After spending $250 million to acquire a company, Polygon lays off 30% of staff—changing its way of operating

TechFlow Selected TechFlow Selected

After spending $250 million to acquire a company, Polygon lays off 30% of staff—changing its way of operating

Polygon is still building through the bear market, but those who will reap the rewards in the bull market may no longer be it.

Author: David, TechFlow

Today I came across a piece of news: Polygon has laid off approximately 30% of its employees.

Although Polygon hasn't officially confirmed this in a public statement, CEO Marc Boiron acknowledged the layoffs in an interview, adding that due to newly acquired teams joining, the total headcount will remain stable.

There are also posts from affected employees on social media, indirectly confirming the fact.

Yet, in the same week, Polygon announced it was spending $250 million to acquire two companies. Cutting staff while spending heavily—doesn’t that seem odd?

If it were purely contraction, they wouldn’t be investing $250 million in acquisitions. If it were expansion, they wouldn’t be cutting 30% of their workforce. Taken together, it looks less like shrinking or growing and more like a blood transfusion.

The people being let go are from existing business lines—their roles are being cleared to make space for incoming teams from the acquisitions.

$250 Million Buys Licenses and Payment Infrastructure

The two companies acquired are Coinme and Sequence.

Coinme, founded in 2014, operates as a fiat-to-crypto exchange channel, running crypto ATMs across over 50,000 retail locations in the U.S. Its most valuable asset is regulatory licenses—it holds money transmitter licenses in 48 states. These are extremely difficult to obtain in the U.S.; even companies like PayPal and Stripe took years to assemble full coverage.

Sequence provides wallet infrastructure and cross-chain routing. Simply put, it allows users to transfer assets across chains seamlessly without dealing with bridges or gas fees manually. Its clients include blockchain networks such as Polygon, Immutable, and Arbitrum, and it has a distribution partnership with Google Cloud.

The combined acquisition cost was $250 million. Polygon has branded this integrated suite the "Open Money Stack," positioning it as middleware for stablecoin payments aimed at B2B customers such as banks, payment processors, and remittance providers.

Here’s how I see the logic:

Coinme offers compliant on- and off-ramps for fiat currency; Sequence delivers user-friendly wallets and cross-chain functionality; and Polygon’s own chain serves as the settlement layer. Put together, these form a complete stablecoin payment infrastructure stack.

But why is Polygon doing this?

The L2 Path Is No Longer Viable for Polygon

The situation in 2025 is clear: Base won.

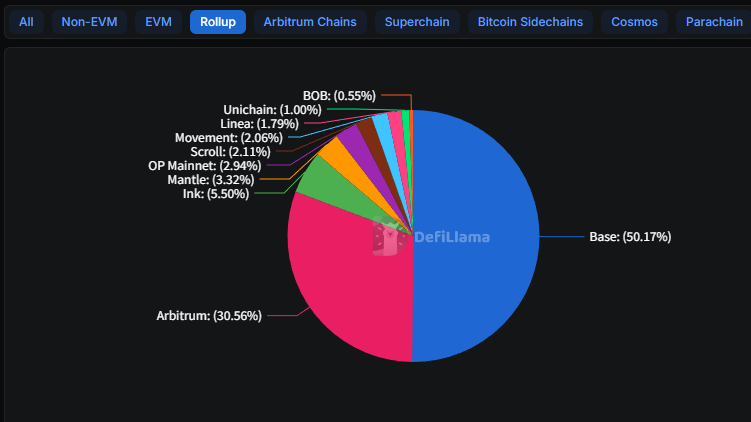

Coinbase’s L2 grew from $3.1 billion in TVL at the start of last year to $5.6 billion, capturing 50% of the entire L2 market. Arbitrum held onto 30% but saw little growth. Most other L2s have been inactive since their token airdrops ended.

Where did Base win? Coinbase has hundreds of millions of registered users—any new product feature gains instant traction simply by being available within the app.

Take Morpho, a lending protocol whose deposits on Base surged from $354 million to $2 billion. The key reason? It was integrated directly into the Coinbase app. Users can access it instantly without knowing what an L2 or Morpho even is.

