A Brief History of Decentralized Stablecoins: The Problems with Overcollateralized Stablecoins, the Collapse of Algorithmic Stablecoins, and the Rise of Cross-Chain Stablecoins

TechFlow Selected TechFlow Selected

A Brief History of Decentralized Stablecoins: The Problems with Overcollateralized Stablecoins, the Collapse of Algorithmic Stablecoins, and the Rise of Cross-Chain Stablecoins

If only a few banks are needed to destroy decentralized finance, is it really decentralized finance?

Author: TapiocaDAO

Compiled by: TechFlow

July 21, 2014 – March 13, 2023

When Circle's USDC depegged, all "decentralized" stablecoins lost their peg due to the failure of a single bank. Their funerals were all held on the same day as this tragic event, using USDC-wrapped coffins.

If just a few banks can destroy decentralized finance, is it really decentralized finance?

Here are three questions:

-

Why did nearly every major "decentralized" stablecoin experience significant (10% or more) depegs due to the collapse of one bank?

-

How did we allow most decentralized stablecoins to become USDC wrappers (mostly backed by USDC)?

-

Is there no room for decentralized finance within fully trusted, highly regulated, and transparent banking institutions?

Imagine a truly decentralized, unstoppable, multi-chain-native, overcollateralized dollar-pegged stablecoin about to be born?

In today’s latest “Death of..” series, we’ll tell the story of the death of "decentralized" stablecoins. As tradition dictates, we must first take you back to the beginning—the origin of decentralized stablecoins.

The Father of DeFi Decentralized Stablecoins

Back in early 2014, the coolest, boldest, and most innovative blockchain technology was released. In my opinion, Dan Larimer—the creator of EOS, the so-called “Ethereum killer”—is the true father of decentralized finance. But I’m not talking about that failed blockchain—we’re discussing BitShares.

With the birth of BitShares came BitUSD, the first decentralized stablecoin.

BitShares was like a clown car, continuously rolling out forex pairs: BitEUR, BitCNY, BitJPY, etc. These coins were called “smartcoins,” all fully maintaining their pegs and unlike what some might claim, never turning into flashy meme coins.

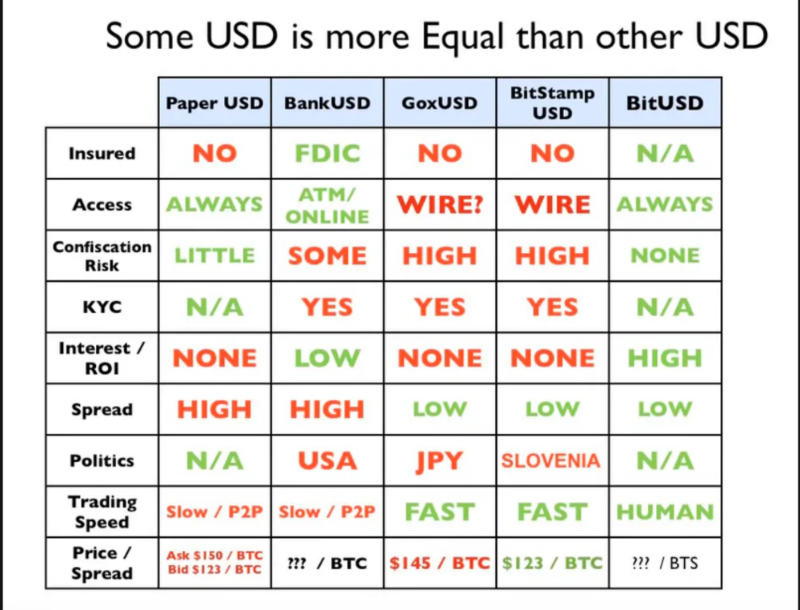

So how did BitUSD work?

Unlike Tether, which was backed by cash reserves, BitUSD was backed by BTS, the native token of BitShares.

To create $1 of bitUSD, you needed to provide $2 worth of BTS as collateral. Thus, bitUSD became the first “overcollateralized” CDP or Collateralized Debt Position stablecoin, equivalent to a 200% collateral ratio (or 50% Loan-to-Value ratio, LTV).

