Messari Research Report: A Comprehensive Breakdown of Arbitrum's Development Path in 2025, From Technology to Ecosystem Expansion

TechFlow Selected TechFlow Selected

Messari Research Report: A Comprehensive Breakdown of Arbitrum's Development Path in 2025, From Technology to Ecosystem Expansion

Arbitrum is no longer defined solely by Arbitrum One, but by an ever-expanding ecosystem of Arbitrum Chains driven by a rich, functional technology stack.

Author: Patryk Krasnicki

Translation: TechFlow

Summary: Amid the vast ocean of blockchain, Arbitrum is ambitiously positioning itself as a "Digital Sovereign Nation," driving DAO treasury growth through high-margin blockspace and innovative revenue streams, weaving an ecosystem network interlaced with technology, governance, and economic incentives—let us witness together the rising flames of this blockchain empire.

Key Insights

Arbitrum’s development is guided by the vision of building a “Digital Sovereign Nation,” pioneering a model for how decentralized, on-chain entities can leverage their resources to increase demand for their products and grow their wealth.

Arbitrum offers dual products: Arbitrum One is one of the most active and liquid networks, with $6.6 billion in stablecoin supply and $2.59 billion in DeFi TVL; the other product, Arbitrum Orbit, consists of a diverse ecosystem of 48 custom Arbitrum Chains running on the mainnet.

This dual-product strategy executes the “Arbitrum Everywhere” strategy, enabling developers to flexibly utilize shared liquidity on Arbitrum One or customize rollups with “Opinionated Blockspace” to meet various emerging use cases.

Arbitrum’s economic engine is driven by multiple on-chain revenue streams, including core protocol revenues and Timeboost auctions, which capture MEV and generated over $1 million in revenue for the DAO within its first 44 days post-launch.

ArbitrumDAO leads the growth flywheel, deploying treasury assets to fund ecosystem investment programs and supporting economic experimentation zones through initiatives like the Stable Treasury Endowment Program (STEP) and Arbitrum Gaming Ventures (AGV).

Arbitrum Today

Arbitrum (ARB), known for its Arbitrum One, is a Layer-2 blockchain that has become one of the most active, liquid, and highest-performing blockchains in the cryptocurrency space. However, this only covers part of Arbitrum’s offerings—the platform has evolved into a comprehensive multi-product technology stack. Arbitrum's proposition consists of two distinct yet interconnected products serving different market segments.

-

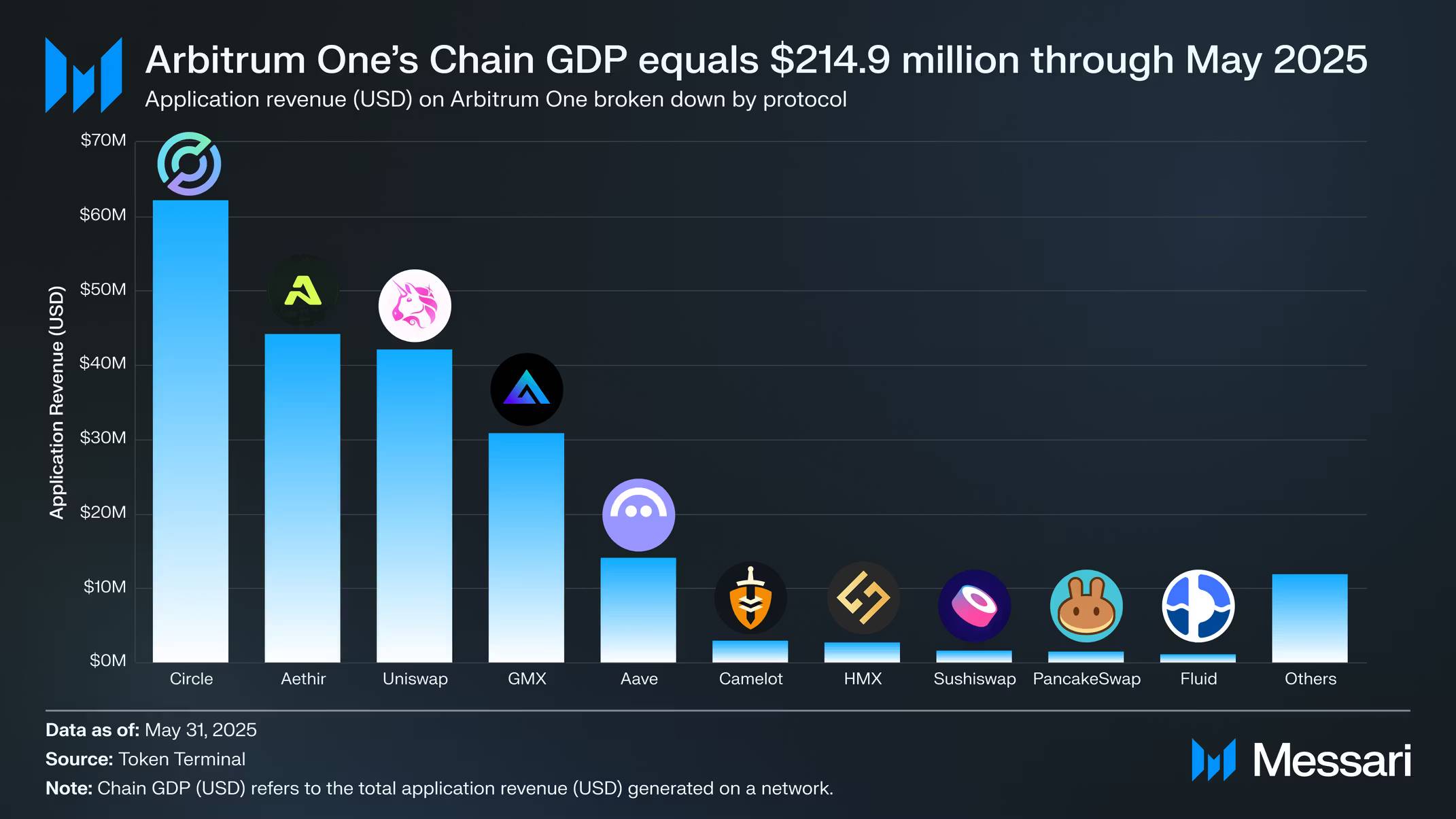

Arbitrum One: The flagship L2 Rollup featuring a shared execution environment with full EVM compatibility. Its success is reflected in its year-to-date on-chain GDP of $214.9 million, TVL of $2.59 billion, and stablecoin supply of $6.6 billion—the highest among all L2s as of May 31, 2025.

