Liquity: A decentralized stablecoin protocol that maintains a soft peg to the dollar through a hybrid mechanism backed by ETH

TechFlow Selected TechFlow Selected

Liquity: A decentralized stablecoin protocol that maintains a soft peg to the dollar through a hybrid mechanism backed by ETH

Centralized custodial solutions are not very secure, and nothing is "too big to fail."

Written by: Surf

Compiled by: TechFlow

“Banks pose a risk to fiat-backed stablecoins” — does this mark the beginning of the decentralized stablecoin narrative? Crypto analyst Surf dives deep into stablecoins and Liquity Protocol’s $LUSD.

Brief Introduction to Stablecoins

Stablecoins are cryptocurrencies designed to maintain a stable value, typically pegged to a fiat currency like the US dollar or a commodity like gold. This stability makes them highly useful for transactions and as a store of value. Stablecoins can be categorized into four main types:

-

Fiat-backed stablecoins (e.g., USDC, USDT, USDP)

-

Crypto-backed stablecoins (e.g., LUSD, SUSD)

-

Commodity-backed stablecoins (e.g., PAXG, XAUT)

-

Algorithmic stablecoins (e.g., FRAX)

This article will focus on fiat-backed and crypto-backed stablecoins.

Fiat-backed stablecoins are generally considered centralized because they are backed by traditional assets such as USD, which are held by centralized issuers or custodians. USDC is one such example.

Its reserves ($32.4 billion) are custodied by BNY Mellon and managed by BlackRock.

Cash reserves are held at BNY Mellon ($5.4 billion), SVB ($3.3 billion), Signature Bank (for minting/redeeming), and Customers Bank ($1 billion).

Most crypto-backed stablecoins are decentralized, as they are issued and maintained by decentralized protocols operating on blockchains without control from centralized entities. Liquity's LUSD is one such example, which I’ll detail further below.

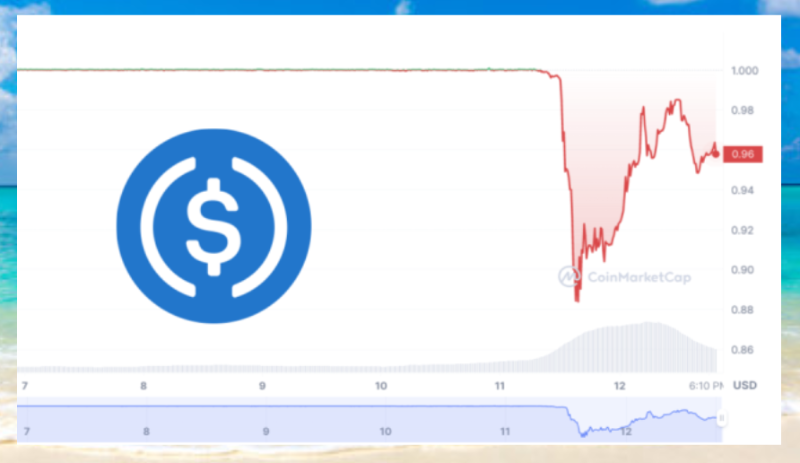

A Brief Overview of the USDC Incident

SVB announced it had sold loss-making bonds, realizing a ~$2 billion loss, and subsequently attempted to raise capital, triggering a bank run.

Unfortunately, Circle had $3.3 billion exposed to SVB.

Over the weekend, FUD (fear, uncertainty, and doubt) about a potential USDC collapse spread rapidly. However, such an outcome was unlikely.

On March 12, despite FDIC insurance caps of $250,000, depositors at SVB were guaranteed full access to their funds starting Monday.

Although USDC re-pegged by Monday, its circulating supply had already dropped by over $3 billion compared to the previous week due to redemptions.

USDC’s depeg also affected several other stablecoins:

The USDC depeg highlighted counterparty risks associated with centralized custodians and the vulnerability of decentralized stablecoins relying on centralized collateral. DAI, FRAX, and MIM all depegged due to exposure to USDC. A new narrative is now emerging — decentralized stablecoins backed by decentralized collateral.

