Collective wrongdoing? Insiders expose Polygon executives for maliciously manipulating Meme coin prices

TechFlow Selected TechFlow Selected

Collective wrongdoing? Insiders expose Polygon executives for maliciously manipulating Meme coin prices

As the "makeshift crew" theory becomes increasingly evident, players should gradually demystify any top-tier projects.

By Wang1, TechFlow

The crypto market never lacks major scandals—even well-known projects are no exception.

Last night, a Twitter user @Rahul__Ghangas, who self-identified as an intern within the Polygon community, posted a 34-part thread exposing alleged misconduct involving senior figures at Polygon. The post claims that top executives colluded with external parties to manipulate the Meme coin ELECOIN for personal profit and accused them of misleading and exploiting community developers.

The allegations were supported by numerous chat screenshots, lending significant credibility to the accusations.

TechFlow summarizes the full timeline of events detailed in the post.

Key Figures Exposed

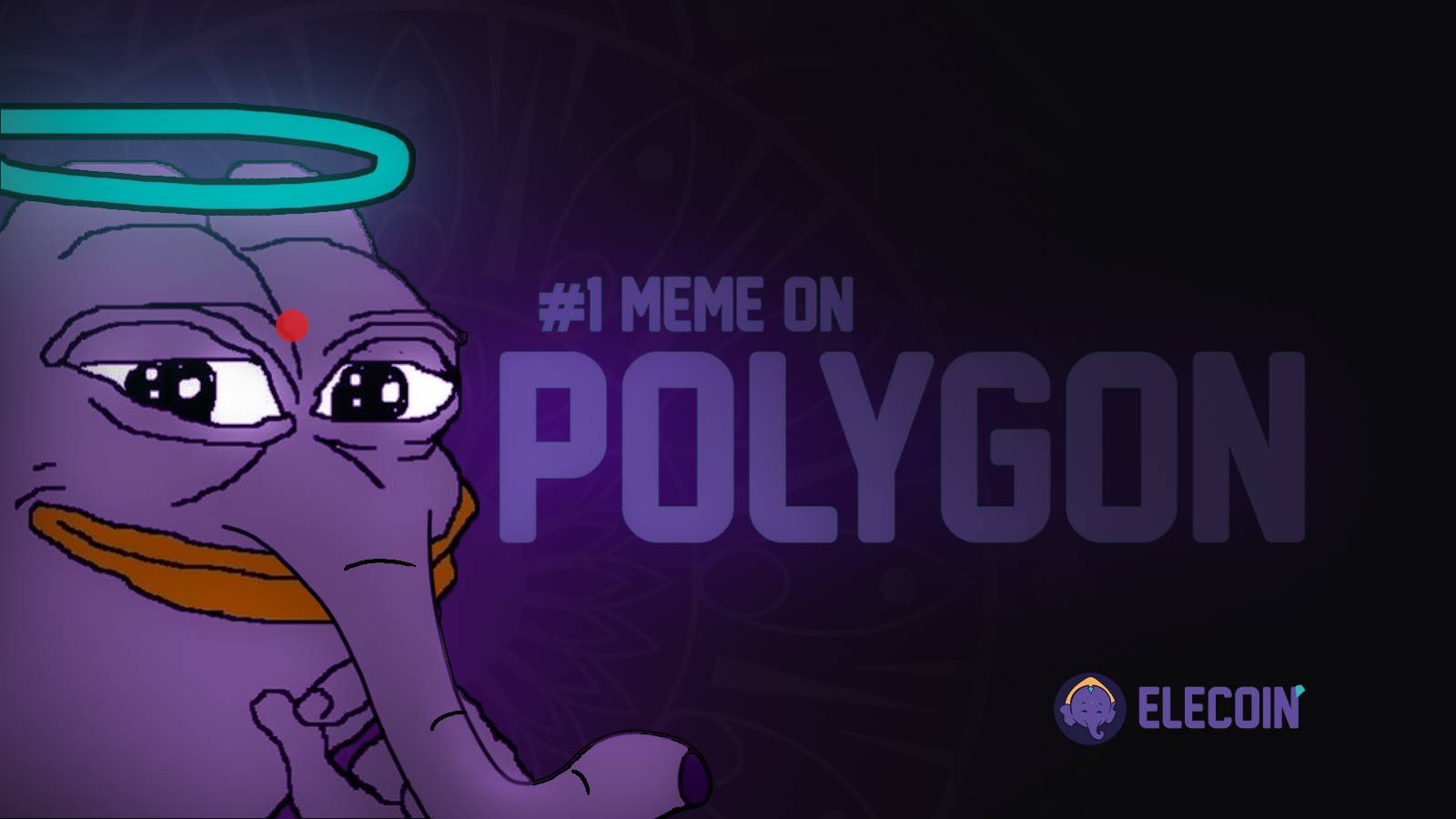

At the start of his thread, Rahul used a Telegram group chat screenshot to reveal the main individuals involved:

