DAO Data Insights: Arbitrum Activity and Contributor Engagement Twice That of Optimism, 85% of Governance Proposals Completed on Snapshot

TechFlow Selected TechFlow Selected

DAO Data Insights: Arbitrum Activity and Contributor Engagement Twice That of Optimism, 85% of Governance Proposals Completed on Snapshot

JokeRace is approaching 700 races held and has generated over $130,000 in revenue.

Author: OurNetwork

Translation: TechFlow

From the editorial team:

Decentralized autonomous organizations (DAOs) are one of the most exciting yet frustrating parts of the crypto space.

The concept is incredibly compelling—crypto has enabled entrepreneurs, for the first time, to move beyond traditional corporate structures like C-corps and LLCs, creating new organizations on-chain with just a few clicks and at minimal cost.

However, on-chain data suggests that true product-market fit has not yet been fully realized. DAOs continue to struggle with low participation rates and poor usability. In fact, a report from Coinbase last week noted that typically fewer than 0.1% of governance token holders regularly participate in voting across major protocols. Clearly, we still have a long way to go before achieving widespread adoption of this new technology.

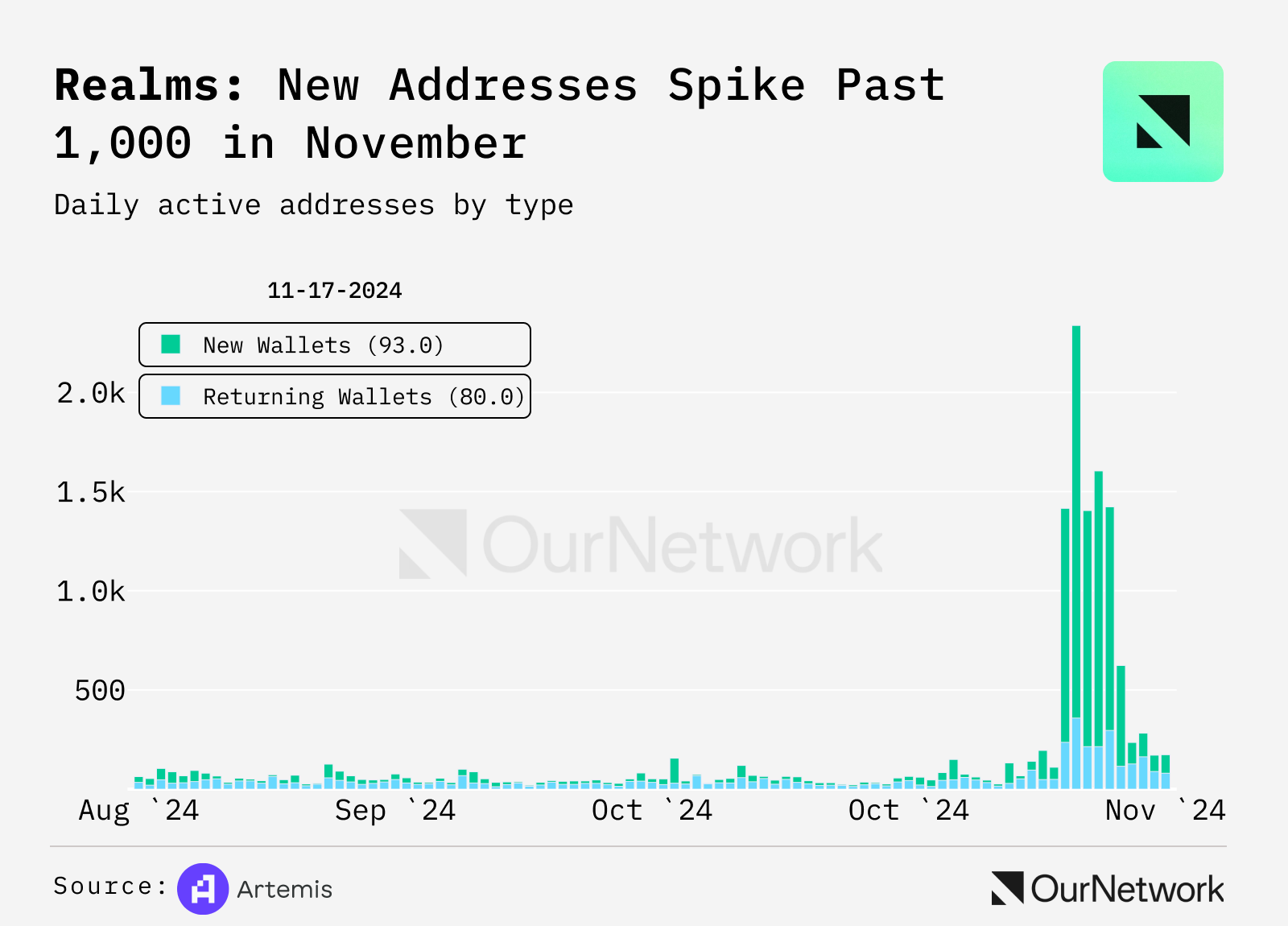

Nonetheless, as the projects below illustrate, the DAO space remains vibrant and innovative. Especially with the emergence of new tools that make participation, voting, and interaction with decentralized organizations more accessible. For example, Realms, a DAO tooling project on Solana, saw a sharp surge in active addresses in November.

These are some early signs of product-market fit. As Spencer put it, with DAOs, we already have the ingredients—we now need to find the right recipe.

