Five Real Yield Projects Worth Watching: ARC, Pendle, Liquity, FactorDAO, and Radiant

TechFlow Selected TechFlow Selected

Five Real Yield Projects Worth Watching: ARC, Pendle, Liquity, FactorDAO, and Radiant

At a time when DeFi is becoming increasingly popular, these real yield protocols may become an important choice for investors.

Written by: Jack Niewold

Compiled by: TechFlow

Below is an introduction to how several cryptocurrency projects achieve real yield: ARC, Pendle, Liquity, FactorDAO, and Radiant. These projects utilize different mechanisms that allow investors to earn actual returns by participating in their protocols. As DeFi grows increasingly popular, such real yield protocols may become a significant choice for investors.

1. Arcadeum

$ARC is a project that adopts GMX's $GLP model and applies it across the entire GambleFi ecosystem: a truly decentralized casino. Their products include:

-

Sports betting

-

Poker

-

Roulette and other casino games

-

1000x leverage trading

Notably, Arcadeum’s “real yield” comes from its ALP mechanism, which allows you to provide liquidity to the casino itself:

This gives Arcadeum LPs a guaranteed edge:

• GLP relies on traders, on average, not being profitable

• ALP, however, can guarantee profits

Their announcement of perpetual futures trading with up to 1000x leverage attracted significant attention, but from a real yield perspective, this simply means more liquidations.

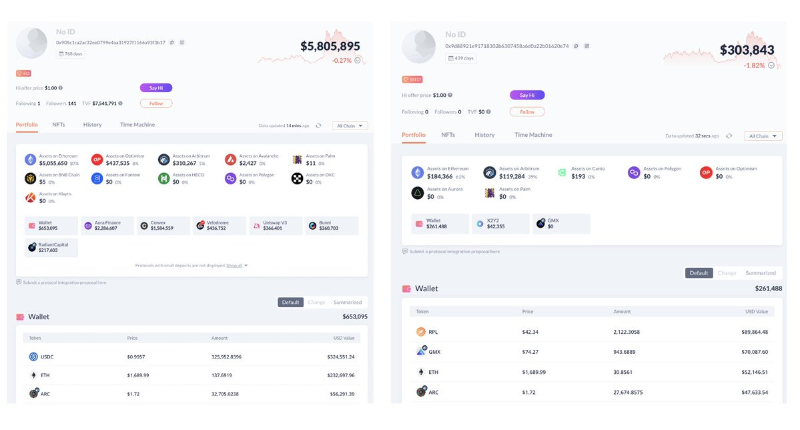

This has caught the attention of Crypto Messiah and other anonymous DeFi whales, all of whom are buying $ARC.