You could redeem the underlying BTS collateral by providing bitUSD, or if the collateral factor dropped below 150%, a basic liquidation mechanism—via a “margin call”—would purchase and liquidate the BTS associated with the bitUSD CDP (again, this was in 2014).

How did bitUSD maintain its dollar peg?

Here’s an actual quote from the BitShares whitepaper: “So far, we have shown that the price of BitUSD is highly correlated with the real dollar; however, we have not yet provided any reasonable method to establish the price.”

Essentially, the price of bitUSD was established based on its weighting relative to BTS on BitShares’ built-in DEX, with no direct mechanism to enforce a $1 price peg for bitUSD.

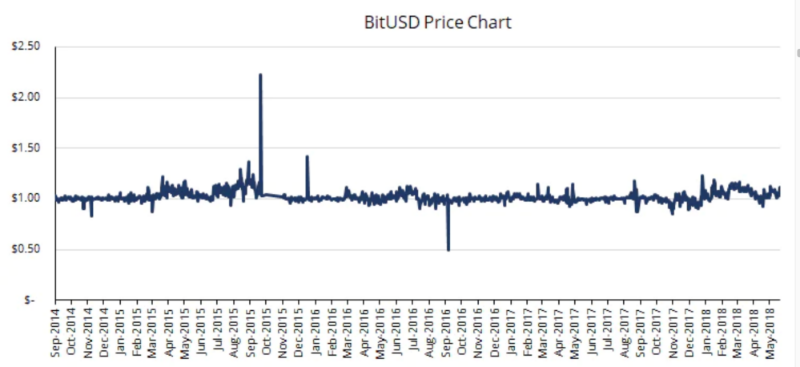

Dan believed bitUSD should trade at $1. While none of the smartcoins perfectly maintained their pegs, bitUSD largely stayed pegged to the dollar.

In 2014, with bitUSD on the BitShares blockchain, you could trade forex, buy bitGOLD and other real-world synthetic assets on early DEXs, lend for yield, borrow against any of these smartcoins, go long or short on any of these assets.

Now you're probably asking yourself: “I’ve never heard of BitShares, so this thing must be dead.” If you think that, you’d be wrong.

Not dead?!

No. Aside from lacking reliable oracle-based price feeds, low trading volume on the BitShares exchange making manipulation easy, and a peg maintenance mechanism equivalent to “well, it should be worth $1, why isn’t it?” there’s a more critical issue—The idea that “bitUSD has 200% BTS backing, so at least it won’t spiral into death” sounds logical, but what is BTS? An asset with extremely low liquidity and high volatility.

Is 1 ETH worth the same as 1 DogeElonSafeMars or FTT? Not all collateral assets are equal. The quality of collateral matters almost as much as the collateral ratio (and many other factors like debt ceiling, liquidation systems, oracle quality, etc.).

Thus, all it would take to break bitUSD’s $1 peg is a sharp drop of 50% or more in BTS, where liquidators would no longer find it profitable to liquidate the underlying BTS.

As mentioned above, BitUSD actually maintained a relatively stable peg to the dollar. However, BitShares as a network was practically unusable. There simply wasn’t enough value in the system. Would someone bother robbing a convenience store when the cash register only holds loose change? Probably not.

As BitShares and BitUSD faded into obscurity, Dan turned to “killing Ethereum” with EOS (which also didn’t go well). So, what would be the next chapter in decentralized stablecoins?

From SAI HAI to DAI

Fast-forwarding through history to the next major stablecoin era: the “Single-Collateral” DAI (or “SAI”) launched in 2017 by the legendary MakerDAO and its leader Rune.

DAI is named after WeiDai, the inventor of cryptocurrency (among other things). Ironically, Rune was originally a prominent member of the BitShares community, and Maker was initially intended to deploy on BitShares.

Compared to bitUSD, DAI’s technical advancement is like comparing a tin-can phone to the iPhone 14 Max. But let’s start with the similarities:

-

SAI had a 150% overcollateralization rate, slightly lower than BitUSD. This offered higher capital efficiency (less idle liquidity). SAI was backed solely by Ether, so SAI—the Single-Collateral DAI—was like BitUSD backed only by BTS.