DAOs

Snapshot | Realms | JokeRace

David Truong | Website | Dashboard

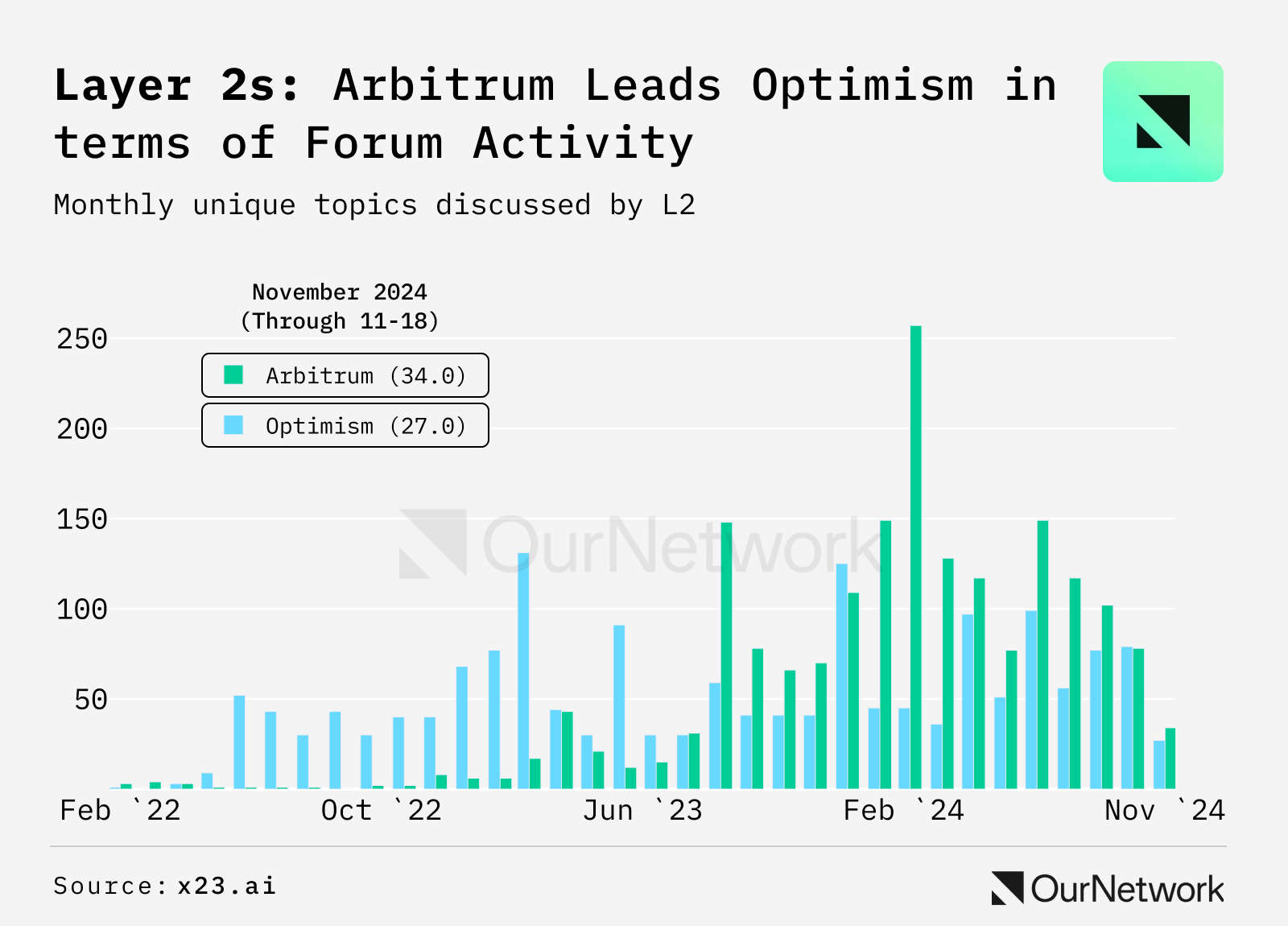

Arbitrum is nearly twice as active as Optimism in terms of activity and contributors

-

In the battle among top Layer 2 (L2) platforms, Arbitrum led in annual forum engagement with 1,497 unique topics discussed, compared to 833 in the Optimism community—a stark contrast to 2022 when the Optimism community dominated. However, in the final months of 2024, these two leading L2s appear to be leveling out, each cultivating its own distinct community. To compare 30 different communities, check out x23.ai’s dashboard.

-

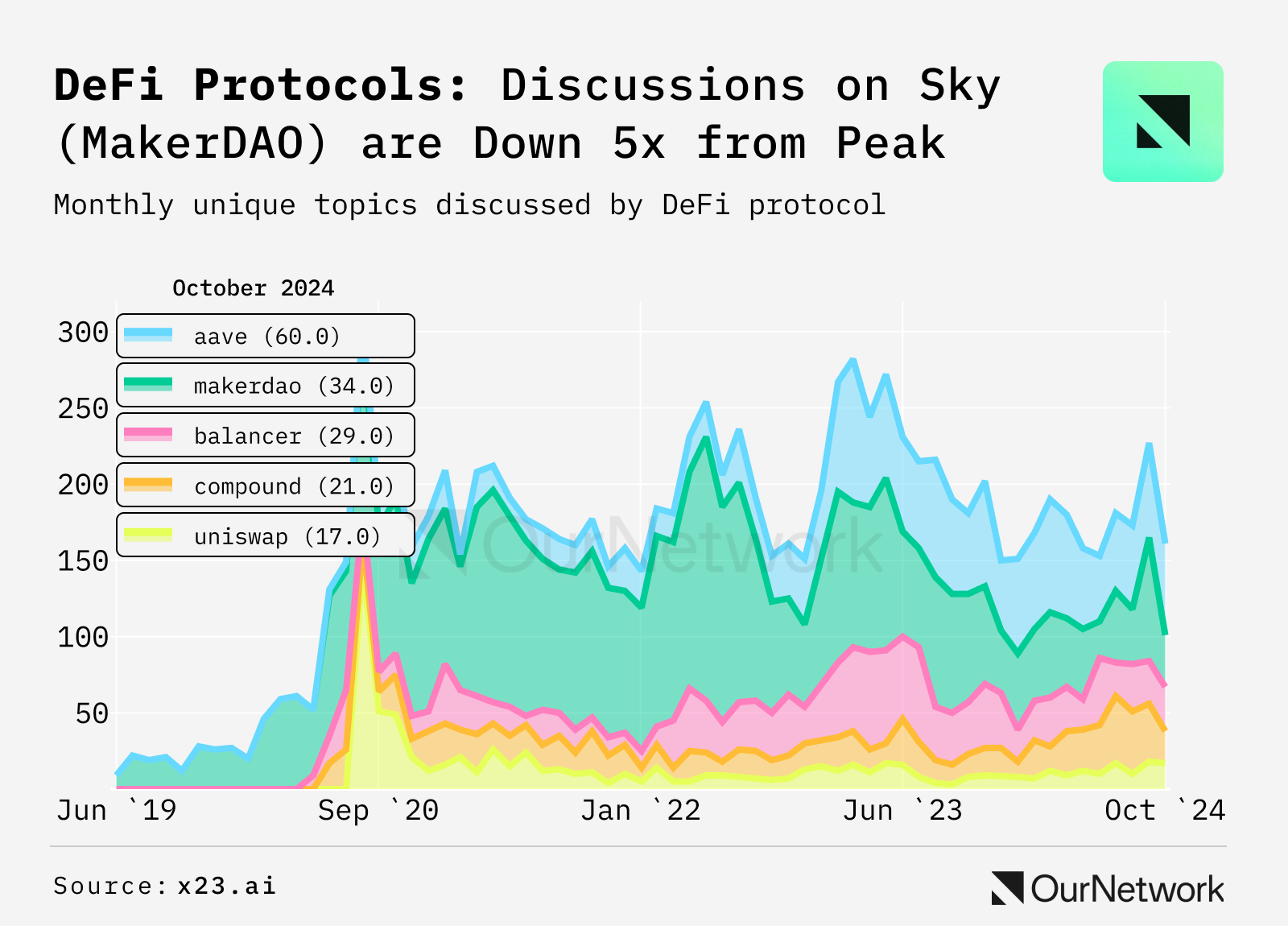

In DeFi protocols, Sky (MakerDAO) and Aave dominate public discussions. Although Sky’s discussion volume is now five times lower than its peak in June 2022, Aave’s discussion volume has grown 2.5x over the same period. In contrast, Compound and Uniswap have consistently seen lower discussion volumes than their peers.