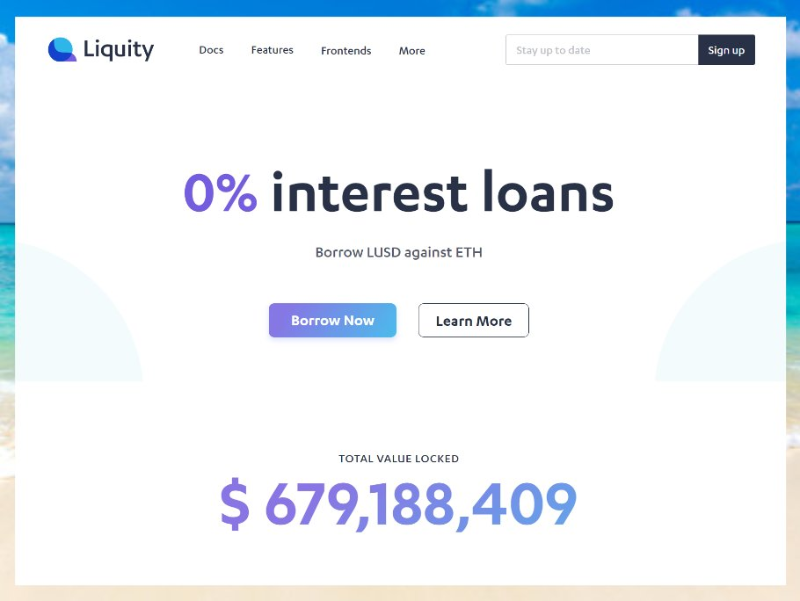

Introduction to Liquity

Liquity is a decentralized lending protocol launched in 2020 that allows users to borrow $LUSD interest-free using ETH as collateral.

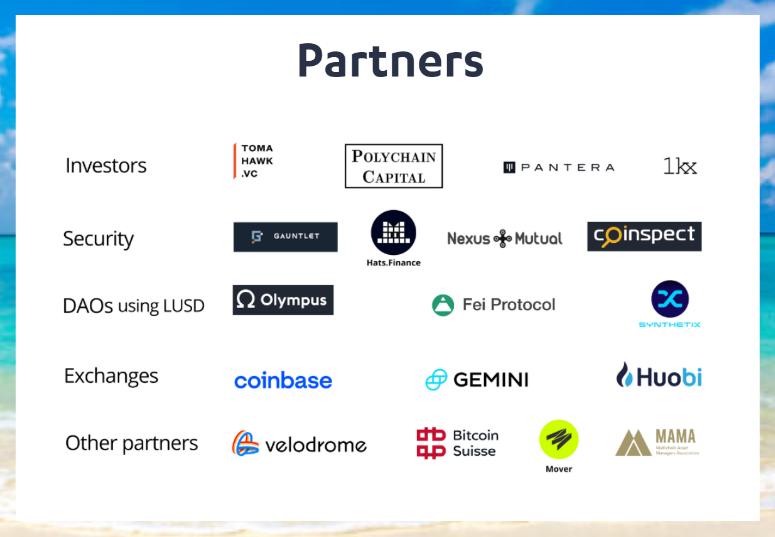

Liquity has received support from well-trusted investors and partners such as Polychain Capital, Pantera Capital, 1kx, Tomahawk VC, Robot Ventures, and others.

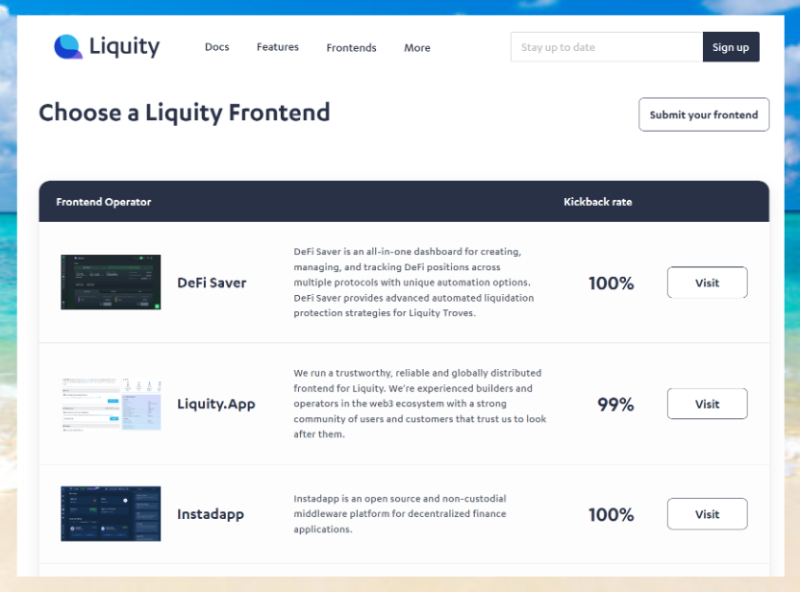

Liquity is governance-free to ensure the protocol remains fully decentralized. The front-end is nearly "outsourced" to third parties, creating a fully distributed ecosystem.

