MIIX Capital: Optimism Project Research Analysis Report

TechFlow Selected TechFlow Selected

MIIX Capital: Optimism Project Research Analysis Report

A Comprehensive Guide to Optimism: Project Mechanics, Market Performance, Ecosystem, and Competitive Advantages

Author: MIIX Capital

Introduction

Optimism is an Ethereum Layer 2 scaling solution based on Optimistic Rollup technology. Its vision is to become the "world computer," using Ethereum as its settlement layer—aligning with Ethereum's own vision of becoming a global settlement layer—and maintains a close partnership with the Ethereum Foundation. OP holds significant growth potential in terms of VC backing, on-chain metrics, ecosystem development, and market competitiveness, making it a compelling project to monitor and consider as an investment opportunity.

1. Basic Information

As a Layer 2 scaling solution for Ethereum, Optimism has matured relatively quickly and developed its own ecosystem. Its Optimistic Rollup technology is now being adopted by multiple other Layer 2 projects, and a hybrid proof mechanism combining OP and ZK proofs has entered Optimism’s roadmap.

1.1 Positioning and Goals

Its primary user base consists of B2B clients, with C2C users as a secondary focus. The project’s vision is to become the world computer, while relying on Ethereum as the settlement layer, thus supporting Ethereum’s ambition of becoming the world’s settlement infrastructure.

1.2 Team Structure

Optimism is governed by the Optimism Foundation, while OP Labs serves as the entity responsible for development and operates as a for-profit organization. LinkedIn shows that OP Labs was founded in 2019 and is registered in the United States, with fewer than 50 team members working remotely. Governance is driven by a bicameral community structure within the Optimism Collective—the Token House and the Citizens’ House—and overseen by the Optimism Foundation.

Karl Floersch: CEO, holds a Bachelor's degree in Computer Science from Stony Brook University and SUNY. Joined Consensys in February 2016 as a blockchain engineer, primarily working on the Ujo Music project. Joined the Ethereum Foundation in September 2017 as a researcher focusing on POS and sharding. Joined OP Labs in January 2020 as CTO and was promoted to CEO in May 2023. He is passionate about Ethereum, Casper, cryptoeconomics, blockchain, open-source software, and meditation.

Prithvi Subburaj: COO, holds a Master's degree in Computer Science from Stony Brook University, with nearly 20 years of industry experience. Previously spent over 15 years at Google, leading R&D in communications, and later served as Chief Operating Officer at its North American headquarters. Joined OP Labs as COO in August 2023, overseeing engineering, product, and day-to-day operations.

Nick Balestra-Foster: Head of Engineering, graduated from the Università della Svizzera italiana. With over 20 years of software development experience, he previously worked as an engineer at OpenTable, Cloudflare, and Meta. Joined OP Labs as a Software Development Engineer in June 2022, became Director of Development in September 2022, and was promoted to Head of Engineering in June 2023.

Benjamin Jones: Co-founder, holds a Bachelor of Science in Mathematics from Northeastern University. Worked at a microscopy company before joining a blockchain-focused VC firm as an investment associate. In September 2018, co-founded Plasma Group to develop Plasma scaling solutions. Joined OP Labs in December 2019 and served as CEO.

Mark Tyneway: Co-founder, studied neuroscience at Stony Brook University and earned a Bachelor’s degree in Neuroscience from Binghamton University. Joined IBM in December 2016 to research the AI system Watson. Entered the blockchain space in May 2018 at Purse.io, focusing on P2P networks, then moved to Handshake to work on domain name services. Later became a co-founder of OP Labs.

Many core team members have strong ties to Stony Brook University, reflecting a technically robust team. Notably, part of the development workload is supported by prominent VCs such as a16z, Base, and Paradigm.

1.3 Investment Backers

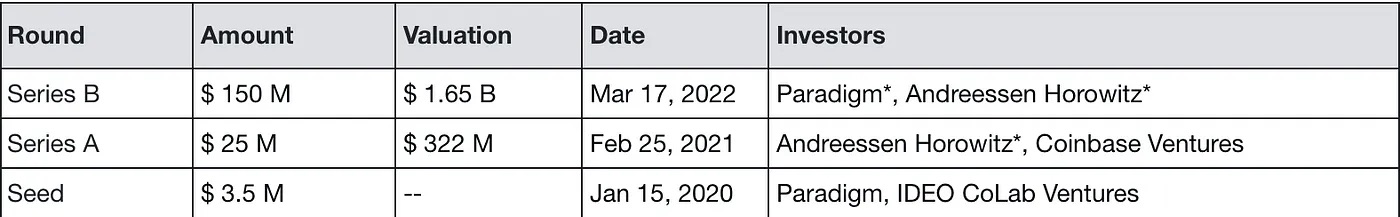

To date, Optimism has raised $178.5 million, with a post-money valuation of $1.65 billion in its latest round. As of January 3, 2024, the circulating market cap was approximately $3.5 billion, with a fully diluted valuation of $16.6 billion. These top-tier VCs have provided substantial support—not only financial but also technical—with OP Stack being jointly advanced by these investors. According to Crunchbase, Wintermute participated in the Series A round, and on-chain address analysis confirms that Wintermute is indeed one of OP’s market makers.

2. Operational Principles

2.1 Background

Launched in 2019, Optimism is a Layer 2 solution built on Optimistic fraud-proof technology, designed to scale Ethereum. Its technical approach involves executing Layer 1 transactions on Layer 2. While Ethereum transitions toward becoming a global settlement layer, Optimism assumes the role of the primary execution layer—fulfilling its own vision of becoming the world computer.

2.2 Core Mechanisms

The main operational framework of Optimism Layer 2 consists of three components: block production, block execution, and fault proofs. We will briefly explain each and assess their technical strengths, weaknesses, and future improvements.

Block Production

Block production on Optimism is primarily managed by the “Sequencer.” The Sequencer provides the following key functions:

-

Transaction confirmation and state updates

-

Construction and execution of L2 blocks

-

Submission of user transactions to L1

The Sequencer is responsible for finalizing state updates—meaning every transaction on L2 must be confirmed by the Sequencer to take effect. It also determines the ordering of user transactions. However, the Sequencer currently runs on centralized infrastructure operated by the Optimism Foundation. This centralization enables efficient operation and allows the foundation to intervene during malicious attacks. On the downside, if the Sequencer acts maliciously—such as extracting MEV (Maximal Extractable Value)—there is no effective oversight mechanism. Additionally, if the sequencer goes offline, the entire network halts, potentially causing significant losses for users, meaning trust in the foundation remains necessary. Therefore, decentralizing the Sequencer remains a key goal across Layer 2 projects. However, even if the Sequencer becomes decentralized, it may still involve only a small number of validators. Under regulatory pressure, this small group could collude to censor transactions. To mitigate this risk, a “withdrawal window” or “escape hatch” is proposed, allowing users to withdraw funds directly from L2 to L1 via a dedicated mechanism if the Sequencer fails to respond within a certain timeframe.

Given the excessive power of the Sequencer and the unresolved risks under regulatory pressure, Layer 2 teams are actively working on improvements—both through Sequencer decentralization and by implementing escape hatches.

Block Execution

The execution engine processes transactions and submits pre-updates of the network state. This is handled by the op-node client, primarily developed by OP Labs and Paradigm. Key responsibilities include:

-

Using P2P networking to synchronize state and blocks with other execution engines—similar to how Ethereum L1 execution clients sync over the network.

-

Aggregating transactions and updating Optimism’s state in real-time based on Ethereum deposits, typically after Ethereum achieves a certain level of finality.

Ethereum compatibility refers specifically to the execution engine’s ability to fully interpret Solidity smart contracts and their underlying opcodes.

Fault Proofs

In Optimistic Rollups, state commitments are posted to L1 with a 7-day challenge window. If no challenge is made, the commitment is finalized. However, if challenged, a successful challenge does not roll back the OP mainnet itself, but only invalidates the published state commitment. Therefore, the OP team is redesigning its proof mechanism and rebranding it. They argue that calling it “fraud proof” implies transactions can be deleted or reverted, which isn’t accurate—all transactions are valid and included in the chain; only the results of transaction execution can be disputed.

The current fault proof functionality is under active redevelopment, operating under the assumption that all submitted transactions are correct by default. Final confirmation of state and block commitments is still performed by the centralized Sequencer, giving it significant authority in the current system.