-

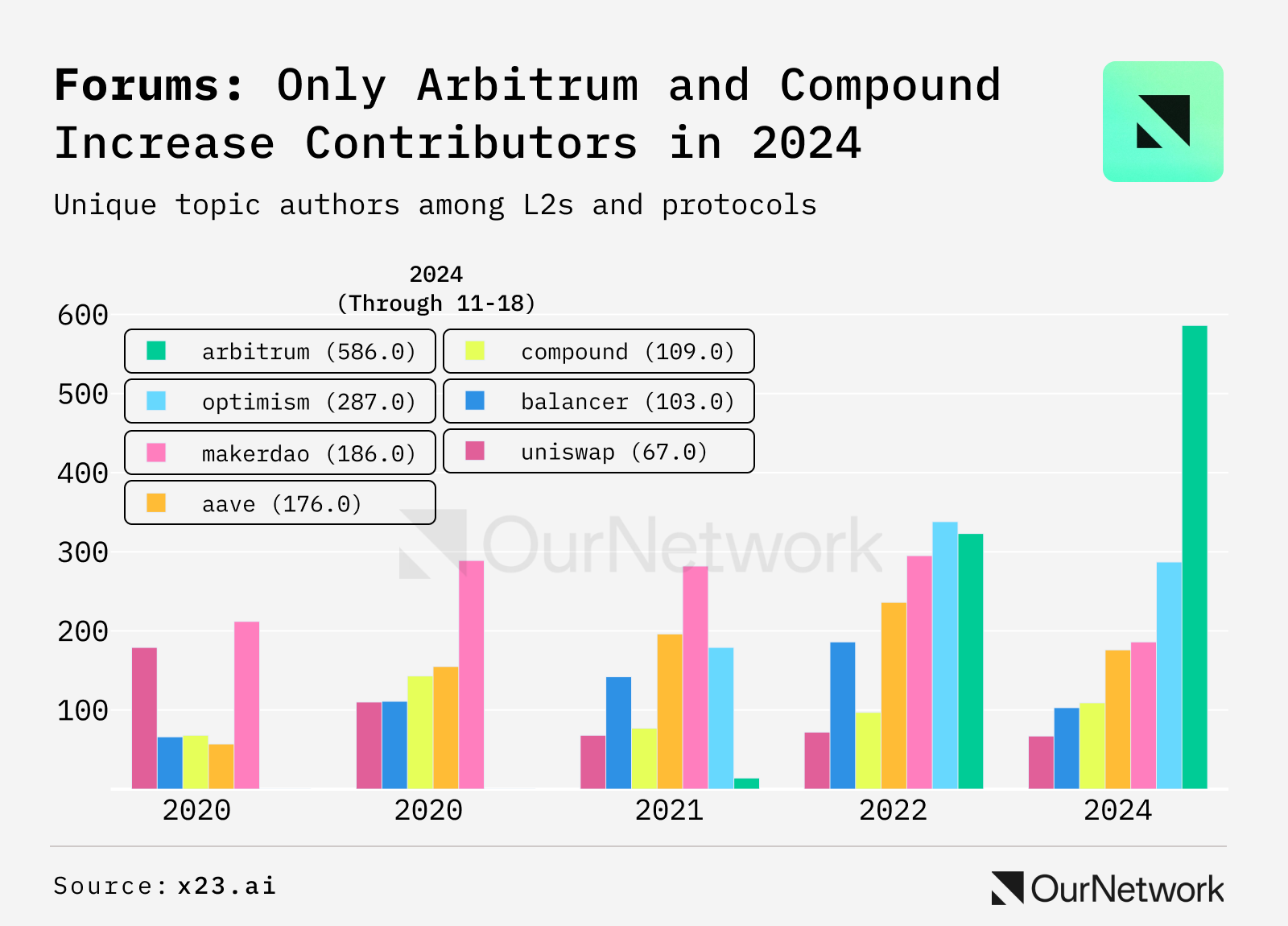

In terms of unique topic authors, only Arbitrum (+81%) and Compound (+12%) grew their contributor base in 2024. Meanwhile, Balancer and Sky/MakerDAO declined by 44% and 37%, respectively, while Uniswap maintained relatively stable author counts between 2023 and 2024.

-

Trade Focus: As DAO treasuries grow, the risk of governance attacks becomes more apparent. For example, Compound was attacked in June via a governance exploit, and Ethereum Name Service (ENS) proposed forming a security council in July to protect its DAO. These developments underscore the need for tools that promote broader participation and more balanced voting power distribution within DAOs.