-

Arbitrum Orbit: The Arbitrum Nitro framework enables projects to deploy customized L2 or L3 networks using the same underlying infrastructure as Arbitrum One. These Arbitrum Chains can be tailored to specific use cases while maintaining interoperability with the broader Arbitrum Orbit ecosystem.

This dual-product strategy allows Arbitrum to capture value from both shared infrastructure and customized deployments, addressing market segments previously seen as competing. Together, Arbitrum One and Arbitrum Orbit support the “Arbitrum Everywhere” vision, positioning Arbitrum as a foundational infrastructure layer for a wide range of applications.

The “Arbitrum Everywhere” vision reflects a strategic approach to support the full application development lifecycle—from initial deployment on a shared liquidity layer to migration toward dedicated, customized networks as demand evolves. This vision is led by three core pillars: performance, unification, and decentralization. The stated goal is to advance all three simultaneously rather than trade them off against each other.

Achieving this vision requires not only technological innovation but also a fundamental shift in governance, marked by the creation of ArbitrumDAO in March 2023. This transitioned Arbitrum from a project primarily led by Offchain Labs to a decentralized protocol governed collectively by ARB token holders. This move empowers the community and embodies Arbitrum’s core belief: Arbitrum’s story is no longer limited to scaling Ethereum, but redefines the spirit of decentralization inherent in crypto’s original vision.

Following the initialization and deployment of on-chain governance via ArbitrumDAO, Arbitrum became ready for expansion. Specifically, it will become a shared rollup ecosystem built using Arbitrum Nitro and governed by ArbitrumDAO. Arbitrum Orbit launched on mainnet in October 2023, growing to 48 publicly announced Arbitrum Chains now live on mainnet—adding credibility to its “Arbitrum Everywhere” reputation.

In 2025, Arbitrum began a new phase of development, shifting focus toward building a vibrant on-chain economy. The foundation for the “Digital Sovereign Nation” has been laid, and Arbitrum aims to pioneer a model for long-term economic prosperity in decentralized protocols.

