ArkStream Capital: Modular Blockchains—The Infrastructure Driving Web3 Ecosystem Evolution

TechFlow Selected TechFlow Selected

ArkStream Capital: Modular Blockchains—The Infrastructure Driving Web3 Ecosystem Evolution

The Next Billion-Dollar Infrastructure Narrative—Modular Blockchains

Abstract

Undoubtedly, modular blockchains will become the new infrastructure narrative for the next cycle. However, this does not mean that monolithic blockchains will be replaced. On the contrary, the development of modular blockchains will serve as a key catalyst driving the evolution and advancement of monolithic blockchains. Together, they will complement each other’s strengths and jointly lead and support the next wave of Web3 ecosystems targeting over a billion users.

Compared to a precise definition of modular blockchains, experiencing and understanding their execution layer, data availability layer, consensus layer, and settlement layer through real transactions and block data provides a more intuitive grasp;

The execution layer acts as a pioneer in scaling transaction capacity and outsourcing computation for monolithic blockchains. The data availability layer not only reduces costs and improves efficiency in blockchain data storage but also ensures data verifiability and accessibility under consensus security. The consensus layer aims to reuse decentralized power by building novel frameworks for decentralized construction. The core function of the settlement layer lies in optimizing the matching between account assets and transaction records, ensuring correct associations between them.

Definition, Development, Advantages, Disadvantages, and Solutions of Monolithic Blockchains

The birth of Bitcoin marked the arrival of a decentralized electronic cash system, introducing people to the concept of blockchain technology and the Proof-of-Work (PoW) consensus mechanism. Later, Ethereum emerged as a "world computer" and smart contract platform, showcasing vast potential across finance, social applications, and gaming due to its powerful programmability. Although blockchain has remained in early stages regarding adoption and technical maturity over more than a decade, its potential remains immense.

Typically, public chains we interact with today are collectively referred to as monolithic blockchains. They use transactions as carriers, store valid transaction records in blocks, and achieve decentralized, trustless, and tamper-proof distributed ledger networks via specific consensus mechanisms.

Monolithic blockchains feature the ability to independently build comprehensive ecosystems—from wallets and applications to middleware and infrastructure—with tightly integrated components. However, as these ecosystems grow and flourish, issues such as transaction congestion, rising transaction costs, high network participation barriers, and increasing costs for maintaining global state emerge. During periods of high concurrency, limited transaction throughput often makes monolithic blockchains expensive and difficult to use, significantly degrading user experience. Moreover, as the blockchain grows continuously, it faces state explosion, raising both the threshold and cost of maintaining the entire network.

To address these limitations, industry professionals have conducted extensive research and exploration over the years in areas like scalability and state pruning. This includes—but is not limited to—technologies such as state channels, sidechains, rollups, light nodes, sharding, and modularity. These efforts continue to optimize the blockchain tech stack and enhance blockchain adoption.

Definition and Products of Modular Blockchains:

At its core, modular blockchain redefines and divides the layered architecture of blockchains using aggregation and composability principles, breaking it into distinct modules. These modules operate independently, can be modified or extended based on needs, and can be combined flexibly. Such composable modular blockchains improve performance across multiple dimensions and better meet diverse application scenarios.

Previously, when thinking from the perspective of monolithic blockchain architecture, we were accustomed to dividing it into: application layer hosting dApps, execution layer handling smart contract logic, consensus layer managing transaction validity, ordering, and block formation, data layer storing transactions and blocks, and network layer enabling peer-to-peer broadcasting.