3. Market and Operations Analysis

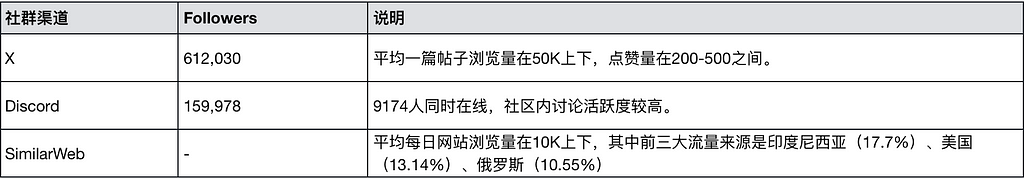

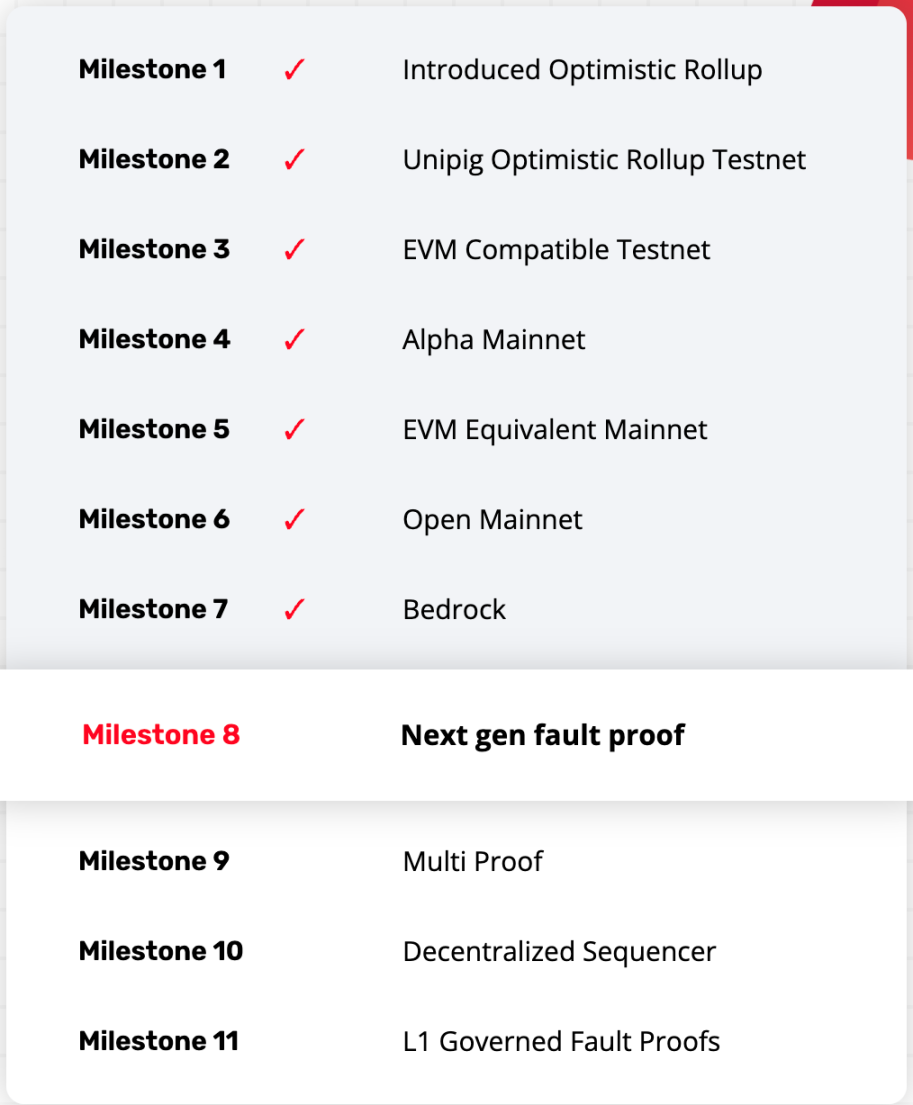

3.1 Social Media Metrics

3.2 Roadmap and Progress

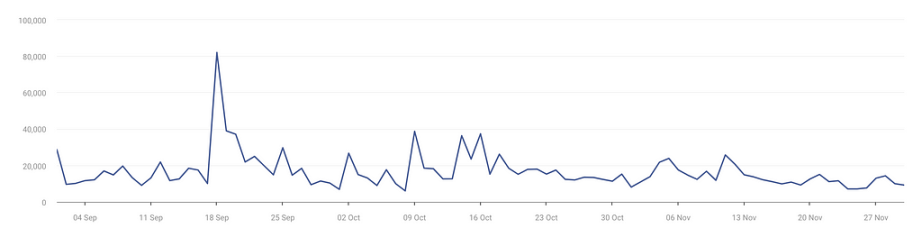

From Optimism’s roadmap, we see that the next-generation fraud proof is currently in development. Milestone 9 is expected to explore a hybrid OP+ZK proof model.

Beyond the public roadmap, OP-Stack—a modular software suite—is under active development. OP-Stack breaks down Optimism’s architecture into reusable components, enabling developers to build new chains compatible with Optimism and realize the Superchain vision. The launch of Superchain will integrate Optimism’s mainnet and other chains into a unified OP network (chains within the Superchain), enabling interoperability, standardized tooling, and shared liquidity across chains.

3.3 Community Governance Updates

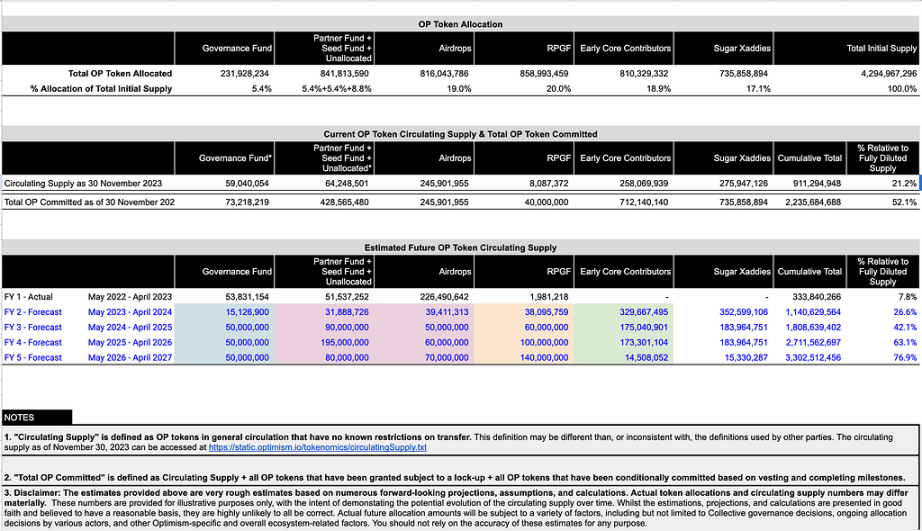

According to the Optimism Foundation’s mid-year report, the maximum supply of OP tokens is 4,294,967,296. As of November 30, 2023, 52.1% of the total supply had been committed for distribution by the Foundation, though only ~21.2% was circulating. For FY2 (May 2023 – April 2024), the circulating supply is projected to reach 26.6%, implying an additional 5.4% release by April 2024. By April 2025, ~42.1% will be circulating, and over 50% by December 2025. This ongoing unlock may exert downward pressure on the market.

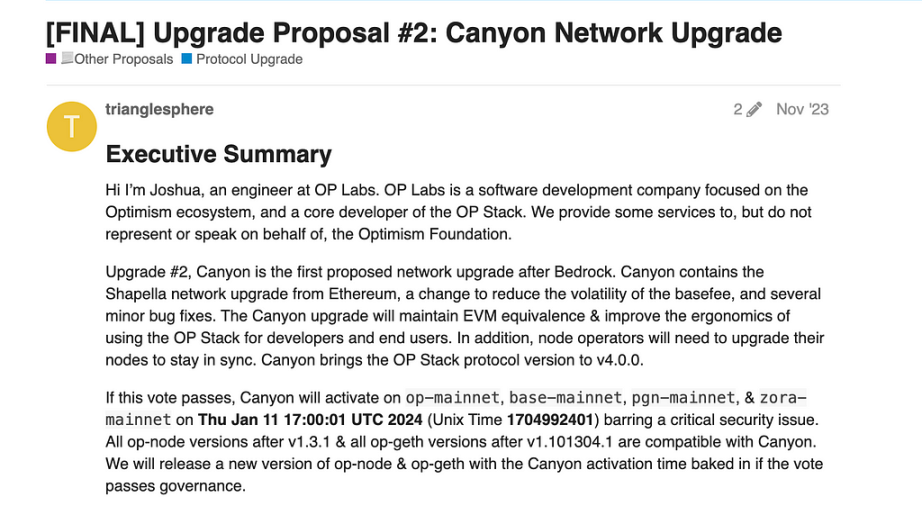

OP Labs announced the Canyon network upgrade on January 11, 2024, at 17:00:01 UTC—its second major upgrade following Bedrock. Canyon includes integration of Ethereum’s Shapella upgrade, changes to reduce base fee volatility (slower gas fee increases/decreases during low/high congestion), and minor bug fixes. Canyon maintains EVM equivalence (by removing the Selfdestruct opcode) and improves usability for developers and end-users building on OP Stack. Node operators were required to upgrade to remain synchronized. Canyon upgraded the OP Stack protocol version to v4.0.0.

