Layer 2 Track Analysis: Exploring Projects Based on Optimistic Rollup Technology and Market Comparison

TechFlow Selected TechFlow Selected

Layer 2 Track Analysis: Exploring Projects Based on Optimistic Rollup Technology and Market Comparison

This article primarily explains the fundamental technical principles, ecosystems, and support for blockchain gaming of the public chain projects Arbitrum, Optimism, opBNB, and COMBO.

Author: Guatian Lab Wlabs

In the previous article, "Guatian Academy GameFi Public Chain Research Series Part 1 – Ethereum's Development and Upgrade Roadmap", we introduced Ethereum’s development history and the basic information about Ethereum 2.0 upgrades, which led to two major Layer2 sub-sectors: Optimistic Rollup and ZK Rollup.

If we analogize Ethereum as a company, Ethereum 2.0 upgrades can be simply understood as restructuring the internal management framework—from the original chain structure to a beacon chain-shard (Shards) centralized-decentralized architecture. Layer2 further outsources tasks requiring execution on top of this structure, thereby further reducing the burden on the main company, improving efficiency, and enhancing overall task processing capacity.

In this second research article, we will further explore Layer2 solutions and dive deep into the Optimistic Rollup sector.

1. Overview of Layer2 Solutions

To understand Layer2 scaling solutions, we first need to clarify the concept of Layer2.

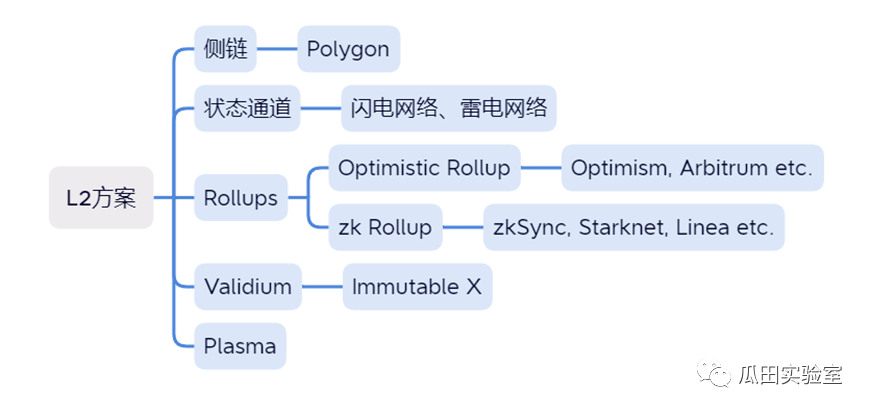

What is Layer2? Layer2 refers to off-chain networks, systems, or technologies built upon an underlying blockchain (i.e., Layer1), designed to scale the base blockchain network. Currently, there are two ways to classify Layer2 in the market. The narrow definition of Layer2 requires inheriting Ethereum's security, bundling transactions through Layer2 Ethereum, where Layer2 only handles computation—ZK and Optimistic Rollups being canonical examples. The broad definition includes all Ethereum scaling solutions, mainly comprising the following five types:

-

01 Sidechains: A sidechain is an independent blockchain operating parallel to Ethereum. It locks a certain amount of assets via smart contracts on the main chain and mints equivalent assets on the sidechain, achieving so-called "atomic swaps." The biggest issue with sidechain schemes is weaker security, although they offer strong independence and flexibility. Polygon is a well-known representative of Ethereum sidechains. Some also consider BNB Chain a sidechain of Ethereum—even though it is EVM-compatible, strictly speaking, it is more of a fork of Ethereum that can operate independently. We will not categorize it as a sidechain here.

-

02 State Channels: By establishing exclusive payment channels and multi-signature addresses between transacting parties, transactions occur off-chain, with only final results recorded on-chain when settlement is needed. This approach features high speed and low fees. Representative technologies include the Lightning Network (based on Bitcoin) and the Raiden Network (based on Ethereum).

-

03 Rollups: As previously explained, Rollups "outsource" data execution to Layer2 and batch-submit results to the main chain. They are primarily divided into Optimistic Rollup and Zero-Knowledge Proof (ZK) Rollup. Optimistic Rollup assumes data validity by default—if no one challenges the data and submits fraud proofs within a specified period, the data is deemed accurate; otherwise, a fraud-proof mechanism is triggered to revert transactions. ZK Rollup bundles multiple transactions together, publishing them to L1 along with a proof (using zero-knowledge technology) asserting their validity.

-

04 Validium: Also uses zero-knowledge proofs, but unlike ZK Rollup, it uploads only the state root and ZK proof to the mainnet while storing transaction data on Layer2. This achieves higher throughput at the cost of some security. Since both use zero-knowledge proofs, many view Validium as a variant of ZK Rollup. Thus, another classification method divides Layer2 into ZK and Optimistic categories, placing Validium under ZK. The gaming chain ImmutableX primarily uses Validium as its underlying technology.

-

05 Plasma: Plasma is a framework for Ethereum Layer2 scalability, also known as "chain-in-chain." It locks assets on the main chain and moves transactions to child chains, which periodically submit state updates back to the main chain. This enables fast settlements and significantly reduces fees. The difference between child chains and sidechains lies in the use of root storage—users can safely exit a Plasma chain if any error occurs, whereas sidechains lack this functionality. In short, child chains have a stronger connection to the parent chain.

