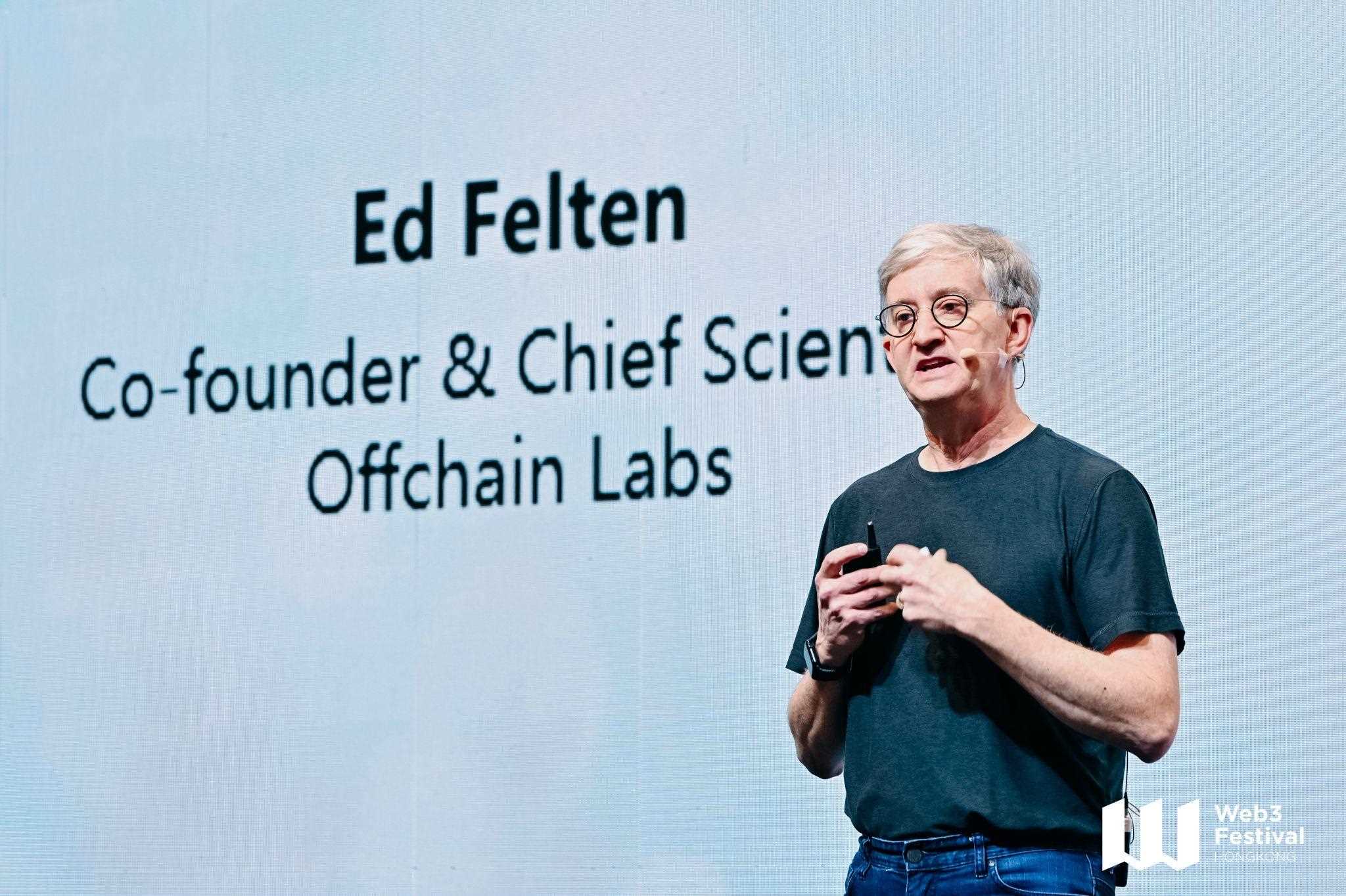

Optimism vs. Arbitrum: A Three-Month Data Comparison – Which L2 Is More Favored?

