Understanding Optimism: Creating a Bright Future for Ethereum

TechFlow Selected TechFlow Selected

Understanding Optimism: Creating a Bright Future for Ethereum

The goal of a modular architecture is to outperform monolithic blockchains by several orders of magnitude at every level.

By: Nansen

Translation: TechFlow

Introduction

Everyone has heard of Ethereum 2.0 and how it aims to solve Ethereum’s scalability issues. But what if I told you that Ethereum is already scalable—whether or not Ethereum 2.0 fully launches?

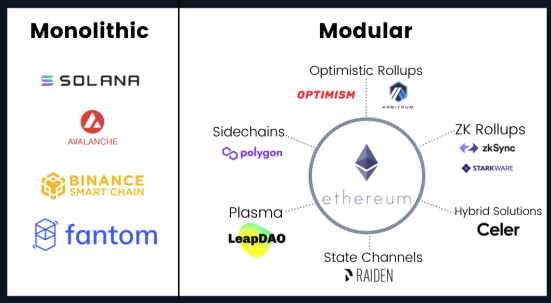

The transition from Proof-of-Work (PoW) to Proof-of-Stake (PoS) consensus is just the tip of the iceberg. The real challenge lies in creating an entirely new framework for blockchain scalability—shifting from monolithic blockchains to modular blockchains.

This is Ethereum’s answer to the blockchain trilemma—balancing decentralization, security, and scalability—aiming to increase throughput without sacrificing decentralization or security.The blockchain trilemma states that a blockchain must make trade-offs among its three core principles—decentralization, speed, and security—and improving one typically comes at the expense of another.

-

Blockchains that perform all computation and processing on a single chain are known as monolithic blockchains. Most current Layer 1s (L1s) follow this structure and are therefore monolithic.

-

In contrast, modular blockchains split functionality into execution, security, and data availability layers. Each layer serves a specific purpose and builds on top of another, inheriting the properties of the underlying layer.

In Ethereum’s case, Ethereum L1 acts as the security and data availability layer, while Layer 2s (L2s) built on top serve as the execution layer.

The goal of this modular architecture is to outperform monolithic blockchains by orders of magnitude at each layer. It aims for L2s to do everything a monolithic L1 can do—only better—while also enabling seamless interoperability with other L2s. Optimism is one such Ethereum L2 designed to achieve exactly this.

Monolithic vs. Modular Blockchain Architectures

What is Optimism?

Optimism is the first Ethereum L2, pioneering the development of EVM-compatible Optimistic Rollup solutions. Optimism operates similarly to Ethereum but enables large-scale transaction processing while preserving Ethereum's security.

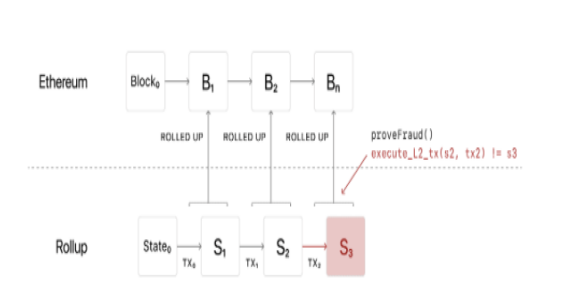

The name "Optimistic Rollup" comes from how transactions are processed. By default, transactions are assumed to be valid without requiring immediate computation. Instead, fraud proofs are used to ensure their legitimacy. Validators—anyone running a full Optimism node—can challenge the validity of transaction proposals submitted by sequencers. If challenged, the rollup re-executes the transaction on Ethereum to verify correctness. Optimism sets a one-week challenge period, during which disputed proposals are resolved before final settlement on Ethereum.

If a proposal is proven fraudulent, the validator is rewarded, and the sequencer is penalized. Sequencers must bond ERC-20 tokens (in Optimism's case, ETH), and rewards come from this pool. This creates incentives for validators to detect fraud and for sequencers to submit only honest proposals. Fraudulent proposals are discarded; correct ones are finalized. The transactions themselves remain unaffected—their invalid outcomes are simply reverted.

