless, verification-first” approach, relying on mathematically verifiable proofs rather than fraud proof mechanisms.

Additionally, the general mechanism of batching transactions and submitting aggregated, compressed data off-chain to Layer 1 is similar across both types.

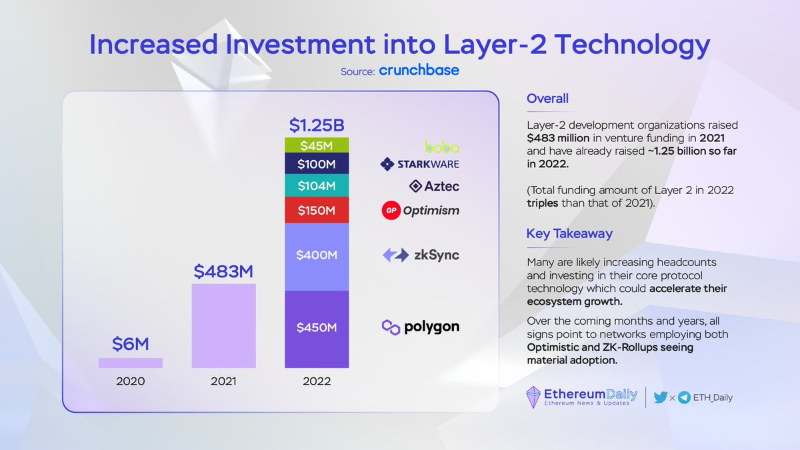

Anticipating the potential of this technology, Polygon invested $1 billion into developing this complex tech, first acquiring the Mir protocol for $400 million (now Polygon Zero) and then the Hermez protocol for $250 million (now Polygon Hermez).

With such internal capabilities, they decided to build Polygon zkEVM.

For many zk-rollups, the ultimate goal is to achieve equivalence with the Ethereum Virtual Machine (EVM). EVM equivalence means full bytecode-level compatibility.

This differs from mere compatibility, which often requires developers to modify or even re-implement certain lower-level code.

When a development environment achieves EVM equivalence, it offers a major advantage for developers—essentially any smart contract or development tool from Ethereum can be used on an equivalent EVM network.

It also simplifies migration for ETH-based decentralized applications (dApps) and makes interoperability easier with other EVM dApps on Layer 1 or other zkEVMs.

Moreover, EVM equivalence (including Solidity and support for Ethereum developer tools) allows rollups to tap into the largest pool of developers and liquidity in Web3.

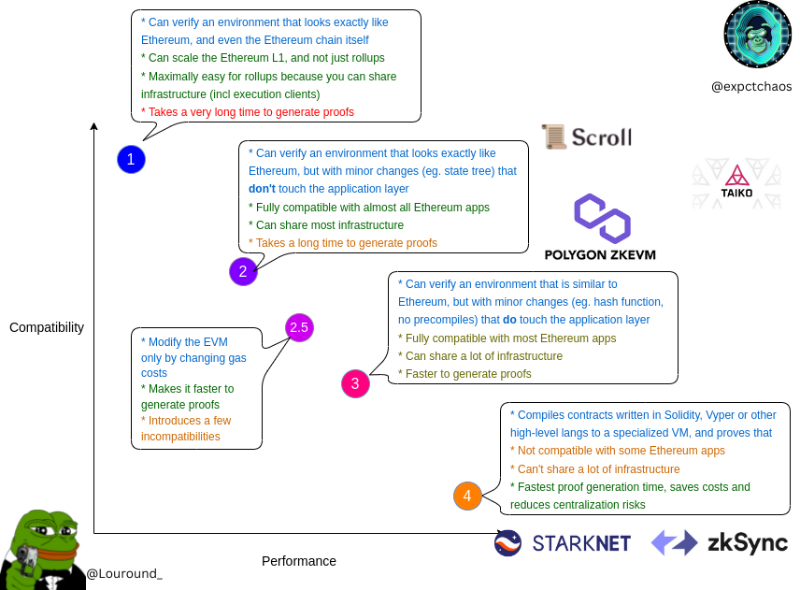

Vitalik Buterin outlined four different types of zkEVM rollups, ranging from Type 1—which benefits from full ETH equivalence but suffers in performance—to Type 4, which is the opposite.

zkEVMs are currently being built at Type 2 equivalence, aiming to reach Type 1.