@0xkenzi Kenzi Wang – Partner at Symbolic Capital, advisor to Polygon

@jack_venture Jack Lu – Co-founder of multibit and bouncebit, partner at @NGC_Ventures

@sourcex44 Sanket Shah – Head of Strategy at Polygon Labs

@0xsachi Sachi Kamiya – Founding member of Polygon Ventures

@mscryptojiayi Jiayi Li – Co-founder of Salus Security

@shawncgeek Shawn Chong – Chief Operating Officer of Salus Security and investor in BounceBit

The incident began when high-level members from Polygon, VC partners, and project co-founders conspired to create a Meme coin together.

As shown in the image provided by the whistleblower, internal communications before ELECOIN’s official launch reveal preparations including discussions on token distribution, participant coordination, and narrative crafting—clear signs of premeditated coordination.

Secret Plotting to Create a Meme Coin

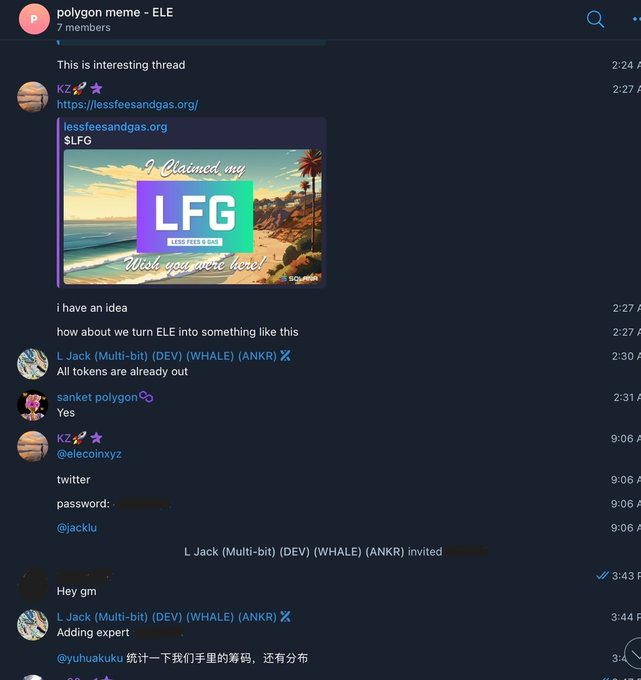

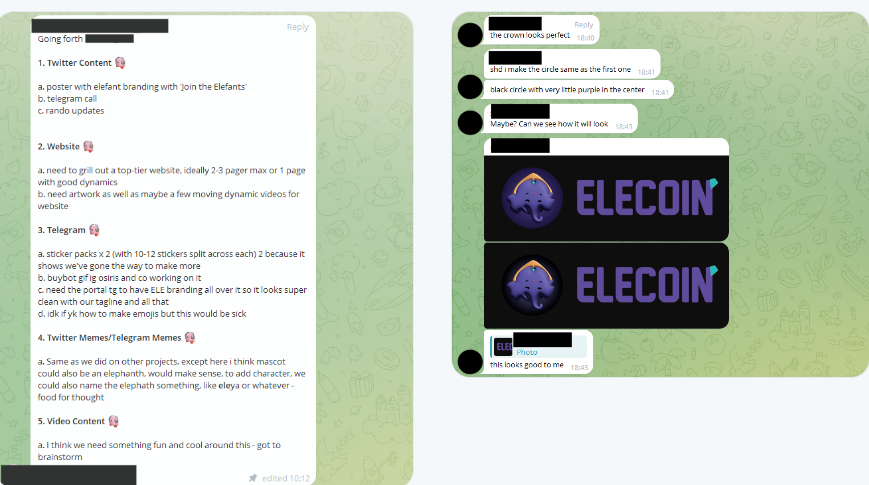

On January 3, 2024, many KOLs gathered in a Telegram group planning to promote the Meme coin ELECOIN under the banner of an “Indian Meme.” Rahul claimed in his tweet that the token had already undergone a "secret TGE" by late 2023, with most of the supply acquired by insiders. At the same time, the team promised developers and KOLs timely compensation in USDC for their work.

The team's marketing plan for ELECOIN

The team planned to use Sandeep, co-founder of Polygon’s pet elephant, as a promotional vehicle for ELECOIN. They hoped Sandeep would post photos of his elephant to drive hype around ELECOIN, an idea reportedly endorsed by"top-level personnel" at Polygon.

Rahul sarcastically remarked, "This sounds absurd, but people will still buy into such stories during a bull market."

Execution of the Plan

After finalizing the strategy, the team aggressively pushed marketing efforts across social media platforms, aiming to quickly reach 5,000 followers.