How fraud proofs work (simplified)

Beyond its technical merits, Optimism stands out for another reason: it is operated by a public benefit corporation dedicated to funding public goods. Since the network isn’t yet fully decentralized, the team donates all profits earned by the centralized sequencer to Ethereum-based public goods projects for their growth and maintenance. In 2021 alone, the team donated $1 million to such initiatives.

What Benefits Does Optimism Offer?

Optimism delivers four main advantages: EVM equivalence, data security, speed, and cost efficiency.

Even if Optimism isn't the most EVM-compatible chain, it pushes closer to true EVM equivalence. It supports any Ethereum application via the Optimistic Virtual Machine (OVM), a VM compatible with the EVM. Developers can deploy Ethereum-based dApps on Optimism with minimal architectural changes, enabling seamless integration of Ethereum dApps onto Optimism.

Unlike sidechains like Ronin—which have independent security due to standalone operation—rollups like Optimism inherit security directly from Ethereum. Transactions are processed on Optimism, but their data is recorded and stored on Ethereum. Thus, Optimism maintains Ethereum’s security while achieving scalability.

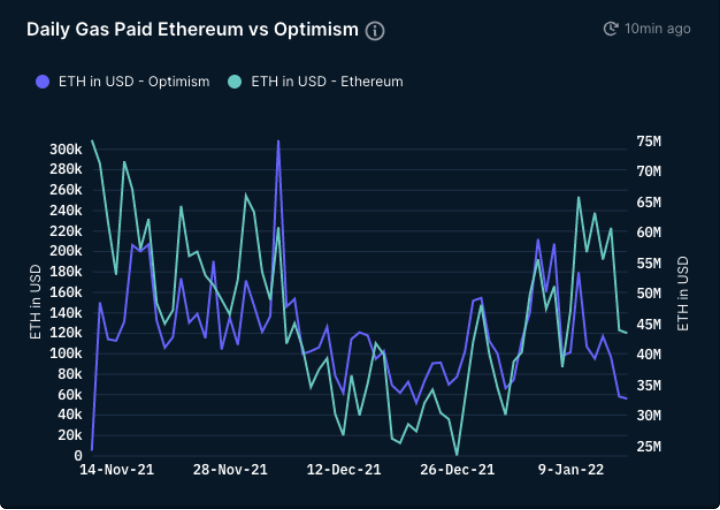

On Ethereum, computation is slow and expensive. By defaulting to non-computation, Optimism achieves 10–100x scalability improvements, depending on transaction type. It enables near-instant transactions—users see results immediately—and fees are a fraction of Ethereum’s. Transacting on Optimism is fast and affordable.

Currently, a standard transfer on Optimism costs $1.66 versus $8.77 on Ethereum. Optimism has saved users over $335 million in on-chain gas fees to date.

Daily Gas Fee Comparison: Ethereum vs. Optimism

What Are Optimism’s Drawbacks?

Optimism faces three primary limitations: long and costly withdrawals, potential misalignment of user incentives, and possible L1 transaction censorship.

Due to the one-week fraud proof challenge window, official withdrawals via the Optimism bridge require a seven-day waiting period. Users must be cautious, as once initiated, these withdrawals cannot be canceled. Withdrawal costs are high—potentially exceeding $100—due to extensive security mechanisms on the bridge. This lengthy and expensive process negatively impacts user adoption and composability.

To address this, third-party bridges like Hop Exchange have emerged. These enable instant withdrawals and are typically cheaper than the native bridge. While Optimism is working to reduce withdrawal fees, key upgrades are still months away.

The network relies on incentives for validators to challenge fraudulent proposals and for sequencers to submit valid ones. If few or no fraudulent proposals exist, validators earn little to no rewards—since they’re only compensated upon successful challenges. This disincentivizes running validator nodes. Without active validators, malicious sequencers could submit fraudulent transactions unchecked, leading to network failure.