Snapshot

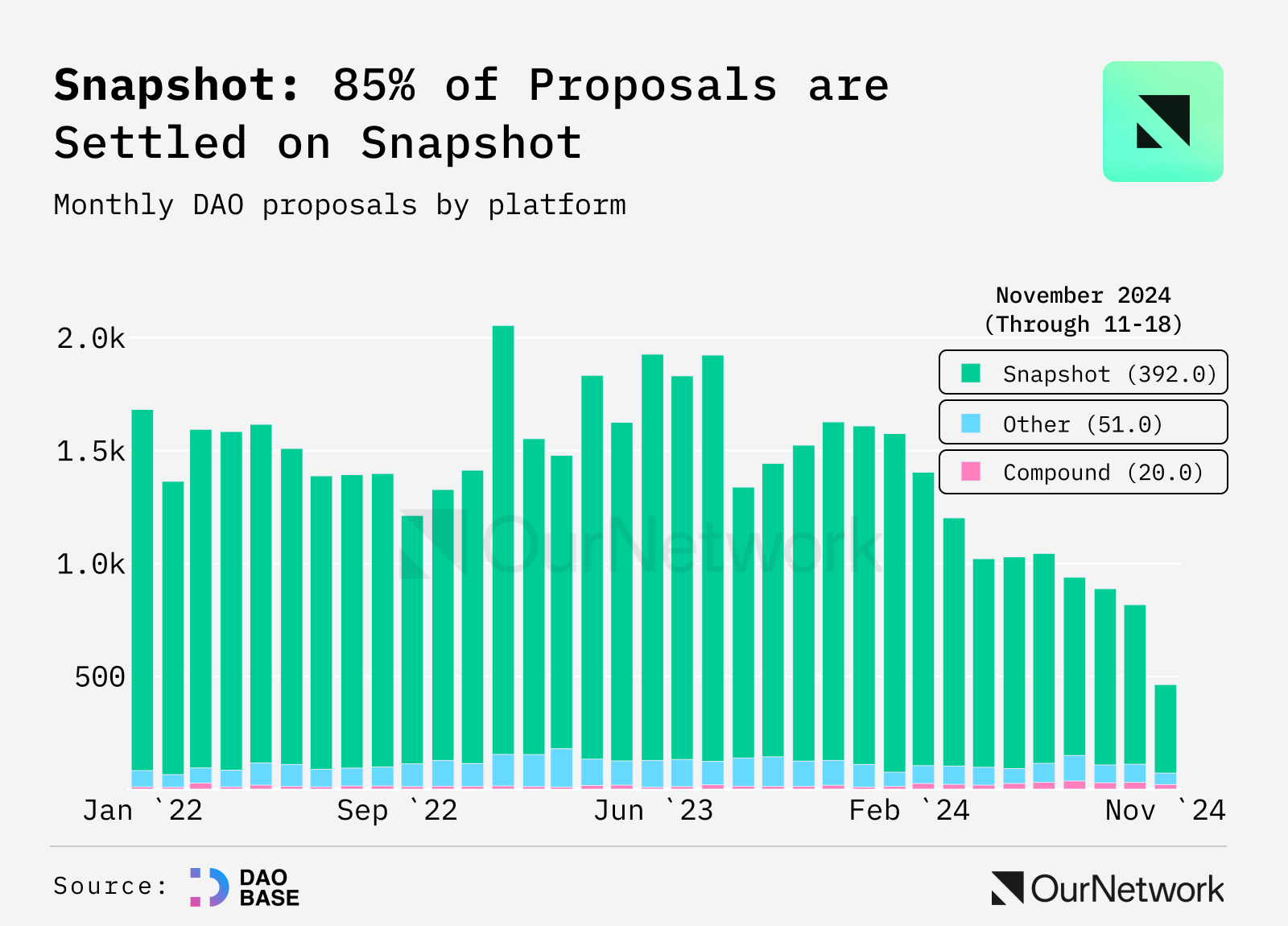

85% of governance proposals are completed on Snapshot

-

Snapshot is the dominant voting platform in governance. Of the 817 proposals tracked in October, 707 were conducted on Snapshot, capturing approximately 86% market share. The trend remained similar in November. However, since the beginning of the year, total proposal volume has roughly halved, and Snapshot’s dominance has slightly waned as dedicated DAO governance platforms like Nouns and Compound have seen relatively stagnant proposal numbers.

-

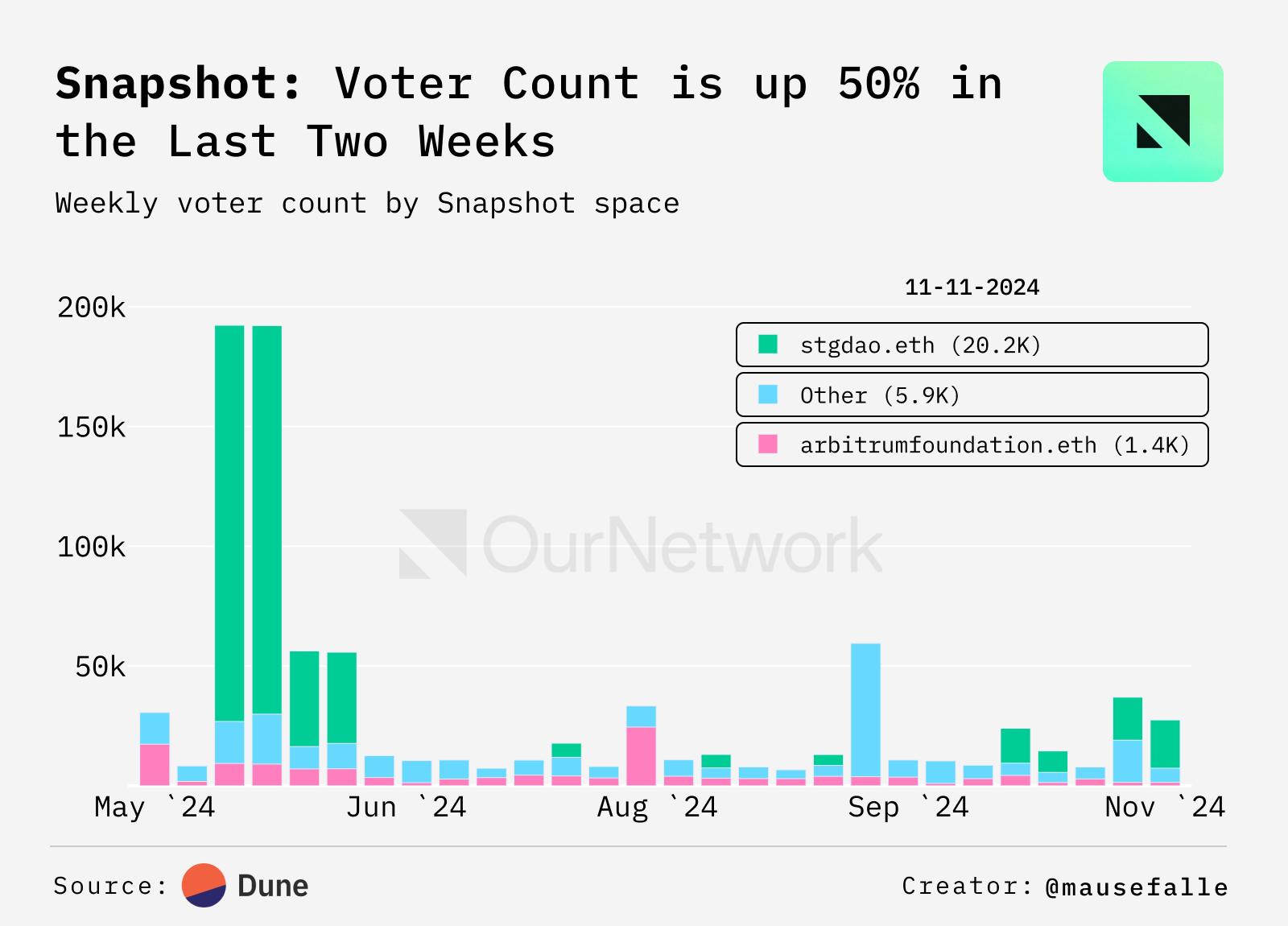

In the past two weeks, Snapshot’s weekly voter count increased by over 50% compared to previous weeks’ averages. Peaks in voter participation, particularly in May 2024, were primarily driven by stgdao (Stargate DAO).

