Modularity, Middleware, and Application Layer: Three Major Future Trends in Cryptocurrency

TechFlow Selected TechFlow Selected

Modularity, Middleware, and Application Layer: Three Major Future Trends in Cryptocurrency

Since there are no bull market scammers and hype promoters, discussions now often focus on technology.

By: Ann

The market remains dull. What's left in the crypto community now are truly those who care about "the tech"—or perhaps just stubborn people like me. With no bull-market scammers or hype-driven actors around, discussions have shifted toward technical depth. Meaningful conversations are everywhere, and through them, I’m starting to see where this industry is headed.

These trends feel unlike typical crypto narratives—often not only possibly unworthy of investment but also potentially years away from realization, whether two, five, or even ten. Yet, they contain so much alpha.

The Future of Modularity

A widely discussed theory in the community concerns how people will use blockchains in the future—an approach fundamentally different from the blockchain and smart contract platforms we know today. With the rise of modular blockchain design, this may indeed come to pass.

Today’s popular public blockchains use what’s known as a monolithic design. Bitcoin is monolithic. So are Ethereum, Solana, and Avalanche. Even projects aiming for modularity, such as Cosmos, aren’t purely modular—they instead adopt a hybrid approach. Interestingly, Layer 2 solutions won’t make Ethereum fully modular either. The same goes for Avalanche subnets, which are essentially monolithic chains built atop another monolithic chain.

In a monolithic design, all types of transactions are handled by a single “layer.” For example, the Ethereum mainnet serves as the place for execution, data availability, settlement, and consensus. As a result, during periods of high activity, Ethereum easily becomes congested. Users experience gas spikes, network slowdowns, and failed transactions. None of these are ideal for a public blockchain aiming for mass adoption.

In contrast, modular smart contract networks consist of different chains, each handling a specific task. These include:

● Data Availability—where chains store and process all transaction-related data, ensuring it remains updated and accessible to users.

● Consensus Layer—responsible for decentralization and security.

● Execution Layer—where transactions are received and executed.

Modular blockchains represent the answer to the infamous blockchain trilemma. By delegating specific tasks to dedicated chains, networks can achieve scalability while maintaining security and decentralization.

However, the modular future still has a long way to go—it’s like assembling a jigsaw puzzle. Each “layer” or stack must be carefully designed to form one large, fully functional system. Currently, Celestia stands out in this category, claiming to be the first fully modular space.

Middleware as the Glue

Think of crypto middleware as the glue that binds chains and dApps together. Some might say middleware exists solely to connect dApps. In fact, in a modular future, middleware could simply become another layer within the stack. They are critical crypto infrastructure.

The middleware/infrastructure sector grows stronger every day, evident from the increasing number of builders focused on this space, new project launches, and venture capital flowing into these areas.

Middleware is a broad category. Projects included here range from decentralized cloud storage solutions and cross-chain bridges to developer toolkits, smart contract automation, node infrastructure, and more.

The infrastructure sub-sector in crypto holds immense potential. Web3 today still heavily relies on existing Web2 infrastructure (e.g., Amazon AWS). We urgently need Web3-native solutions across many domains while preserving decentralized economic incentives. The total addressable market for middleware projects could be infinite. (After all, it’s AWS—not Amazon’s marketplace—that drives profitability.) This explains why venture capitalists are pouring significant funds into this area.

Yet, despite being crucial, middleware is boring. From an investor’s perspective—especially retail investors—this is one of the weaknesses of infrastructure building. There’s little room for hype. Investing requires deep technical understanding, making it inaccessible to most.

More importantly, middleware projects heavily depend on the networks they operate on. For instance, an Ethereum-centric project needs Ethereum’s success to succeed itself. Evaluating and investing in middleware is tricky. Uncertainty remains over which project will emerge as a Web3 tech giant. This also explains why this space currently seems reserved for VCs.

At the very least, as ordinary participants, we now know where the smart money is betting. This awareness helps us spot opportunities overlooked by the mainstream.

Applications > Protocols

In 2016, an article titled “Fat Protocols” popularized the idea that in ecosystems with few applications but many protocols, value concentrates at the base layer. Investing in foundational protocols was seen as more profitable than investing in applications.

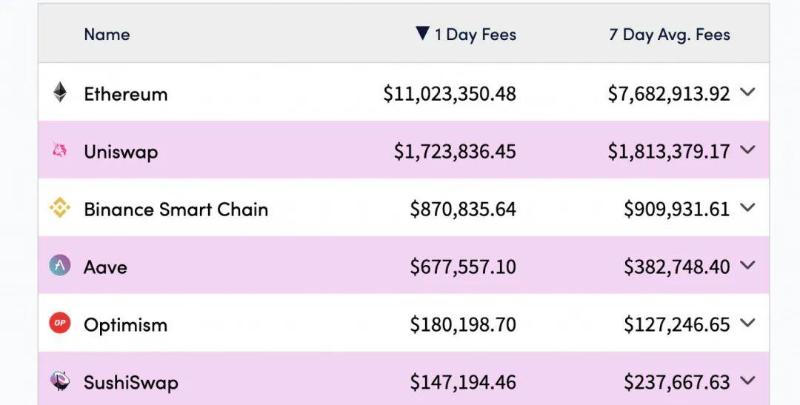

In many ways, crypto remains protocol-centric today. Ethereum generates the most revenue. People still tell us holding BTC or ETH is better than investing in app tokens—the same old refrain.