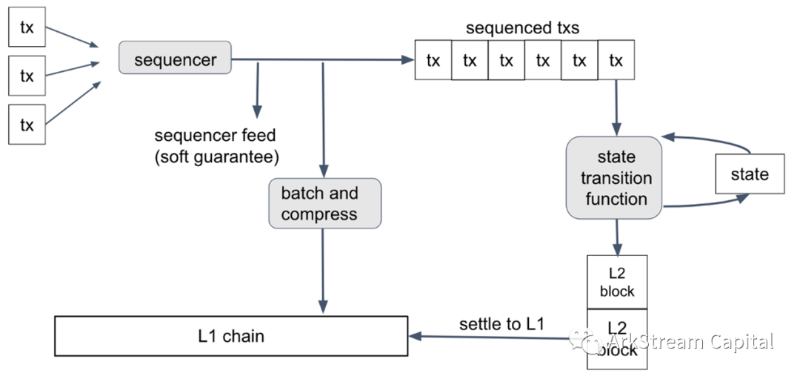

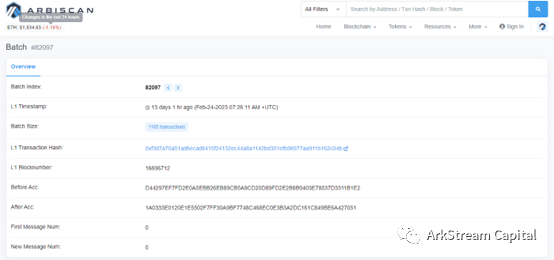

Understanding modular blockchain layers through the lens of monolithic blockchain thinking often leads to confusion. At this point, taking the user's perspective and examining Arbitrum—an Ethereum optimistic rollup Layer 2 network—in action offers an intuitive and deep insight. According to Arbitrum’s whitepaper description of Layer 2 transaction flow: User-submitted transactions no longer directly interact with the Layer 1 network; instead, they are collected and batch-processed by the sequencer on Layer 2. The sequencer compresses raw data from multiple transactions and sends it to Layer 1, while also sorting the transactions, computing changes in user and network states, and sending the resulting state updates to Layer 1 for settlement.

The Layer 2 sequencer collects and processes transactions (execution layer)

Layer 2 compresses processed transactions and sends them to Layer 1 (data availability layer)

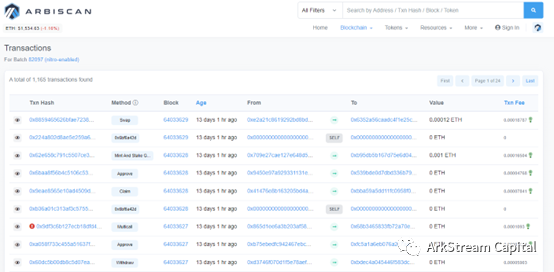

As for settlement details, Arbitrum’s block explorer does not clearly map individual settlements. Here, we turn directly to Arbitrum’s official smart contracts deployed on Ethereum, analyzing settlement-related functions in the Delayed Inbox contract: sendL1FundedContractTransaction, which is called when disputes arise; otherwise, the Outbox contract's updateSendRoot function is invoked. For related contract addresses, refer to: https://developer.arbitrum.io/useful-addresses.

Now, we have a clear and intuitive understanding of the respective roles of the execution layer, data availability layer, consensus layer, and settlement layer. The execution layer refers to the sequencer’s batch processing of transactions—including compression of raw transaction data and calculation of state transitions. The settlement layer confirms finality of state changes. The data availability layer involves Layer 1 storing and maintaining compressed transaction data generated by the execution layer. As for the consensus layer, it secures the safety upon which the execution layer relies in terms of data availability and settlement.

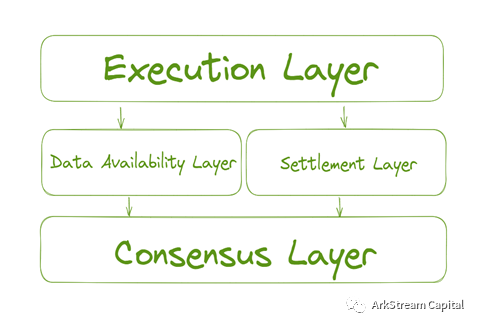

According to the top-down definition, the hierarchical structure of modular blockchains is illustrated below:

Since the settlement layer involves designs for proving transaction validity across different execution layers—such as optimistic fraud proofs and zero-knowledge proofs—we will temporarily set aside deeper analysis. Below, we focus directly on the three commonly discussed modules in modular blockchains: execution layer, data availability layer, and consensus layer—emphasizing their background, problems solved, current developments, and challenges faced.

