5 ETH Controls $6.5 Million in Voting Power: Arbitrum Election Dispute Unlocks the "Pandora's Box" of DAO Governance

TechFlow Selected TechFlow Selected

5 ETH Controls $6.5 Million in Voting Power: Arbitrum Election Dispute Unlocks the "Pandora's Box" of DAO Governance

A platform named LobbyFinance (LobbyFi) enabled users to obtain voting rights for up to $6.5 million worth of ARB tokens at extremely low cost, successfully influencing the outcome of a key committee member election.

Author: Frank, PANews

As a leading Ethereum Layer 2 scaling solution, Arbitrum DAO has been widely anticipated—not only for its technical capabilities but also for its large and active decentralized autonomous organization (DAO). Through the collective wisdom of ARB token holders, it aims to guide the protocol toward a broader future. However, a recent controversy surrounding the election of DAO members has brought into sharp focus a long-hidden "ghost" lurking in the depths of DeFi governance: vote buying (or vote markets).

At the heart of the issue is a platform called LobbyFinance (LobbyFi), which enabled a user to acquire voting rights over $6.5 million worth of ARB tokens at an extremely low cost—just 5 ETH (approximately $10,000)—and successfully influence the outcome of a critical committee election. This incident has opened Pandora’s box, exposing not only the fragility of the “one token, one vote” governance model but also triggering deep concerns about the legitimacy, security, and future direction of DAO governance. Is this merely an isolated "black swan" event, or is it the tip of an iceberg signaling systemic crisis in DAO governance?

5 ETH Moves $6.5 Million in Voting Power: The Capital “Ghost” Behind the Election Controversy

In early April 2025, Arbitrum DAO was holding elections for its newly established Oversight and Transparency Committee (OAT). This seemingly routine community governance process was thrown into chaos by a seemingly minor transaction.

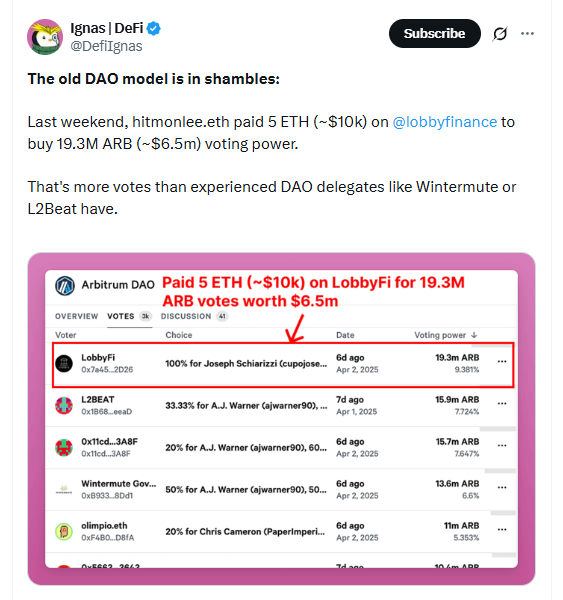

According to disclosures by DeFi researcher @DefiIgnas, an address named hitmonlee.eth used the LobbyFi platform to spend just 5 ETH (worth about $10,000 at the time) to purchase voting rights for as many as 19.3 million ARB tokens. At market value, these tokens were worth approximately $6.5 million. More shockingly, the volume of acquired voting power exceeded that held by well-established representatives such as Wintermute and L2Beat—longtime participants in Arbitrum DAO with significant community delegations.

Rather than distributing these votes across multiple candidates, hitmonlee.eth directed all of them to Joseph Schiarizzi, one of the OAT committee candidates and a developer and expert in the DeFi space. This massive influx of votes proved decisive, ultimately securing Schiarizzi’s election to the OAT committee.

