Polygon CEO's Bet with AAVE Guardian: Is Polygon's Dual-Token Design a Blessing or a Curse?

TechFlow Selected TechFlow Selected

Polygon CEO's Bet with AAVE Guardian: Is Polygon's Dual-Token Design a Blessing or a Curse?

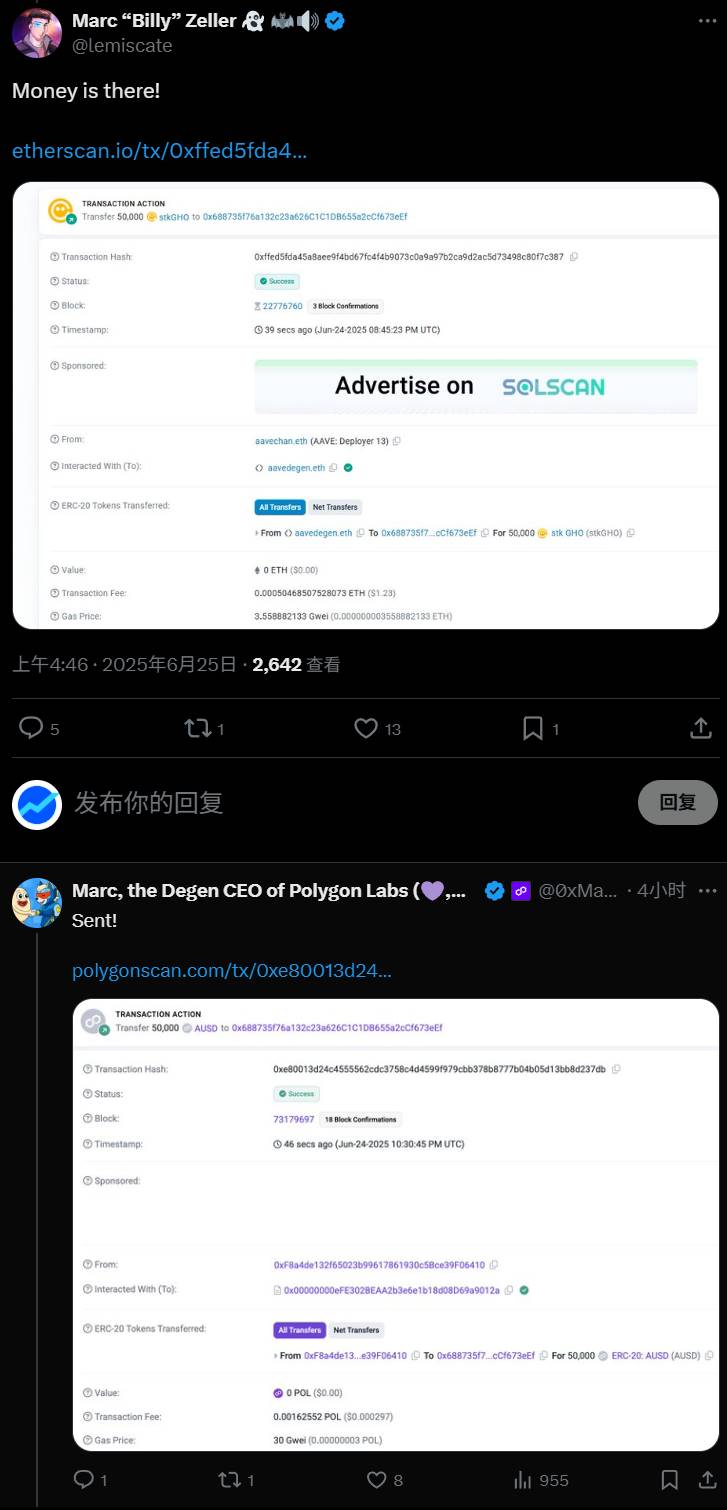

Aave ecosystem contributor Marc Zeller and Polygon Labs CEO Marc Boiron have made a $50,000 bet regarding Polygon's "dual-token" model, wagering whether the combined market cap of POL and the new token KAT will surpass current levels by the end of 2025.