In this article, we will focus on Polygon PoS sidechain solution, two major Optimistic Rollup projects—Arbitrum and Optimism—and BNB ecosystem projects opBNB and COMBO, which are both BNB forks and Optimistic Rollup implementations. We’ll examine the fundamental technical principles, ecosystems, and support for blockchain games of these public chains. ZK Rollup and Validium will be covered in the third part.

2. Analysis of Polygon PoS

About Polygon

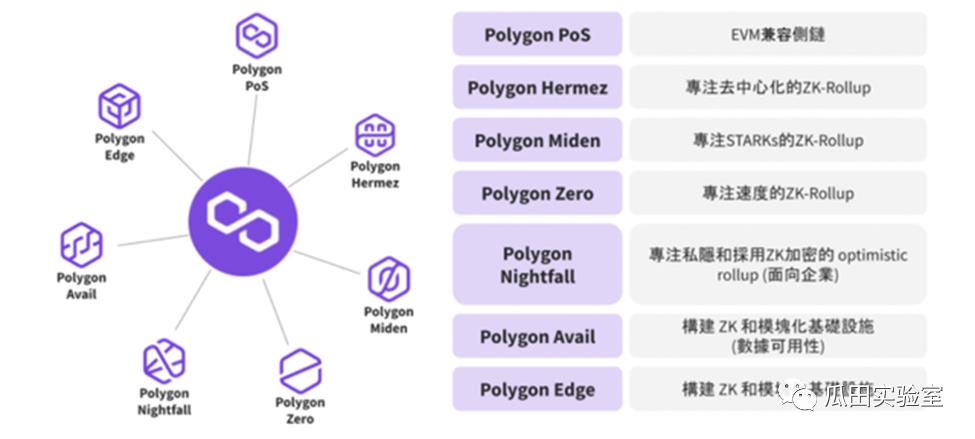

Polygon was formerly known as Matic and initially served as a blockchain scalability platform dubbed the “Internet of Blockchains for Ethereum.” Over time, as its ecosystem expanded, the platform evolved from a single Layer2 solution into a “Network of Networks,” aiming to solve transaction speed and scalability issues on the Ethereum mainnet, particularly focusing on blockchain gaming and NFTs. Classifying Polygon strictly as a sidechain isn’t entirely accurate—while the sidechain product Polygon PoS forms its core foundation, its potential growth drivers lie in the ZK Rollup matrix composed of Polygon zkEVM, Polygon Miden, Polygon Zero, and Polygon Nightfall. Moreover, in the recently announced Polygon 2.0 upgrade, the team plans to transition Polygon PoS entirely into a zkEVM Validium. Due to space constraints and thematic focus, this article will analyze the sidechain product Polygon PoS, with ZK-related aspects discussed in the next piece.

Technology

Although based on Ethereum, Polygon PoS benefits from faster speeds and higher scalability, maintaining a daily transaction volume over twice that of Ethereum (~2 million transactions per day), while gas fees are merely 0.1% of Ethereum’s.

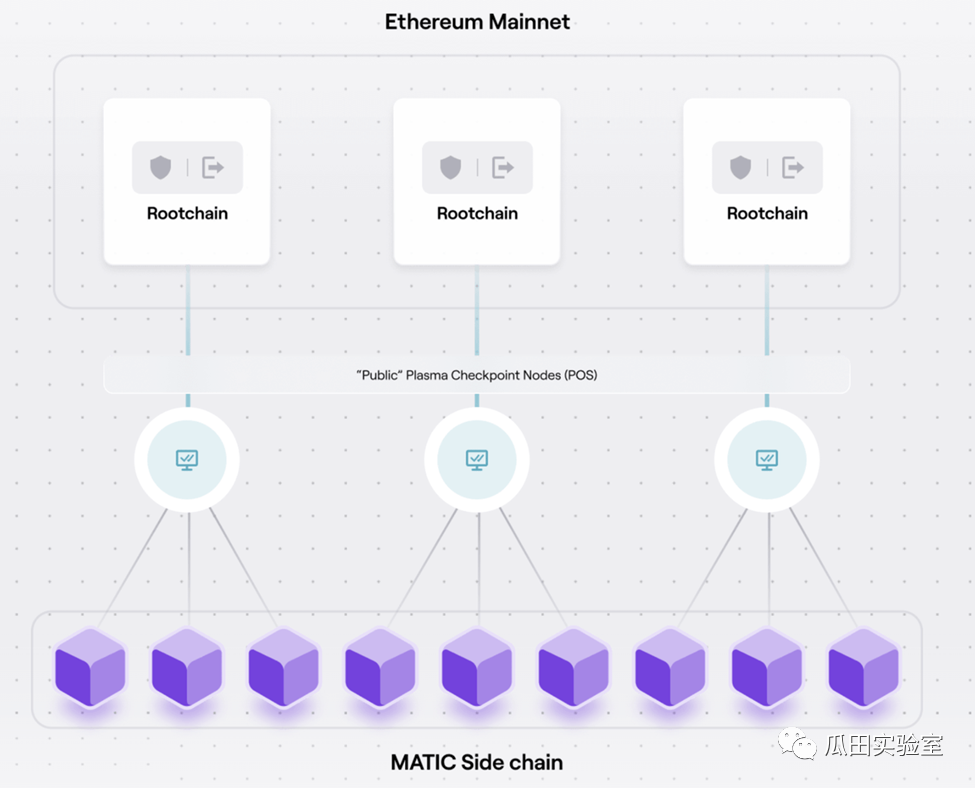

Polygon PoS is an EVM (Ethereum Virtual Machine)-compatible sidechain launched on June 1, 2020, and currently serves as Polygon’s primary business. To date, it remains the most mature Ethereum sidechain solution. Its architecture consists of three layers:

-

Ethereum Layer: Composed of a series of Ethereum smart contracts responsible for handling processes on Ethereum and using Ethereum as the finality layer, effectively leveraging Ethereum’s security as a shield. MATIC tokens are also staked at this layer.