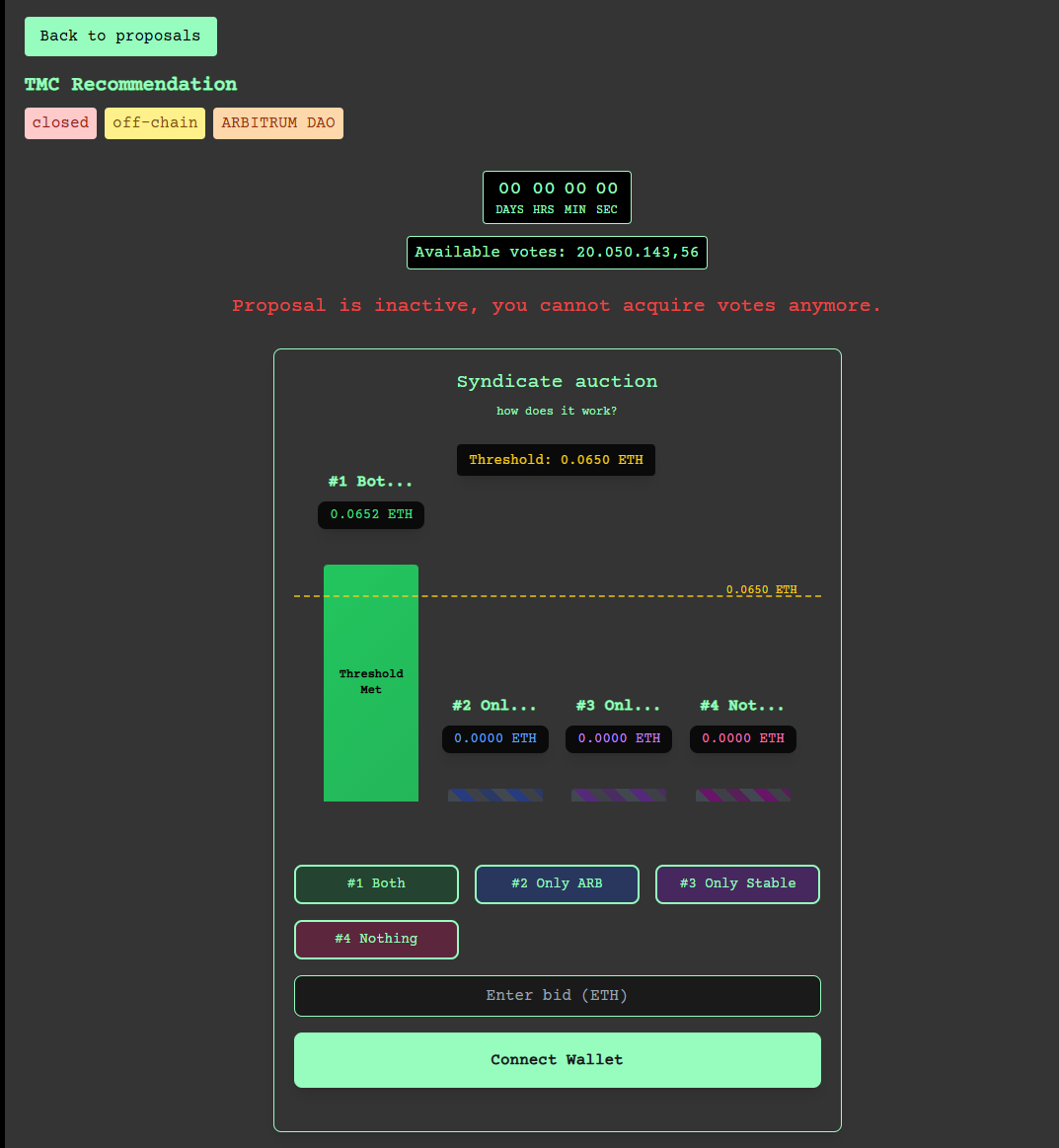

The key enabler behind this event was LobbyFinance (LobbyFi). Positioned as a governance influence platform—or more bluntly, a “voting rights rental market”—LobbyFi allows token holders to delegate their voting rights to the platform in exchange for rental income. Voting rights can be sold through auctions (going to the highest bidder) or via fixed-price “instant buy” options set by the platform.

In the case of the Arbitrum OAT election, hitmonlee.eth exploited the $10,000 “instant buy” option. While LobbyFi claims transparency—disclosing available proposals and prices and allowing time for market response—the fundamental nature of the mechanism is the commodification of governance power. It enables short-term capital to gain disproportionate influence at a fraction of the cost of directly purchasing equivalent tokens.

Economic Incentives Behind the Election Controversy

The reason this incident sparked such intense debate lies in the imbalanced economic incentives involved. Membership on the OAT committee is not honorary; it comes with tangible financial rewards. Estimates suggest the position offers around 47.1 ETH in compensation over a 12-month term (roughly $7,500 per month), plus potential bonuses of up to 100,000 ARB tokens (worth approximately 18.7 ETH at the time), resulting in total potential earnings of about 66 ETH.

This means that hitmonlee.eth spent only 5 ETH to help elect a candidate who could earn up to 66 ETH—a massive return on investment. Such a stark disparity clearly creates powerful economic incentives for vote-buying behavior.

The beneficiary himself, @CupOJoseph, publicly acknowledged that current pricing for vote purchases is “too low and highly risky,” stating that “obtaining $10,000 from a DAO shouldn’t cost only $1,000.” While this statement appears to distance him from direct involvement in vote buying, it also indirectly confirms the existing vulnerabilities in the system.