TechFlow Selected TechFlow Selected

Optimism vs. Arbitrum: A Three-Month Data Comparison – Which L2 Is More Favored?

This article compares the performance of Optimism and Arbitrum over the past three months from three aspects: coverage, retention, and revenue.

Author: Popescu Razvan

Compiled by: TechFlow

The debate between Optimistic rollups has never ceased. So let's compare the performance of Optimism and Arbitrum over the past three months across three dimensions—coverage, retention, and revenue—to see which comes out on top.

The "coverage, retention, and revenue" framework focuses on metrics that matter to any blockchain ecosystem. Every blockchain should care about three things: expanding its user base (coverage), retaining its users (retention), and generating value from its users (revenue).

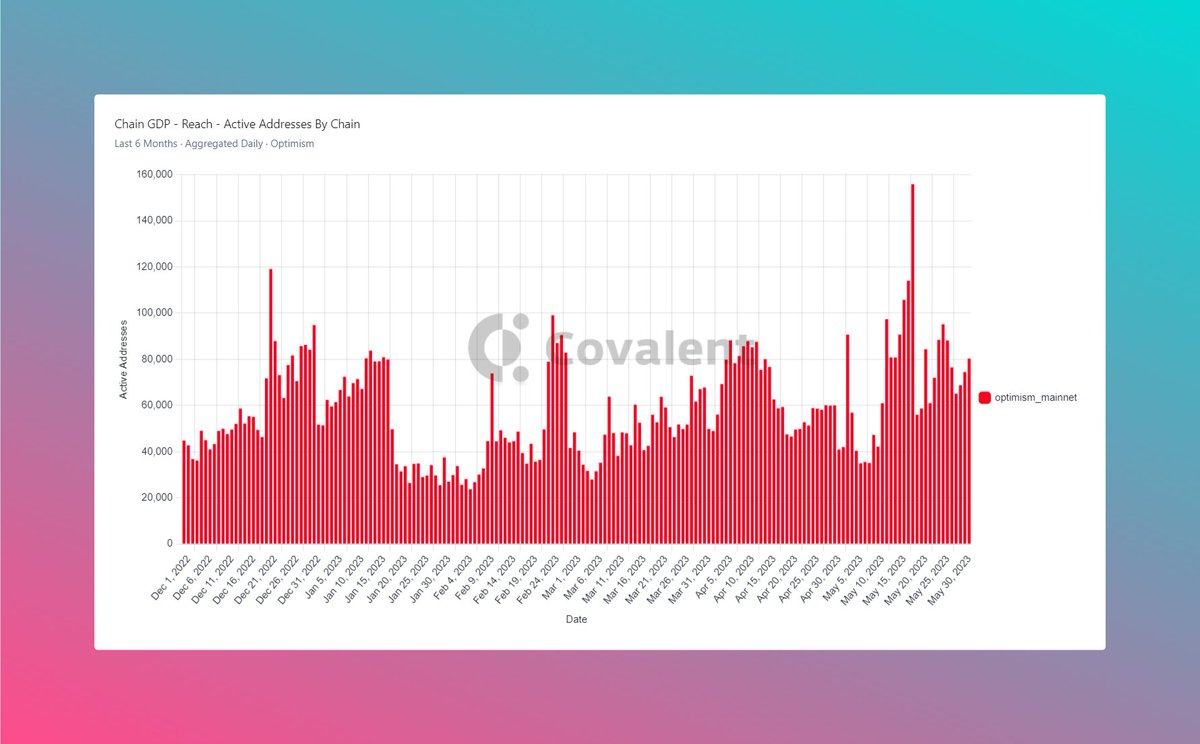

First, let’s examine Optimism’s coverage. It has an average daily transaction volume of 254,566, an average of 72,734 daily active addresses, and processes 3.23 transactions per second. Coverage appears “solid,” but without comparison, it means little.