4. Ecosystem

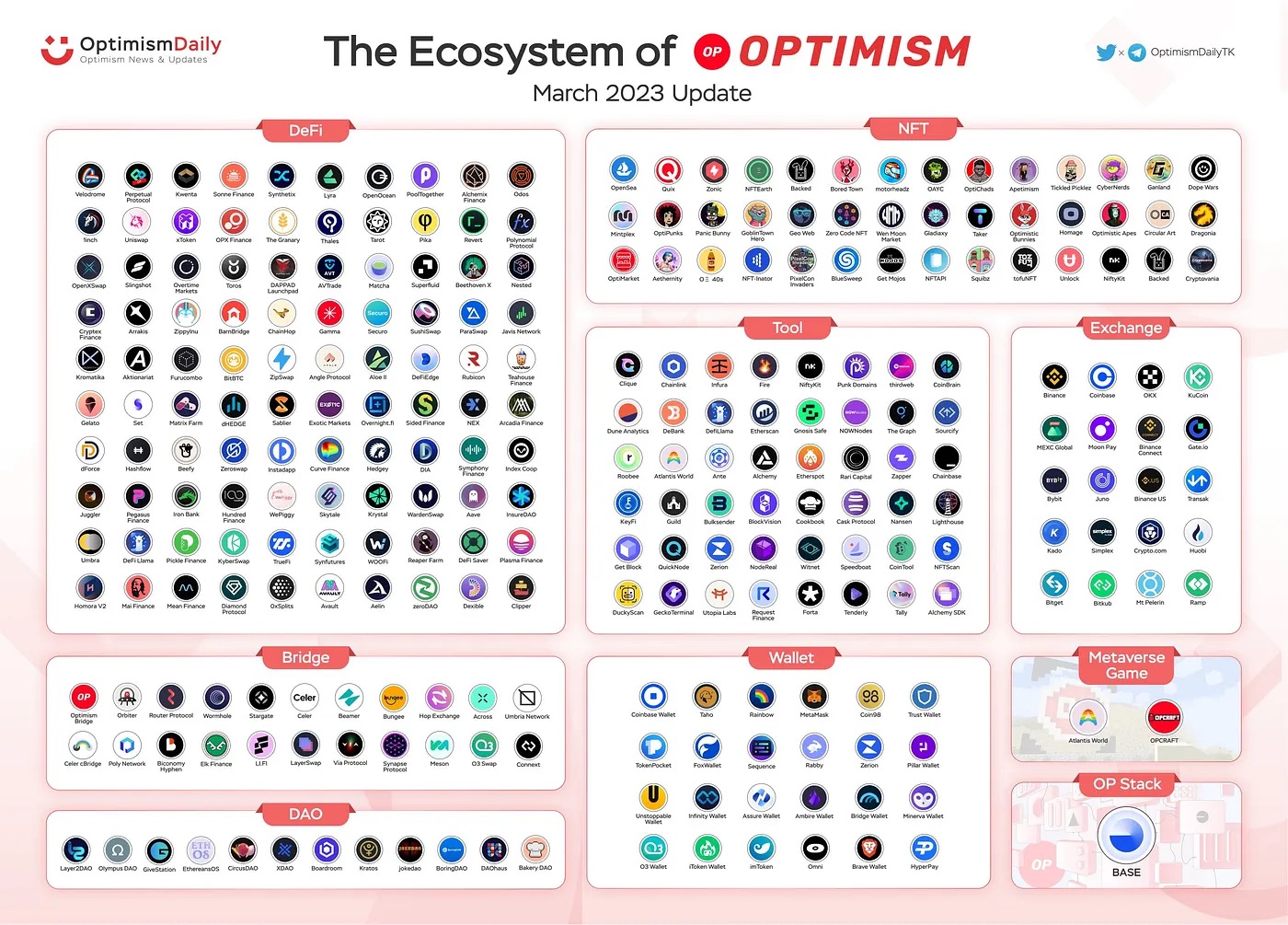

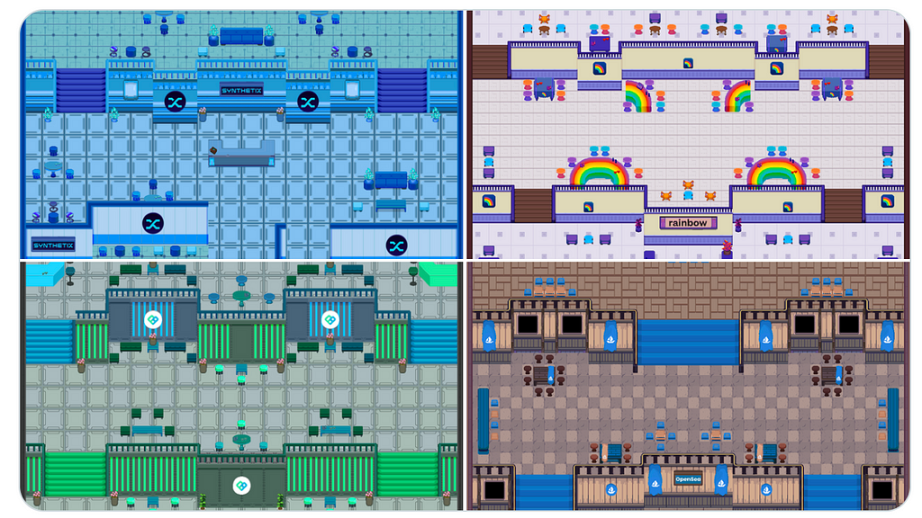

https://twitter.com/OptimismDailyTK/status/1633132990489575424/photo/1

From Optimism’s ecosystem map, DeFi dominates its application landscape, with rich offerings in tools and bridges.

4.1 DeFi

TVL in OP’s DeFi ecosystem continues to hit new highs. With Ethereum’s Dencun upgrade improving gas efficiency and throughput, more developers and users are expected to join.

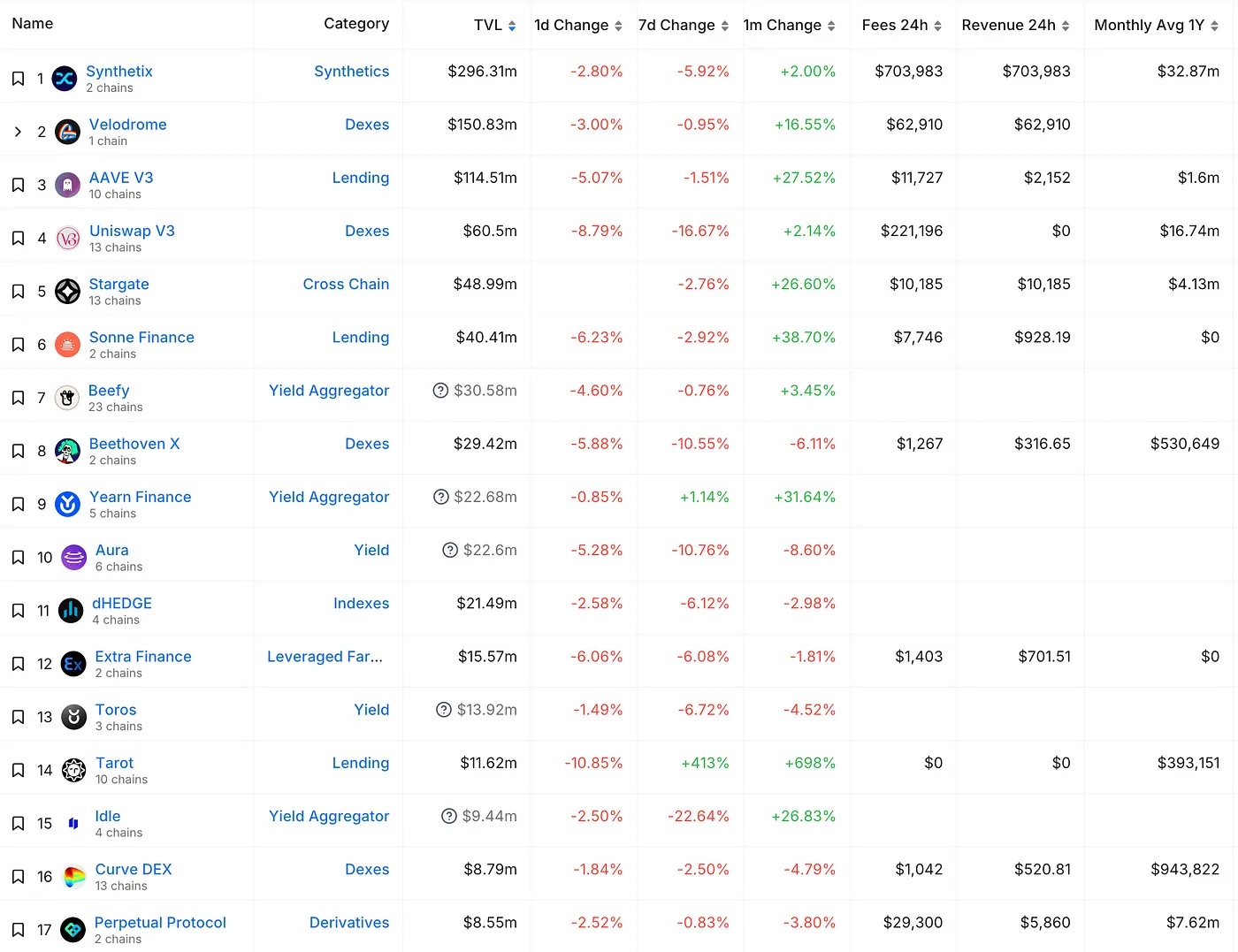

Key native DeFi projects on Optimism include Synthetix (derivatives), Velodrome (DEX), and Sonne (lending).