Execution Layer Products and Projects

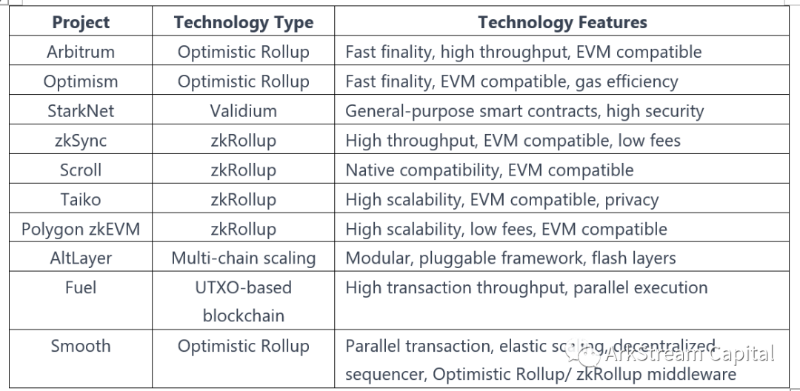

Before the formal emergence of dedicated execution layer products, a term frequently heard was “Ethereum killer,” indicating a clear mismatch between user demands—regarding transaction throughput, speed, and cost—and what Ethereum currently offers. To bridge this gap, many new public chains explored innovations in transaction structures, block design, consensus mechanisms, and network broadcast protocols to construct entirely new high-performance blockchains capable of achieving massive throughput, fast speeds, and low fees. Meanwhile, Ethereum’s ecosystem actively researched various technological approaches. Today, the Rollup-centric Layer 2 roadmap dominates, with optimistic rollups like Optimism and Arbitrum surpassing other EVM-compatible chains in project development, user acquisition, and retention. Additionally, ZK-Rollups based on zero-knowledge proofs (Starknet, Hermez, zkSync, Scroll, Taiko, etc.) and parallelized execution platforms like Fuel, AltLayer, Smooth continue advancing within their respective domains.

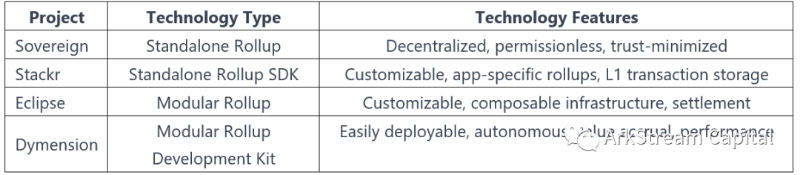

With the robust growth of rollups and similar Layer 2 solutions, the concept of an “execution layer” encompassing these rollups and parallel execution systems has formally emerged. Notably, beyond Ethereum, even high-TPS, low-cost chains like Solana, BNB Chain, Cosmos, and Aptos have seen official or community-driven proposals for their own rollups and execution layer offerings. Thus, we are not only entering an era of multi-chain coexistence but also one of diverse execution layers coexisting. This brings new challenges: isolated and closed-off execution environments hinder ecosystem interoperability; cross-layer operations become costly for users; developers face long cycles and high expenses in building and operating applications. In response, “Rollup-as-a-Service” (RaaS) platforms have emerged—such as Sovereign Labs, Stackr Labs, Eclipse Builders, and Dymension. These act as execution layer hubs, transforming traditional Layer 2 rollups into Layer 3 constructs, thereby forming tree-like architectures with one hub and multiple rollups.

Driven by historical demand for scalability, execution layer products have undergone years of exploration and development, achieving significant breakthroughs. Nevertheless, unresolved challenges remain under active investigation in future cycles—such as decentralized sequencers, zkEVMs, and parallel transaction processing.