They currently have over 15 front-ends.

Front-end operators are rewarded with a share of the $LQTY tokens generated by their users.

The “kickback rate” is the percentage of $LQTY rewards that a front-end operator chooses to share with Stability Pool depositors who use their front-end.

Liquity Mechanism

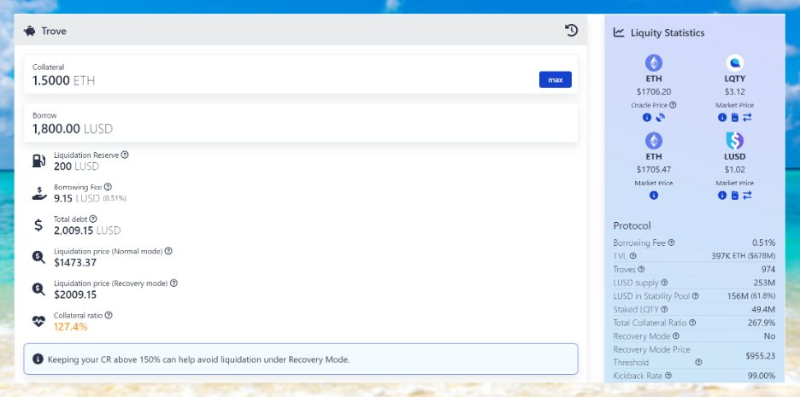

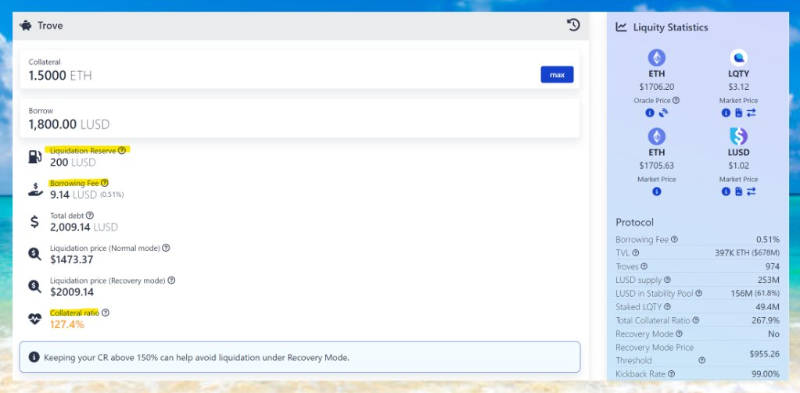

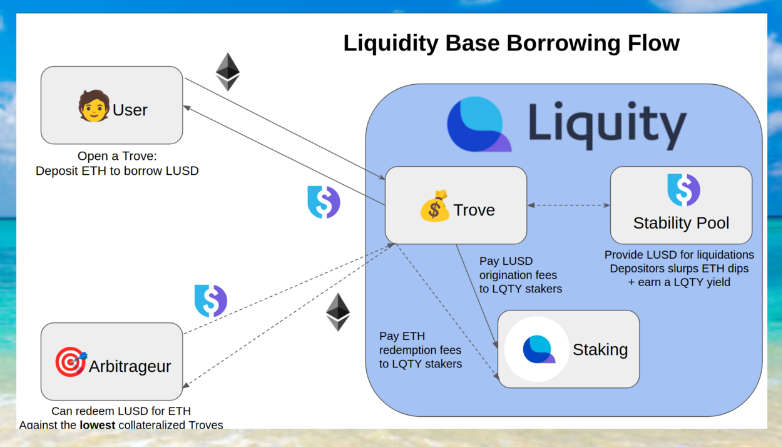

I. Troves

Troves are similar to MakerDAO’s vaults, allowing users to take out and manage loans.

Your Ethereum address is linked to one Trove (one per address), containing two balances: an asset balance denominated in ETH and a debt balance denominated in LUSD.

If ETH price increases, your collateral ratio decreases because the value of your collateral rises relative to your debt. Conversely, if ETH price falls, your collateral ratio increases as your collateral value drops relative to your debt.

If your collateral ratio falls below the system’s minimum requirement, your Trove will be liquidated. During liquidation, the system sells your ETH to repay your LUSD debt and charges you a liquidation penalty.