Synthetix

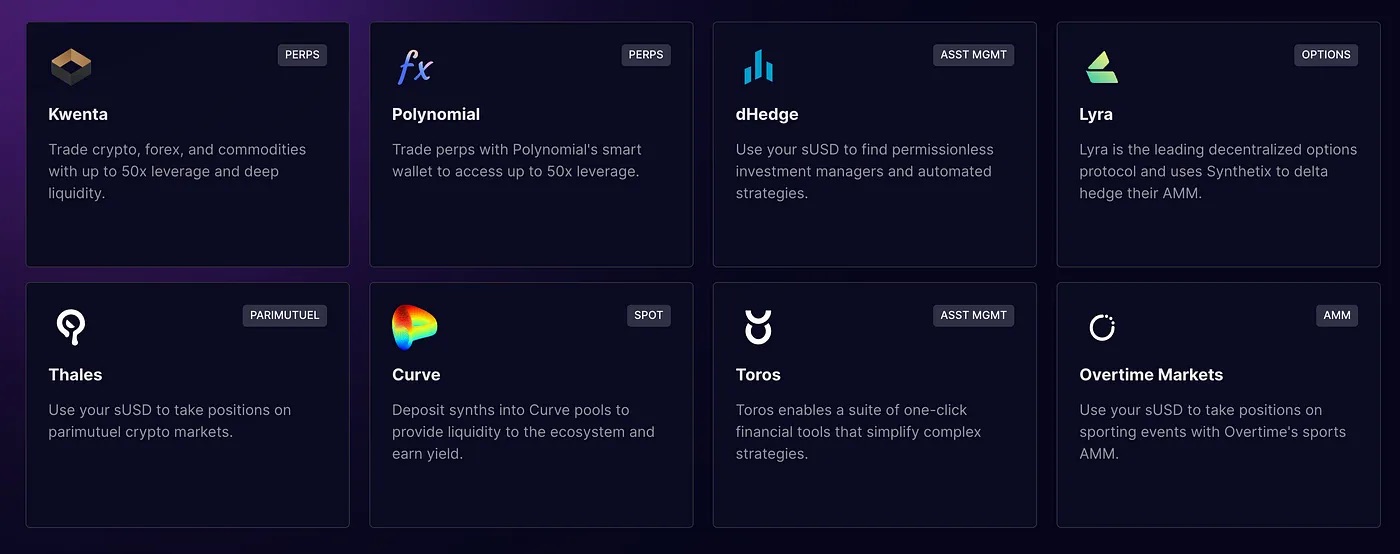

Synthetix is an Ethereum-based DeFi protocol offering on-chain exposure to both crypto and non-crypto assets. Users can mint and trade ERC-20 synthetic assets called “Synths.” Traders can gain exposure to commodities, fiat currencies, stocks, and cryptocurrencies without owning the underlying assets and without slippage. However, Synthetix does not provide a frontend interface and relies on third-party platforms.

Key use cases enabled by Synthetix:

-

Synthetic trading: Users can trade various Synths like ETH, BTC, USD, EUR, JPY, etc., using pooled collateral without holding the actual assets.

-

Staking: Unlike most DeFi protocols, staking SNX provides dual rewards: transaction fees paid in sUSD and SNX token rewards locked for 12 months.

-

Decentralized perpetual futures: Beyond spot trading, users can trade perps on Synthetix with simulated liquidity, enabling near-zero slippage and up to 10x leverage. Two DEXs currently support Synthetix perps: Kwenta and Decentrex.

Synthetix has become the foundational liquidity provider for synthetic assets on OP, integrating with dApps like Kwenta, Lyra, and Curve.

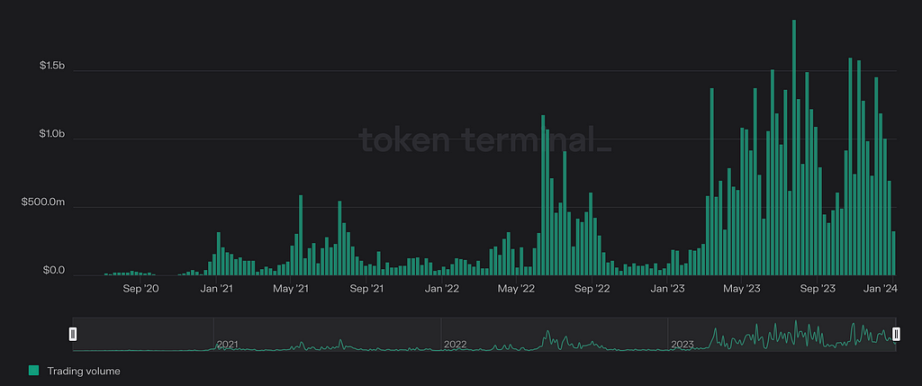

Recent weekly trading fees reached $700–800 million, peaking at $1.9 billion—surpassing the previous bull market high of $1.2 billion.

Synthetix is preparing for its V3 upgrade, introducing major enhancements to the perps platform focused on improving trader and LP experiences, simplifying integrations, and deeper ecosystem connectivity.

-

Native cross-margin: Unified margin pool where gains from one position offset losses from others, simplifying account management.

-

Expanded collateral options: Support for various Synths from the V3 spot market (e.g., sETH, sBTC) as collateral.

-

MEV-resistant liquidations: Gradual, configurable liquidation mechanisms to reduce MEV risks.

-

Improved deterministic settlement: Enhanced low-latency oracles to limit frontrunning opportunities.

-

NFT-based accounts: Positions controlled via NFTs, enabling transfer of trading accounts or granting limited permissions to others.