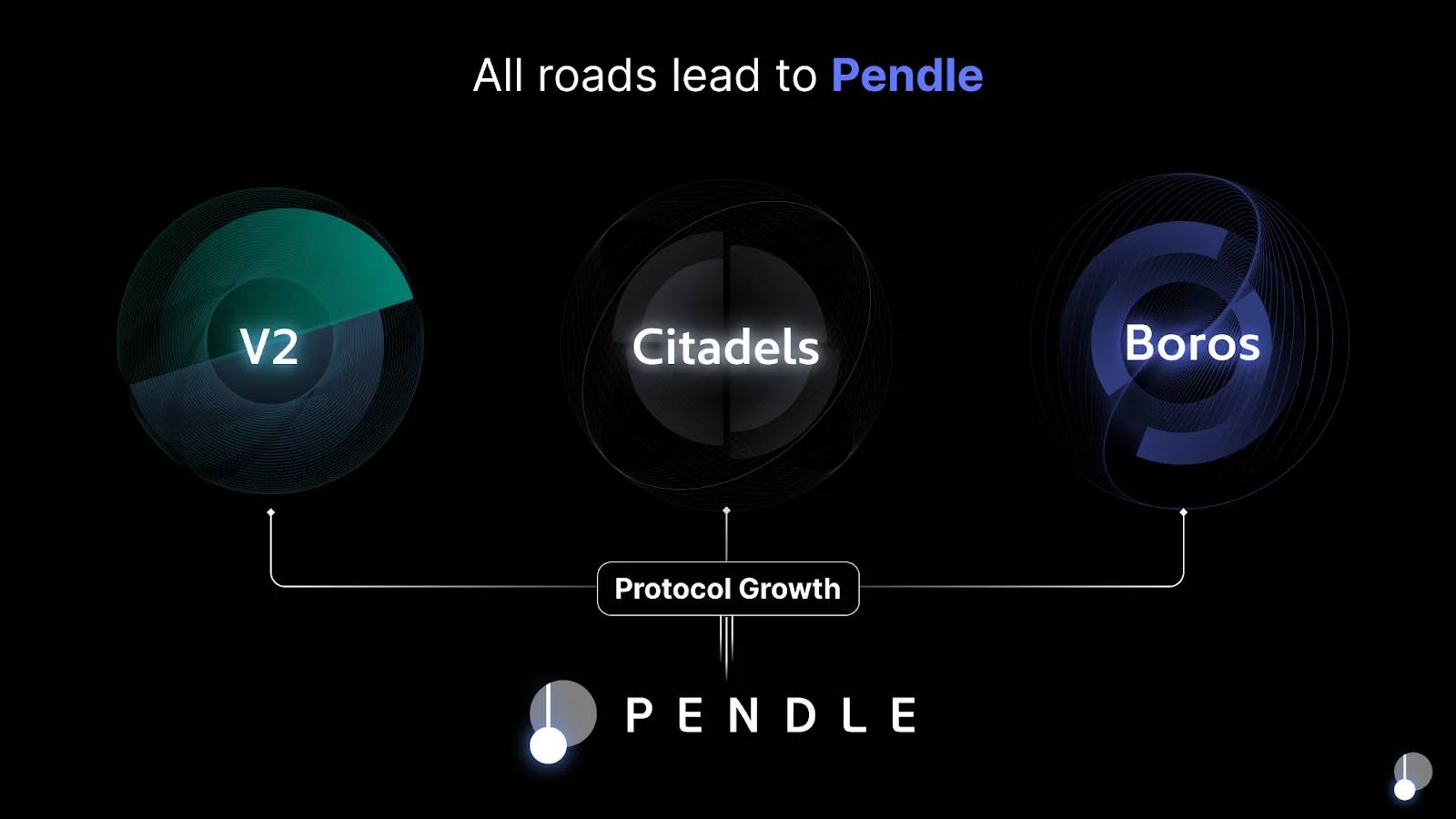

2. Pendle

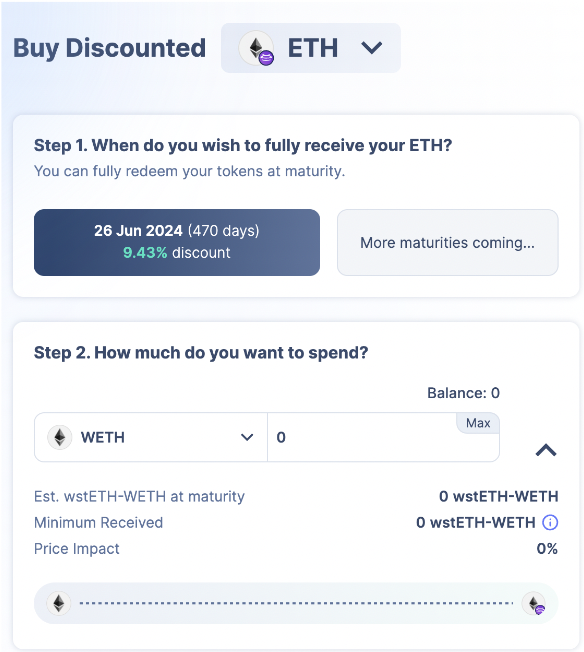

Pendle is a fixed-rate yield protocol that allows you to sell future yield.

It involves two counterparties:

1. Yield sellers: Receive discounted ETH today by selling future yield at a fixed price.

2. Yield buyers: Speculate on future yield by trading GLP/ETH yield.

Since future yield can be immediately converted back into underlying assets, I consider this a “real yield” protocol.

You can speculate on the direction of GLP fees or purchase ETH at a discount today.

Your choice depends on your market outlook and personal risk preference. If you believe GLP fees will rise in the future, you might choose to hold future yield rights. If you prioritize asset liquidity and cash flow, purchasing ETH at a discount would be preferable.