Key details to note:

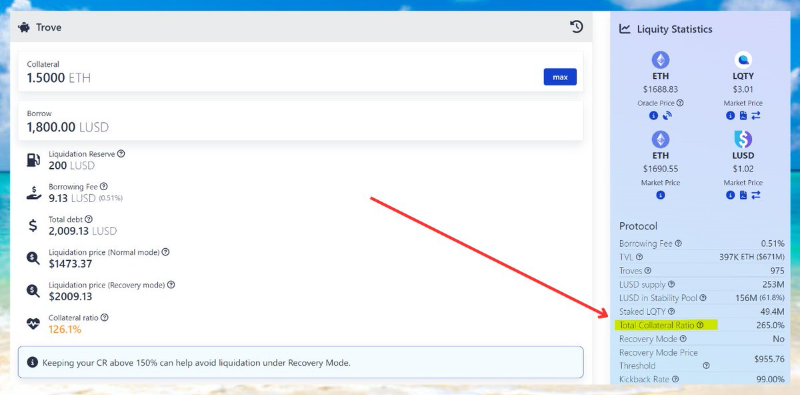

-

Minimum collateral ratio is 110% (150% in Recovery Mode)

-

Borrowing fee ranges from 0.5% to 5%, depending on demand

-

A $200 liquidation reserve (similar to a deposit) is required

II. Stability Pool

The Stability Pool acts as a liquidity source that maintains solvency during Trove liquidations. Users become Stability Providers by depositing LUSD into the pool.

When a Trove is liquidated, LUSD from the Stability Pool is burned to repay the debt, and the Trove’s collateral is transferred to the pool. Stability Providers lose a portion of their LUSD deposits but gain a share of the liquidated collateral.

Stability Providers earn returns through:

-

Liquidation gains (theoretically, up to 10% extra collateral)

-

$LQTY rewards (based on pool share and front-end kickback rate)

Risks that may affect “liquidation gains”:

-

Oracle failure

-

Flash crashes

III. Liquidation and Recovery Mode

When a Trove’s collateral ratio falls below 110%, it becomes subject to liquidation to ensure $LUSD remains backed. The Trove’s debt is canceled and absorbed into the Stability Pool, while its collateral is distributed to Stability Providers.

As previously mentioned, when a Trove falls below the minimum collateral ratio (110%), it is liquidated to maintain $LUSD backing. After liquidation, the debt is canceled and absorbed into the Stability Pool, while the collateral is allocated to Stability Providers.

Additionally, the aforementioned $200 liquidation reserve/deposit is awarded (in addition to 0.5% of the Trove’s collateral) to compensate the user initiating the liquidation for gas costs.

When the system’s Total Collateral Ratio (TCR) drops below 150%, the system enters Recovery Mode (which could occur during a sharp ETH price drop).

In Recovery Mode, any Troves with collateral ratios below 150% are subject to liquidation, and the system prevents borrowers from taking actions that would further reduce TCR.

Recovery Mode incentivizes borrowers to increase TCR above 150% and encourages LUSD holders to refill the Stability Pool.

Liquidation losses are capped at 110%, with the remaining 40% reclaimable by the borrower.

Thus, the complete borrowing process:

Pegging Mechanism

Liquity’s LUSD maintains its dollar peg through a combination of hard and soft mechanisms. The hard peg includes a $1 floor (minus redemption fees) and a $1.10 ceiling. The collateral ratio is set at 110%.

The soft peg treats LUSD = USD when calculating Trove collateral ratios, thereby anchoring LUSD<>USD equivalence within the system.

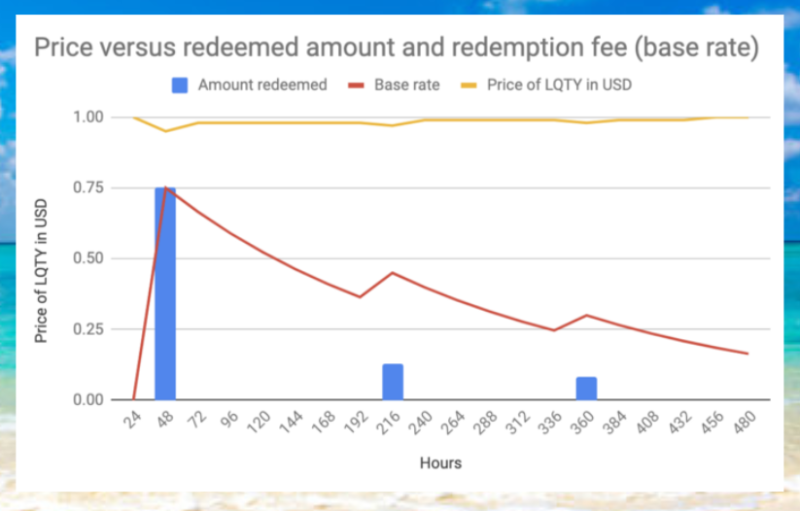

A base rate formula determines redemption fees, starting at 0% and increasing with each redemption, gradually decreasing back to 0% if no redemptions occur.