Arbitrum One

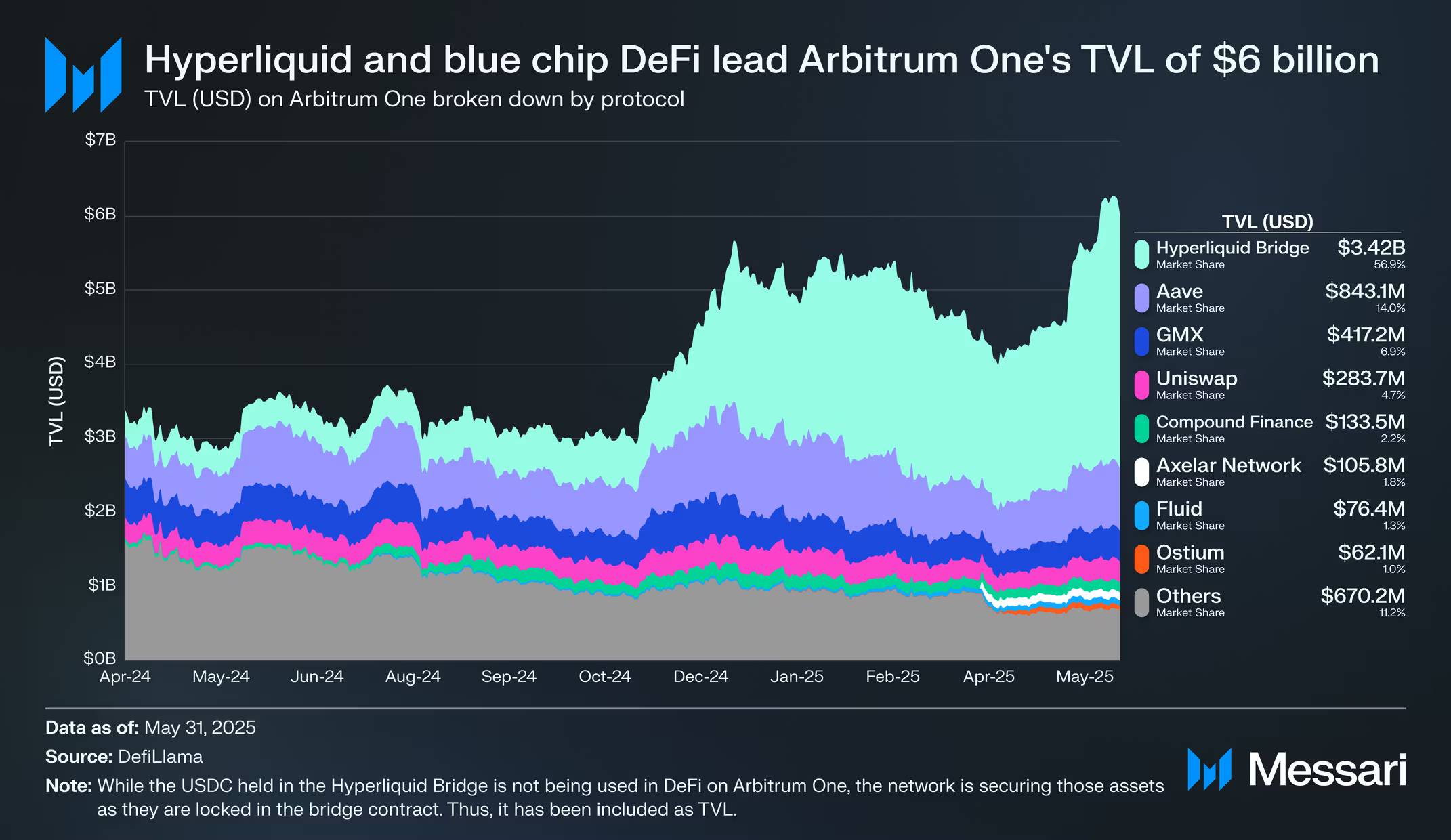

Arbitrum One’s strength stems from its focus on DeFi. It is the most liquid DeFi hub within the Arbitrum Orbit ecosystem, with DeFi Total Value Locked (TVL) reaching $2.59 billion as of May 31, 2025. However, when including Hyperliquid and Hyperliquid Bridge, Arbitrum One’s total TVL surges to $6 billion. All USDC liquidity from Hyperliquid Bridge originates from Arbitrum One, accounting for 56.9% of TVL at $3.42 billion.

Arbitrum One also hosts the largest-scale L2 deployments of blue-chip DeFi protocols such as Aave ($843.1 million), Uniswap ($283.7 million), Compound ($133.5 million), and native Arbitrum protocol GMX ($417.2 million). Additionally, Arbitrum hosts emerging protocols, including:

-

Fluid: A lending protocol where deposited assets also back its decentralized exchange (DEX). For a comprehensive overview of Fluid, see Messari’s Initiation of Coverage report.

-

Ostium : A perpetual futures exchange focused on real-world assets (RWA). For an overview of perpetual markets for real-world assets including Ostium, refer to Messari’s report on “Decentralizing Real-World Assets.”

-

Renegade: An on-chain dark pool offering spot token trading with privacy preservation and elimination of Maximum Extractable Value (MEV).

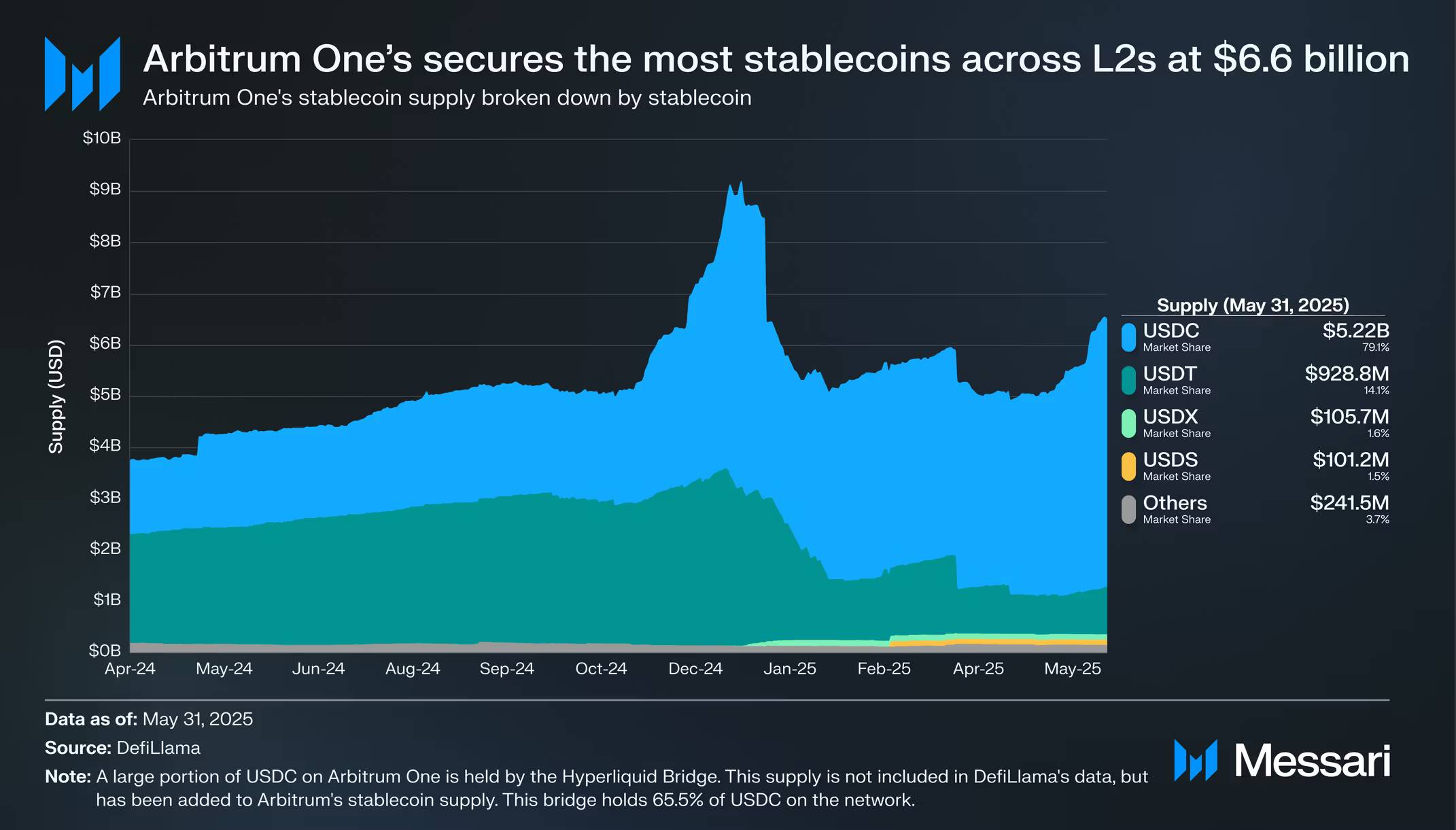

As of May 31, 2025, Arbitrum One holds a stablecoin supply of $6.6 billion—the highest among all L2s. Hyperliquid Bridge holds 51.8% ($3.42 billion) of all stablecoins ($6.6 billion) on Arbitrum One. This makes Circle the top revenue-generating protocol on Arbitrum One year-to-date, generating $62.1 million in revenue from network stablecoin supply. USDT is the second-largest stablecoin on Arbitrum One, representing 14.1% of all stablecoins at $928.8 million. In January 2025, USDT0, a fully connected implementation of USDT, launched and uses Arbitrum One as its central liquidity hub.