By Luke, Mars Finance

"The money is in."

With Marc Zeller posting a screenshot of an Etherscan transaction on X, a debate over Polygon’s ecosystem future has officially escalated into a $50,000 public wager—verified by smart contracts and backed by industry heavyweights. This sum is no joke; it's securely locked in an escrow address managed by renowned crypto KOL Cobie.

On June 24, 2025, the bet was finalized between two towering figures in the crypto world: Marc Zeller, core contributor to the Aave ecosystem, and Marc Boiron, CEO of Polygon Labs.

Their wager brings into sharp focus a fundamental question haunting the industry: when a leading blockchain ecosystem introduces a second token, does it create new value—or merely cannibalize and dilute existing value?

The terms of the duel were sharpened through heated exchanges, clear and strict:

-

Stake: $50,000 worth of stablecoins.

-

Escrow Agent: Renowned crypto KOL Cobie (@cobie).

-

Source of Truth: CoinGecko.

-

Settlement Time: 8 PM UTC, December 24, 2025.

-

Win Condition: At settlement time, will the combined market cap of POL and the new token KAT exceed the standalone market cap of POL at the time Polygon announced the Katana plan (2.387 billion USD)? If yes, Boiron wins; if no, Zeller wins.

Beneath this wager lies a fierce collision between two fundamentally opposed crypto worldviews.

On one side stands Marc Zeller, "guardian" of the Aave ecosystem. As founder of the Aave Chan Initiative (ACI), he is one of DeFi’s most resolute risk-averse thinkers. He firmly believes that Polygon’s dual-token model will only dilute value, resulting in a negative-sum “1+1<1” game.

On the other side is Marc Boiron, “empire builder” of Polygon Labs. This ambitious CEO aims to unify the fragmented blockchain landscape via Polygon 2.0’s Aggregation Layer (AggLayer) strategy. He counters sharply, arguing that sophisticated design can break the “curse,” achieving a value leap where “1+1>2.”

This is not merely a personal feud over reputation or money—it’s a public experiment testing two opposing philosophies for industry development.

Spark: A Long-Simmering War of Ideas

This showdown didn’t erupt overnight. It’s the volcanic culmination of long-standing ideological tensions between the two protagonists and their respective protocols.

Their conflict first flared publicly in December 2023. At that time, the Polygon community proposed a controversial idea: activate dormant assets on its PoS bridge to generate yield and boost treasury income. To Boiron and many in the Polygon community, this was prudent capital utilization. But to Zeller, it was like playing with fire next to Aave’s vaults. Billions of dollars in assets are deposited in Aave on Polygon, and cross-chain bridges are among the most vulnerable points in all of DeFi. Zeller swiftly moved within the Aave community to counteract, proposing drastic increases in borrowing costs for relevant assets—a financial penalty against what he saw as reckless behavior—and stating bluntly: “Aave should not pay for Polygon’s risk experiments.”

This clash laid bare the philosophical divide: Zeller’s Aave prioritizes risk control above all, like a cautious banker managing vast wealth; Boiron’s Polygon places ecosystem growth first, like a bold empire-builder unafraid of risk.

This long-festering dispute reached boiling point on May 28, 2025, when Polygon officially announced that Katana Network, a flagship project in its ecosystem, would launch its own token, KAT. Once again, Zeller invoked his signature “dual-token curse” theory. In the final exchange before locking in the bet, Zeller lashed out sarcastically at Boiron: “All of this started six months ago with your Pre-PIP [early version of a Polygon Improvement Proposal]. That’s when POL’s price began falling. These are the consequences of your own decisions.”

This fiery accusation underscores just how deep the rift runs—transforming the bet from pure ideology into something tinged with personal rivalry.

Zeller’s Curse: Historical Ghosts and the 'Dual-Token Curse'

Marc Zeller’s pessimism isn’t baseless. It draws strength from bloody lessons etched in crypto history. His so-called “curse”—the “dual-token curse”—posits that introducing a second token rarely creates incremental value. Instead, it often destroys existing value by fragmenting community attention, muddying value propositions, and increasing system complexity. Two infamous cases loom like ghosts over the space, lending strong support to his argument.