-

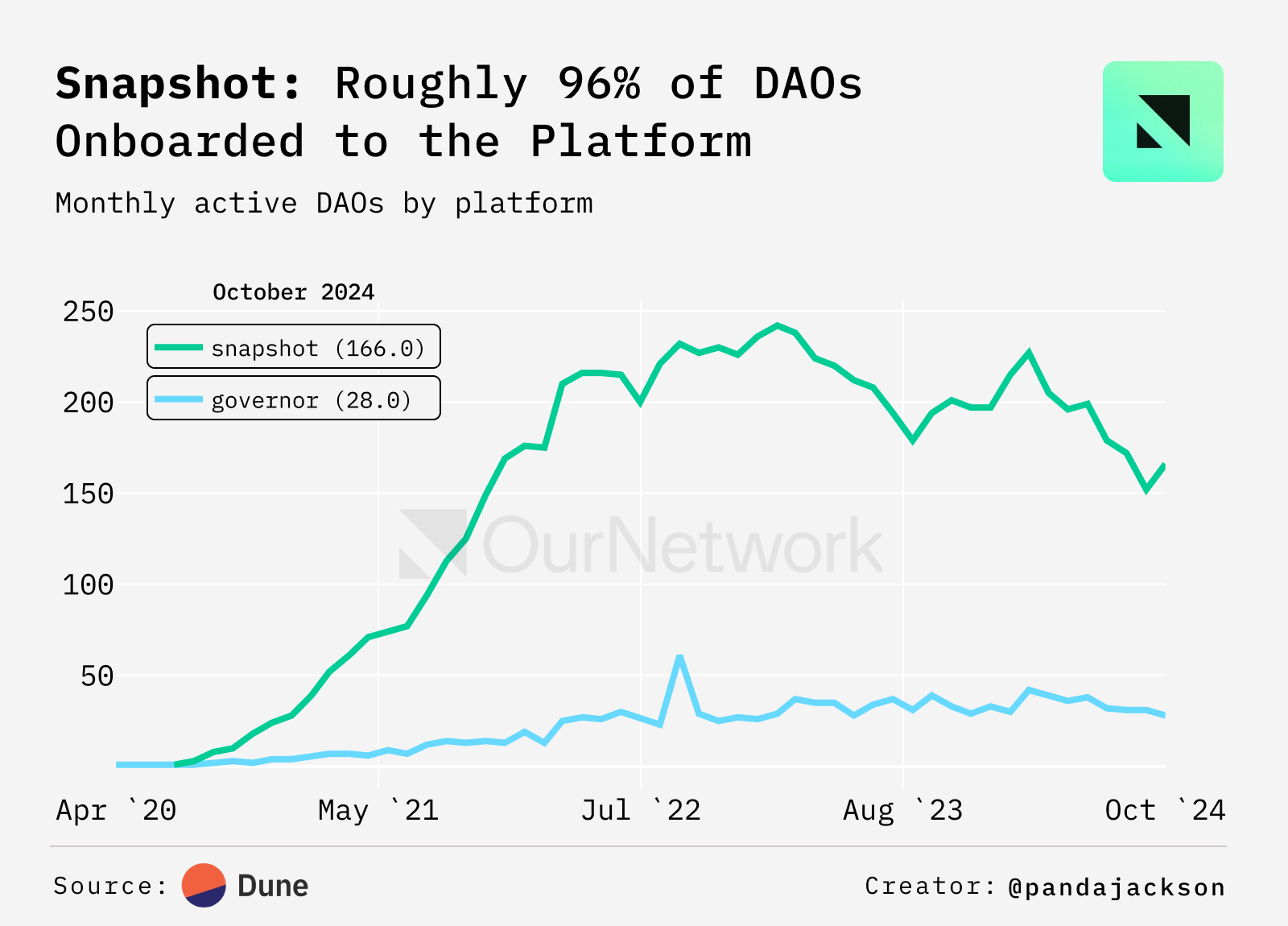

Snapshot has attracted around 96% of tracked DAOs. In October, 166 proposals were launched, while approximately 120 were initiated by mid-November. This reflects a slight downward trend since the beginning of the year, consistent with the overall decline in governance metrics across the market.