Arbitrum One’s on-chain GDP—the total application revenue generated on the network—reached $214.9 million from the beginning of 2025 through May 31, 2025. Uniswap, GMX, and Aave account for 40.5% of Arbitrum One’s on-chain GDP.

A network’s Application Revenue Capture Rate (App RCR) measures the ratio between revenue generated by applications and its Real Economic Value (REV). For Arbitrum One, REV is defined as the sum of base transaction fees, priority fees, and Timeboost auction revenue. As of May 31, 2025, the network’s total REV reached $7.4 million, resulting in a year-to-date App RCR of 2,904%. This means that for every $100 spent on fees and auctions on Arbitrum One, applications earn $2,904 in revenue.

A network’s App RCR can exceed 1 if applications successfully monetize activity and/or transaction costs are low. Arbitrum One achieves both. Project revenue streams can even flow to project token holders. For example, application revenue generated on GMX is partially shared with GMX stakers.

Arbitrum Orbit

Arbitrum Orbit launched on mainnet in October 2023, enabling anyone to launch their own Arbitrum Chains. Rollup-as-a-Service (RaaS) providers such as Caldera, Gelato, Conduit, Alchemy, and AltLayer have streamlined the build process, powering Arbitrum Chains like ApeChain, Proof of Play, and ReyaChain.

A key driver behind Arbitrum Orbit’s growth is its technical flexibility. This technology stack allows developers to perform network-level customization, creating dedicated blockspace tailored to specific use cases. Key customization features include:

-

Custom Gas Tokens: Arbitrum allows Arbitrum Chains to use any ERC-20 token (often a project’s own token) to pay for network transaction fees.

-

AnyTrust Protocol: Arbitrum’s alternative data availability (DA) solution optimizes performance by trusting off-chain actions from a Data Availability Committee (DAC). Notably, Arbitrum Nitro also supports external DA providers such as Celestia and EigenDA.

-

Layer-3s: Arbitrum allows Arbitrum Chains to function as L3s, rolling up to L2s like Arbitrum One instead of directly to L1s like Ethereum.

Arbitrum Chains can settle on L1s like Ethereum as L2s or on L2s like Arbitrum One as L3s, via settlement. As of May 31, 2025, the Arbitrum Orbit ecosystem includes 48 publicly announced Arbitrum Chains live on mainnet, with another 38 in testnet or development. Arbitrum Orbit has accumulated over 1.1 million weekly active addresses, $13.7 billion in TVL, 1.89 billion total transactions, and accounts for 31.8% of all L2 transactions.

Arbitrum’s Economic Engine

Digital Sovereign Nation

Arbitrum’s next stage of development stems from the vision of becoming a self-sustaining “Digital Sovereign Nation.” The “Arbitrum Everywhere” strategy has given rise to an economic and governance model understood through three core components: diverse participants and stakeholders, valuable digital resources, and economic experimentation zones fueled by treasury deployment.

-

Diverse Participants and Stakeholders: The first pillar comprises Arbitrum’s participants and stakeholders—including developers, users, and investors—all represented by ArbitrumDAO. What sets Arbitrum’s model apart is granting ArbitrumDAO full authority, giving it complete on-chain control over protocol upgrades and treasury holdings. This control forms the foundation of the Digital Sovereign Nation.

-

Valuable Digital Resources: The second pillar is Arbitrum’s valuable digital resources. Here, these refer to Arbitrum’s blockspace and execution environment, functioning as high-margin digital commodities. The L2 economic model allows Arbitrum to retain substantial network revenue, unlike L1s that distribute most revenue and issue new tokens to incentivize validators securing the network. Arbitrum One transactions average over 95% gross margin, and additional revenue from initiatives like Timeboost and the Arbitrum Expansion Program (AEP) ensures value generated from on-chain activity flows directly into the ArbitrumDAO treasury.

-

Economic Experimentation Zones Driven by Treasury Deployment: The third pillar involves economic experimentation zones that power the growth flywheel. The ability to generate and retain revenue enables ArbitrumDAO to reinvest assets into new ventures. These projects, in turn, drive demand for Arbitrum blockspace and activity, further accelerating the flywheel and reinforcing the long-term vision of the Digital Sovereign Nation.

Growth Flywheel

At the heart of Arbitrum’s transformation into a Digital Sovereign Nation lies a growth flywheel that returns value to its members and stakeholders. First, revenue is generated from digital resources like blockspace and execution environments. This revenue flows into a treasury fully managed by ArbitrumDAO. The DAO then invests in ecosystem programs and economic experiments, compounding demand for its products while expanding its asset base.