-

Like bitUSD, SAI was also a CDP-based stablecoin, but far more complex. If borrowers accumulated too much debt due to Maker’s interest rates, chain-external liquidation bots could profitably buy parts of users’ collateral—a smoother and more efficient system than BitShares’ “margin call” mechanism.

That’s where the similarities between SAI and bitUSD end.

SAI deployed on the far more sophisticated Ethereum blockchain.

Maker adopted Oracle price feeds to ensure accurate valuation of the Ether used as collateral. The protocol controlled SAI supply via interest rates—just like a real central bank—allowing users always to exchange SAI for Ether, with arbitrage enforcing the $1 peg: if SAI trades above $1.00, users can mint new SAI at a discount; if below $1.00, users buy SAI to repay debt at a discount.

Even during SAI’s first year, when Ether dropped 80%, SAI still maintained its $1.00 peg.

Power Struggle

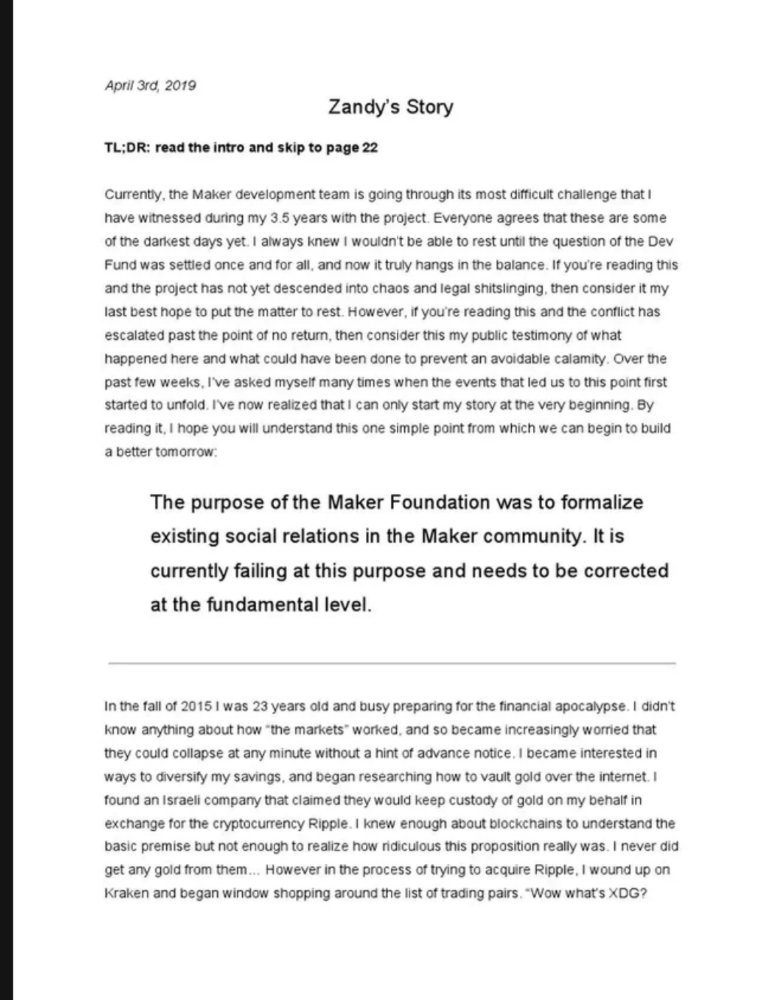

With the highly successful decentralized SAI (Single-Collateral DAI) stablecoin reaching nearly $100 million in liquidity, a power struggle inevitably began—which indeed happened in 2019.