-

PoS Checkpoint Node Layer: The core of Polygon, responsible for producing and validating Matic sidechain blocks. PoS nodes monitor events on the Ethereum chain, relay information to the Matic sidechain, and regularly publish Matic-generated blocks onto the Ethereum chain, enabling synchronization between the Matic sidechain and Ethereum mainnet.

-

Matic Sidechain Layer: Handles transactions, shuffling, block creation, and periodically sends checkpoints to the node layer.

Polygon’s unique hybrid structure allows Polygon PoS to support the Plasma framework, inheriting Ethereum’s security. The PoS Bridge, secured by the same set of validators and staked MATIC, further ensures the chain’s own security.

Ecosystem

Since launching in 2020, Polygon entered explosive growth in Q2 2021, quickly becoming the third public chain after Ethereum and BNB with a complete ecosystem. By Q1 2023, the number of projects within Polygon’s ecosystem exceeded 53,000.

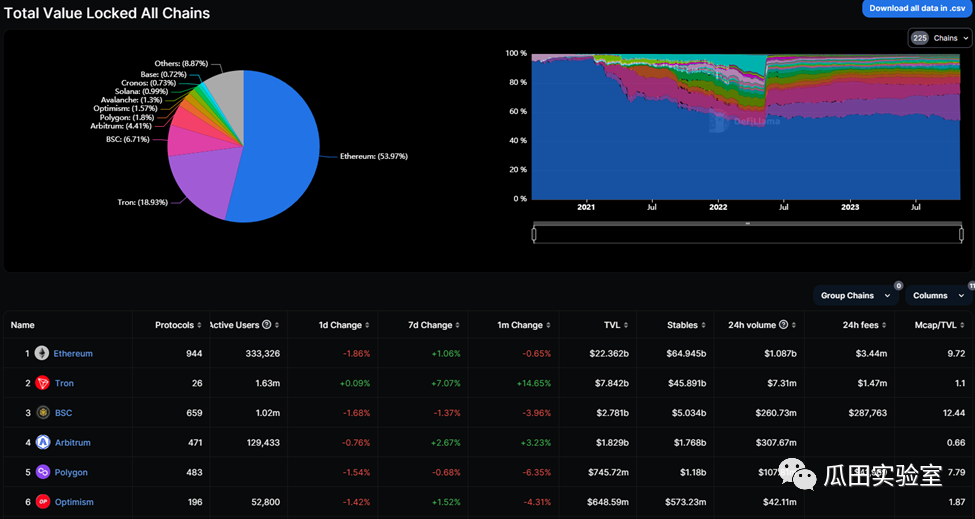

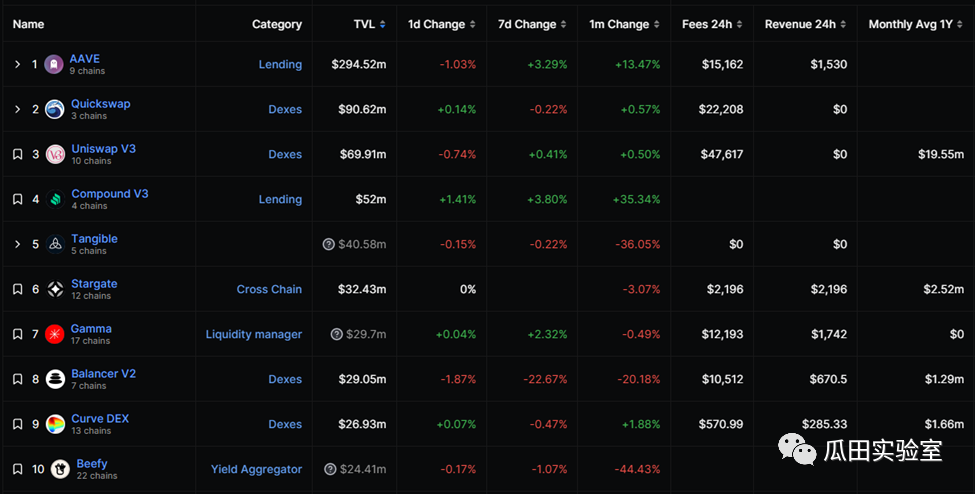

Benefiting from the DeFi boom during its early development phase, DeFi projects rapidly expanded—for example, leading DeFi platforms like Uniswap, Aave, and Curve chose Polygon as their first multichain deployment destination. In April 2021, Polygon launched a $150 million DeFi development fund offering MATIC rewards to projects. However, despite its momentum, Polygon’s DeFi ecosystem suffers from innovation stagnation. Its total value locked (TVL) ranks fifth overall, already surpassed by rising stars such as Arbitrum.