Liquity expects arbitrageurs to prevent LUSD from reaching $1.10; if it does, it should quickly fall back.

$LQTY Token

$LQTY is a secondary token used to capture fee revenue and incentivize early adopters and front-end operators. It is not a governance token — Liquity has no governance.

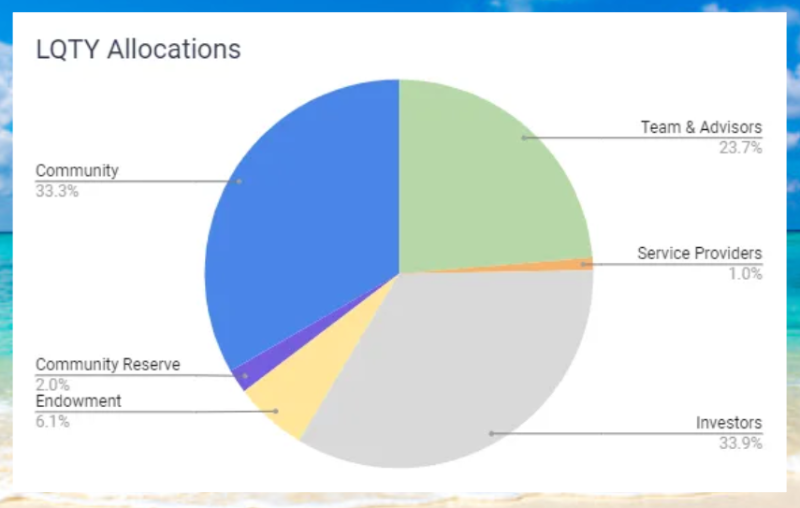

It has a maximum supply of 100 million tokens, distributed as follows:

$LQTY can be obtained via:

1. Providing liquidity in the LUSD<>ETH Uniswap pool (1,330,000 $LQTY allocated as rewards)

2. Becoming a Stability Provider or front-end operator (32,000,000 $LQTY allocated as rewards)

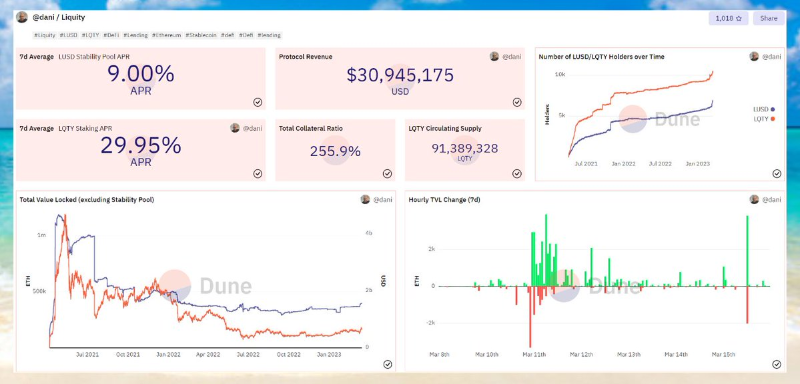

$LQTY can be staked to earn a share of LUSD borrowing and redemption fees, with a 7-day average annualized yield of 29.95%.