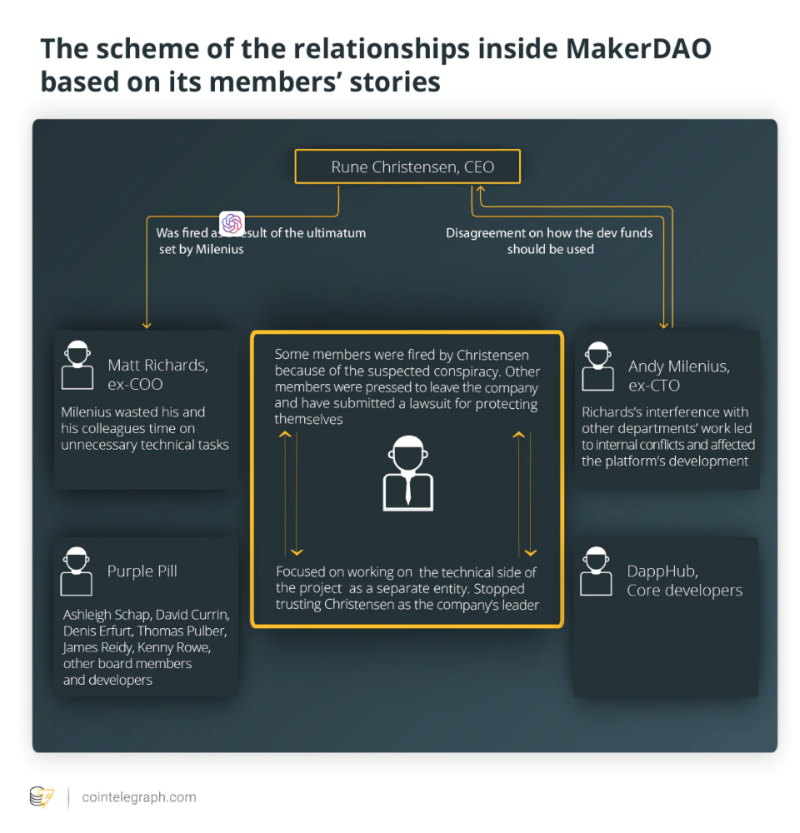

Rune’s views had shifted—he believed the path of pure decentralization was limiting DAI’s potential, and Maker needed to integrate with traditional financial systems to truly succeed. CTO Zandy left Maker due to this strategic shift. Zandy publicly released his memoir “Zandy’s Story” on April 3, 2019.

Before reading it, you’d never know whether it was written in 2019 or 2023—Zandy clearly foresaw what was coming:

After Zandy’s departure, Rune emerged victorious, determined to conquer the world by combining traditional finance (tradfi) and heavily regulated financial systems with DeFi’s trustless medium of exchange—SAI.

Rune presented MakerDAO contributors with two choices—the red pill or the blue pill:

-

Those choosing the red pill committed to delivering regulatory compliance solutions and integrating Maker into existing financial systems.

-

Those choosing the blue pill focused on building core contracts for Multi-Collateral DAI, then were ousted (fired) from Maker.

Unfortunately, core contributors didn’t enter the Matrix, and Rune wasn’t as convincing as Morpheus. Some contributors instead created the “purple pill,” overthrowing Rune and taking control of Maker’s $200 million, continuing SAI’s path as a truly decentralized currency.

The Poisoned Apple

By 2020, Multi-Collateral DAI emerged, supporting additional collateral assets beyond ETH. BAT, or Basic Attention Token, became the second asset allowed to back DAI. The legendary Maker PSM (“Price Stability Module”) was born, enabling seamless exchange of DAI with other assets via MIP29, with low slippage and fees.

On March 16, 2020—a fateful date—Maker introduced a third collateral type for Multi-Collateral DAI: Circle’s USDC.

This was a pivotal moment in DeFi, as a centralized Trojan horse joyfully marched through the gates of DeFi’s top-tier decentralized and censorship-resistant stablecoin fortress.

Initially, it was isolated, with a cap limiting USDC to only 10% of DAI. But once the poisoned apple was bitten, DAI’s USDC backing quickly swelled to dominate DAI’s support.

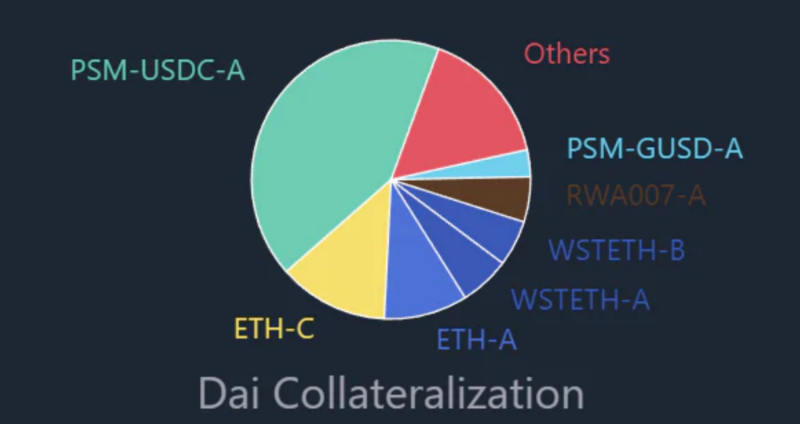

RWA and other centralized stablecoins were somewhat isolated, but USDC now accounts for 57% of circulating DAI and 40% of its backing.