3. Liquity

After a wild week for stablecoins, it's clear we need alternatives to USDC and USDT. Consider $LQTY—a project that generates real cash earnings for token holders while continuously growing issuance of its stablecoin, $LUSD.

$LUSD, Liquity’s stablecoin, continues to perform well despite volatility in the broader stablecoin market, maintaining decentralization and censorship resistance. The protocol is designed so that various stakeholders within the ecosystem must pay fees to LQTY holders:

• Borrowing fees

• Excess funds from liquidations

4. FactorDAO

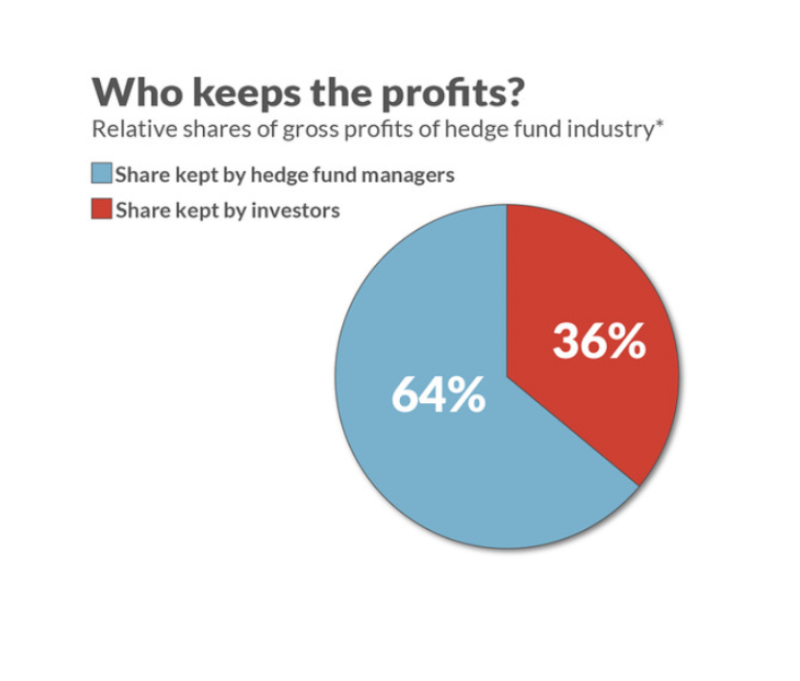

In traditional finance, approximately 66% of funds are actively managed, generating billions in fees annually.

Yet in crypto, most capital remains passively held:

FactorDAO aims to redesign how capital is managed in crypto.

Despite high fees for active management, these funds remain popular because top-performing funds significantly outperform others. FactorDAO enables stakers to earn yield through:

• A share of protocol fees

• Incentives/bribes

5. Radiant

Radiant is a cross-chain money market that effectively operates like a bank:

• Depositors earn interest from borrowers

• Borrowers access capital across different chains

Over-collateralized lending is likely the simplest form of borrowing.

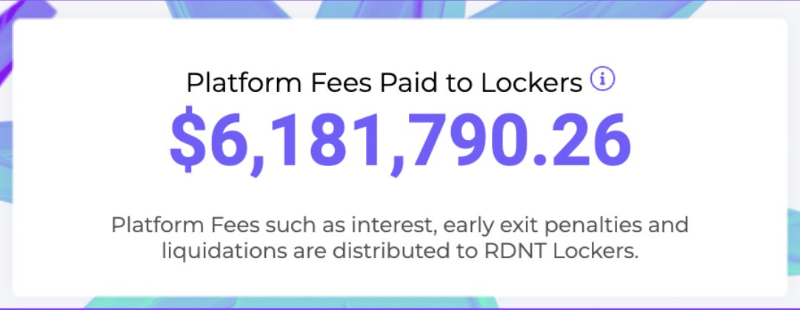

Interest rates fluctuate based on borrowing demand for specific assets. As an RDNT holder, you earn real yield through:

• Borrowing interest

• Platform fees

• Penalties imposed on users who unstake immediately

They’ve distributed over $6 million in payouts despite a market cap of just $69 million.

In crypto, some narratives are long-term (real yield), while others represent rapid capital rotation (AI coins). Given the success of real yield protocols and the push toward more sustainable DeFi models, I believe real yield protocols are here to stay for the foreseeable future.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News