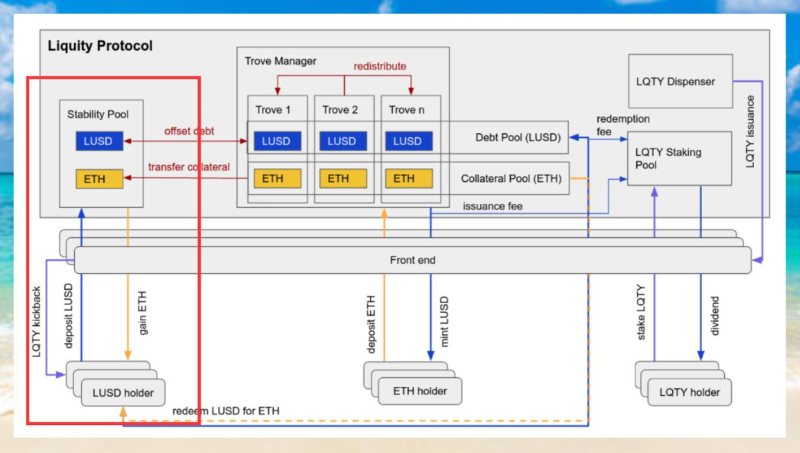

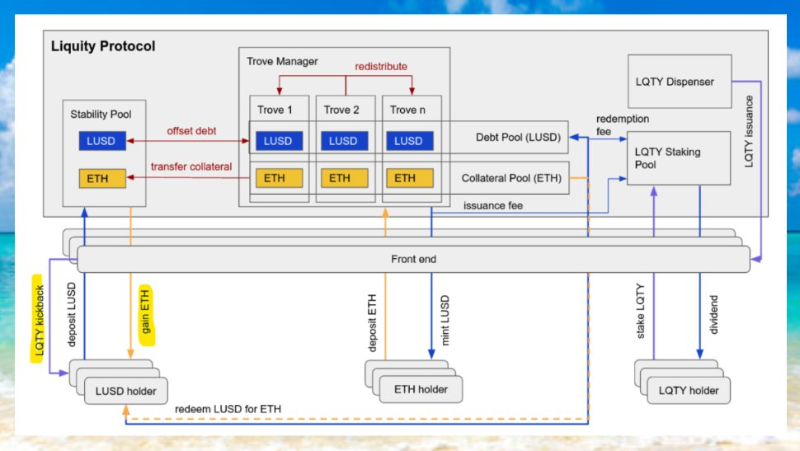

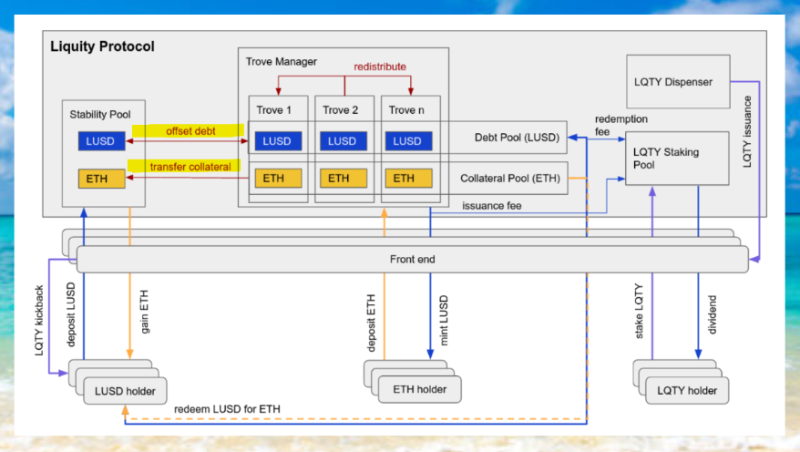

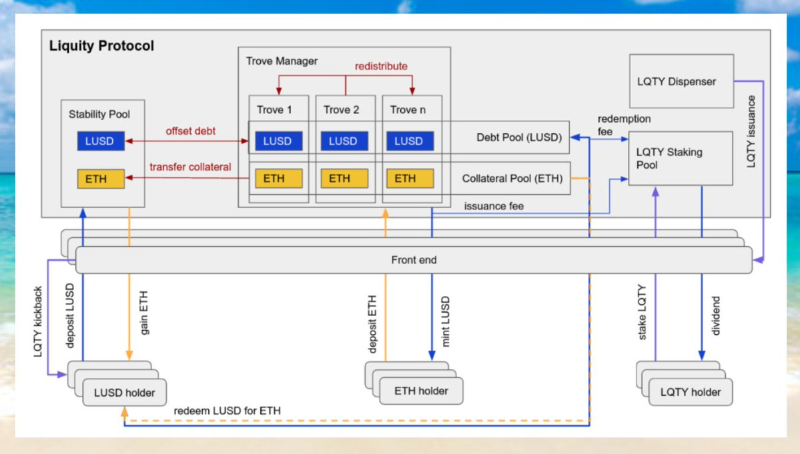

Diagram showing fund flows between the protocol and users:

Conclusion

Centralized custodial solutions are not very secure — nothing is too big to fail. Following the USDC incident, USDC’s supply has dropped by $5 billion, highlighting alternatives like LUSD.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News