This event triggered ripple effects, luring more and more “decentralized” stablecoins to bite the centralized poisoned apple—especially Circle’s stablecoin, gaining meaningful adoption during the 2021 bull market frenzy.

The massive capital offered by Circle and other centralized entities proved too tempting, easily causing us to forget why crypto was created—the 2008 financial crisis and the repeated collapse of banking institutions due to endless greed and reckless negligence.

Fifteen years later, we’re still stuck in the same damn place...

To give you a sense of recent months in crypto:

-

Silicon Valley Bank: $1.8 billion loss;

-

Silvergate Bank: $1 billion loss;

-

FTX: $8 billion loss;

-

Celsius: $5 billion loss;

-

Three Arrows Capital: $3.5 billion loss;

-

Genesis (Digital Currency Group): $3.4 billion loss;

-

Total: $22.7 billion.

While Lehman Brothers’ 2008 bankruptcy reached $600 billion, we can keep deceiving ourselves that centralized entities are “too big to fail.” And USDC is decentralized because they manage it in a decentralized way—even though Circle (or the government) can press a button to erase them from existence.

No centralized entity is too big to fail, and we need a trustless, censorship-resistant dollar-pegged currency—like SAI once was—one of the most fundamental needs in truly decentralized finance. Without a dollar-based decentralized currency, how can you even imagine the existence of a decentralized financial system?

Wake Up

In August 2022, after Alexey Pertsev (founder of Tornado Cash) was arrested, Rune (apparently) realized the dire situation facing DeFi, even suggesting we seriously consider decoupling multi-billion-dollar stablecoins (DAI) from the dollar.

Now, centralized entities possess DAI’s “kill switch,” able to flip it at will—and consequently collapse most “decentralized” financial systems like a bug.

Subsequently, Rune released the now-famous Maker Endgame proposal.

This radical shift aims to initiate chemotherapy on Maker’s centralized tumor—accumulating ETH into Maker’s PSM and eventually swapping all remaining USDC into ETH, becoming a censorship-resistant... freely floating non-stablecoin.

Maker also released an emergency proposal to begin purging centralized assets from Maker’s PSM following Silvergate Bank, Silicon Valley Bank, and Circle’s USDC depeg, as DAI began unlocking.

But unfortunately, I believe this cancer is already terminal.

Deeper issues further compound Maker and DAI’s predicament:

-

Circular financing: Backing DAI with... DAI (DAI / USDC LP - $375 million)

-

Centralization: $300 million Gemini USD (GUSD) backs DAI.

-

Custody risk: $1.6 billion USDC in Maker’s PSM is lent to Coinbase Prime.

-

More centralization: Abusing Maker’s upgradable automated contracts to seize user funds from DAI vaults (Wormhole Hacker’s $202 million), serving British courts.

In my view, DAI is now so poisoned by centralized assets (and governance theater) that it’s no longer the censorship-resistant decentralized stablecoin it once was—especially compared to its Single-Collateral DAI days.

But before we dive into what might emerge in our beloved wide-open field, we must first examine this tattered scroll—an ancient chronicle of decentralized stablecoins written by Rick, the so-called “master” of stablecoins.

Rick and Morty’s Foundation in Decentralized Stablecoins

Your first thought might be, “Wait, Rick?”

Before this stablecoin “master” used his real name, he went by Rick—a pseudonym borrowed from the main character of the popular animated show “Rick and Morty”—and dubbed an engineer from his company as “Morty.”

So what did “Rick” and “Morty” build? Basis Cash. Actually, they didn’t really “build” anything. Basis Cash existed long before Rick claimed the title of stablecoin “master,” tracing its roots back to Basecoin / Basis. Basecoin was an unbacked algorithmic stablecoin leveraging the now-common monetary issuance model. Essentially, when Basecoin fell below its peg, Base Bonds would be auctioned to re-peg it; when above peg, shares would be issued.