Next, consider Arbitrum’s coverage. It averages 1,230,979 daily transactions, 236,396 daily active addresses, and handles 11.73 transactions per second. Clearly, Arbitrum appears significantly more active.

Interestingly, even though Arbitrum seems 4–5 times busier, the ratio of average daily transactions per active address—5.20 for Arbitrum versus 3.5 for Optimism—is not drastically different.

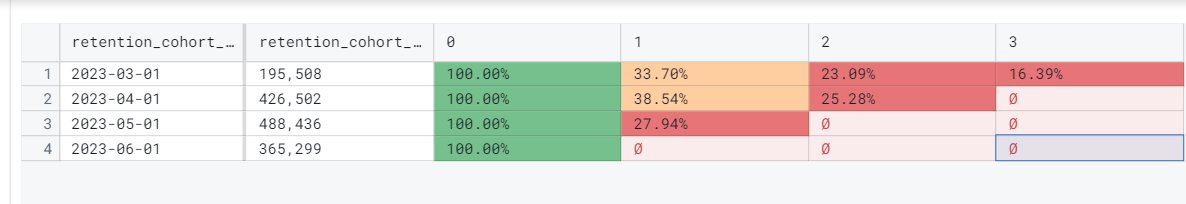

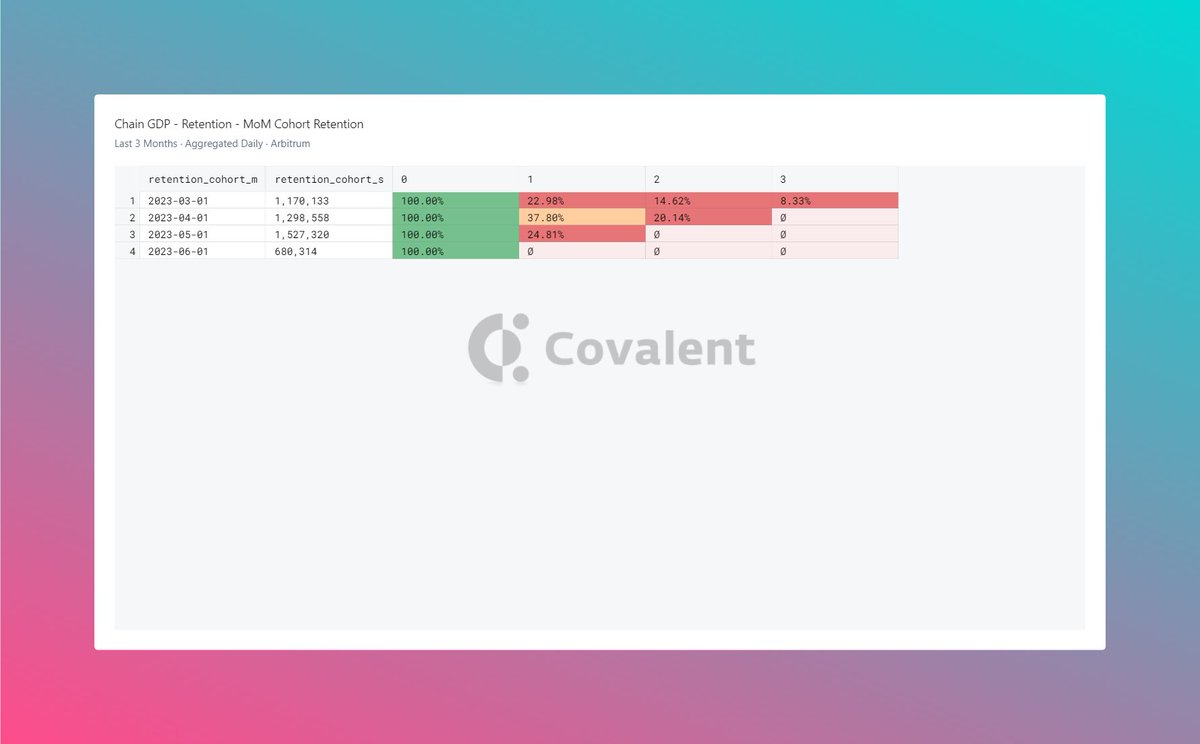

Now let’s look at Optimism’s retention. Retention appears to be slowly declining (possibly due to bear market conditions). The number of days per week that “users” remain active is also a useful metric.