Realms

Takisoul | Website | Dashboard

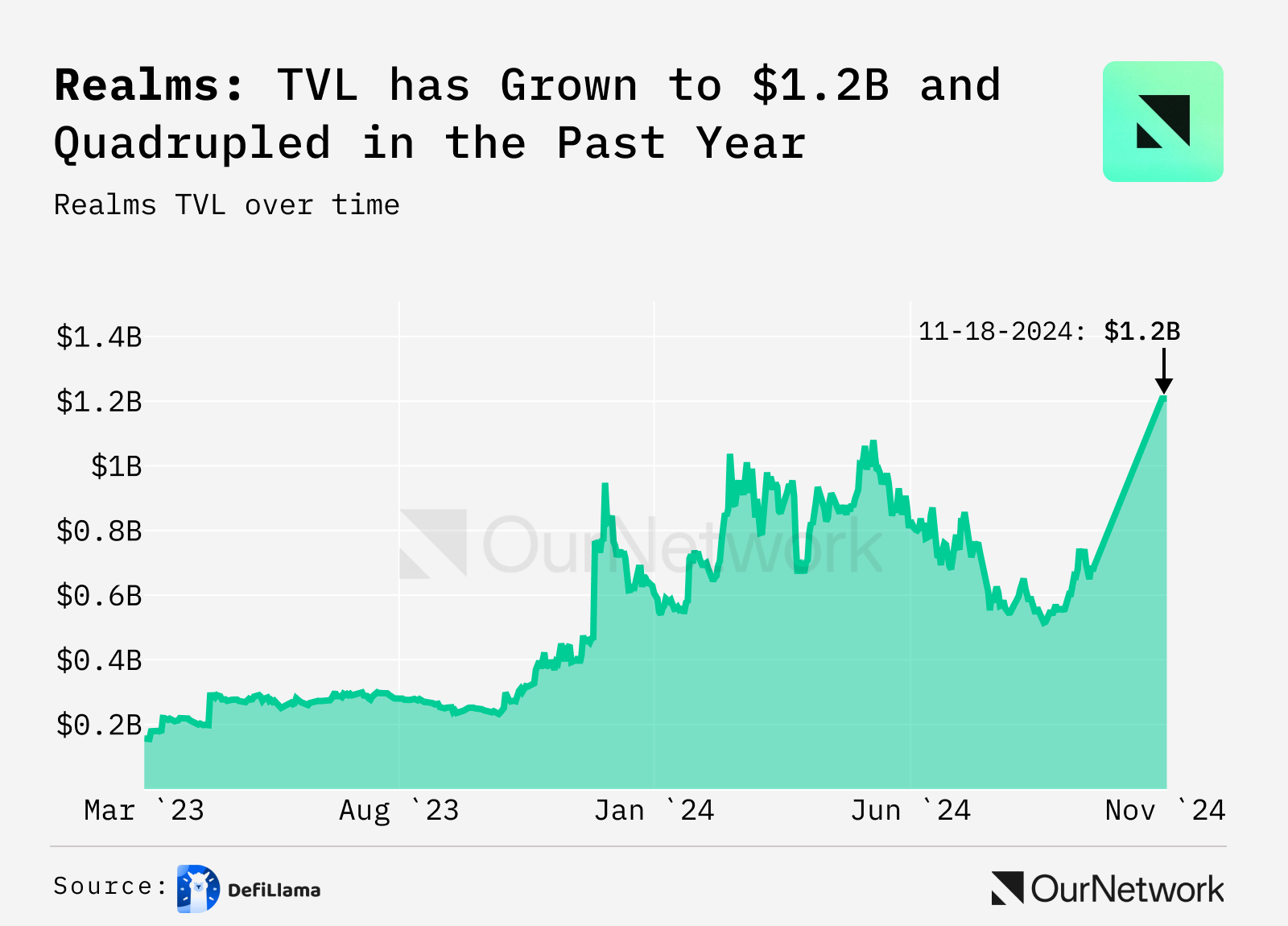

Realms surpasses $1.2 billion in managed assets

-

Realms is a Solana-based project offering tools for DAO treasury management, voting, and more. Over the past year, Realms’ total value locked (TVL) has surged to $1.2 billion, with assets locked in Realms/SPL Governance quadrupling in value—indicating Realms is one of the leading asset custodians on Solana. Solana-based DAOs continue steady growth, and Realms has become their primary platform on the network.

-

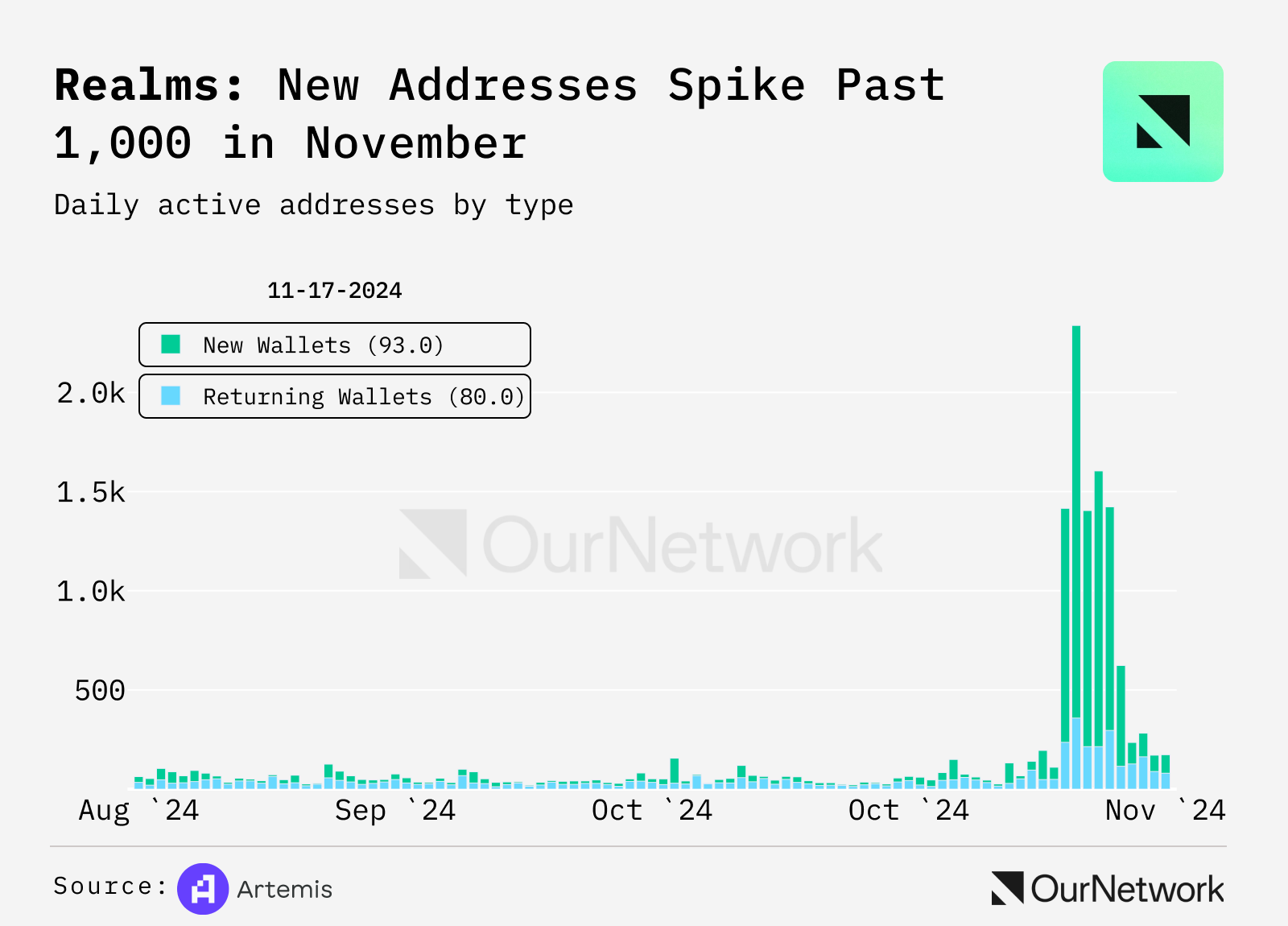

In November 2024, the number of active addresses on Realms significantly increased, especially new wallets.