Let’s take a step back—what is an algorithmic stablecoin?

Algorithmic stablecoins aren’t directly backed; instead, they rely on mathematical formulas and incentive mechanisms to maintain price parity with the dollar. In other words, it’s a proven way to ensure many people lose large sums of money.

Currently, the three main algorithmic stablecoin models are Rebases, Seigniorage, and the newest—Fractionally Backed—the hybrid of collateral and monetary issuance.

-

Rebase—The stablecoin mints or burns supply to maintain its dollar peg. Ampleforth is an example. Generally, Rebase stablecoins are no longer favored.

-

Monetary Issuance—These stablecoins typically require a multi-token economy. A stable token and a second, non-fixed-price token work together to stabilize the stablecoin. Incentives usually encourage market participants to buy or sell the secondary asset to keep the stablecoin pegged.

-

Fractional Backing—Part monetary issuance, part collateral. Frax is an example. That said, Frax has adjusted its collateral ratio to 100% for some time, and despite being fully backed by USDC, Frax has now officially declared it will become an overcollateralized stablecoin under FIP-188.

Regardless, Basecoin was never deployed because its founder Nader Al-Naji cited regulatory restrictions forcing Basecoin to shut down.

Yet, Nader believed that cloning the Bitcoin blockchain, naming it “BitClout,” selling CLOUT tokens to VCs at $0.80, then reselling them to retail investors at $180—enabling himself and a group of “top-tier” VCs to rapidly profit 5000%—wouldn’t attract regulatory scrutiny.

El jefe will never understand, in Nader’s mind, how Basecoin’s mechanism could be considered less legitimate than him and a group of “top-tier” VCs scamming retail investors for massive profits.

However, returning to our stablecoin master “Rick,” he didn’t care about Nader’s legal concerns—or more importantly, technical sustainability. In summer 2020, he made an announcement via his Telegram group, rivaling only the Sermon on the Mount:

“Does anyone remember what Basis was? It was an early DeFi algorithmic stablecoin, ambitious, but shut down due to risks related to the SEC. Today we resurrect Basis Cash from the grave.”

With this declaration, “Rick” began his mission! An algorithmic stablecoin based on monetary issuance—one we all know (don’t worry, we’ll get to it).

The Foundations of Basis Cash

Basis Cash launched in summer 2020. Rick & Morty deployed Basis Cash (the stablecoin), Basis Bonds, and Basis Shares.

A quick history lesson helps explain algorithmic stablecoins like Basis and money itself—the U.S. Treasury is the institution through which the U.S. government can print dollars and issue bonds and treasury bills. Therefore, algorithmic stablecoins like Basis Cash aren’t innovative at all—they merely mimic the actual fiat system, which functions perfectly well.

Basis Cash = USD, Basis Bonds = Government Bonds, Basis Shares = Treasury Bills.

One caveat: Is the U.S. government’s creditworthiness as reliable as “Rick and Morty”?

Basis Cash was a terrible idea and a Ponzi scheme, ultimately absorbing $30 million before crashing to $0.30 in January 2021. But Rick & Morty kept busy—they launched Empty Set Dollar (ESD), which plummeted from a $22 million market cap to pennies within months, and Dynamic Set Dollar (DSD), another failure. See the pattern?

But why did Basis Cash fail?

Basis Cash was the best performer among the three, reaching a $170 million market cap. Surprisingly, it didn’t catastrophically fail—it just never maintained its dollar peg.

The best summary of Rick & Morty’s adventure starts with this quote: “When DeFi degens are busy diving into zero-sum games like Emptysetsquad, Dsdproject, and BasisCash, remember—the only truly stable force in algorithmic stablecoins is growing adoption and usage.”

Who said that? Rick of Rick & Morty—the very person who built ESD, DSD, and BAC.

That doesn’t make sense—why would Rick call his own projects “zero-sum games”?