Data source: Defillama

Polygon has also demonstrated foresight in NFTs. In June 2021, OpenSea first supported Polygon, after which Ethereum and Polygon almost split the high-end and low-end NFT markets respectively. Many international brands have since launched their own NFTs on Polygon—including Starbucks, Mastercard, Adidas, among others—gradually driving more brands to join, creating a positive feedback loop. Other popular projects include Lama Kings, Doodle Changs, y00ts, Bungo Beanz, and Super Pengs.

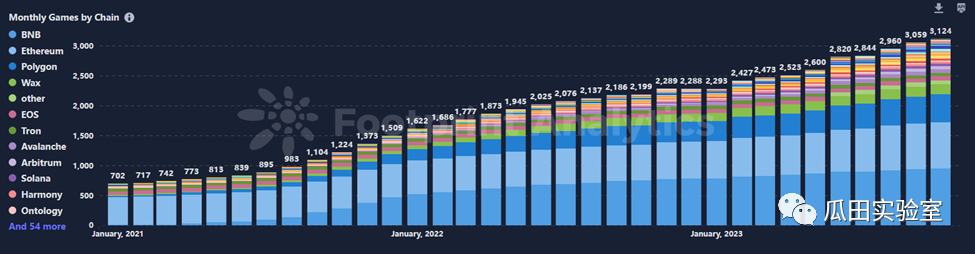

In gaming and metaverse, according to Footprint Analytics, Polygon hosts 468 active game projects, ranking third behind BNB and Ethereum. Notable metaverse projects Decentraland and The Sandbox deployed on Polygon in April and June 2021 respectively. Other popular games include Pixels, Arc8, Benji Bananas, Sunflower Land, and Skyweaver.

In July 2021, Polygon announced the establishment of Polygon Studios, dedicated to investing in NFT, Gaming, and Metaverse sectors. Offline promotion efforts have been frequent—thanks to its low-cost and fast transaction experience, Polygon has become one of the top choices for Web2 and traditional enterprises exploring blockchain or Web3.

Summary of Pros and Cons

As one of the earliest mature Ethereum Layer2 ecosystems, Polygon PoS enjoys strong first-mover advantages with clear strengths:

-

Speed: Intuitive and efficient bridging, deposits, and withdrawals, capable of up to 7,000 tps—far exceeding pre-upgrade Ethereum performance (15 tps);

-

Security: Leverages and shares Ethereum’s security;

-

Compatibility: Full EVM compatibility allows direct deployment of smart contracts on Polygon;

-

Low Cost: Approximately 0.1% of Ethereum’s fees.

Low transaction costs and high speed make Polygon the preferred choice for high-frequency applications (DeFi, GameFi, etc.) within the Ethereum ecosystem. While rising Layer2 stars like Arbitrum, Optimism, and zkSync may somewhat impact Polygon’s market position, Polygon itself continues evolving, fully embracing the ZK track and acquiring/launching a series of ZK-based products. We will detail this in the next article.

Polygon PoS entered the market at just the right time—when in 2020 Ethereum faced severe congestion and scalability issues, there was urgent demand for a breakout product to enhance Ethereum’s performance. At that time, Rollup solutions and Ethereum 2.0 were still under development, and no strong competitors had emerged in the Layer2 space. Combined with effective marketing strategies—early adoption of DeFi, subsidizing blue-chip projects like Aave, Curve, Uniswap, and Quickswap—alongside investment and incubation strategies in gaming and metaverse, Polygon cultivated numerous quality projects. Deep collaborations with platforms like ImmutableX also allowed it to share traffic benefits. With continued ecosystem refinement and gradual maturity of its ZK offerings, Polygon is poised for another wave of significant growth, solidifying its place among top-tier public chains.

3. Arbitrum Project Analysis

About Arbitrum

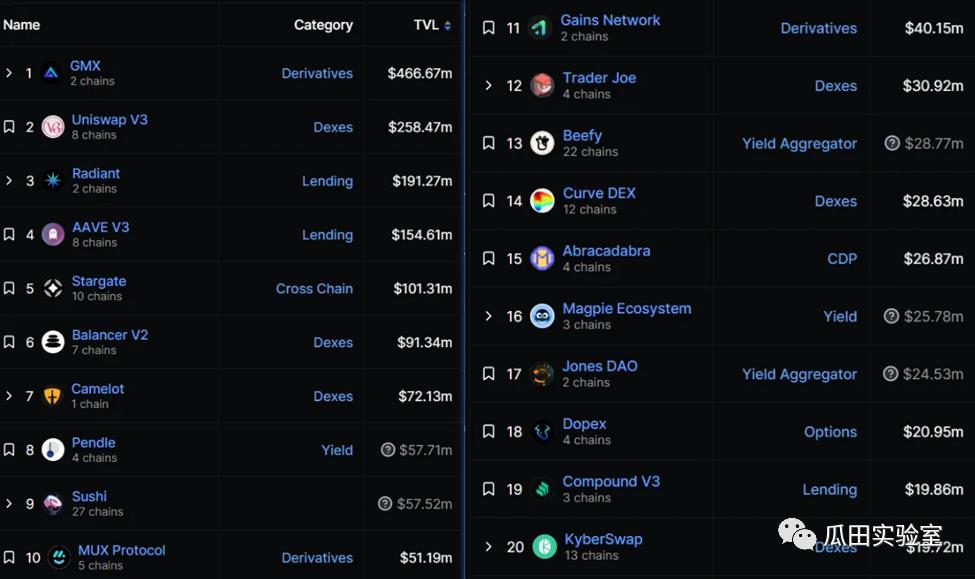

Arbitrum, as a leading Layer2 project, has long been surrounded by hype. Especially during its token launch in the first half of 2023, it became one of the hottest topics in the crypto community—one everyone rushed to join. Data from Defillama confirms this: Arbitrum now ranks fourth in total value locked (TVL), trailing only ETH, BSC, and TRON, even surpassing veteran Layer2 sidechain Polygon—a true sign of dominance in the Layer2 space.