Polygon lacks such an entry point. It did lay off 20% of staff in 2024, which was part of broader industry-wide cuts during the bear market.

This round is different—laying off despite having cash reserves indicates a deliberate strategic pivot.

Recall when Polygon used to pitch enterprise adoption—partnerships with Disney for accelerators, Starbucks’ NFT loyalty program, Meta enabling minting on Instagram, Reddit avatars, etc.

Four years later, most of those initiatives have gone silent. Starbucks quietly shut down its Odyssey program last year.

Continuing to compete head-on with Base in the L2 space gives Polygon almost no chance of winning. Technical gaps can be closed—but user access cannot. Rather than burn resources in a losing battle, it makes sense to seek new opportunities.

Stablecoin Payments Are Promising—but Crowded

Stablecoin payments are indeed a growing market.

In 2025, the total stablecoin market cap exceeded $300 billion, up 45% year-over-year. Use cases have evolved—from primarily arbitrage between exchanges to real-world applications like cross-border payments, corporate treasury management, and payroll disbursement.

But the space is already crowded.

Last year, Stripe spent $1.1 billion acquiring Bridge, a stablecoin infrastructure company, and recently secured rights to issue USDH, a stablecoin on Hyperliquid. PayPal’s PYUSD already accounts for 7% of stablecoins on Solana.

Circle is building its own Payments Network. JPMorgan, Wells Fargo, Bank of America, and others are forming alliances to launch their own regulated stablecoins.

In an interview with Fortune, Polygon co-founder Sandeep Nailwal said these acquisitions put Polygon in direct competition with Stripe.

To be honest, that sounds overly ambitious.

Stripe spent $1.1 billion on its acquisition; Polygon spent $250 million. Stripe has relationships with millions of merchants; Polygon's customer base remains largely developers. Most importantly, Stripe has spent over a decade accumulating payment licenses and banking partnerships.

Head-to-head, they’re not on the same playing field.

But perhaps Polygon is betting on a different approach. Stripe aims to embed stablecoins into its closed-loop system—merchants still use Stripe, just with faster, cheaper settlements via stablecoins.

Polygon wants to build open infrastructure so any bank or payment provider can build on top of it.

One is vertical integration; the other horizontal enablement. While not necessarily direct competitors, both are vying for the attention of the same institutional clients.

A New Way Forward—Uncertain but Necessary

Ultimately, layoffs aren’t unusual in crypto these days.

OpenSea cut 50%, Yuga Labs and Chainalysis are downsizing. ConsenSys laid off 20% last year and again this year. Most of these are reactive moves—burn rate reduction to survive another day.

Polygon is different. It has cash, invested $250 million in acquisitions, yet still chose to cut 30% of its team.

This is transformation—not desperation. But it comes with risks.

The acquired company Coinme relies heavily on crypto ATMs—machines deployed across 50,000+ retail points nationwide allowing users to buy crypto with cash or convert crypto back to cash.

The problem? This business hit regulatory trouble last year.

California fined Coinme $300,000 for allowing ATM withdrawals exceeding the daily $1,000 limit. Washington state went further, imposing a full ban—only lifted in December last year.

Polygon’s CEO claimed Coinme’s compliance standards were “beyond requirements.” But regulatory penalties are documented facts—PR statements don’t erase them.

Looking at the implications for the $POL token, the narrative shifts.

Previously, value accrued to POL based on network usage—more activity meant higher demand. Now, with Coinme earning transaction fees, there’s actual revenue—real cash flow, not just tokenomics. The company projects over $100 million in annual revenue.

If achieved, Polygon could evolve from a “protocol” into a “company”—with revenue, profit, and a valuation anchor. That’s rare in the crypto world.

However, traditional finance players are entering rapidly, narrowing the window for native crypto firms.

There’s a saying in the industry: “Build in bear markets, harvest in bull markets.”

Polygon’s challenge now is—it’s still building, but when the next bull market arrives, it may no longer be the one doing the harvesting.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News