However, this scenario is unlikely. Beyond potential protocol rewards, there are strong incentives for users to act as honest validators. To ensure protocol integrity, applications on Optimism—such as third-party bridges and DeFi protocols—offer additional incentives to encourage honest validation.

A sequencer might bribe Ethereum miners: if a transaction is valuable enough, a sequencer could pay miners a small fee to accept a fraudulent proposal during the verification window. This would undermine trust and compromise network security. However, this is improbable because miners’ long-term incentives align with Ethereum’s health. Accepting such bribes would jeopardize their ongoing revenue as Ethereum validators. Honest sequencers and validators are more likely to counter-bribe miners, especially since the total value at stake often exceeds that of a single transaction.

How Does Optimism Compare to Arbitrum?

Optimism was the first to develop an EVM-compatible Optimistic Rollup protocol, but delays in mainnet launch gave Arbitrum a head start. For example, Uniswap initially launched on Optimism, but due to deployment delays, the team proposed launching on Arbitrum in the interim.

Both Optimism and Arbitrum are Optimistic Rollups and share many similarities. Their main difference lies in fraud proof design. Optimism uses non-interactive fraud proofs, which re-execute the entire transaction on L1 and perform all necessary computations to verify correctness.

Arbitrum, by contrast, employs interactive fraud proofs, executing only the disputed step on L1. The dispute is broken down iteratively between the sequencer and validator until the exact point of disagreement is isolated. Only then is computation performed on L1 to determine the correct outcome.

Non-interactive fraud proofs are simpler by design, eliminating coordination overhead and enabling faster resolution. Interactive proofs require collaboration and take longer to resolve. However, the downside of non-interactive proofs is higher L1 computation costs—re-running an entire transaction is far more expensive than verifying a single step. Non-interactive proofs also face block and transaction size limits (based on L1 constraints), whereas interactive proofs avoid this since only individual steps are validated.

Optimism is actively transitioning toward interactive fraud proofs with full EVM equivalence—a shift aligned with its long-term vision. The distinction between EVM compatibility and EVM equivalence is critical: the former runs on a compatible VM (like Arbitrum’s AVM), while the latter runs natively on the EVM. Arbitrum is also pursuing EVM equivalence. Both teams are clearly pushing the boundaries of Optimistic Rollups, innovating and learning from each other.

Over the past 30 days, Optimism had 452,000 unique active addresses compared to Arbitrum’s 668,000—giving Arbitrum a slight edge. However, Optimism currently outperforms Arbitrum in on-chain transaction activity. This suggests that while Optimism’s user base is smaller, its users are more actively engaged.

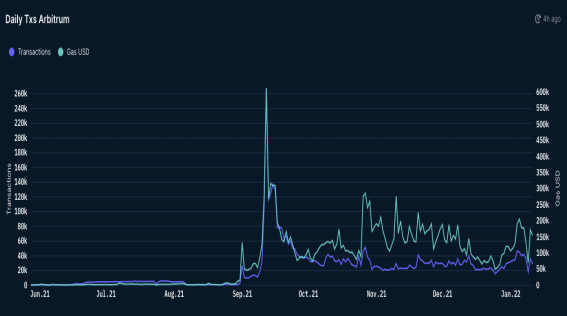

Arbitrum Daily Transaction Volume

How Can You Interact With Optimism?

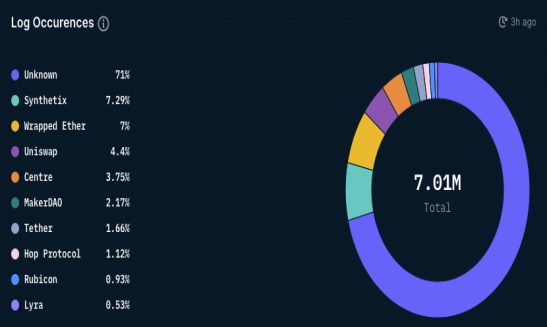

Major Ethereum-based dApps like Uniswap and Synthetix are already deployed and fully operational on Optimism. The ecosystem is growing rapidly, featuring native DeFi projects like Rubicon Finance and an active NFT marketplace: Quixotic. Several NFT collections have emerged on Optimism, with the top three being OptiPunk (a CryptoPunks derivative), Optimistic Bunnies, and OldEnglish. Currently, DeFi dApps dominate usage; 50% of the top 10 dApps by log count are DeFi protocols. Log count refers to the number of times a smart contract is successfully executed.