-

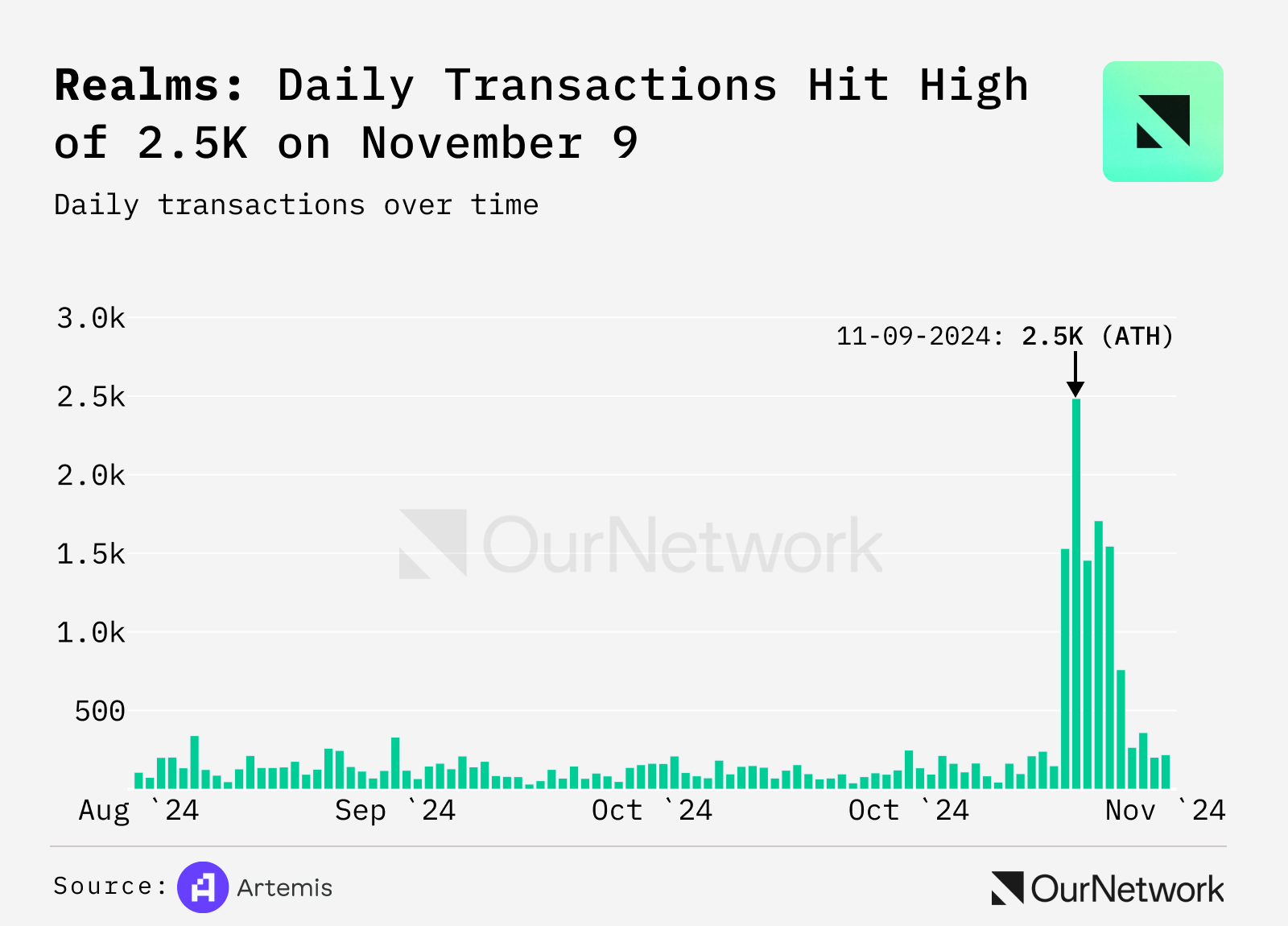

Daily transaction volume using Realms hit a record high of 2,500 on November 9. While volume has since pulled back, it remains above pre-surge levels.

-

Transaction Highlight: A successful Bonk DAO vote executed on Realms saw the BONK community vote to burn 5 million $BONK. The proposal was specifically added and executed through Realms’ SPL governance contract via a programmatic method.