However, problems emerged immediately on day one: the organizing team failed to pay developers or marketers for their contributions, leaving participants to fund everything out-of-pocket.

Rahul joined the project later and handled only minor tasks, primarily helping build the ELECOIN website. He stated that access to the ELECOIN domain was granted directly by Kenzi Wang, Polygon advisor. Rahul even double-checked through other channels that the Telegram account he communicated with indeed belonged to Kenzi Wang.

Conversation between @Rahul__Ghangas and Kenzi Wang

Since Rahul wasn't removed from the group chat after completing his task, he witnessed firsthand over the next three months how"the wealthy exploited others' time and money without cost through malicious dumping, psychological manipulation, and outright fraud."

The Show Begins

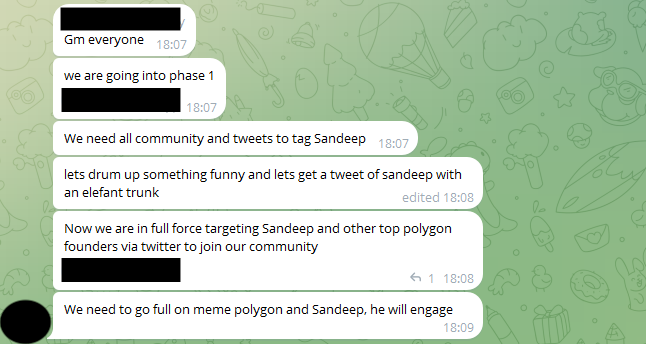

In the initial days, facing early sell-offs by some participants, the team actively repurchased tokens to maintain the illusion that ELECOIN was stable and trustworthy. As the plan progressed, the main event arrived: the team aimed to tag Sandeep on Twitter and "attract" him into participating to generate traffic and grow the community.

Team's planned interaction with Sandeep

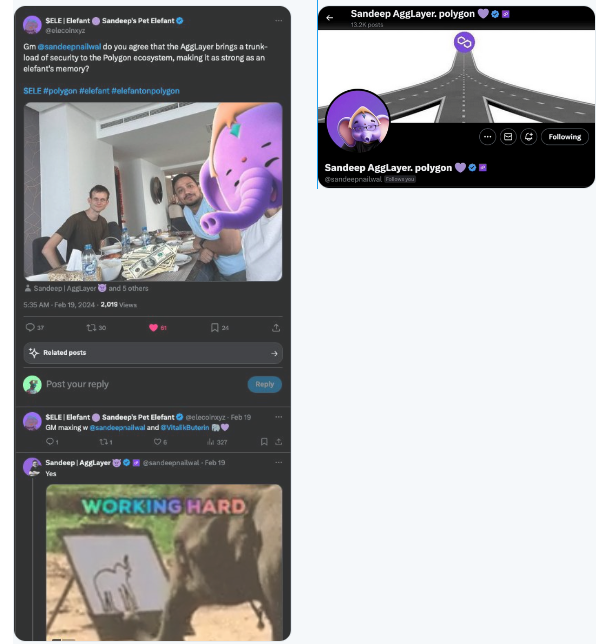

Of course, all of this was pre-planned. From Sandeep’s first interaction with the official ELECOIN account to changing his profile picture to an elephant Meme (mirroring Solana founder Anatoly Yakovenko’s adoption of the SillyDragon avatar which boosted the Silly token), the poster believes thatevery step of the event was meticulously orchestrated by the ELECOIN team and even高层 within Polygon.

Interaction between ELECOIN’s official account and Sandeep

The Truth Emerges

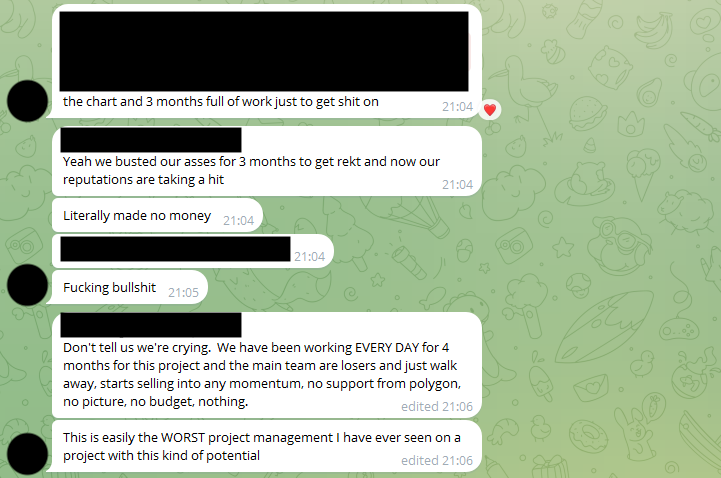

Following this carefully crafted campaign, ELECOIN achieved its desired level of popularity. However, what followed was three months of continuous selling pressure from early wallets. No one could trace these sales back to insiders because the wallets were newly created prior to $ELE’s public launch and funded via exchanges. Despite ongoing sell-offs, developers and marketers continued working for free, clinging to hopes of future payment and a big payoff. Then one night, everything collapsed—$ELE was dumped en masse, and within two weeks, its market cap plummeted from $17 million to $2 million. All early wallets began massive sell-offs, triggering outrage among unpaid contributors.