Velodrome

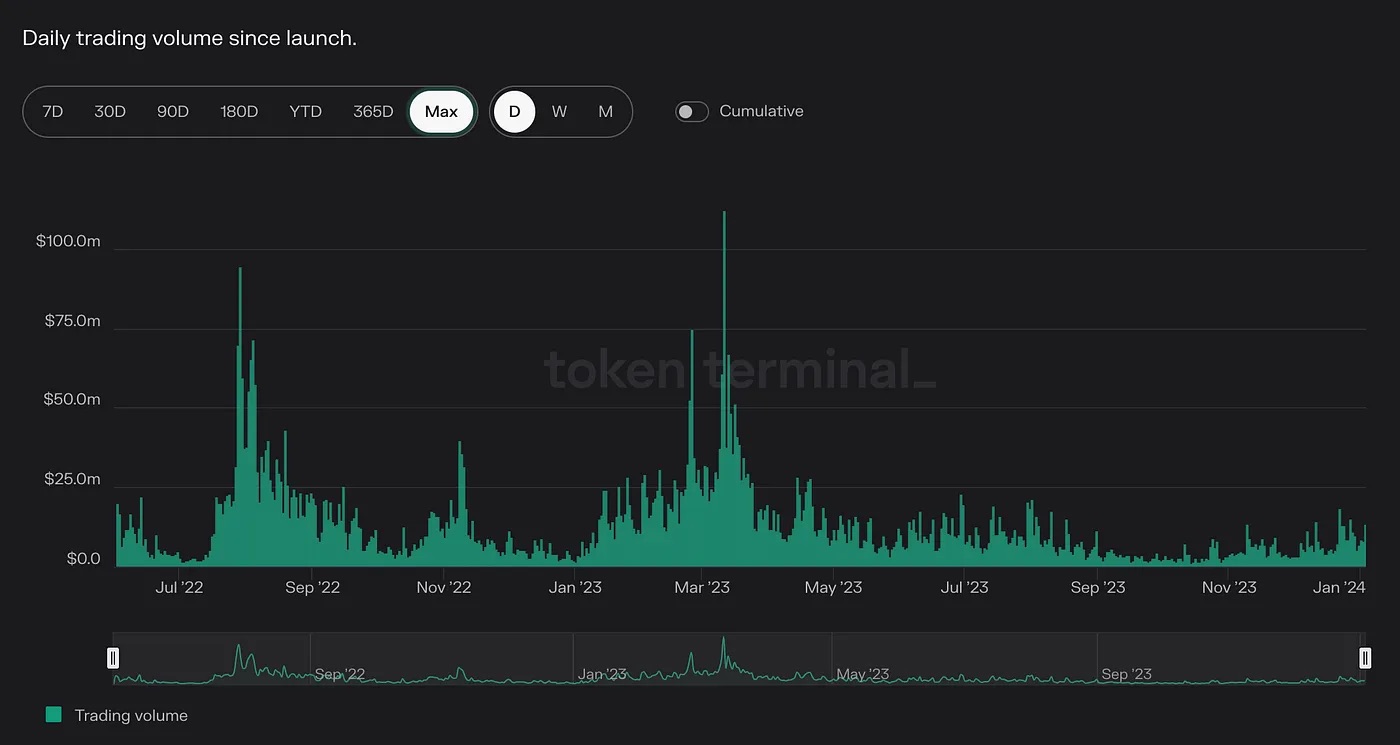

Velodrome is an AMM DEX serving as the primary trading and liquidity hub on Optimism. Its TVL is nearing half of its previous bull market peak. Though unable to compete with Uniswap, it maintains a dominant position in OP’s DEX landscape due to strong support from the OP Foundation. However, daily trading volume remains sluggish compared to prior highs.

Sonne

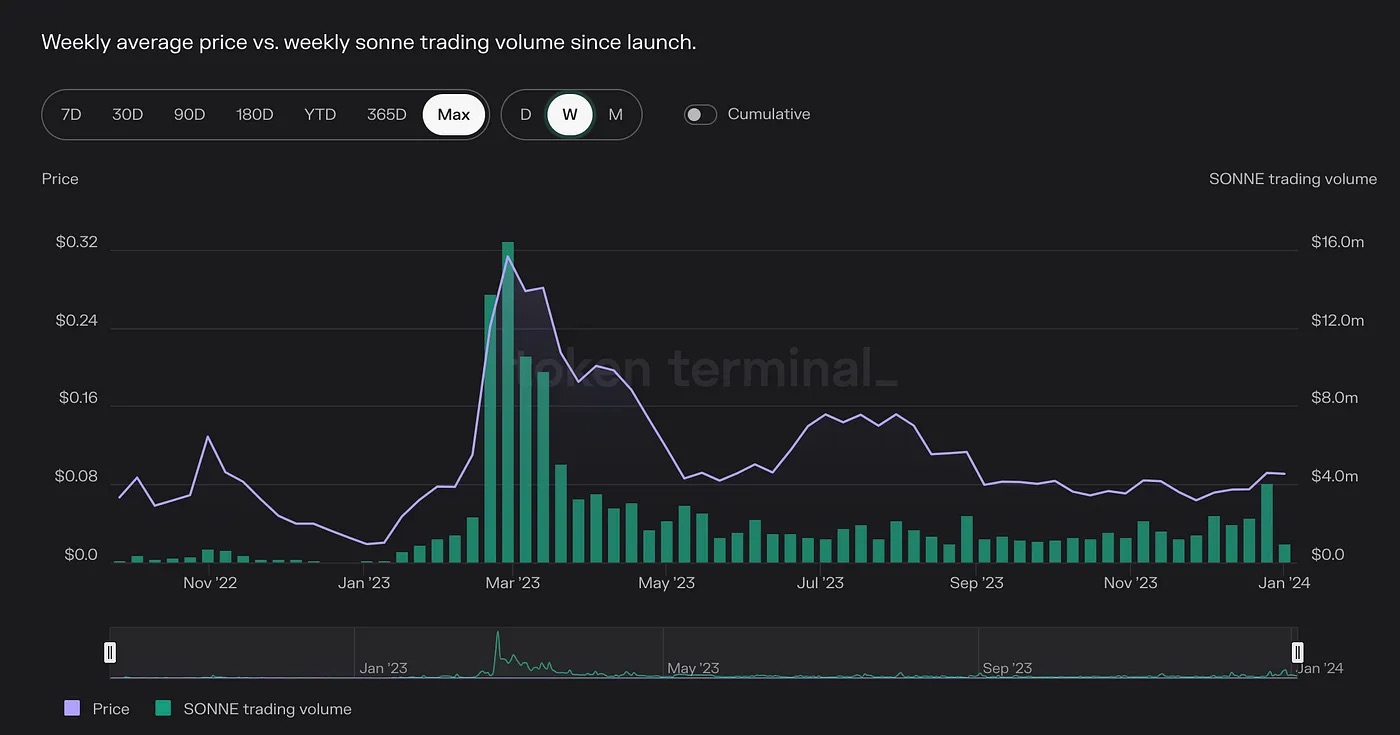

Sonne Finance is a permissionless, open-source lending protocol on Optimism, allowing individuals, institutions, and protocols to access financial services.

Users can deposit assets as collateral and borrow against them. TVL is approaching an all-time high. However, trading volume remains low. Despite this, Sonne has a relatively small market cap of just $6 million, with a fully diluted valuation of $8 million.

4.2 GameFi

GameFi development on Optimism is lagging, with weak ecosystem innovation.

Atlantis World

In Atlantis World, each project can apply for a dedicated community space. The alpha testnet has closed, and V2 is under development. The project received 23,656.03 OP tokens in funding.

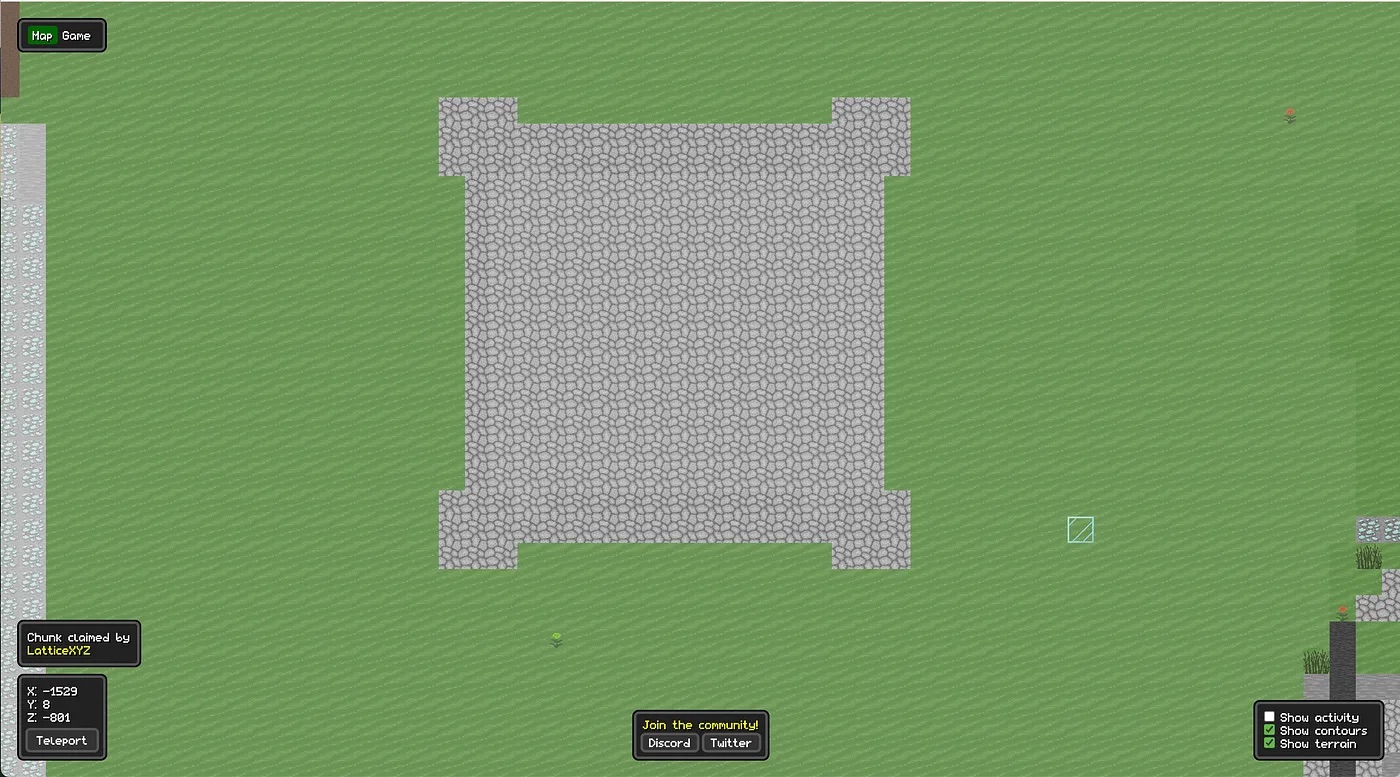

OPCRAFT

OPCRAFT is a fully on-chain game similar to Minecraft, built using OP Stack technology. It was the first application built on OP Stack, creating a dedicated appchain for the game. All in-game actions are recorded on-chain, delivering fast and smooth gameplay.