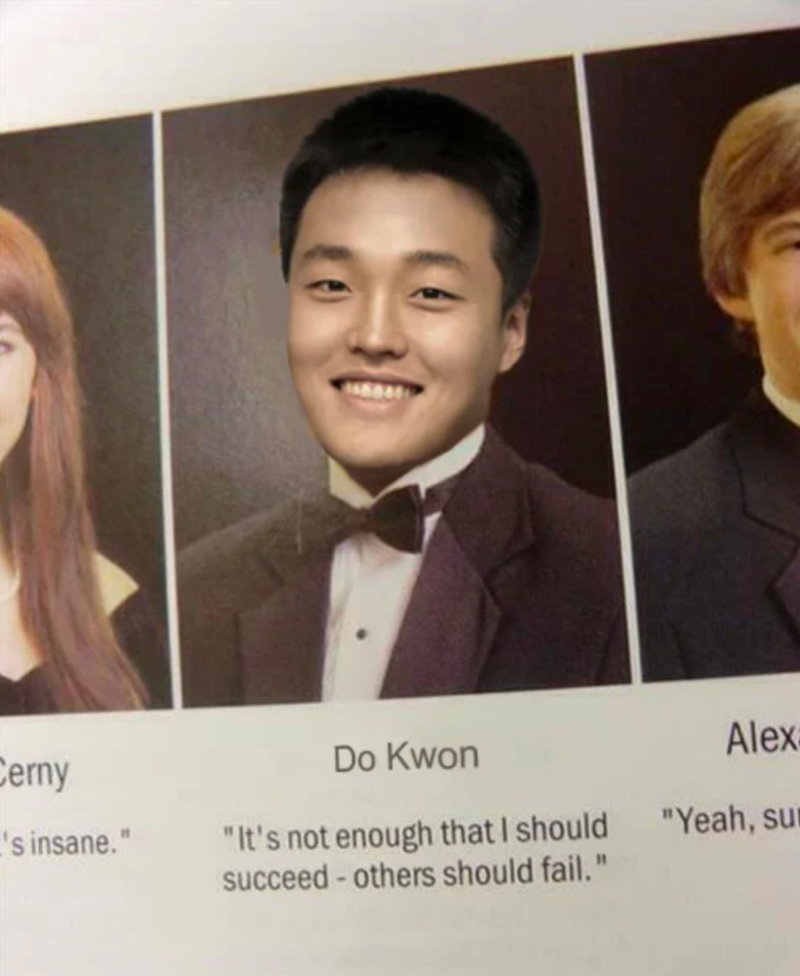

Because Rick is no longer called Rick—he’s now known as Do Kwon. Having three failed stablecoins gave him the experience to make his fourth disaster the biggest yet.

Yet, that’s not the most ironic or interesting part of the statement. “The only stable force in algorithmic stablecoins is growing adoption and usage.” What does that mean? Do Kwon realized that to maintain an algorithmic stablecoin’s peg, people must keep buying into the ecosystem to sustain it. Well, what’s that called again? A Ponzi scheme?

Rick realized his “unbacked” stablecoins—ESD, DSD, and Basis—lacked the crucial element of incentivizing users to buy and keep buying to maintain stability. So let’s keep failing!

Can Do Kwon Destroy DeFi?

Yes, you can—enter Terra.

In 2019, Do Kwon and Terraform Labs, registered in Singapore, completed the seed round of LUNA tokens at $0.18, creating a Cosmos blockchain with participation from every “top VC” (oxymoron).

Soon after in 2020, UST was publicly announced on the Terra blockchain as a “decentralized” stablecoin. But there’s a second key part—the Anchor Protocol, a money market on Terra offering high, consistent yields paid in UST, was created by an engineer at Terraform Labs. Developers told Do they’d set Anchor’s yield at 3.6%. One week before Anchor’s launch, Do told them: “3? No, let’s do 20%”.