Data Availability Layer Products and Projects

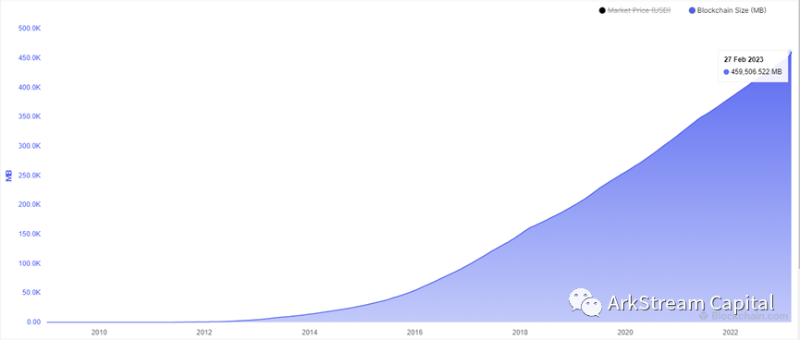

In the age of big data and cloud computing, data—as a foundational modern resource—plays a strategic role akin to oil in decision-making contexts. When referring to blockchain data, we typically mean on-chain transaction and smart contract data. Its storage differs fundamentally from traditional databases: each node maintains a complete copy of all data. With growing on-chain activity and smart contract complexity, blockchain data is transitioning from linear to exponential growth. For instance, Bitcoin’s total network size grew steadily at ~50GB per year since 2016, starting from 55GB. But since 2020, annual growth jumped to ~60GB, reaching 459GB by February 2023.

https://www.blockchain.com/explorer/charts/blocks-size

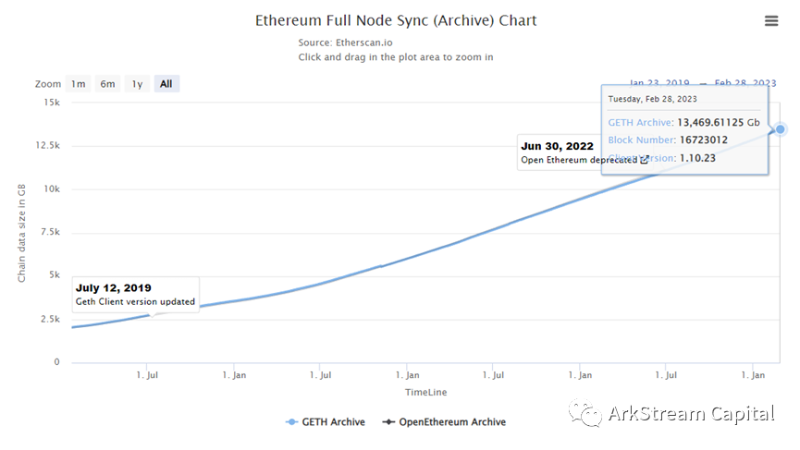

As a world computer and smart contract platform, Ethereum’s total data volume far exceeds Bitcoin’s, which focuses primarily on payments. According to Etherscan, running a default full node on Ethereum now requires over 800GB, while an archive node demands at least 13,000GB of storage.

Beyond sheer volume, much of this data is unstructured, making processing, indexing, and querying extremely difficult. Hence, from the monolithic blockchain perspective, efficiently and affordably storing, rapidly processing, and supporting massive access to blockchain data has become a critical research direction.

Even in the original Bitcoin whitepaper, Satoshi Nakamoto proposed preliminary solutions to state bloat: Reclaiming Disk Space and Simple Payment Verification (SPV). Reclaiming Disk Space allows nodes to prune historical data to reduce overall size—this helps lower maintenance costs and entry barriers. However, given the massive scale of network data and differences in account models (e.g., Ethereum vs. UTXO), direct applicability is limited. Based on this idea, the Ethereum community pursued Stateless Ethereum, aiming to offload account state from the main chain. SPV promotes lightweight clients using Merkle trees to verify transactions, lowering participation thresholds while preserving data validity. But since SPV clients only download block headers, they remain vulnerable to fraudulent proof attacks. To counter this, Mustafa Al-Bassam (co-founder of Celestia), Alberto Sonnino (Mysten Labs), and Vitalik Buterin published “Fraud and Data Availability Proofs: Maximising Light Client Security and Scaling Blockchains with Dishonest Majorities” in 2018, proposing defenses against such attacks. Thus, data availability in monolithic blockchains can be understood as light clients verifying transaction validity without fully syncing block data—relying solely on transaction Merkle trees.