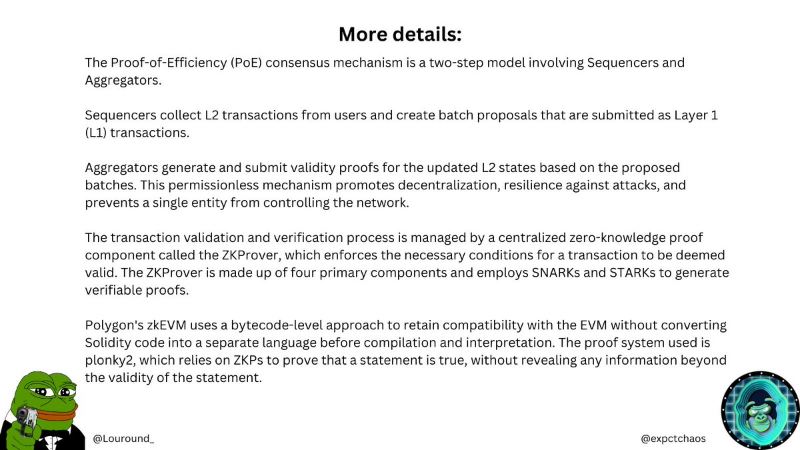

Beyond adopting bytecode-level EVM compatibility, Polygon zkEVM stands out among its competitors by implementing a novel consensus mechanism called Proof of Efficiency (PoE), which enhances decentralization and increases network security.

Additionally, Polygon’s zkEVM uses one of the most advanced zk-proof systems available.

Plonky2 is a recursive zk-proof system that combines the strengths of STARK and SNARK proofs, likely making it the cheapest and most efficient proving system on Ethereum.

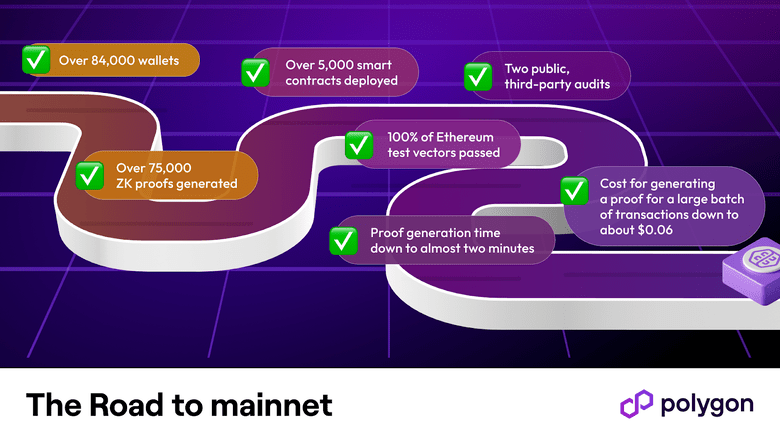

After reaching key milestones, the Polygon team and developers decided on a full launch on March 27—earlier than all their competitors.

(The only missing metric is transactions per second (TPS), though we can assume a minimum of 2k TPS.)

The chain has attracted over $1 billion in total value locked (TVL), along with $8.3 billion in total cross-chain transferred value (60% of which is in $MATIC).

This distinction is important because DefiLlama’s TVL metric only includes value locked in protocols, not assets held in wallets (an important consideration).

Financial Metrics

Polygon was the highest-earning chain over the past year, generating over $26 million in revenue, compared to $19 million for Arbitrum and $18 million for Optimism.

However, net income (cost minus revenue) averaged around -$300 million annually, primarily due to token incentive programs, according to Token Terminal data.

This still amounts to less than 15% of Polygon’s $2.4 billion treasury.

