How Quasar, the asset management protocol, is leading Cosmos DeFi into the next wave of liquidity?

TechFlow Selected TechFlow Selected

How Quasar, the asset management protocol, is leading Cosmos DeFi into the next wave of liquidity?

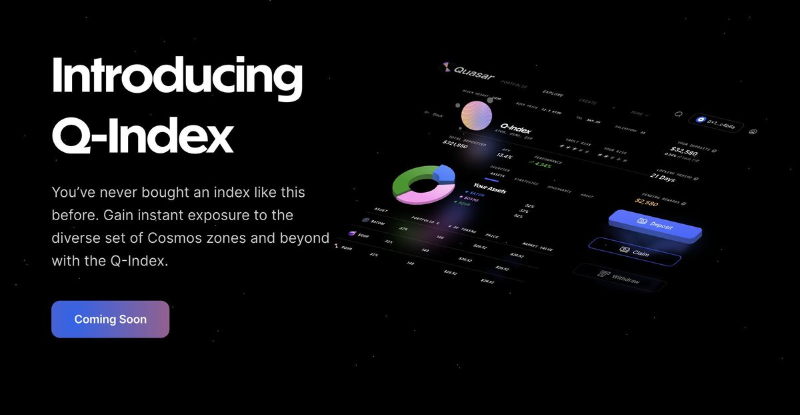

Quasar's liquidity vaults and asset management solutions have brought billions of dollars in liquidity to Ethereum, and now they're bringing this to the Cosmos ecosystem—launching a new app chain to unlock the next wave of liquidity.

Written by: Emperor Osmo

Compiled by: TechFlow

Quasar’s liquidity vaults and asset management solutions have brought billions of dollars in liquidity to Ethereum, and now they are bringing this innovation to the Cosmos ecosystem—unlocking the next wave of liquidity through the launch of a new application chain.

What is Quasar?

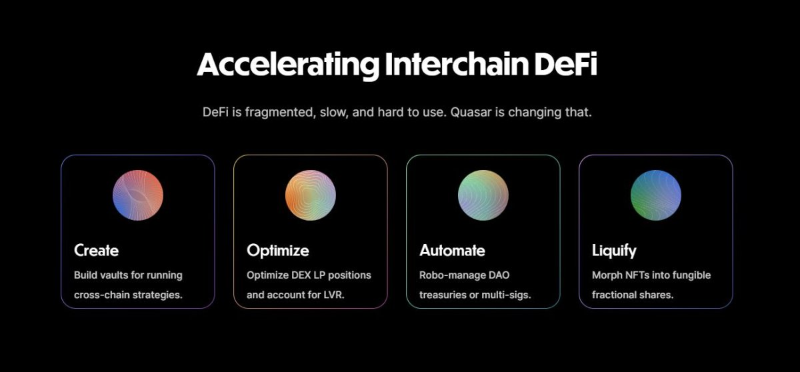

Quasar is a pioneering sovereign application chain that manages digital assets using Interchain Vaults.

Its goal is to enable users anywhere to easily invest and earn passive income, enabling cross-blockchain asset management.

Web3 empowers us to be our own custodians and asset managers. But let's face reality—not everyone is suited to be their own financial expert. Perhaps you lack the necessary expertise or simply don't have the time.

That’s where Decentralized Asset Management (DAM) comes in.

DAM leverages DeFi’s permissionless and transparent nature to create innovative investment solutions.

In today’s cryptocurrency market, you hold various digital assets—tokens, liquidity pools, non-fungible tokens (NFTs)—all of which can be difficult to track and manage effectively.

Vaults are designed to solve this problem.

What are Vaults?