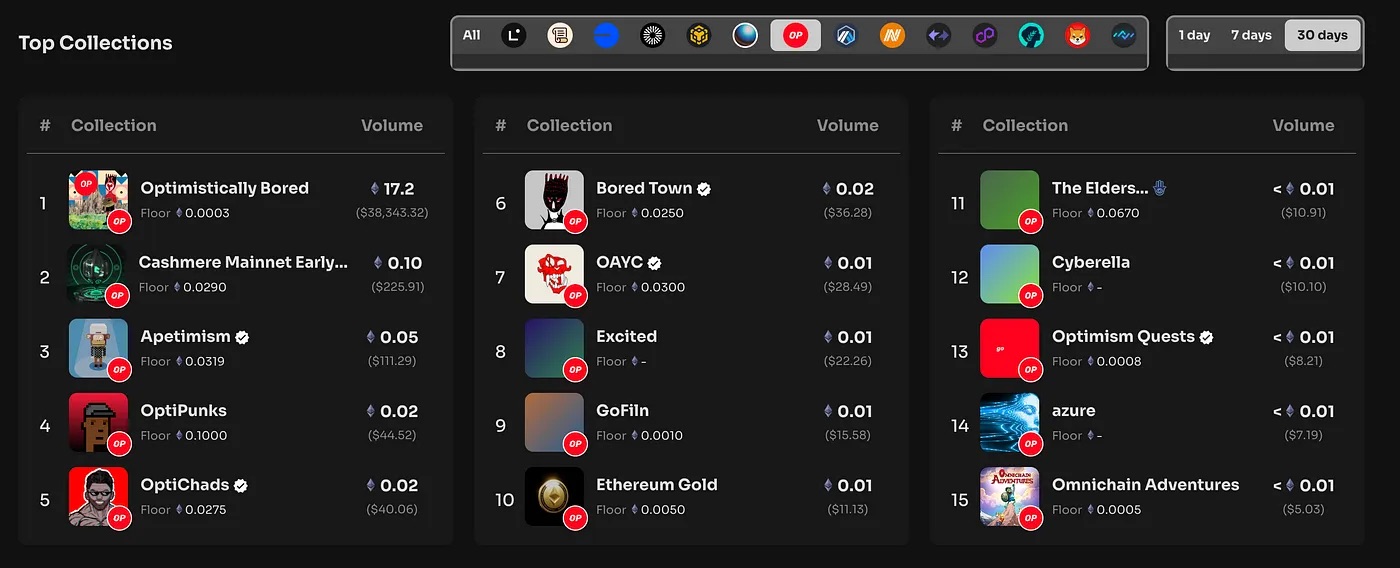

4.3 NFT

QUIX, the main NFT marketplace on OP, announced shutdown last year due to poor performance and extremely low trading volume. Currently, the only project with minor activity is Optimistically Bored, but its low floor price means the NFT sector on OP has seen little development.

4.4 Others

WorldCoin

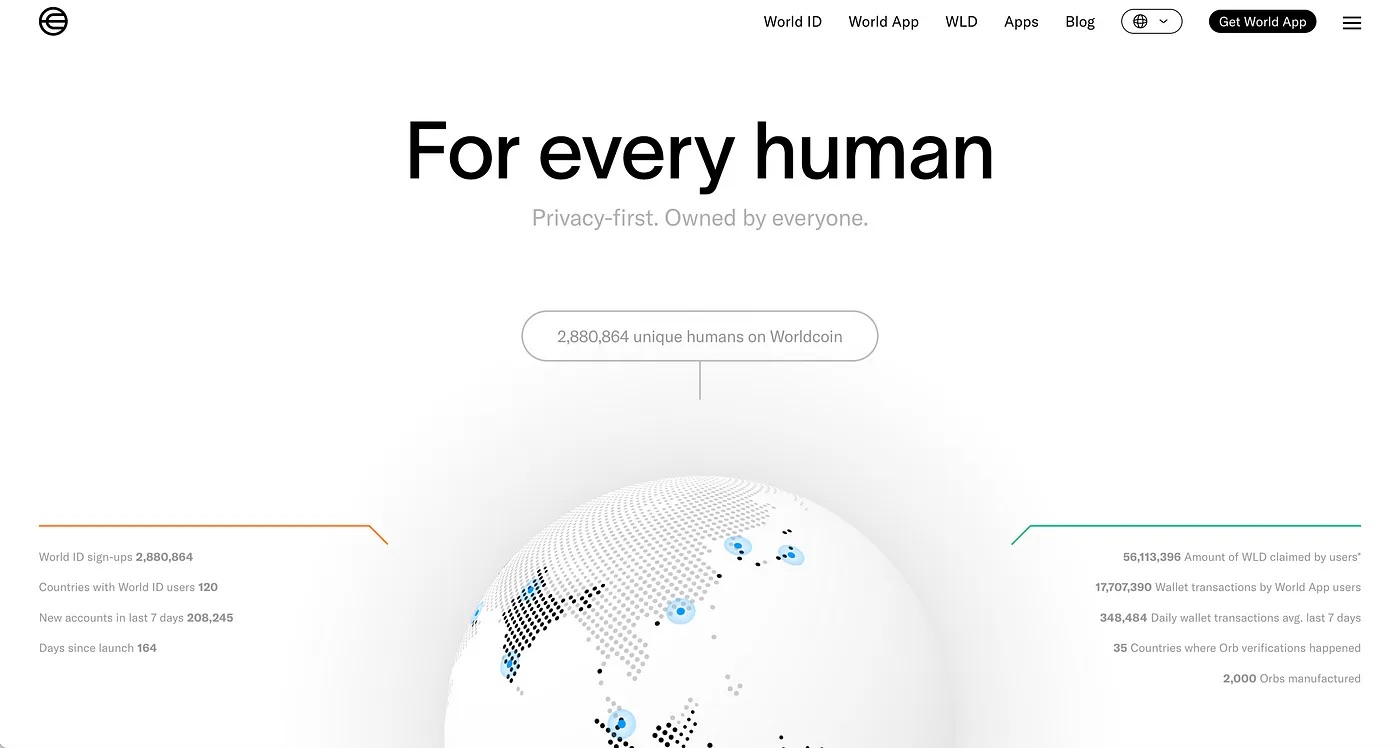

WorldCoin has migrated to Optimism. The WorldCoin Foundation and early contributors from Tools for Humanity (TFH) have pledged support for the Optimism Collective’s Superchain vision, collaborating to build a scalable blockchain ecosystem based on OP Stack. As a first step, World ID—a decentralized, privacy-first identity protocol—will launch on the OP mainnet. TFH’s World App, the first wallet supporting Worldcoin, digital assets, and stablecoins, is also migrating to the OP mainnet.

OlympusDAO

Olympus Protocol is a decentralized finance (DeFi) system issuing and managing OHM, a fully collateralized, algorithmic, freely floating stable asset. It aims to become a trusted, stable on-chain accounting unit, replacing centralized stablecoins. Total OHM supply is around 18 million, with the algorithmic stablecoin consistently trading around $11.

Olympus revolutionized DeFi by introducing “protocol-owned liquidity.” Every staked OHM earns compound rewards in additional OHM, secured by a community-owned treasury. The treasury can introduce liquidity by selling OHM bonds at a discount, generating profits. When OHM trades above intrinsic value, the treasury sells discounted OHM bonds for DAI, increasing reserves and distributing returns to stakers. When OHM trades below intrinsic value, the treasury buys OHM with its liquidity, reducing supply and theoretically increasing price.

OPSTACK

OP Stack is Optimism’s open-sourced modular codebase, aiming to enable developers to easily build appchains, Layer 2s, and Layer 3s. Chains built on OP Stack not only achieve full EVM compatibility but also aim to form a Superchain network, sharing sequencers and liquidity. The project is strongly backed by Base, Paradigm, and a16z.