Tokenomics

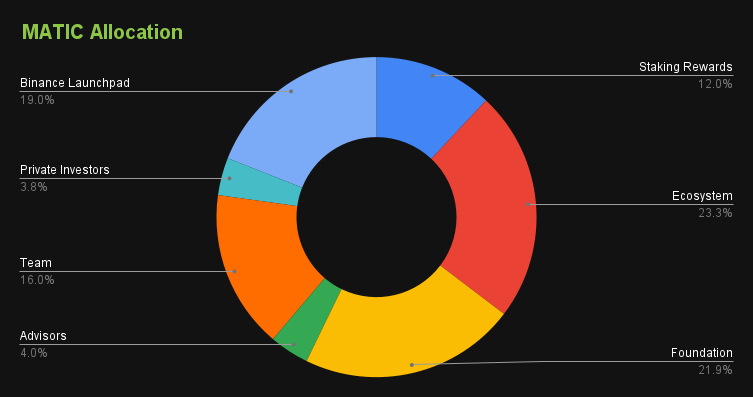

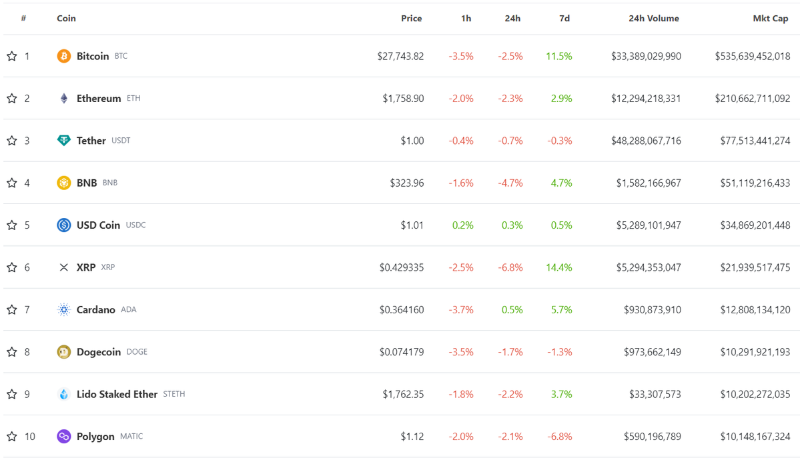

Polygon’s native token is $MATIC, with a supply of 10 billion tokens, currently priced at $1.12 (down 60% from its all-time high). The token is used for governance, paying transaction fees on the PoS chain (though fees on zkEVM will be settled in $ETH), and staking to secure and validate the network.

Supply has been distributed among various stakeholders and is now nearly fully circulating (90%), although staking rewards have not yet been unlocked.

Interestingly, Binance Launchpad investors have already seen a 458x return on investment, peaking at 1100x during the all-time high.

Ecosystem

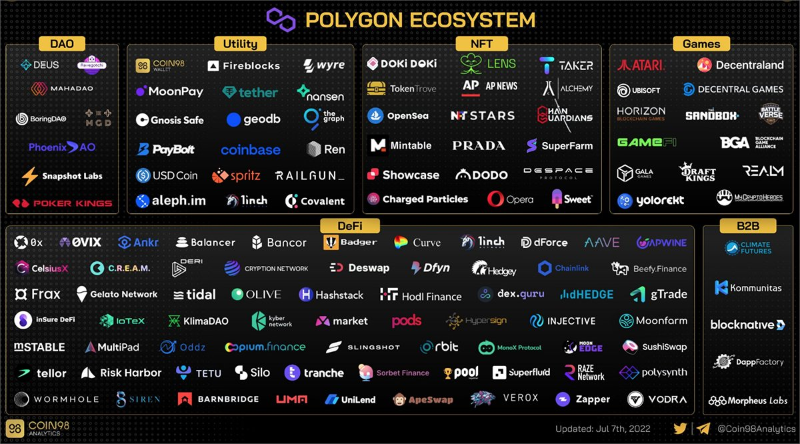

Despite not having the highest TVL, Polygon hosts one of the largest ecosystems with over 7,000 active dApps.

Compared to its competitors, the team has focused on expanding its ecosystem beyond DeFi, particularly into NFTs and GameFi.

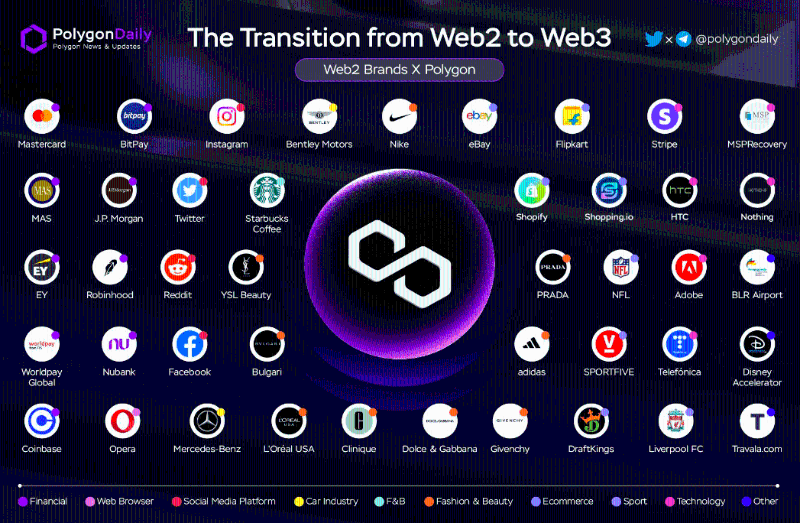

As a result, Polygon has attracted more Web2 companies into its ecosystem than any other chain over the past few years (primarily in GameFi and NFTs)—a crucial step for the industry, making Polygon the go-to platform for Web2 companies.