The first and most devastating is Terra/LUNA’s death spiral. In May 2022, this ecosystem, once valued at $40 billion, collapsed within a week. At its core was a dual-token mechanism: algorithmic stablecoin UST and governance token LUNA. UST maintained its peg via an intricate arbitrage system, but under extreme market stress, this became an uncontrollable printing machine. When panic selling caused UST to depeg, the mechanism required massive LUNA minting to absorb sell pressure, which crashed LUNA’s price further, fueling more distrust in UST—an inescapable “death spiral.” This case proved in the starkest way possible that a flawed dual-token system doesn’t fail linearly—it fails exponentially, leading to “1+1<0” value annihilation.

The second example is the Steem-Hive “civil war.” Unlike Terra’s implosion, this is a story of division. In 2020, dissatisfied with Tron founder Justin Sun’s acquisition of Steem, key community members hard-forked to create a new chain, Hive. This split effectively divided community and assets. Network effects were halved, liquidity diluted, developer efforts scattered. Though neither token went to zero like Terra, the unified community was torn apart, and value was partitioned between two competing tokens—perfectly illustrating Zeller’s concept of “value dilution.”

One case reflects systemic collapse, the other community fragmentation—but both lead to the same conclusion: dual-token models easily backfire. Yet Boiron and Polygon argue precisely this: Katana is neither a fragile algorithm nor a product of community schism. It is a deliberate, hierarchically structured expansion within a grand strategic blueprint. Applying past failures directly to Polygon may be like cutting a boat’s mark on the water. The bet, in essence, tests a novel, unproven third type of multi-token architecture.

Boiron’s Blueprint: Breaking the Curse with 'Aggregation'

In response to Zeller’s historically grounded pessimism, Marc Boiron offers a grand, intricate, and highly ambitious vision—Polygon 2.0. This framework is designed explicitly to resolve every concern Zeller raises.

First, Polygon upgraded its core token from MATIC to POL, redefining it as a “hyper-productive token.” This is far more than a name change. Traditional PoS tokens like MATIC earn rewards only when staked on a single chain. POL, however, allows holders to stake once and simultaneously provide security, validation, transaction ordering, and zero-knowledge proof generation across countless chains within the Polygon ecosystem. This means POL’s value is no longer tied solely to the fate of one chain, but scales with the prosperity of the entire Polygon “value internet.” It captures economic activity from every connected chain like a revenue pump.

Second is the “nervous system” of the whole design—the Aggregation Layer (AggLayer). If traditional cross-chain bridges resemble bumpy rural roads prone to banditry, AggLayer functions like a central terminal in a super international airport. It unifies liquidity and state across all connected Layer 2 networks, enabling near-instantaneous, trustless atomic cross-chain transactions. This doesn’t just solve Zeller’s original security concerns—it lays the foundation for a seamless, unified user experience.

Finally, we have the other protagonist of this bet—Katana. Within Polygon’s grand narrative, Katana is not a rebellious “second son” competing with POL for resources, but a carefully chosen “strategic special forces unit.” Its sole mission is to demonstrate the raw power of AggLayer. Katana’s design is revolutionary: it allows only one dominant protocol per DeFi sector on its chain (e.g., Sushi for DEXs), concentrating liquidity and avoiding the fragmentation common on general-purpose chains. It also uses token incentives and real yield to economically empower these exclusive partnerships.

This reveals a deeper strategic intent: Katana acts as a showcase “model apartment.” Its primary value isn’t how high its own market cap climbs, but whether it successfully proves that AggLayer is a viable paradigm capable of attracting massive liquidity and top-tier projects. If Katana becomes a hit, it becomes the brightest billboard for AggLayer, drawing countless builders into Polygon’s aggregated ecosystem. This powerful network effect could, in theory, dramatically increase demand for POL. Polygon isn’t telling the story of “A+B < A” that Zeller fears, but rather “(A+B) → A++”—a myth of exponential growth.