Arbitrum launched in May 2021: Arbitrum One officially went live on the Ethereum mainnet. October 2021 saw the public testnet release of Arbitrum Nova. In 2022, progress continued on the Arbitrum Orbit plan—an L2 solution specifically designed for NFT and virtual reality (VR) applications, aimed at expanding capabilities for digital assets and apps in virtual worlds.

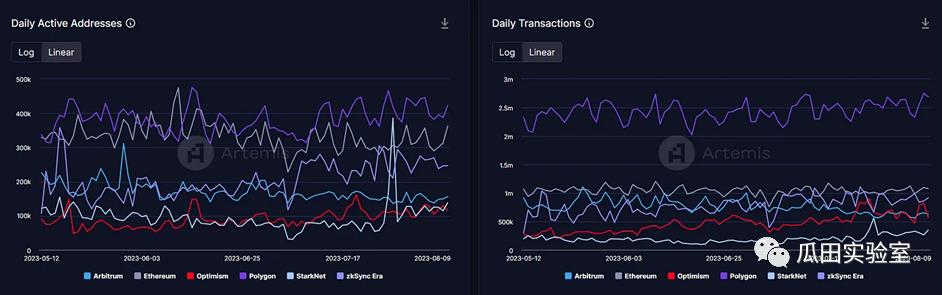

Arbitrum currently boasts a TVL of $5.93 billion, a circulating market cap of $1.45 billion, and an FDV of $11.3 billion, with no new unlocks expected in the next six months. Daily active addresses hover around 150,000, with approximately 620,000 transfers per day—close behind Polygon and firmly in the top tier.

Technology

Arbitrum is a Layer2 scaling solution closely aligned with the Optimistic Rollup approach—assuming all transaction validations are honest but implementing a challenge period during which anyone can dispute invalid transactions. The system introduces two key roles to ensure integrity: Verifiers and Sequencers (referred to as Managers). Verifiers process transactions and earn ETH rewards, while Sequencers monitor whether verifiers correctly execute transactions. Before transactions are finalized on Ethereum, there is a 7-day challenge window. During this time, any Sequencer can challenge a transaction. If fraud is confirmed, malicious actors lose their staked tokens. Through this mechanism, as long as at least one honest Sequencer exists during the challenge period, Arbitrum’s security is guaranteed.

The project encompasses several major product lines:

-

Arbitrum One: Built on Optimistic Rollup technology, it achieves high-performance and low-cost smart contract execution by verifying transactions on Ethereum. Arbitrum One provides a fast, affordable way to run Ethereum smart contracts, alleviating network congestion and boosting performance for DeFi and NFT markets. It is the flagship rollup, hosting most applications (DeFi, NFTs, etc.).

-

Arbitrum Nova: Utilizes zk-Rollup technology, employing zero-knowledge proofs to validate transactions, enhancing both security and efficiency. Nova adds diversity to Arbitrum, allowing developers to choose optimal solutions tailored to different needs. Nova targets high-throughput applications such as gaming and social dApps.

-

Arbitrum Orbit: A strategic initiative to grow the Arbitrum ecosystem by providing tools, libraries, and support to help developers build on Arbitrum. Orbit aims to expand the developer base and accelerate application development and deployment.

These three components collectively drive Arbitrum’s growth, offering greater technical flexibility and ecosystem support, attracting more developers and projects, and further fueling expansion within the Ethereum ecosystem.

Ecosystem

Arbitrum’s ecosystem includes around 600 projects, featuring standout names like GMX, Radiant, TreasureDAO, and Camelot, creating diverse use cases. Notably, game projects like Treasure DAO and Pirate Nation show explosive growth, contributing significantly to Arbitrum’s activity levels.

Summary of Pros and Cons

Arbitrum inherits the strengths of Optimistic Rollup, including:

-

High Performance: Optimized smart contract execution increases throughput and lowers costs, easing Ethereum congestion.

-

Low Cost: Transactions executed on Layer2 drastically reduce gas fees on Ethereum, lowering user costs for participating in DeFi and NFT activities.

-

Compatibility: Fully compatible with Ethereum smart contracts, enabling seamless migration of existing dApps and contracts.

-

Security: Implements Layer2 security measures like Rollup technology to protect user funds and data.

-

Ecosystem Support: Attracts prominent Ethereum-native projects, offering users more options and growth opportunities for DeFi and NFT ventures.

However, Arbitrum also faces disadvantages:

-

Centralization: Compared to Ethereum’s mainnet, Layer2 solutions tend to be more centralized, raising potential security and trust concerns.

-

Steeper Learning Curve: New users may face unfamiliar workflows, such as bridging ETH assets from the mainnet to Arbitrum, increasing onboarding difficulty.

-

Lower Network Effects: Requires time to build sufficient network effects to attract more users and developers.

Overall, Arbitrum excels in performance, cost-efficiency, and compatibility, yet must address centralization and network effect challenges. Looking ahead, as Layer2 technology matures and gains wider adoption, Arbitrum is well-positioned to enhance Ethereum’s scalability and user experience.