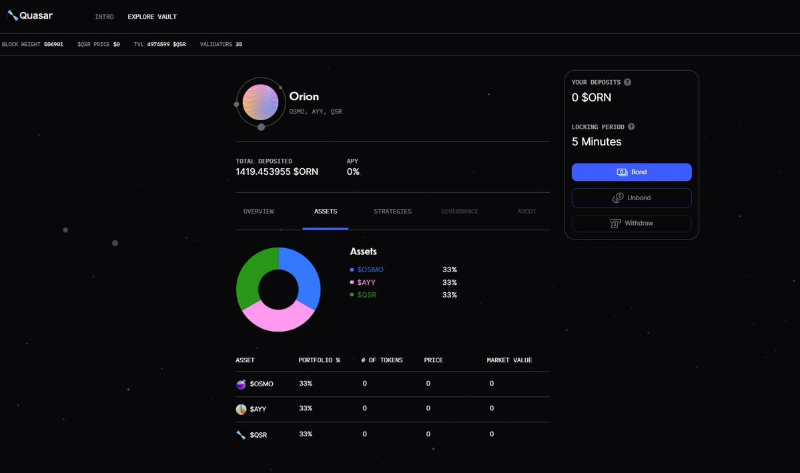

Vaults are essentially containers that hold encrypted assets and form a core part of Quasar’s strategy. Here, you can create and manage strategies, deposit liquidity, and rotate funds.

QuasarFi Vaults will have three key roles:

-

Vault Administrator: Controls vault management, which can be an individual or multisig depending on governance.

-

Strategist: Creates pool strategies (risk profiles).

-

Liquidity Provider: Supplies liquidity to the vault.

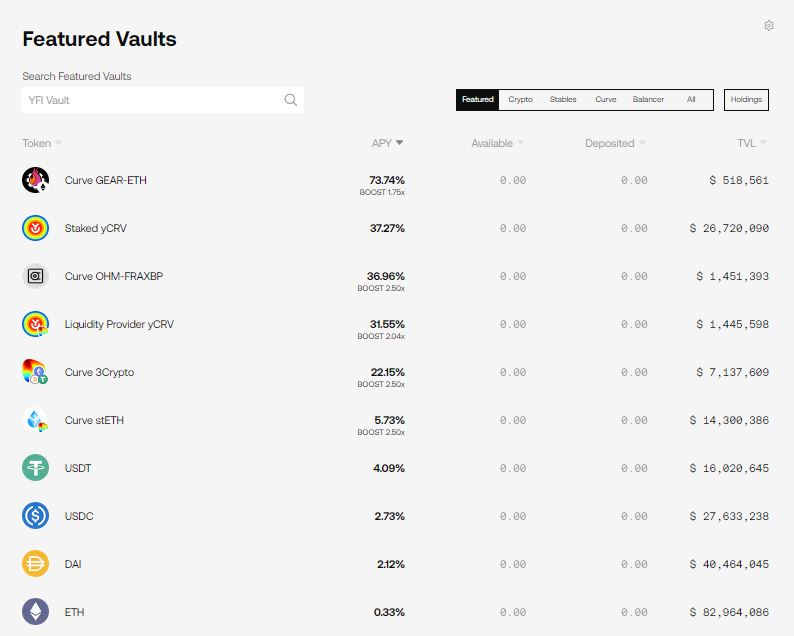

On Ethereum, Vaults have been widely used by @Yearnfinance. However, Quasar takes Vaults to a new level by offering:

-

Cross-chain yields;

-

Self-custody of assets;

-

Full control over strategy parameters.

How does it work?

Similar to how pools operate on Osmosis. Through the power of CosmWasm, Quasar users will be able to deposit liquidity into specific strategies.

Each Vault will feature a unique yield aggregation strategy customized by its creator.

Quasar Vaults stand out by injecting social elements into customization while providing a simple entry point. Being launched as an application chain allows greater customization and sovereignty for developing more optimized strategies. As such, it will have its own token, $QSR.

The $QSR token will serve four main purposes:

-

Security

-

Governance

-

Fees paid to stakers

-

Vault creation

QuasarFi will initially integrate with Osmosis, allowing users to create strategies using the $OSMO token. Some potential use cases include:

-

Reward restaking/re-delegation

-

Automatically deploying funds into various LPs

-

Automatic compounding of LP rewards

-

Automatic LP rebalancing

Ultimately, Quasar Interchain Vaults will become the go-to DeFi interface for individual users and institutional investors seeking to maximize capital efficiency.

As more strategies, more "outposts," and more tokens become available, Cosmos DeFi will grow exponentially.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News