Ghosts of the Past: Can Polygon Cure Cosmos’s 'Value Capture Disease'?

Theory is elegant, but reality is harsh. For judging whether Polygon’s grand vision can succeed, one ecosystem offers the most critical and brutal benchmark—Cosmos.

Cosmos is essentially the “spiritual mentor” behind Polygon’s aggregation dream. It pioneered the vision of a network composed of numerous sovereign, interconnected “app-chains.” Yet despite spawning stars like dYdX and Celestia—each with large, independent market caps—the value they generate rarely flows back to benefit the core token ATOM. This is known as Cosmos’s “value capture problem.” A Coinbase research report once noted bluntly that ATOM holders have seldom benefited from the historical success of the broader Cosmos ecosystem.

This is precisely where Polygon’s design shows its brilliance—and where its ability to break the “dual-token curse” hinges. Polygon isn’t blindly copying Cosmos. It’s implementing a deliberate correction to the “Cosmos value capture disease.”

The core remedy? A mandatory, institutionalized mechanism for value sharing. The most direct component: Katana will airdrop 15% of its total KAT supply directly to POL stakers. This move establishes a formal, robust economic link between new projects and the core token right from the start. In Cosmos, app-chains can thrive without “paying taxes” to ATOM holders. In Polygon’s aggregated ecosystem, this “tax” is institutionalized through airdrops.

This creates a powerful “golden shovel” effect: holding and staking POL equips you with the tool to mine the future value of every new project in the ecosystem. It generates direct, ongoing demand for POL, as rational investors anticipate that every project graduating from the “Aggregation Breakthrough Program” will follow the same rule.

Thus, the real stakes of this bet are no longer about “whether Polygon repeats history,” but “whether Polygon has engineered a working solution to Cosmos’s value capture failure.”

Final Prediction: Who Will Have the Last Laugh?

Now that all cards are on the table, it’s time to make a final call on this year-end showdown.

The case for Marc Zeller is strong: the weight of history. Markets are often short-sighted and complexity-averse. Within a mere six-month window, investors may punish the novelty of a new model rather than reward its long-term vision. The ghosts of Terra and Cosmos still haunt investor psychology—any sign of trouble could trigger immediate pessimism.

The case for Marc Boiron rests on architectural elegance and narrative power. Polygon’s entire strategy appears custom-built to refute every one of Zeller’s arguments. The mandatory airdrop mechanism could ignite FOMO, driving a strong, narrative-fueled rally in the short term.

Yet the decisive variable is the timeline itself—six months. For a project aiming to reshape blockchain infrastructure, half a year is barely a blink. The true value and network effects of AggLayer are unlikely to fully materialize by the end of 2025.

Therefore, this battle may hinge less on fundamentals and more on a race between short-term market sentiment and narrative momentum.

My final prediction: Marc Zeller has a slightly higher chance of winning.

Historical inertia is powerful. Convincing the market to completely reverse its skepticism toward dual-token models within six months—and fully embrace Polygon’s complex, novel value proposition—requires Katana to achieve immediate, undeniable, and spectacular success. This demands flawless execution, perfect marketing, and maximum community mobilization. Against a backdrop of potentially tightening macro conditions and reduced liquidity by year-end, this is an immense challenge. A more likely scenario: Katana launches successfully, the combined POL+KAT market cap spikes initially, then settles down, failing to sustainably surpass the 2.387 billion USD threshold by the precise moment of judgment on December 24.

But this wouldn’t mean Polygon has failed. Quite the contrary—it might simply reflect a mismatch in timelines. Boiron is betting on the industry structure years ahead; Zeller is betting on market sentiment over the next six months.

No matter who pops the champagne, this wager will be remembered as a fascinating footnote in Web3 history. It forces us to confront fundamental questions about ecosystem expansion and value capture. The true winner may not be decided until 2026 or 2027, when the AggLayer is truly blooming with applications. And when that day comes, the ultimate victor may well be the entire crypto industry.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News