4. Optimism Project Analysis

About Optimism

Optimism is an Ethereum Layer2 solution that processes transfers and smart contracts on the Optimism chain, recording only final results on Ethereum—significantly reducing per-transaction fees.

The Optimism project began in early 2020 with the release of its whitepaper, followed by a testnet launch at year-end to validate technological feasibility and security. On the testnet, developers could begin deploying smart contracts and applications on Optimistic Ethereum. Throughout 2021, Optimism actively collaborated with the Ethereum community to advance Layer2 adoption. Recognizing scalability as a pressing issue, Ethereum embraced Optimism as a viable solution. The Optimism mainnet officially launched by end-2021—marking the debut of Ethereum’s first canonical Layer2 scaling solution. Soon after, DeFi projects and decentralized exchanges started migrating to Optimistic Ethereum to cut costs and improve performance. Since mainnet launch, Optimism has seen widespread adoption, attracting numerous projects across DeFi, NFT markets, and other Ethereum ecosystem applications.

Optimism’s development highlights its critical role in addressing Ethereum’s network congestion and high fees, reflecting growing traction and integration within the broader Ethereum ecosystem. It represents a major advancement in Layer2 scaling technology within the blockchain space.

Technology

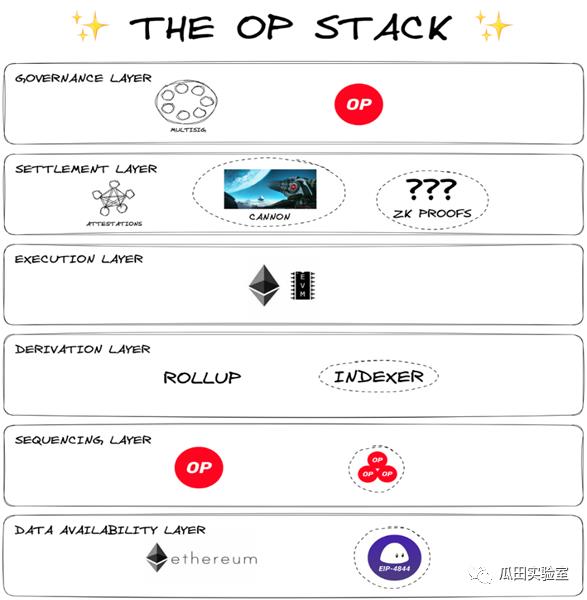

When discussing Optimism’s technology, OP Stack must be mentioned. OP Stack refers to a set of open-source software components enabling anyone to build their own L2 blockchain on Ethereum using Optimistic Rollup.

OP Stack comprises four main components:

-

Mainnet: The OP Mainnet is a low-cost, high-speed Ethereum L2 network compatible with the Ethereum Virtual Machine (EVM).

-

Contracts: Smart contracts implementing OP Stack’s core logic and functions. These include the State Transition System (STS), Fraud Proofs (FP), State Commitment Chain (SCC), and Canonical Transaction Chain (CTC).

-

Services: Provide data availability, synchronization, and communication between L1 and L2.

-

Tools: Facilitate development, testing, deployment, monitoring, and debugging of OP Stack-based blockchains.

OP Stack is designed as a forkable, modular, and scalable blockchain infrastructure. To realize this vision, all types of L2s will integrate into a unified Superchain—interconnecting isolated L2s into an interoperable system. Launching an L2 could become as simple as deploying a smart contract on Ethereum today—transforming the narrative from “one-click token issuance” to “one-click chain issuance.” Essentially, Superchain is a horizontally scalable blockchain network sharing Ethereum’s security, communication layer, and development tools. Think of Superchain as a Cosmos-like network secured by Ethereum—but now OP Stack is considered a potential “Cosmos Killer.” Thanks to the OP Stack–Superchain architecture, five public chains—Optimism, Base, Zora, Aevo, and Public Goods Network—are already live, with opBNB recently joining.

Architecturally, OP Stack consists of six layers from bottom to top: DA Layer (Data Availability), Sequencing Layer, Derivation Layer, Execution Layer, Settlement Layer, and Governance Layer. Each layer functions as a modular API, freely composable and decouplable. Among them, DA, Execution, and Settlement layers are most critical, forming the core workflow of OP Stack.

-

DA Layer: The source of raw data for OP Stack. Can pull input data via single or multiple data availability modules. Currently, Ethereum is the primary DA layer, though more chains may join in the future.

-

Execution Layer: Defines the state structure within OP Stack, supporting EVM or other VMs. Enhances support for L2 transactions initiated on Ethereum, adding incremental L1 data costs per transaction to the overall expense.

-

Settlement Layer: Aggregates L2 transaction data from OP Stack, sending information to the target chain post-confirmation to finalize settlement. In the future, it may incorporate ZK and other validity proof mechanisms, bridging gaps between chains—even connecting OP-system L2s with ZK-system L2s.

Ecosystem

DeFi remains the cornerstone of any public chain. A thriving and innovative DeFi ecosystem attracts massive liquidity—fueling the entire chain like gasoline powers an engine. Optimism’s DeFi landscape is robust, covering decentralized exchanges, lending, and more. Velodrome is Optimism’s largest DEX, while Sonne Finance is its native lending platform and ranks second in TVL among lending protocols.