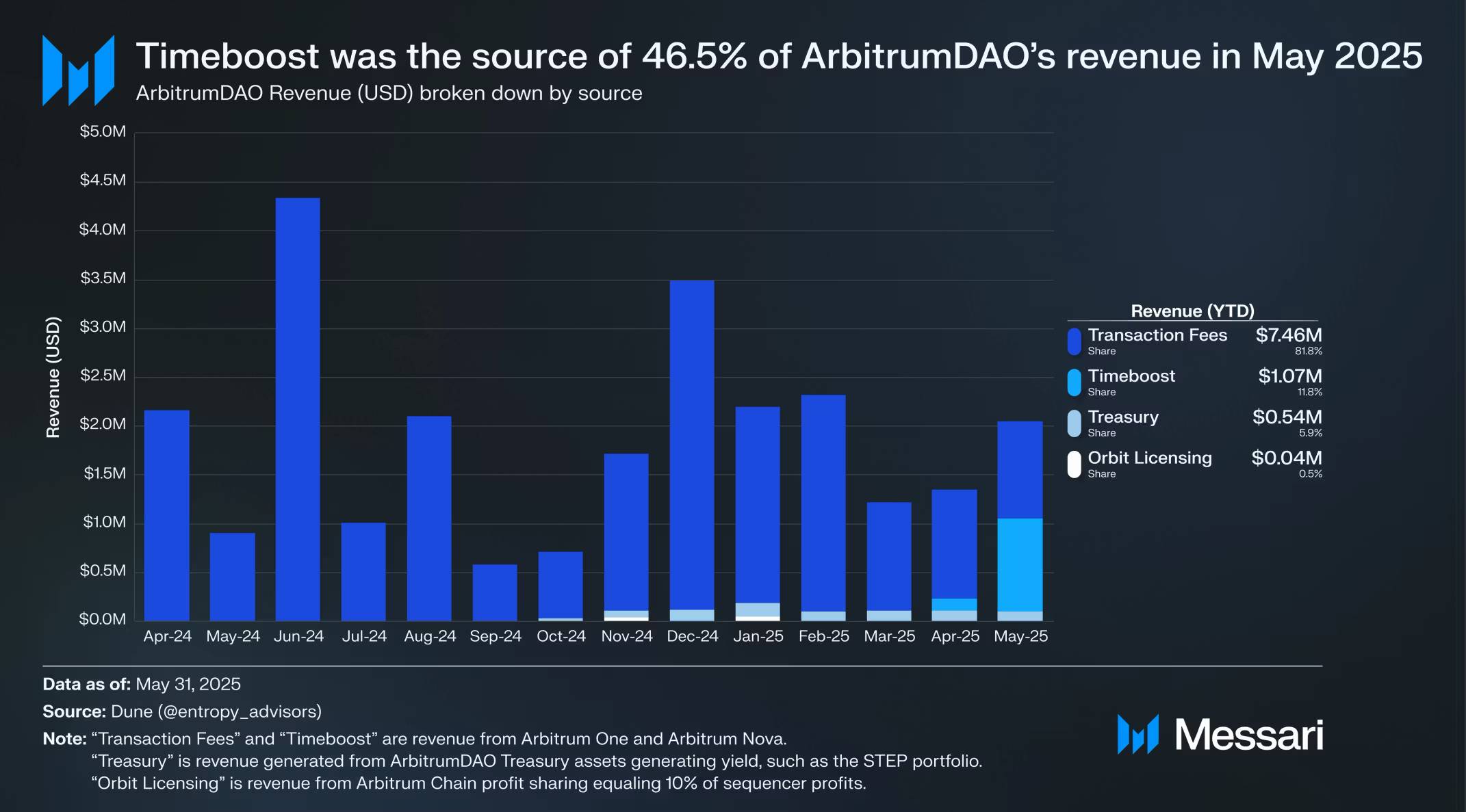

Core Protocol Revenue

ArbitrumDAO captures value directly from the use of Arbitrum’s core products—including Arbitrum One and Arbitrum Orbit. This model of direct value accrual to a DAO-controlled treasury is a key differentiator for Arbitrum. Arbitrum One and Arbitrum Nova contribute 100% of sequencer profits to ArbitrumDAO. All other Arbitrum Chains must share 10% of sequencer profits as part of the Arbitrum Expansion Program (AEP) license fee, with 8% going to ArbitrumDAO and 2% to the Arbitrum Developer Guild. Notably, L3s settling on Arbitrum One and other Arbitrum Chains are exempt from profit sharing. From the start of the year through May 31, 2025, ArbitrumDAO has generated $7.5 million in revenue from these sources.