This was not the only low-cost transaction on LobbyFi. As @DefiIgnas revealed, there had previously been purchases of 20.1 million ARB votes for less than 0.07 ETH (worth under $150 at the time). With influence so cheap, the gates of DAO governance appear increasingly open to capital interests.

Official Discussion Sparks Divided Community Opinions – DAO Governance May Be Under Regulatory Scrutiny

The voting controversy at Arbitrum caused a major uproar within the community and forced both the Arbitrum Foundation and DAO members to confront the challenges posed by vote markets, prompting efforts to find solutions.

Shortly after the incident, the Arbitrum Foundation launched an official discussion thread titled “DAO Discussion: Vote Purchase Services” on its governance forum. The foundation acknowledged this as a “pivotal moment,” but instead of imposing immediate bans, chose to defer the decision to the community, continuing to uphold the principle of collective deliberation.

According to the proposal, LobbyFi had been active within Arbitrum DAO for several months, but this was the first instance where someone used paid influence to sway an election outcome.

Community opinions are sharply divided. A small number of hardliners advocate zero tolerance for vote buying, proposing to cancel or disregard any votes identified as purchased.

Others argue that in a token-weighted governance system, vote buying reflects market dynamics and cannot be fully eradicated. Attempting to ban it outright may simply drive the practice underground. Some even suggest platforms like LobbyFi offer traceability advantages over opaque private deals. There are those who believe LobbyFi actually activates otherwise dormant voting power, thereby increasing overall participation.

More constructive discussions focus on addressing root causes—aiming to reduce the appeal of vote buying while enhancing rewards for honest, engaged governance participation.

Notably, regulatory bodies may now be paying attention to the disorder and vulnerabilities in DAO governance. According to a report by Katten, U.S. regulators such as the SEC and CFTC have begun scrutinizing DeFi and DAOs. In its 2017 investigative report on “The DAO,” the SEC explicitly stated that certain tokens issued by DAOs could qualify as securities. In the CFTC’s lawsuit against OokiDAO, the court ruled that a DAO can be treated as an unincorporated association liable under law—and potentially hold individual voting token holders jointly responsible. The SEC’s investigation into Mango Markets marked the first time regulators focused directly on governance tokens themselves. If DAO governance is widely perceived as manipulable and lacking effective oversight, it increases the likelihood of falling under existing financial regulations—and could even impact the legal classification of governance tokens.

Has Pandora’s Box Been Opened? Is DAO Governance Becoming a Hunting Ground for Capital?

The Arbitrum voting controversy is no isolated incident—it reveals a deep-seated crisis facing DAO governance across the DeFi landscape. The rise of vote markets like LobbyFi lays bare the inherent contradictions within the foundational “one token, one vote” model.

The core ideals of DAOs are decentralization and community self-governance. Ideally, decisions should reflect members’ understanding of the protocol and their commitment to its long-term health. Yet, the emergence of vote markets allows governance influence to be bought directly with money, tilting decision-making power toward capital.

Extreme examples include the “coup” at BuildFinanceDAO: On February 9, 2022, a single user purchased enough BUILD tokens on the open market to seize control of the DAO, then passed a proposal granting themselves authority to mint new tokens and access the treasury, ultimately draining around $470,000 in assets and rendering the original tokens worthless.

In 2022, Beanstalk Farms suffered a flash loan attack where an attacker borrowed massive amounts of governance tokens within a single block, passed an emergency proposal, and stole $182 million in reserves. These cases highlight the fragility of DAO governance mechanisms—and vote markets provide would-be attackers with cheaper, more accessible tools.

The Arbitrum DAO voting controversy acts like a prism, reflecting the difficult balance DAOs must strike between efficiency, fairness, and security. Beneath the simplicity of “one token, one vote” lies the potential erosion of decentralized ideals by concentrated capital. Platforms like LobbyFi emerge from market-driven demands for efficiency and yield, yet they undeniably open doors to governance manipulation and pose serious challenges.

Currently, there is no silver-bullet solution. Banning vote markets outright may prove unenforceable and could push activities into darker corners; leaving them unchecked risks turning DAOs into playgrounds for capital. This incident serves as a wake-up call for all DAO participants: decentralized governance is not a utopia achieved overnight. It is a complex system requiring continuous design, iteration, and strategic博弈 (strategic game-playing). The central challenge for the DeFi ecosystem in the coming years will be how to maintain the open, permissionless spirit of Web3 while building robust governance defenses capable of resisting capital capture and malicious attacks.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News