In GameFi, unfortunately, Optimism lacks standout projects—no equivalents to Arbitrum’s Treasure DAO (“Nintendo of Web3 Gaming”) or Trident’s innovative “Risk-to-Earn” model. However, Optimism does have a secret weapon: Op Craft, built on OP Stack. Full-chain gaming is an emerging paradigm. When thinking of pure on-chain games, you might recall Dark Forest. Expanding further, a trending concept called “Onchain Autonomous World” (on-chain autonomous world)—originating from gaming but transcending it—may best capture blockchain’s essence. This buzzword was actually coined by Op Craft.

Summary of Pros and Cons

Optimism offers four key advantages: EVM equivalence, data security, speed, and cost efficiency.

-

Optimism is one of the most EVM-compatible chains, striving toward full EVM equivalence. Using its Optimistic Virtual Machine (OVM)—an EVM-compatible runtime—it supports any Ethereum application. Developers can deploy Ethereum-based dApps to Optimism with minimal architectural changes, enabling seamless integration of Ethereum-built dApps.

-

Optimism’s rollup architecture inherits security from the Ethereum mainnet. Transactions are processed on Optimism, but transaction data is written and stored on Ethereum, allowing Optimism to maintain scalability while benefiting from Ethereum’s security.

-

Optimism achieves 10–100x scalability improvements depending on transaction type. It offers near-instant transaction finality, allowing users to immediately verify outcomes.

-

Transactions on Optimism are extremely cheap—about 1% of Ethereum’s costs.

Optimism has three main drawbacks: long and costly withdrawals, potential misalignment of incentives among network participants, and underlying L1 transaction censorship.

-

Due to the one-week fraud proof challenge period, official bridge withdrawals require a seven-day waiting period. Once submitted, these withdrawals cannot be canceled. Additionally, due to implemented security measures, main bridge withdrawals are expensive—potentially exceeding $100. Such lengthy and costly exit periods may negatively impact adoption and composability.

-

The network relies on incentivized verifiers to challenge fraudulent proposals. If few or no fraudulent proposals arise, verifiers receive little or no rewards (only paid upon successful challenge), discouraging node operation.

-

If a transaction carries enough value, the Sequencer might bribe Ethereum miners to allow a fraudulent proposal to pass at very low cost during computation checks.

5. Analysis of opBNB and COMBO Projects

opBNB

opBNB is a Layer2 network built on BSC using OP Stack technology. Like Ethereum’s Optimism Rollup, opBNB improves network performance by computing transaction data off-chain, batching it, and submitting it to Layer1—achieving high TPS, low gas fees, and consistent security with Layer1.

In 2020, amid Ethereum network congestion, BSC provided users and developers with a fast, secure, low-cost environment for decentralized applications. However, as volumes surged—especially in GameFi—BSC occasionally faced congestion and high gas fees, indicating limitations in scalability. opBNB emerged as a new solution to address BSC’s scalability challenges.

The open-source nature of OP Stack allows developers to easily build Layer2 chains using OP components—Coinbase’s Base being another example. The difference is Base is an Ethereum L2, while opBNB is a BSC L2. BNB chose OP over ZK mainly due to OP’s practicality—simplicity, ease of use, high customizability, true EVM compatibility, rapid application development, and user adoption. In contrast, ZK has higher narrative appeal but comes with greater development complexity.

Compared to Ethereum, BSC is already “fast”—opBNB makes it even faster. opBNB raises the gas limit to an “astonishing 100M,” surpassing Optimism’s 30M gas cap, processing over 4,000 transfer transactions per second with average transaction costs below $0.005.

Backed by BNB’s vast ecosystem, opBNB enjoys inherent advantages in seamlessly onboarding BNB-native projects. DeFi projects include derivative exchange OpenOcean, trending platforms Goose Finance and BabySwap, and cross-chain bridge Orbit Bridge. GameFi titles include football game Ultimate Champions, metaverse game SecondLive, Mobox’s NFT Farmer, and upcoming Cards Ahoy.

COMBO

Unlike the three public chains detailed above, COMBO is a Layer2 network dedicated exclusively to Web3 gaming, opening its testnet this April. Similar to opBNB and built atop BNB Chain, COMBO employs Optimistic Rollup technology to achieve speeds up to 5,000 TPS with gas fees as low as 0.001 Gwei.

To support game developers, COMBO has partnered with numerous infrastructure providers, offering comprehensive on-chain development tools, including:

-

Full-stack Development Kit: Provides game developers with a complete suite of tools and resources covering frontend and backend development—frameworks, libraries, documentation, testing tools, etc.;

-

ComboUp: Offers developers a ready-to-use environment to launch games and apps, providing templates, modules, and infrastructure to accelerate development and deployment;

-

Web3 Gaming Solutions & Ecosystem: Enables asset ownership, decentralized markets, and interoperability with other blockchain-based games, uniting developers and players to co-create a holistic gaming ecosystem.