Now let’s review Arbitrum’s retention. Retention appears to be dropping at a faster pace (possibly due to airdrop-related activity). The weekly number of active days per “user” is also lower.

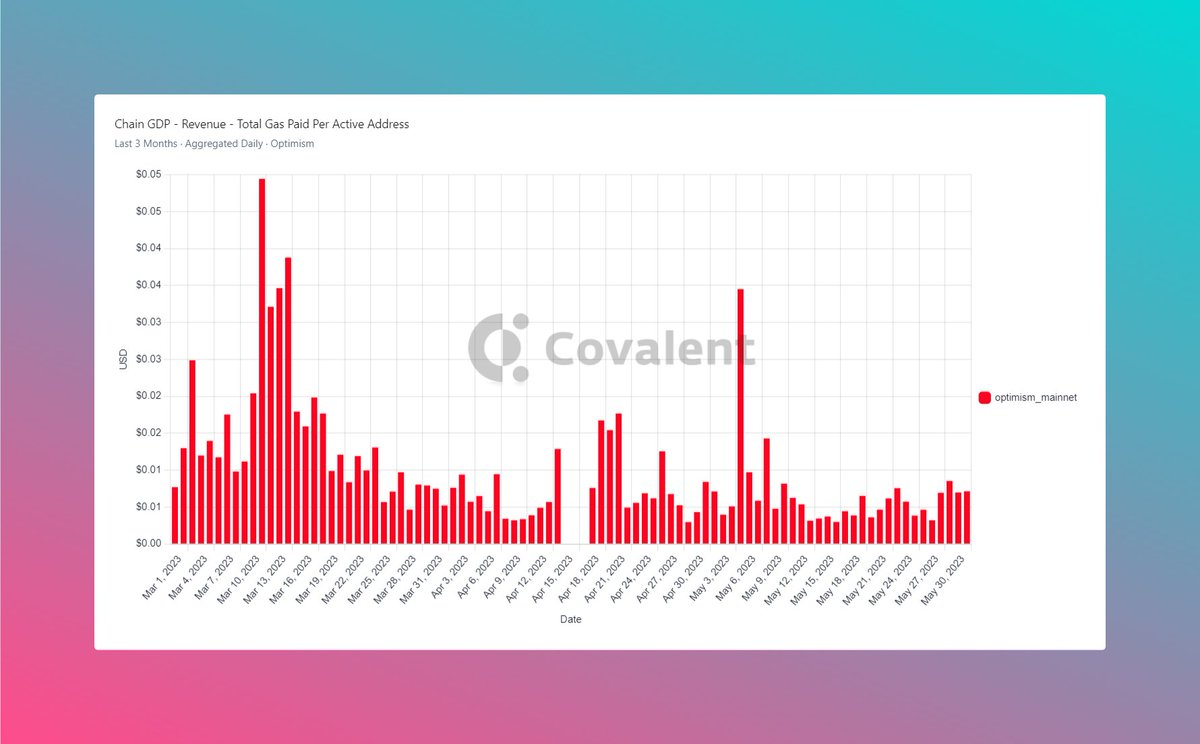

Finally, let’s analyze Optimism’s revenue. Optimism DEXes have seen $1 billion in total trading volume, with $42,729 in gas consumption and an average gas fee of $0.01. Optimism focuses on public goods, resulting in minimal speculative airdrop-driven trading activity. The gas fees paid per active address look quite reasonable.