For modular blockchain execution layers, monolithic blockchain data becomes on-chain data, while execution layer transaction data—after compression—is stored off-chain atop this on-chain base. On-chain data imposes not only direct requirements on performance and cost (storage/query), but must also leverage the underlying consensus mechanism for security assurance. Indeed, the rise of execution layer products has enriched our understanding of data availability in monolithic blockchains and broadened the context of the data availability layer.

Before proceeding further, it's essential to distinguish between the data availability layer and the data storage layer—they are not interchangeable. The data availability layer emphasizes accessibility from the standpoint of data validity. The data storage layer focuses more on hardware-level definitions of storage and usage performance, emphasizing on-chain storage costs and read/write efficiency. Data availability necessarily builds upon the data storage layer, extending it through the addition of consensus mechanisms that ensure verifiability. Put differently: Don’t Trust, Verify—the “Verify” here corresponds precisely to data availability.

Ethereum, currently the preferred data availability layer for execution layer products, suffers from notable drawbacks due to its Gas model and Calldata structure:

1. High operational and storage costs;

2. Limited storage capacity;

3. Unequal distribution of network resources.

To address these, Ethereum proposes Proto-Danksharding (EIP-4844), Data Availability Sampling (DAS), Erasure Coding, and Proposer/Builder Separation as part of its data sharding and state scaling roadmap.

In the future, Ethereum plans to introduce Blob transactions and an additional data layer, reducing dynamic on-chain storage costs while preserving data availability. Meanwhile, specialized DA projects are pushing forward not only in DAS and erasure coding but also innovating in areas like Polygon Avail’s Fast Sync and Celestia’s sovereignty and interoperability. Beyond dedicated DA layers, new storage-sidechain initiatives like BNB Greenfield, and hybrid storage solutions like Kvye and Arweave are emerging in the broader data storage landscape.

Consensus Layer Products and Projects

Not your keys, not your crypto. In blockchain networks, private keys represent ownership of digital assets. To secure this link between keys and asset ownership, blockchains require robust consensus mechanisms that ensure sufficient decentralization and security. Consensus mechanisms validate data conforming to monolithic blockchain formats—for example, Bitcoin secures its transactions and embedded scripts, while Ethereum secures transactions executable and verifiable within the EVM.

Moreover, because two fundamentally different consensus mechanisms exist in the blockchain world—PoW and PoS—it is challenging to interoperate or combine them across different monolithic blockchains. Even inherently interoperable chains like Cosmos and Polkadot, despite achieving compatibility in transaction formats or consensus rules, still struggle to share consensus mechanisms effectively.

Before diving into consensus layer products, let’s first review the development and current status of PoW and PoS.

PoW can be roughly understood as securing blockchain networks using real-world computational power. The most common threats are 51% attacks and double-spending. Therefore, network security depends directly on having sufficiently large computational power.

Many newer PoW chains face security risks during cold starts due to insufficient initial hash rate. To mitigate this, they either endure long, costly periods of hash accumulation or consider merged mining—leveraging Bitcoin’s or other established PoW networks’ hashing power using the same algorithm.

Since blockchain hash power accumulates gradually with block height, merged mining rents hash power via crypto-economic incentives. When interests align between two chains, merged mining is attractive to miners. However, when a new PoW chain conflicts with Bitcoin’s interests, Bitcoin cannot enforce penalties at the protocol level, so miners may act against the newer chain.

For example, Namecoin once used merged mining with Bitcoin, but misaligned incentives created latent risks. RSK, a Turing-incomplete sidechain of Bitcoin with smart contract functionality, optimized alignment with Bitcoin’s incentives, yet its development remains constrained by Bitcoin’s lack of Turing completeness, limiting progress in merged mining innovation.

Similarly, Quai Network was designed from the start to implement multi-chain joint PoW, pooling hash power across chains. Still, this merely distributes cold-start consensus costs rather than enabling true reuse or composition of PoW consensus mechanisms.