Log Count Distribution Across dApp Categories on Optimism

You interact with platforms and dApps on Optimism using an Ethereum wallet like MetaMask, just as you would on Ethereum. First, bridge your ERC-20 assets to the Optimism chain before use. This can be done via Optimism’s native bridge or third-party bridges. For most users, third-party bridges are sufficient and recommended—they're usually cheaper and offer instant withdrawals, unlike the native bridge’s one-week wait.

Where Is Optimism Headed?

Optimism has no native token and no short-term plans to issue one, though it may happen eventually. Centralized exchanges might introduce direct access to Optimism, similar to how Binance and Huobi support Arbitrum. This would allow users to deposit assets directly onto Optimism, bypassing bridging steps and associated costs.

The Optimism team will gradually decentralize the network. As critical upgrades roll out, we’ll see progress toward full decentralization. Currently, the team has disabled legacy fraud proofs and is building a new interactive fraud proof system.

The Optimism ecosystem continues to expand, with governance proposals underway for major DeFi apps like Aave to deploy on-chain. Deploying Ethereum-based dApps on Optimism is straightforward, effectively removing entry barriers. Widespread dApp adoption and a vibrant ecosystem are inevitable. Given its low fees, we can expect more DeFi, NFT, and GameFi projects to build on Optimism.

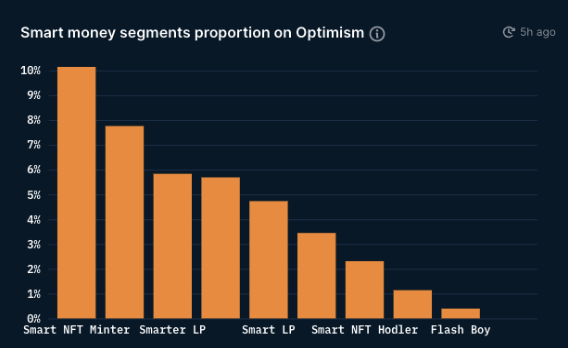

Optimism Smart Money Overlap with Ethereum

Smart money exploration of Optimism has barely begun—the current overlap with Ethereum smart NFT mints is only 10%. This indicates Optimism is still in early stages, with significant room for ecosystem growth.

Current L2 solutions operate in silos, lacking interoperability. For truly scalable Ethereum, cross-L2 communication is essential. Once key upgrades go live and Optimism achieves greater decentralization, this will likely become a top priority.

Ethereum 2.0 will further enhance Optimism’s capabilities. A faster, more efficient Ethereum L1 means all dependent systems—including L2s—become more efficient. Even with Ethereum 2.0, demand for block space will grow, making L2s indispensable for meeting that demand.

Conclusion

L2 solutions are here to stay, and the majority of future Ethereum transactions will occur on them. Critics argue that L2s complicate user experience by requiring extra steps to manage assets across chains. This criticism holds some truth today, but over time, third-party tools and improved UX from L2 teams will resolve these issues. Ethereum 2.0 doesn’t replace L2s—it enhances their scalability and efficiency.

Optimism is a key L2 player in Ethereum’s scaling journey. It set ambitious goals—especially around EVM equivalence—and delivered despite initial delays. Its ease of deployment makes it attractive for existing dApps, and low fees draw users. Beyond building infrastructure, Optimism actively funds high-impact projects in the Ethereum ecosystem.

We’re still in the early days of the blockchain-powered world. Ethereum’s move toward modularity may be the key that unlocks entirely new possibilities. While many speak of a “cross-chain” future, a more accurate term is “multi-chain.”

Interested in this data? The Optimism dashboard is now live on Nansen.ai!

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News