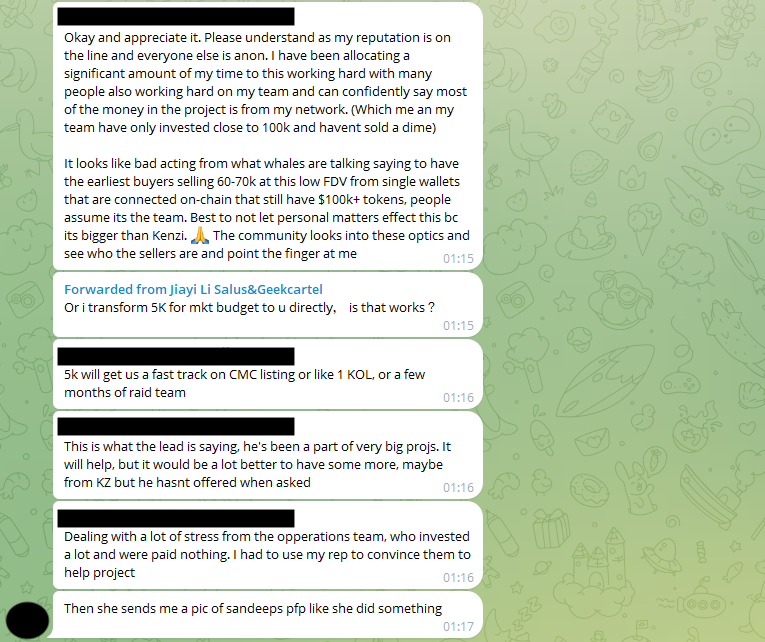

Team members expressing frustration in Telegram

Although these early wallets tried to stay hidden, some clues surfaced: certain addresses were linked to Jiayi Li and Shawn Chong.

These two individuals are precisely the co-founder and COO of Salus Security mentioned earlier.

Clearly, the selling pressure came from within.

In response, Jiayi Li claimed the internal sell-off stemmed from infighting among the founding team. She pledged to personally repurchase some tokens and allocate $5,000 for market support.

Jiayi Li explains the reason for the sell-off to the team

Rahul mocked her statement in his tweet: “How generous!”

From the initial setup to the eventual exposure of insider dumping, while we cannot currently verify the authenticity of these chat logs, the overall narrative alleging collusion between Polygon’s leadership and outside actors in manipulating ELECOIN is now clearly laid out.

After exposing the entire scheme, Rahul directly confronted Kenzi Wang, advisor to Polygon, and Jack Lu, co-founder of bouncebit, accusing both of past and ongoing fraudulent behavior.

Rahul stated, “If bad actors aren’t held accountable, the Web3 ecosystem will never fulfill its transformative potential... We need to cultivate a culture of transparency, integrity, and respect. When executives abuse their power, they must be held responsible. Profiting at the expense of others contradicts the very spirit upon which this industry was built.”

Conclusion

To date, none of the individuals involved have responded to Rahul’s extensive exposé and impassioned accusations.

As for the broader market reaction, $MATIC’s price showed little fluctuation—either the story hasn’t spread widely yet, or perhaps the market has become desensitized to such “irrelevant” wrongdoing.

There is nothing new under the sun. The Meme craze, fueled by financial nihilism, originally arose as resistance against hidden fraud and manipulation—but now it appears those same corrupt forces have infiltrated this space. Even Meme coins, symbols of freedom, fairness, and community culture, are not immune to manipulation and hijacking by interest groups.

The Memecoin in your wallet may not represent “your freedom”; the price surge you see might stem from a coordinated move by powerful interests.

As the “amateur crew” theory becomes increasingly evident, players should gradually demystify even the most elite projects.

In the world of crypto, proceed with caution and care.

Update:

After the incident went viral, Jack stated that the Meme project reached out seeking his support and emphasized that he did not participate in any trading activities.

Another individual, m00se1, said the leaked screenshots originated from him. He clarified that Rahul personally bought $100,000 worth of the Meme token, but the individuals named in the post did not engage in token trading and were merely innocent bystanders caught up in the drama. Accusing them is unfair, he added. In conversation with Rahul, m00se1 noted that misinformation is harming bouncebit and reiterated that Jack did not participate in any token sales.

In response, Rahul stated he never held large amounts of @elecoinxyz tokens, let alone invested $100,000 into a Meme coin. Any figures mentioned to m00se1 were solely to gather evidence.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News