Timeboost

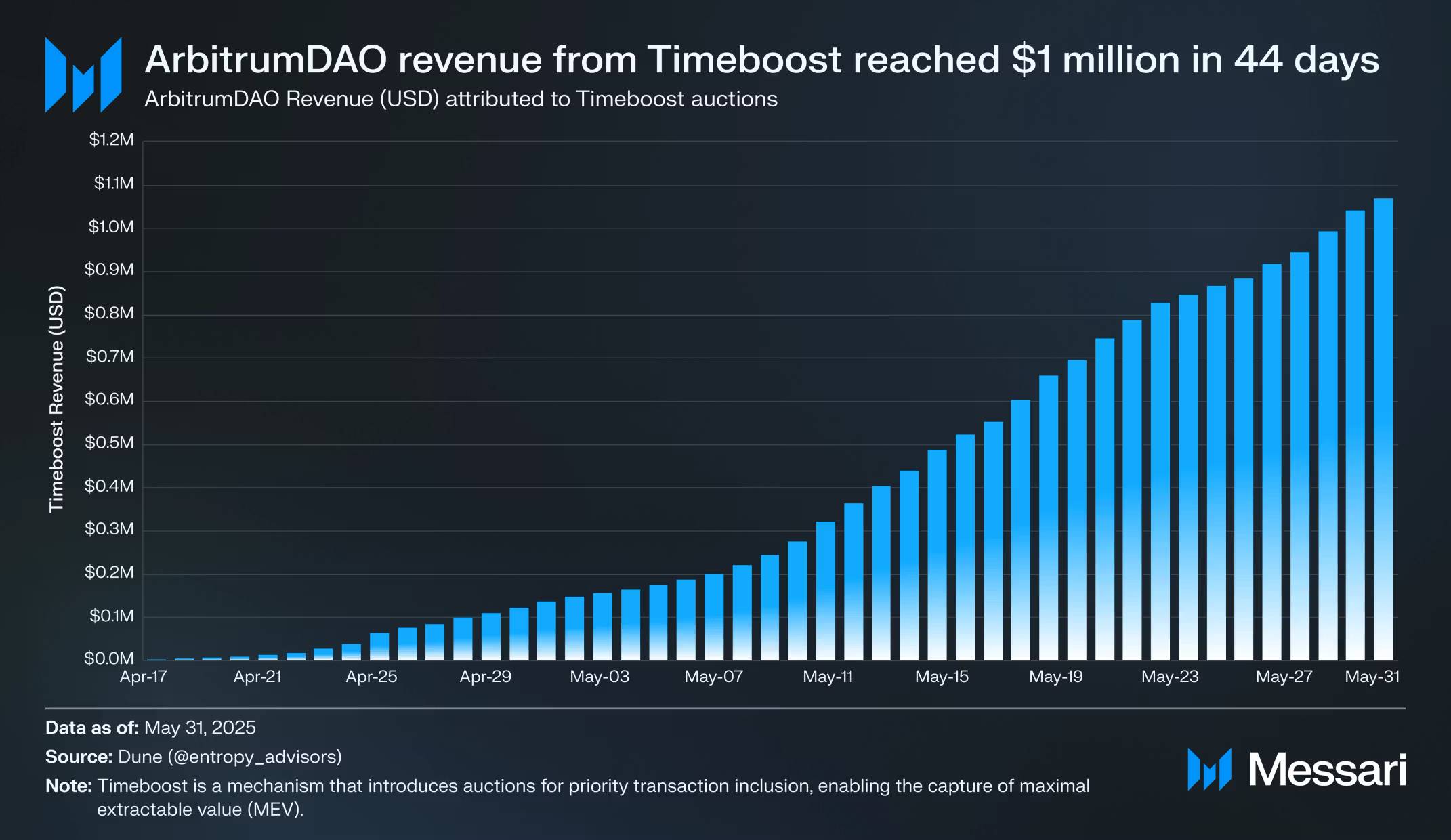

In March 2023, Offchain Labs announced the development of the Timeboost protocol, a protocol modifying the sequencer’s transaction ordering. This change aims to preserve Arbitrum’s long-standing fair first-come-first-served model while creating a new revenue stream for ArbitrumDAO by auctioning priority transaction slots. Timeboost adds approximately 250 milliseconds of latency, introducing an auctionable express lane for transactions, enabling capture of Maximum Extractable Value (MEV) from strategies like atomic arbitrage and liquidations.

Timeboost launched on April 17, 2025, initially on Arbitrum One and Arbitrum Nova. Forty-four days after launch, Timeboost’s total revenue exceeded $1 million. As of May 31, 2025, Timeboost is on track to generate $11.3 million in annualized revenue (based on a 30-day moving average). Of this, 97% is allocated to ArbitrumDAO, with the remaining 3% going to the Arbitrum Developer Guild.

Timeboost auctions consistently account for over 50% of the network REV generated by Arbitrum One, and over 99% of auctions have active bidders. Meanwhile, other Arbitrum Chains can also opt in to implement Timeboost as part of their Arbitrum Nitro setup. As more Arbitrum Chains adopt Timeboost, its significance may continue to grow.

Ecosystem Investment Programs

All applications built on Arbitrum One and all Arbitrum Chains are eligible for support under Arbitrum’s Ecosystem Investment Programs. Throughout ArbitrumDAO’s history, these programs have continuously distributed ARB tokens to promote long-term growth of Arbitrum and increase market demand for the platform. They are a crucial component of Arbitrum’s vision to “make Arbitrum Everywhere” and “become a self-sustaining Digital Sovereign Nation.”

DeFi Renaissance Incentive Program (DRIP)

The DeFi Renaissance Incentive Program (DRIP) was approved on June 23, 2025, aiming to incentivize DeFi activity on Arbitrum One to achieve specific goals, such as becoming the “best platform to borrow USDT, USDC, and ETH using wstETH as collateral.” DRIP will roll out up to four quarterly phases, each distributing up to 20 million ARB (0.2% of total token supply). Entropy Advisors, Arbitrum Foundation, and Offchain Labs will serve as program managers, with launch expected in July 2025.

Onchain Labs

In March 2025, the Arbitrum Foundation and Offchain Labs established Onchain Labs to “accelerate innovative on-chain experiences on Arbitrum.” The first project incubated by Onchain Labs, Talos, was released in July 2025. Talos is an upcoming protocol controlled by an AI agent that autonomously manages capital assets, tokenomics, and protocol mechanisms. However, the agent will be governed by its future token holders, who will submit upgrade proposals via GitHub following public community votes.

Other Ecosystem Funding Programs

The Arbitrum Foundation and ArbitrumDAO also support grant programs. Past initiatives include the Trailblazer AI Grant Program, Stylus Sprint, Arbitrum x Farcaster Buildathon, Uniswap-Arbitrum Grant Program, Pluralistic Grants Program, and ArbiFuel.

The Arbitrum DAO (Domain Allocator Offerings) grant program Season 3 was approved in February 2025, continuing for a year through March 2026 after running two seasons since October 2023, distributing 23.4 million ARB (0.23% of total token supply) across five categories of projects via Questbook.

Previously, ArbitrumDAO approved several incentive programs distributing ARB tokens within the Arbitrum Orbit ecosystem:

-

Short-Term Incentive Program (STIP): STIP was approved in October 2023, allocating 50 million ARB (0.5% of total supply) to 30 Arbitrum Orbit projects as incentives distributed to their users.

-

STIP Backfund: STIP Backfund was approved in November 2023, allocating 21.5 million ARB (0.22% of total supply) to 26 Arbitrum Orbit projects already approved under STIP but who did not make the top 30 vote recipients.

-

STIP Bridge: STIP Bridge was approved in May 2024, allocating an additional 37.5 million ARB (0.37% of total supply) to prior recipients of STIP or STIP Backfund.

-

Long-Term Incentive Program (LTIP): LTIP was approved in February 2024, allocating up to 45 million ARB (0.45% of total supply) to projects that received STIP funding.