Communication

The crypto industry remains immature and irrational, which is why having the best technology is not necessarily one of the most critical success factors for blockchains (e.g., top 15 by market cap).

Hype, marketing, and brand awareness are just as important as the underlying technology.

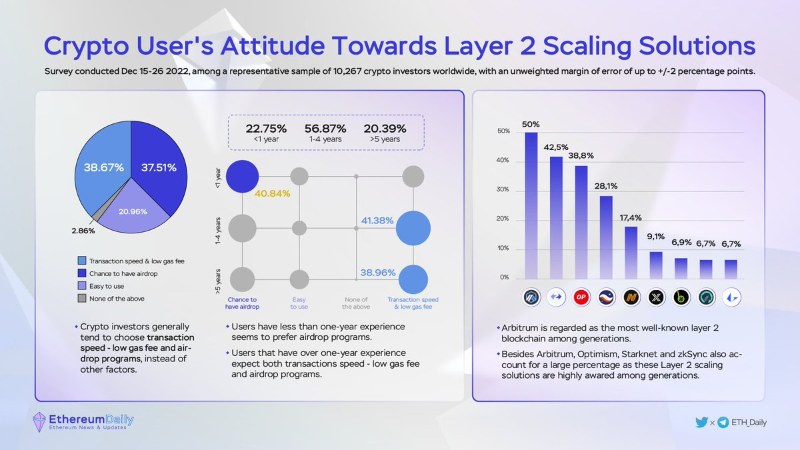

In terms of brand awareness, Polygon leads with 1.8 million followers on its Twitter account—the most followed chain. However, zkEVM only has 32,000 followers, significantly behind zkSync (640k), Arbitrum (588k), and Scroll (261k).

While follower count doesn't mean everything, ETH Daily conducted a survey of the top 9 Layer 2s, and at the time, zkEVM wasn't even listed.

The study also revealed that new users are actively seeking financial opportunities through airdrops, and zkEVM should not rule out launching one.

This poses a challenge for the chain, as airdrops drive participation by bringing in TVL, trading volume, fees, etc., which in turn attract builders, projects, and more users—creating a virtuous cycle.

Funding

In 2022, Polygon raised $450 million—the largest funding round in blockchain history—bringing its current treasury to $2.4 billion.

This level of funding enables Polygon to develop aggressively, hire top talent, and scale operations without concern for bear market conditions.

Team

To operate such a project, Polygon relies on a team of 400 employees who joined after the project was founded in 2017 by four co-founders:

- Jaynti Kanani – CEO

- Sandeep Nailwal – COO

- Anurag Arjun – CPO (now independently developing Avail)

- Mihailo Bjelic

On the zkEVM team, we have:

- Eduardo and Jordi Baylina – Co-founders of Polygon Hermez, now project leads and developers.

- Brendan Farmer and Daniel Lubarov – Co-founders of the Mir Protocol (now Polygon Zero).

The team is well-prepared to deliver a fully functional and efficient scaling solution.

Advantages

• Partnerships with Web2 companies.

• Type 2 zkEVM enables easy development and dApp onboarding, offering significant potential.

• Substantial funding and reserves support smooth adaptation, market phase management (bull/bear markets), marketing, and events.

• A skilled team has developed a major chain and integrated developers from acquired projects (Mir, Hermez) to run the initiative.

Risks

• zk risks exist due to complexity and recent implementation within the blockchain industry.

• Privacy implications from zero-knowledge proofs may bring regulatory scrutiny. Privacy-focused projects have previously been targeted by regulators (e.g., Monero, Tornado Cash).

• Increasing competition from teams building cutting-edge technologies (zkSync, Scroll, Starknet, Taiko, etc.).

• Attracting users, developers, and projects without airdrop incentives and a vibrant DeFi ecosystem will require more effort than competitors.

Conclusion

Polygon’s launch of zkEVM is a highly significant event for the industry. zk-rollup technology will make blockchain networks more efficient and scalable, offering seamless integration advantages for EVM-compatible dApps.

While risks and competition remain, Polygon has demonstrated strong capabilities in ecosystem development, fundraising, and team building.

In the coming period, the project is poised to continue its success and shape the direction of the entire industry.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News