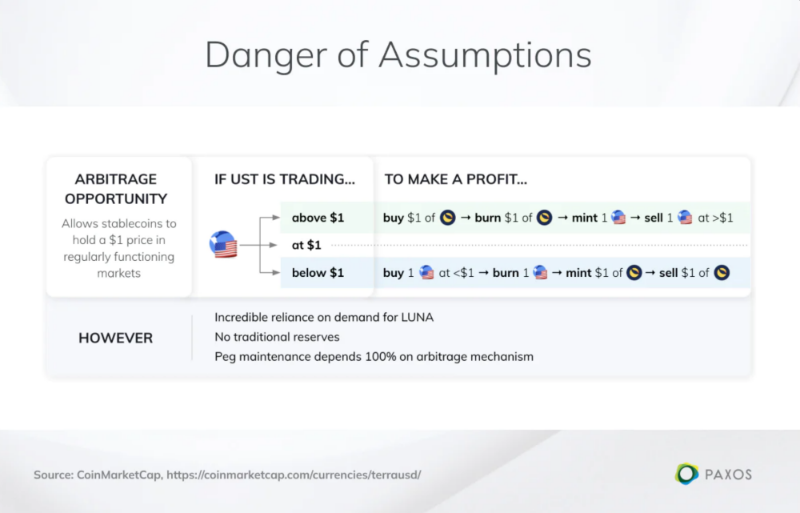

UST, also known as TerraUST, is a “decentralized” stablecoin. Many anonymous users mistakenly believe UST is backed by LUNA—but it’s not.

UST has no backing whatsoever—it’s a purely uncollateralized algorithmic stablecoin.

We’ve discussed the monetary issuance model, but let’s explain it again: You can burn $1 worth of LUNA to create 1 UST, and vice versa.

-

If UST trades above peg, you can convert $1 of LUNA into 1 UST (worth more than $1) and sell it for profit.

-

If UST trades below peg, you can always burn 1 UST for $1 worth of LUNA. (This is the crucial part)

Theoretically, this model may seem somewhat reasonable. But remember: “The only stable force in algorithmic stablecoins is growing adoption and usage.”

Why would anyone take the risk of holding or using UST over USDC or DAI?

Well, here’s the $60 billion answer—remember that Anchor Protocol? That was Terra’s central bank. Remember that guaranteed 20% yield?

Essentially, you could deposit UST into Anchor and earn a steady 20% APY. This meant for every UST deposited, you’d receive $1.20 after a year. How is this possible when real banks barely offer 1% yields? Well, we’ll come back to that. But through this Ponzi-like yield, DK gained his “stable force,” attracting adoption and usage of UST with absurdly high returns!

Additionally, in 2021, Do Kwon tweeted that the “Black Wednesday Soros attack” attempting to destroy UST was “stupid.”

What is the “Black Wednesday Soros attack”?

Black Wednesday

To explain this as effectively as possible: In 1990, the UK joined the European Exchange Rate Mechanism (ERM). The ERM effectively pegged member currencies to the European Currency Unit (ECU), a basket of member currencies. The ECU ensured all member currencies traded within a “band” against each other, minimizing exchange rate volatility across Europe to gradually adopt a shared European currency. But when member countries placed their currencies within this “band,” they artificially altered their currency values for exchange convenience, potentially leaving them vulnerable.

Since the German Deutsche Mark (DM) economy was booming, most ERM members closely tied to the Bundesbank. However, there was a problem—Germany’s economy thrived while the UK suffered from inflation amid economic stagnation.

When the UK entered the ERM, it set its exchange rate at 2.95 DM = 1 GBP, overvaluing the pound. Inflation continued to spiral in the UK, forcing interest rates up to 10%, further worsening economic stagnation.

A billionaire named George Soros saw the UK had entered the ERM at an overvalued rate and decided to short £1 billion against a 20:1 leveraged position. Central bankers thought Soros was overleveraged like a Web3 VC on Adderall, but Soros knew this was a house of cards he could easily topple—and profit enormously.

This forced the UK into a game of “chicken” with Soros—either let the pound depreciate and let Soros print money from his short, or find a way to squeeze Soros out. So the UK repurchased pounds. Starting Tuesday, September 15, 1992, the Bank of England faced a bank run. It looked bad, but in hindsight, Tuesday was trivial compared to Wednesday.

Wednesday, September 16, 1992, was “Black Wednesday.” The Bank of England bought back $2 billion in pounds per hour, eventually forced to abandon all options and formally exit the ERM—completely uncoupling the pound from the Deutsche Mark. This caused the pound to sharply depreciate, allowing Soros to repay his leveraged loan and walk away with $1 billion in profit, nearly collapsing the UK economy.

Therefore, the artificially pegged pound, repurchases, and bank run triggered Black Wednesday—let’s keep that in mind as we return to Do Kwon.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News