5. On-Chain Data

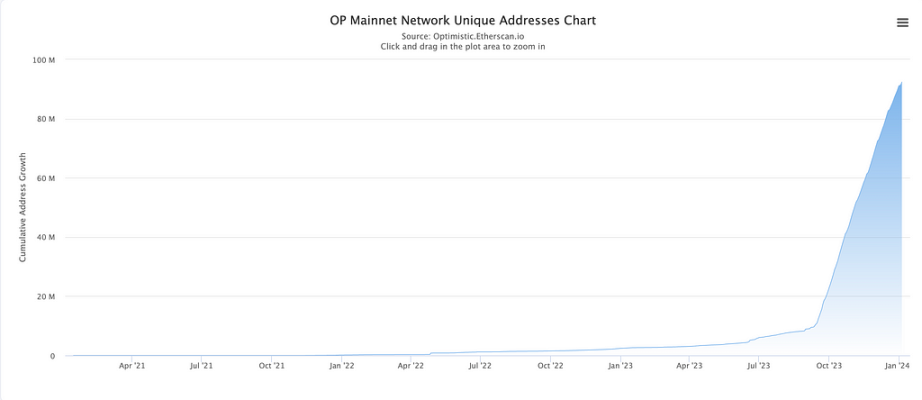

Optimism’s daily active addresses continue to grow, along with rapid expansion in new addresses, indicating strong momentum.

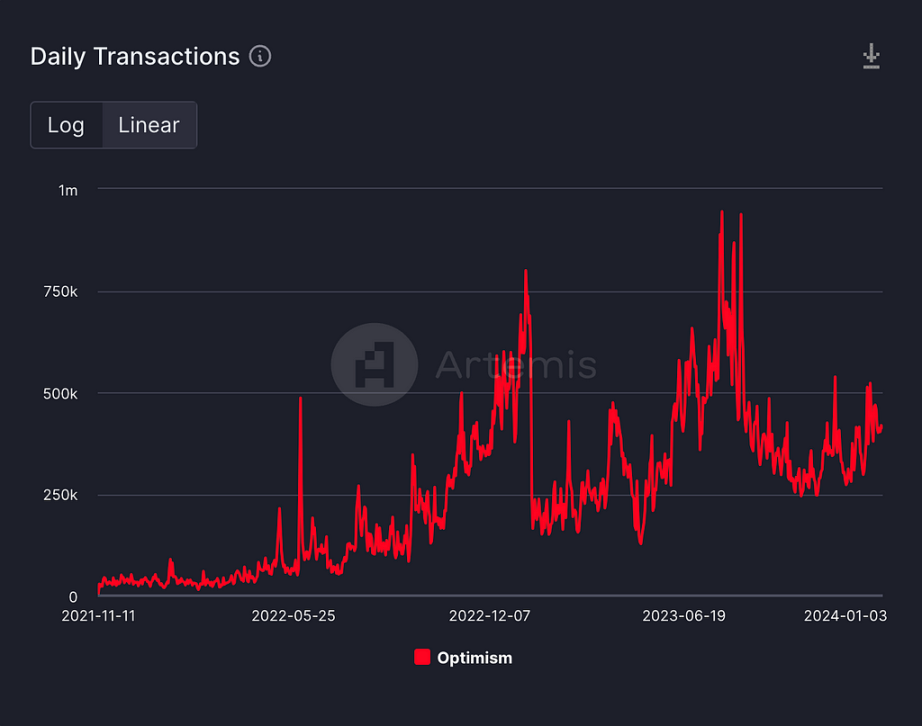

Daily transaction count is rising steadily. With Dencun upgrade enabling 3–5x higher throughput and lower gas fees, OP is expected to set new records in transaction volume.

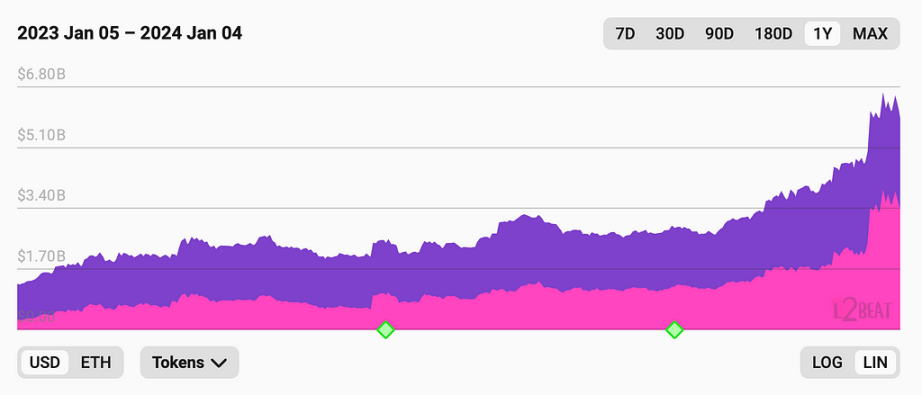

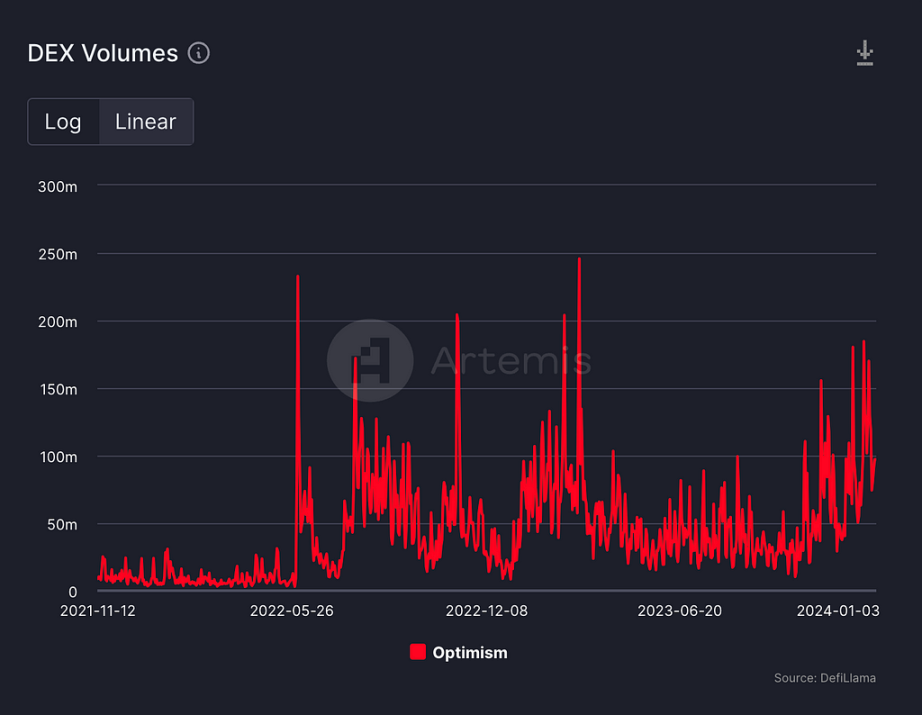

By DefiLlama’s TVL metric, DeFi TVL on OP is nearing all-time highs, and DEX trading volume shows clear signs of recovery.

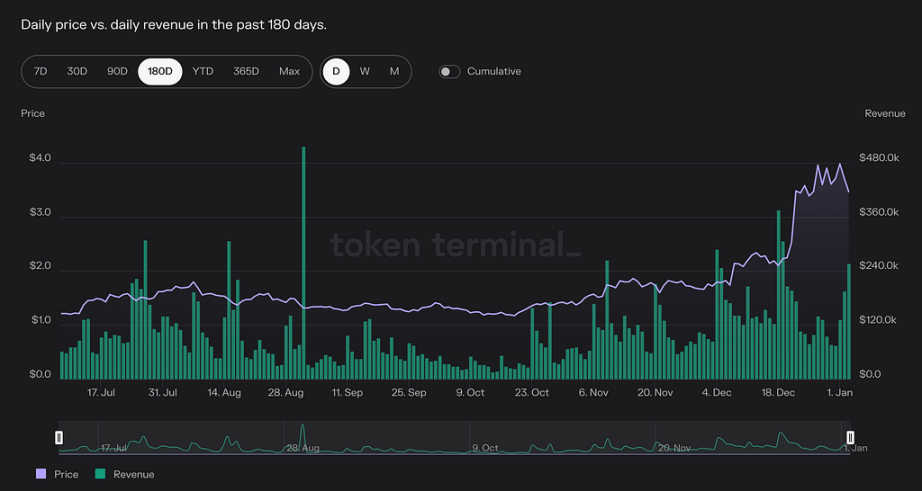

From a revenue perspective, most Layer 2s generate minimal income, indicating no direct correlation between revenue and token price.

Overall, Optimism demonstrates solid fundamentals. Its on-chain activity remains strong, and with the Dencun upgrade ahead, it is highly likely to break historical records—making it a promising investment candidate.