Conversely, whether fewer protocols with many applications is beneficial remains debatable. Today’s internet is application-centric—and doesn’t look particularly appealing. Power and value are concentrated in what we now call “Big Tech,” which is exactly what we don’t want in a decentralized world.

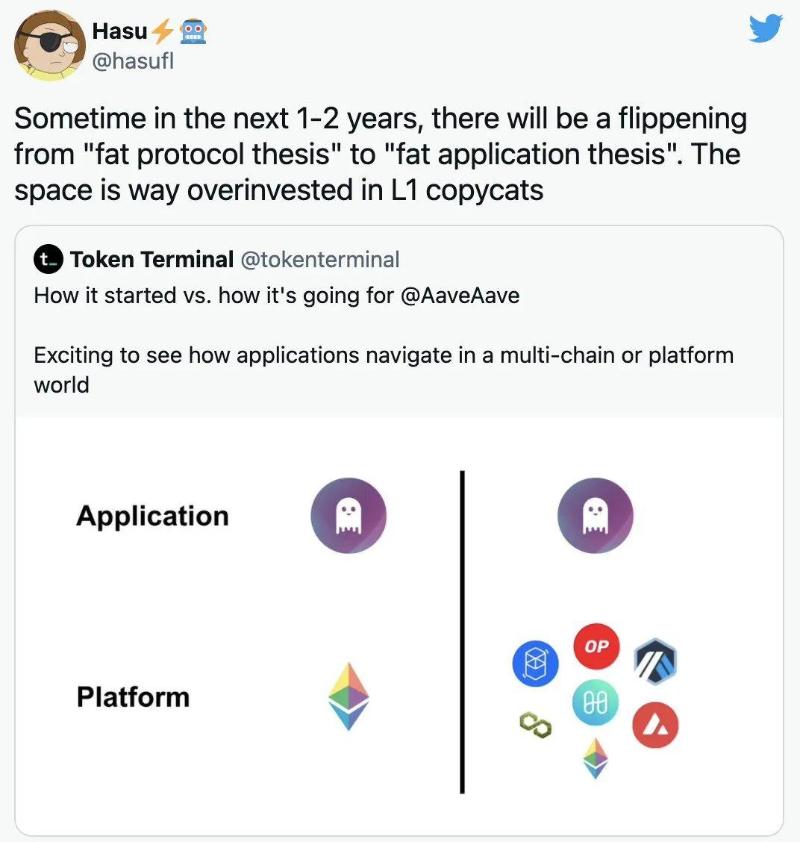

Yet, we do need more value to flow down into the application layer of crypto. Perhaps in a decentralized world, business models and profit-sharing can be more equitable than in traditional tech. Recently, a post by renowned crypto researcher Hasu sparked discussion, arguing that we’ve over-invested in Layer 1. He’s not wrong.

The ideal crypto world I envision is one where users interact with dApps without caring which chain they’re connected to. The application would seamlessly route users to the optimal network based on specific conditions—best yield, minimal congestion, lowest fees, etc. On the backend, apps would be multi-chain, possibly running their own chains—stack-specific chains within a modular system, rather than entirely independent Layer 1s. If it’s DeFi, their liquidity would be omnipresent. The protocol earns revenue from every corner of Web3, becoming the “big tech” of crypto.

Some DeFi protocols today are already moving in this direction. Rooted across multiple chains, they continuously innovate across product dimensions, surviving various market turmoil and security incidents, building credibility, and steadily growing profits. Their goal is to become household names.

A major shift toward applications could prompt retail investors to revisit forgotten “DeFi baby boom” era apps like Aave, Uniswap, or Curve. Previously overlooked DeFi 1.0 protocols are slowly regaining attention. But this trend isn’t limited to old dApps—some new projects are equally ambitious.

If this “flip” toward applications truly happens, we’ll see stagnation in returns from Layer 1 investments—not due to lack of technology or innovation, but because capital floods into the application layer. This transition may take time—but as with everything in crypto, it could happen faster than imaginable.

Observing these trends, you can sense how early-stage crypto technology still is, with countless unresolved problems—or technological solutions yet to be invented. The road to widespread adoption remains long. But it will be an exciting journey. Whether you’re a builder or an investor in this space, opportunities await.

As I mentioned earlier, investing in these trends remains largely ambiguous in most cases. While staying observant, allow the space to evolve organically, using these trends as a framework for your due diligence. When a real opportunity arises, you’ll recognize it.

Original link: https://medium.com/crypto-24-7/alpha-from-the-giga-brains-3-crypto-tech-trends-of-the-future-994e8a17663c

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News