The core of PoS consensus is protecting the network via staked value—the higher the stake value, the greater the network’s overall security and worth. Only sufficiently valuable stakes can secure high-value networks. Modern PoS systems are largely improvements over PBFT, remaining fundamentally proof-of-stake. Prominent examples include Cosmos and Polkadot. Adhering to minimal-trust principles, Cosmos Hub does not actively interfere with the consensus mechanisms of its connected app-chains.

App-chains in the Cosmos ecosystem benefit from mature development toolkits, but establishing and maintaining validator sets comes with high barriers and costs—reflecting the price of trust and security. Many chains rely on token airdrops and high inflation rewards to attract Cosmos validators. To reduce consensus setup costs and boost app-chain security, Cosmos 2.0 introduced several enhancements: Interchain Security (ICS) allows shared security for app-chains, and Space Mesh enables consensus sharing.

Additionally, Babylon in the Cosmos ecosystem attempts to import Bitcoin’s PoW security to protect app-chains. Polkadot, known for strong on-chain governance and cutting-edge consensus design, extends its security boundary to other chains through parachain slot auctions. While these mechanisms are visionary in consensus reuse, mismatches between governance efficiency and consensus urgency have contributed to Polkadot’s parachains fading from prominence.

Now, turning to post-merge Ethereum with its PoS consensus: Ethereum stands out as an exceptional consensus layer resource. Years of PoW development have endowed it with substantial economic value. Combined with years of iterative refinement in PoS, a mature smart contract platform, and a thriving ecosystem of execution layer products, Ethereum is now well-positioned to serve as the foundation for next-generation consensus layer services.

Building on Ethereum’s existing staking model, we can design effective incentive and penalty mechanisms to reuse staked ETH—allowing portions of it to secure other types of networks, such as oracle networks or cross-chain bridges.

EigenLayer has conducted extensive research in this domain and recently released a whitepaper formally introducing the concept of Restaking, detailing its slashing mechanism and network design. Furthermore, the booming liquid staking derivatives sector already controls vast amounts of staked ETH. Once suitable consensus layer products emerge, these liquid staking platforms could seamlessly transition into consensus providers.

Conclusion

Modern software development embraces microservices architecture—breaking applications into independent, functional services that can be developed, deployed, and operated autonomously. These services communicate and share data flexibly, enhancing scalability, flexibility, and maintainability. Though microservices still face practical challenges—like distributed transactions, service governance, and security—these issues are gradually being resolved as the technology matures and experience accumulates.

Modular blockchains share many similarities with microservices architecture. As blockchain evolves, modular design will become a pivotal direction. Currently, execution layer products are increasingly shouldering transaction computation workloads, delivering outstanding results across user and transaction metrics. Data availability and consensus layers continue advancing in their respective domains, while the settlement layer remains underdeveloped. The potential for flexible combinations among these layers unlocks boundless possibilities. Looking ahead, we have every reason to believe that modular blockchains will drive innovation and opportunity, playing a crucial role in advancing blockchain technology and its real-world applications.

References

https://developer.offchainlabs.com/docs/home

https://community.optimism.io/

https://starkware.co/starknet/

https://zksync.io/dev/

https://scroll.io/

https://taiko.xyz/

https://www.paradigm.xyz/2022/08/dasData Availability Sampling: From Basics to Open Problems

https://arxiv.org/abs/1809.09044Fraud and Data Availability Proofs: Maximising Light Client Security and Scaling Blockchains with Dishonest Majorities

https://ethereum.org/en/developers/docs/data-availability/

https://ethresear.ch/t/the-stateless-client-concept/172/13

https://notes.ethereum.org/@vbuterin/proto_danksharding_faq

ArkStream Capital is a primary market fund founded by native cryptocurrency practitioners, integrating investment, strategic consulting, and growth acceleration to foster unicorn companies in the Web3.0 space. The ArkStream Capital team includes members from MIT, Stanford, SUSTech, UBS, Accenture, Tencent, Google, and others. Portfolio investments include AAVE, Filecoin, Republic, FLOW, Pocket, Secret, Secondlive, and more.

Website: https://arkstream.capital/

Medium: https://arkstreamcapital.medium.com/

Twitter: https://twitter.com/ark_stream

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News