Economic Experimentation Zones

As of May 31, 2025, the assets held by the ArbitrumDAO treasury were valued at $1.21 billion, continuing to grow from core protocol revenues. ArbitrumDAO uses these assets to invest in promising economic areas, generating new income streams. This proactive capital allocation strategy is a core component of the growth flywheel, enabling the DAO to continuously invest in Arbitrum’s expansion.

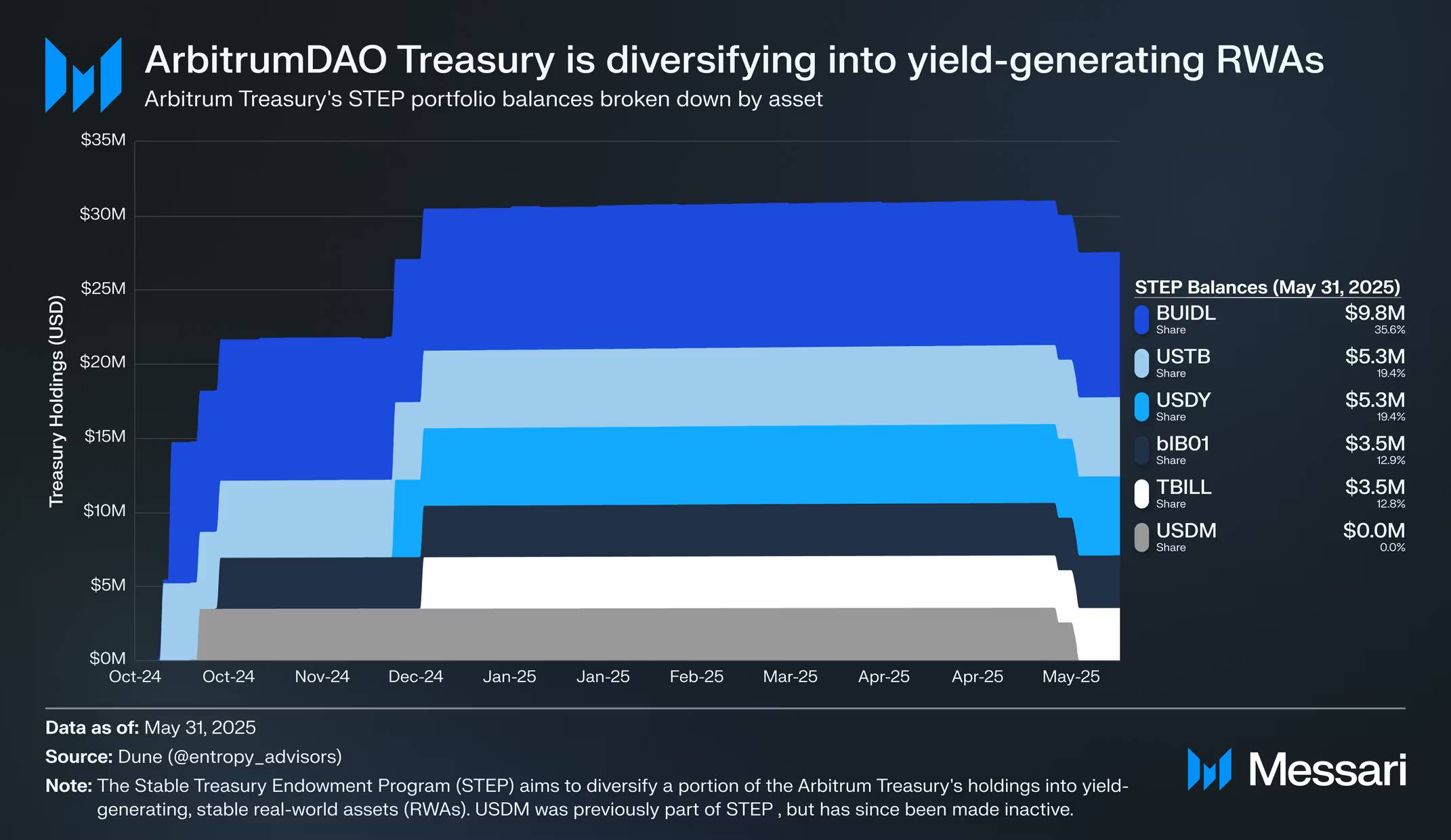

Stable Treasury Endowment Program (STEP)

In December 2023, a proposal was approved to establish a Treasury and Sustainability Working Group to support ArbitrumDAO’s financial operations. In January 2024, kpk released the “Arbitrum Treasury and Sustainability Research Report,” assessing potential impacts of ARB token sales, exploring potential uses for ETH-denominated sequencer revenue, and establishing effective financial management guidelines.

Efforts to diversify the treasury and generate yield began with the Stable Treasury Endowment Program (STEP). The program aims to diversify part of the treasury holdings into yield-generating stable real-world assets (RWA), significantly boosting adoption of RWAs on Arbitrum One.

-

Step 1: Proposed by the Treasury and Sustainability Working Group and approved in April 2024, Step 1 converted 35 million ARB (0.35% of total supply) into RWAs. Out of 33 applications, six were approved via Snapshot off-chain voting. The proceeds from ARB sales totaled $29.3 million, later converted into Securitize’s BUIDL ($9.6 million), Ondo’s USDY ($5.2 million), Superstate’s USTB ($5.2 million), Mountain’s USDM ($3.5 million), OpenEden’s TBILL ($3.5 million), and Backed Finance’s bIB01 ($3.5 million).

-

Step 2: Proposed by the Treasury and Sustainability Working Group and approved in February 2025, Step 2 will convert another 35 million ARB (0.35% of total supply) into RWAs—specifically WisdomTree’s WTGXX, Spiko’s USTBL, and Franklin Templeton’s BENJI.

As of May 31, 2025, ArbitrumDAO’s RWA holdings totaled $27.6 million. Since inception, STEP has generated $745,000 in interest income.