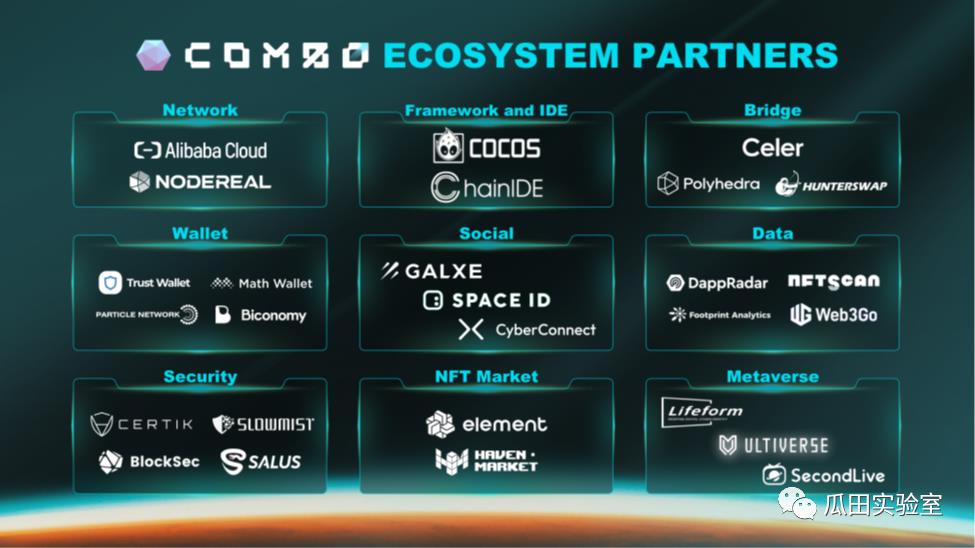

COMBO’s ecosystem strategy centers entirely on gaming and metaverse—covering foundational infrastructure, networks, security, wallets, data, NFT markets, and more. Backed by heavyweight metaverse projects like Lifeform, Ultiverse, and SecondLive, its ecosystem, while not massive, is comprehensive.

To date, COMBO has raised $40 million, with Binance leading a $12 million round. In June, the COMBO team allocated $80 million to an ecosystem fund supporting Web3 game developers on COMBO, offering advisory services and industry resources. COMBO ecosystem projects may also qualify for $100,000 in COMBO token grants and follow-on strategic investments.

COMBO’s relationship to BNB and Optimistic Rollup mirrors Immutable’s to ETH and ZK Rollup. Both are gaming-specific chains backed by large ecosystems (BNB and ETH), adopting the two dominant Layer2 technologies. Each has flagship gaming/metaverse products—Gods Unchained for Immutable, SecondLive for COMBO. Leveraging SecondLive’s influence in the metaverse space, strong backing from Binance, and deep expertise in gaming and metaverse, COMBO is well-positioned to ride the current wave of growth in gaming and metaverse sectors.

Conclusion

This in-depth research article marks our entry into Layer2 analysis, focusing on the OP track by examining Polygon PoS (sidechain-based), Arbitrum and Optimism (Optimistic Rollup-based), and opBNB and COMBO (also Optimistic Rollup-based but within the BNB ecosystem).

Overall, Rollup has become the dominant Layer2 solution, offering significant improvements in security, speed, scalability, and cost compared to the original Layer1 mainnet. However, Rollup solutions do face challenges—particularly the withdrawal delays caused by OP’s challenge period, limited interoperability due to bridges, restricted asset support, fragmented liquidity, and centralized sequencers. Coupled with potential security vulnerabilities inherent in Rollup technology, these remain user concerns. Addressing these issues—reducing withdrawal wait times, improving capital efficiency and security, decentralizing sequencers—will be key areas for future improvement in the OP track.

The five Layer2 public chain projects discussed here include three from the Ethereum ecosystem and two from BNB; one uses sidechain technology (Polygon PoS), while four adopt OP architecture. These five represent crown jewels of the Layer2 and OP sectors,肩负重大生态发展使命. Of course, other OP-based Layer2 chains like Metis, Boba, and Mantle are also pillars of the current OP ecosystem, though space limitations prevent deeper analysis here.

In closing, since Optimism and Arbitrum are often compared, let’s briefly discuss their differences in technical and non-technical aspects.

Technically, the main difference lies in dispute resolution. When challenged, Optimism relies entirely on the Ethereum EVM for execution, whereas Arbitrum uses an off-chain dispute resolution process to reduce disputes down to a single step within a transaction before sending the result to EVM for final validation. Hence, Optimism’s dispute resolution is simpler, potentially offering advantages in speed and cost.

From a market perspective, Arbitrum and Optimism are comparable in transaction data and performance—with Arbitrum slightly ahead. Their valuations are similar, with market caps of $1.36 billion and $1.32 billion respectively. Strategically, Optimism follows a horizontal expansion model via OP Stack, attracting more developers to launch L2 chains on its platform, leveraging strong B2B partnerships to bring in giants like Binance and Coinbase. Arbitrum, meanwhile, pursues vertical ecosystem development via Arbitrum Orbit and is actively advancing into the Layer3 space with XAI Games for even higher performance.

Looking at GameFi, Arbitrum currently leads Optimism in ecosystem strength. Although Optimism has Op Craft, it pales in popularity compared to Arbitrum’s TreasureDAO. In terms of dedicated GameFi support, Arbitrum Nova (a high-interaction-dedicated chain) and XAI (a Layer3 gaming-dedicated chain) outperform Optimism.

Overall, Arbitrum and Optimism each have distinct strengths and strategic focuses. As competition intensifies in the Layer2 space, public chains will continue refining their offerings—delivering ever-higher performance, richer ecosystems, and better user experiences. In the next article, we’ll focus on ZK and Validium赛道, analyzing several Layer2 public chains to explore the broader development of the ZK track—stay tuned!

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News