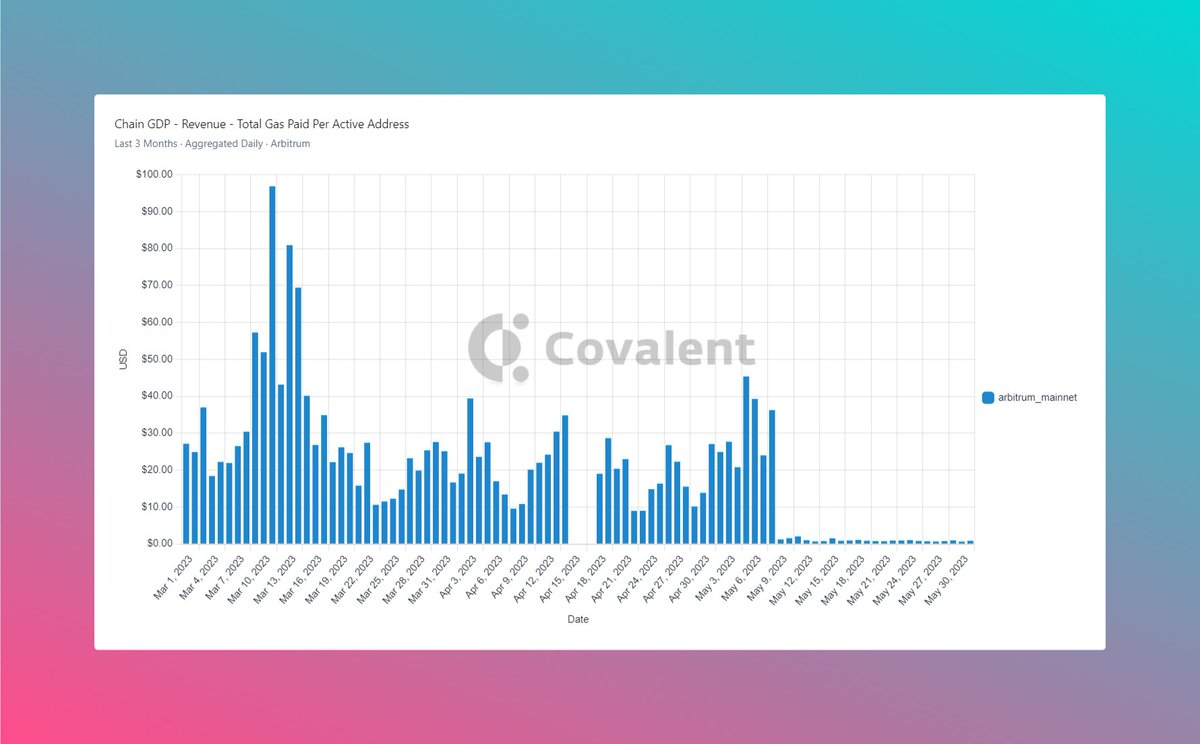

Now consider Arbitrum. It has around $52 billion in DEX trading volume, $303,311,801 in gas consumption, and average gas fees ranging from $2 to $4. The gas fees paid per active address look somewhat odd, showing a sudden drop.

In conclusion, my assessment is that both Optimistic Rollups appear healthy and vibrant. They have different goals and cannot be fairly compared using purely objective metrics—especially given Arbitrum’s recent airdrop. A more accurate analysis may need to wait until the next bull market begins. Both projects have strong track records and embrace DAO culture and Web3 funding initiatives.

Don’t forget: Optimism was built on a foundation of supporting public goods. It represents a sustainable ecosystem funding experiment driven by protocol revenues. Arbitrum, meanwhile, appears more focused on decentralization, as it was the first EVM rollup to achieve Stage One decentralization.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News