Arbitrum Gaming Ventures (AGV)

Arbitrum Gaming Ventures (AGV, formerly the Gaming Catalyst Program (GCP)) was approved in June 2024, allocating up to 200 million ARB (2% of total supply) to invest in gaming studios, applications, and storefronts on Arbitrum Orbit. AGV’s goal is to “bring in outstanding developers and help accelerate their progress throughout all stages of game development.” Funding is divided into three categories:

-

Build Grants: 25 million ARB (0.25% of total supply) for “teams accelerating early development on Arbitrum or incentivizing user onboarding.”

-

Investments: 135 million ARB (1.35% of total supply) for “teams seeking over 500,000 ARB or additional funding beyond initial development.”

-

Infrastructure Bounties: 40 million ARB (0.40% of total supply) for “creating gaming-specific technologies making Arbitrum the best choice for game developers.”

AGV also issued 25 million ARB (0.25% of total supply) for operations. AGV operates as an entity aligned with Arbitrum, led according to its charter and key performance indicators (KPIs), and overseen by a five-member CGP Council.

The vast majority of ARB allocated to GCP is intended for venture investments that could yield multiples of return for ArbitrumDAO. AGV announced its first investment on May 8, 2025—$10 million total—to Wildcard, Hyve Labs, T-Rex, Xai, and Proof of Play. Its latest update, published on May 31, 2025, highlighted over 70 projects in the investment pipeline. The full list of Arbitrum Gaming Ventures’ investments is available on Messari Fundraising.

Arbitrum Technology

Arbitrum’s technology stack powers the Arbitrum Chains forming the Arbitrum Orbit ecosystem. At the core of Arbitrum’s technology is Arbitrum Nitro, a technology stack developed by Offchain Labs. Arbitrum Nitro has evolved into a dynamic stack capable of meeting the needs of diverse emerging use cases. A key principle of Arbitrum Nitro is its focus on customizable and autonomous blockspace, enabling developers to perform network-level customization based on their protocol needs, supporting the “Arbitrum Everywhere” vision.

Stylus

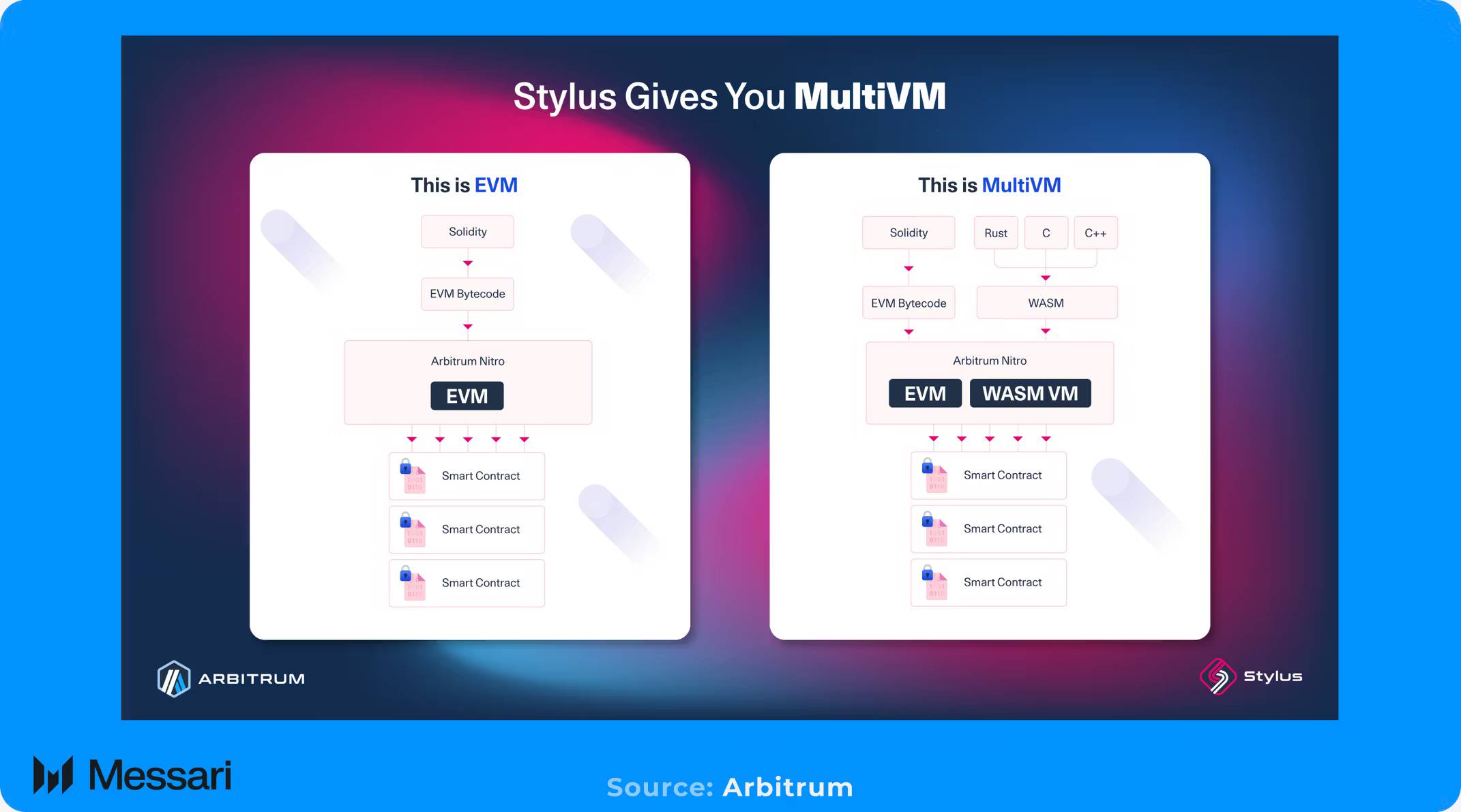

In February 2023, Offchain Labs announced the development of Stylus, an enhanced virtual machine operating alongside the EVM. Stylus launched on mainnet in September 2024, initially on Arbitrum One and Arbitrum Nova. It allows developers to compile non-EVM languages like

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News