6. Market and Competition

6.1 Market Overview

Layer 2 competition centers on three key areas:

-

Proof mechanisms: To align with Ethereum’s ZK-centric roadmap (The Verge phase), the OP stack is moving toward a hybrid OP+ZK proof model. ZK-focused chains are optimizing algorithms to improve TPS, proof generation, and verification efficiency.

-

Sequencer decentralization;

-

Modularization: Projects like Polygon’s Superchain, Arbitrum’s Orbit, Optimism’s OP Stack, zkSync’s ZK Stack, and StarkWare are modularizing their codebases to facilitate the creation of appchains, L2s, and L3s.

Across the Layer 2 landscape, Arbitrum leads in TVL, but Optimism’s market share continues to rise. Currently, OP-based chains dominate the Top 5 TVL rankings, largely due to superior user experience. ZK technologies still require time to mature and depend on specialized hardware acceleration. Nevertheless, the broader ecosystem and Ethereum’s long-term direction clearly favor ZK solutions.

6.2 Competitive Analysis

Layer 2 competition revolves around developer adoption and ecosystem strength, driven by developer-friendliness (EVM compatibility), user experience (TPS, gas fees), and future roadmap. For comparison with Optimism, we focus on OP-stack chains, selecting Arbitrum and Base for detailed analysis across multiple dimensions.

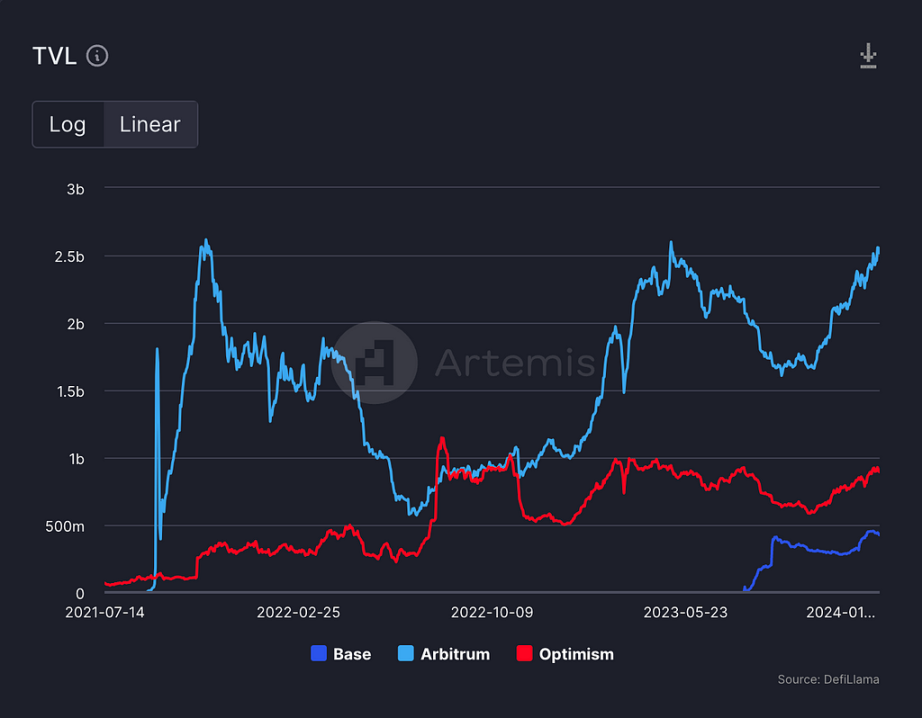

TVL Data

TVL

TVL

DefiLlama data shows all three major OP-stack chains nearing all-time high TVL. Base recently entered the top 3, largely due to Coinbase’s backing—Coinbase Wallet being the second-largest wallet by user count.

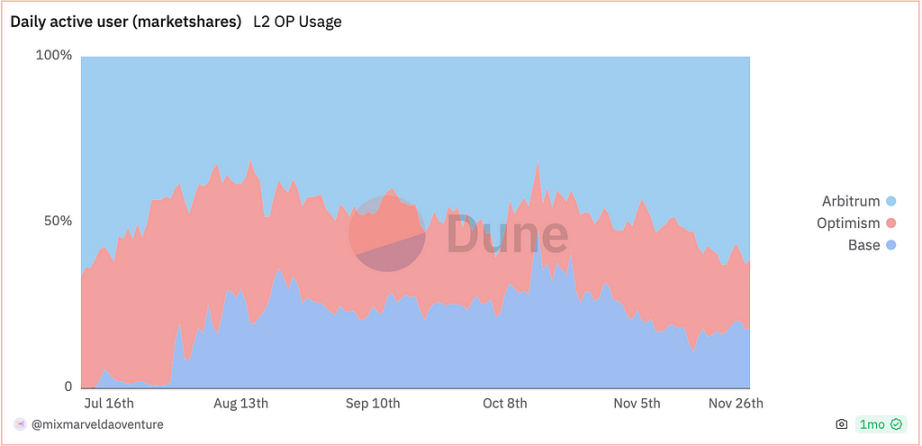

DAU Data

YoY DAU Growth

Daily active users have grown across the board. Arbitrum remains far ahead, while Base is catching up to Optimism in user numbers, thanks to massive traffic inflow. OP’s user share is gradually shrinking, and ecosystem growth has been flat—largely due to its strategic focus on building the Superchain vision.

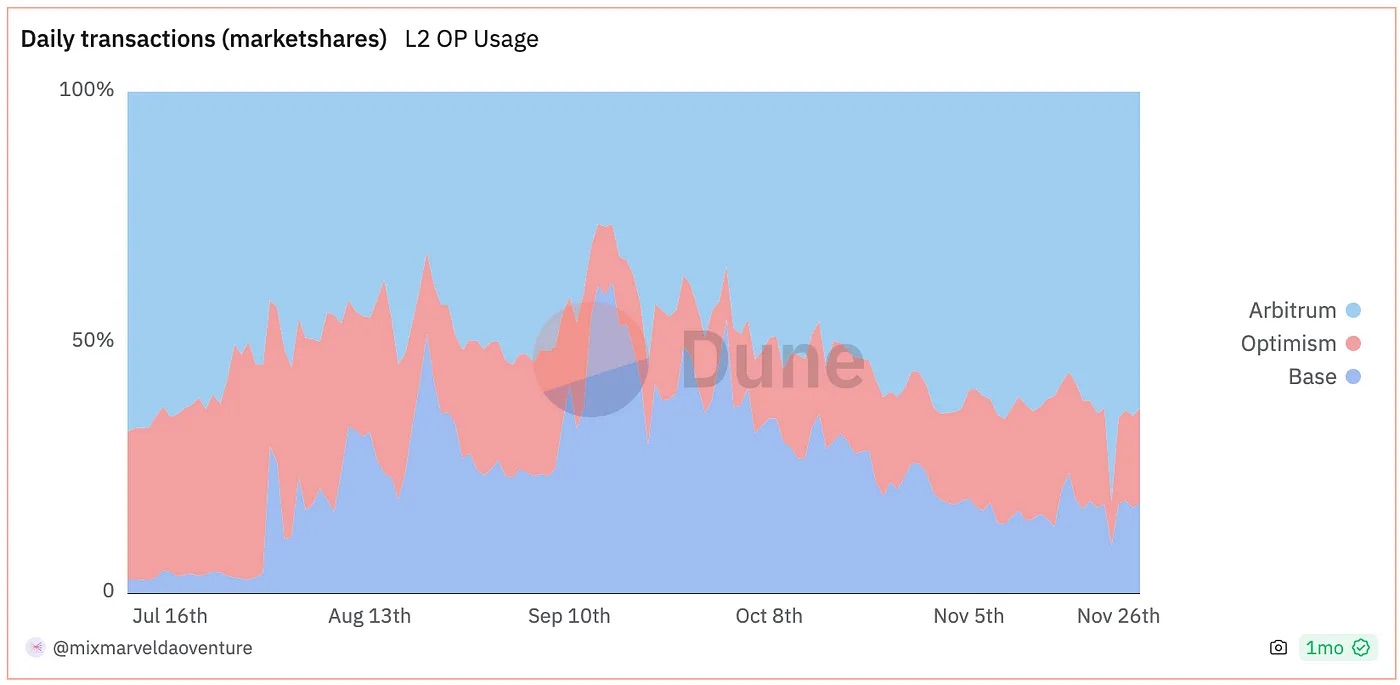

Daily Transaction Volume

In daily transaction volume, Arbitrum significantly outpaces OP and Base due to its more mature ecosystem. On a YoY basis, OP’s transaction share has remained stable over the past three months, while Arbitrum is gradually capturing Base’s market share—due to Base’s weak ecosystem and low user retention.

Gas Consumption Data

Join TechFlow official community to stay tuned Telegram:https://t.me/TechFlowDaily X (Twitter):https://x.com/TechFlowPost X (Twitter) EN:https://x.com/BlockFlow_News