JokeRace

JokeRace nears 700 contests, revenue exceeds $130,000

-

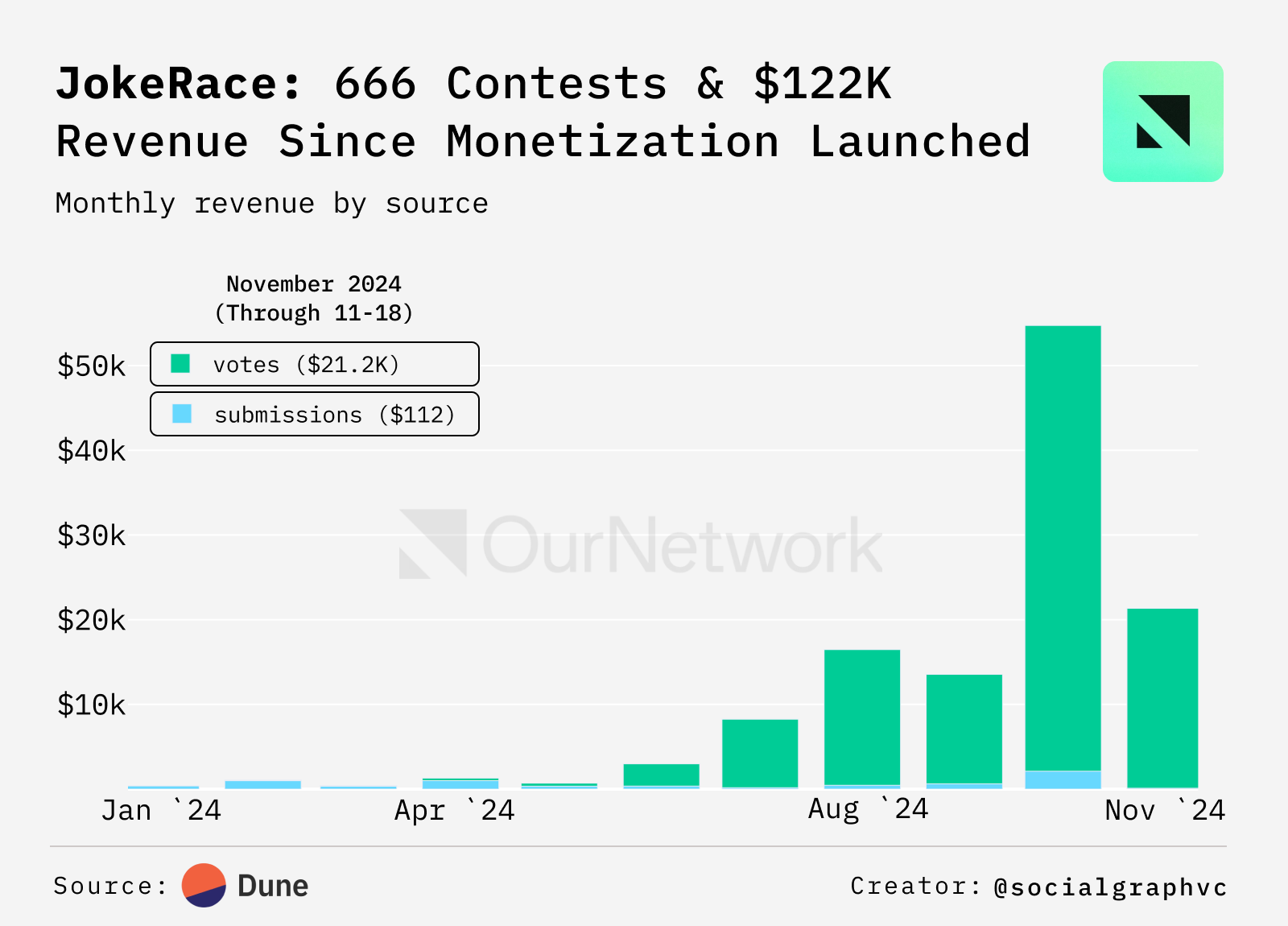

JokeRace is a platform for creating and voting on on-chain contests. The project has two revenue streams: entrants pay a fee to submit entries, and voters pay to cast votes. Since monetization launched in early 2024, JokeRace has hosted 666 contests and generated $121,000 in revenue, split evenly between the protocol and contest creators.

-

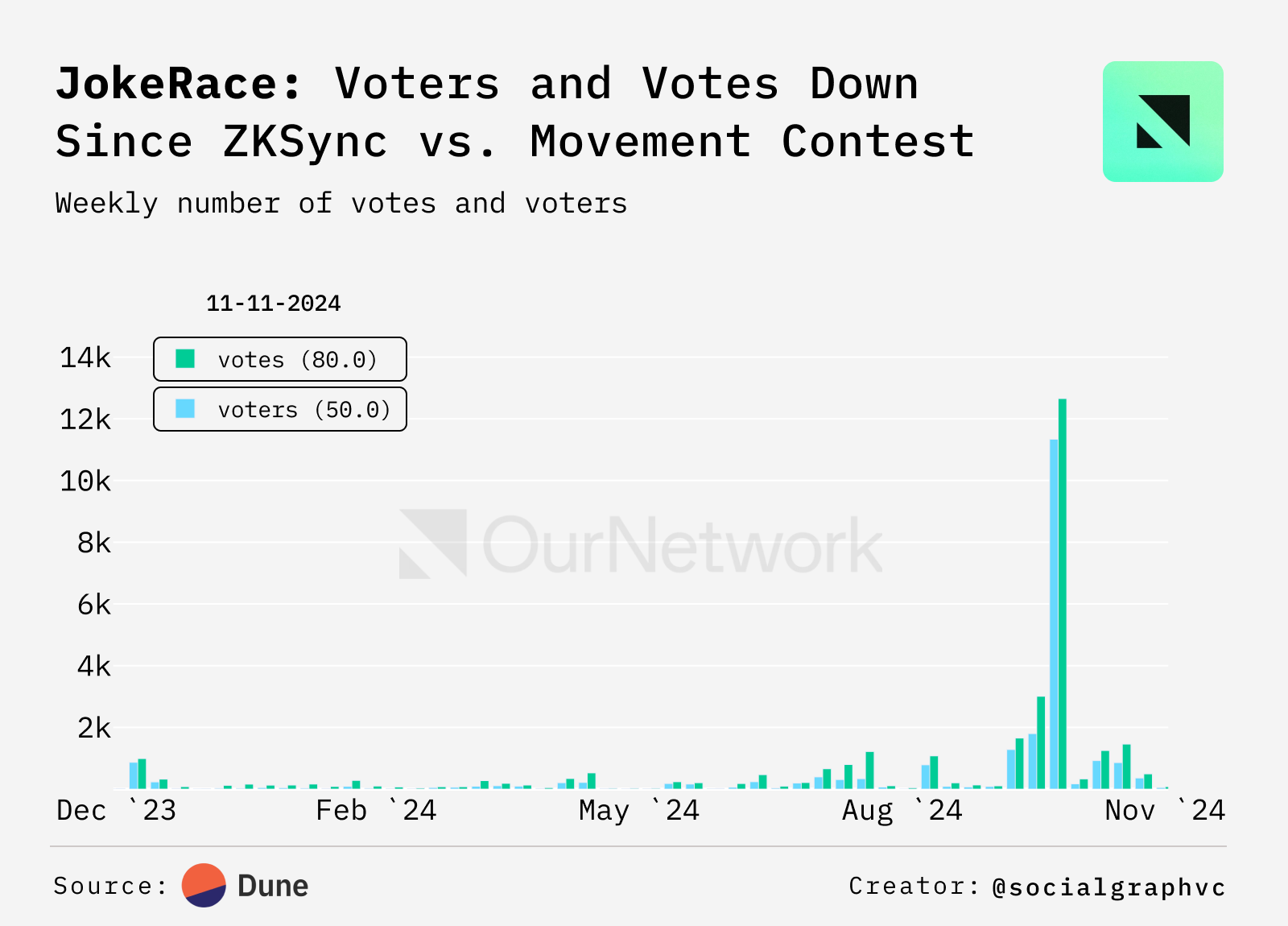

One of JokeRace’s core metrics is the number of votes and voters. Last week, there were 360 unique voters and 493 votes—far below the peak in early October during the ZKsync vs. Movement L2 race, which saw 11,000 voters and 12,000 votes.

-

JokeRace’s growth strategy focuses on converting voters into creators and retaining them. There are currently 278 creators, 37 of whom started as voters before becoming creators. Creator retention is low: around 10% on average in the first month after launch, dropping to less than 10% by the third month, with some cohorts showing 0% retention. Improving creator retention remains an open challenge.

-

Trade Highlight: “Where are the apps?” was a competition aiming to identify the best crypto applications, generating the highest engagement among participants and voters. A total of 65 crypto apps competed, with over 1,000 people voting to select the winner. The contest generated $11,000 in revenue. The first-place winner was Aquari, a sustainability project, which received a prize of 1.375 ETH. Second and third place received 0.687 ETH and 0.229 ETH, respectively.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News