Understanding Modular Blockchains Celestia and Fuel: Models, Funding Background, Teams, and Roadmaps

TechFlow Selected TechFlow Selected

Understanding Modular Blockchains Celestia and Fuel: Models, Funding Background, Teams, and Roadmaps

The public blockchain race is an endless competition for the entire blockchain industry.

The public blockchain race is an endless competition within the broader blockchain industry.

From Ethereum to high-performance "Ethereum killers" like Solana, and now to Aptos, it's clear that the public chain space remains fiercely competitive.

After five or six years of development, the public chain landscape has evolved significantly. Now, many community members are turning their attention toward modular blockchains.

This year, two major projects in modular blockchains are Celestia and Fuel.

Interestingly, Fuel and Celestia could be considered “siblings” — both projects share a co-founder, John Adler, who was one of the earliest proposers of the Optimistic Rollup scheme. Both have recently secured substantial funding rounds, making them the focal points for this emerging sector.

Without further ado, let’s dive into these two modular blockchains from our perspective.

Celestia

Website: https://celestia.org

Twitter: https://twitter.com/CelestiaOrg

Celestia was formerly known as Lazy Ledger — an infrastructure specialized in "data availability," and the first blockchain network to propose modularity. With its simplified, modular consensus layer, it empowers developers with limited budgets to easily deploy their own blockchains.

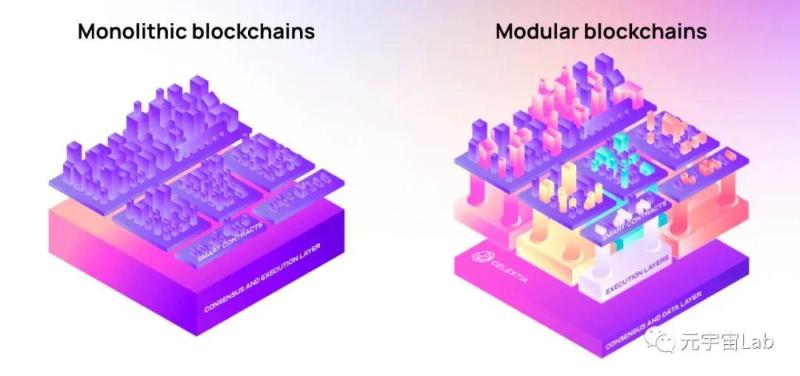

Celestia is referred to as a simplified blockchain because it separates the consensus layer from the application execution layer. It only packages transaction data into blocks and publishes them without executing transactions. In contrast, traditional monolithic blockchain architectures bundle consensus and execution together, forcing developers to use only the chain’s supported programming language. All applications follow the same execution flow, share resources, and require hard forks to upgrade smart contracts.

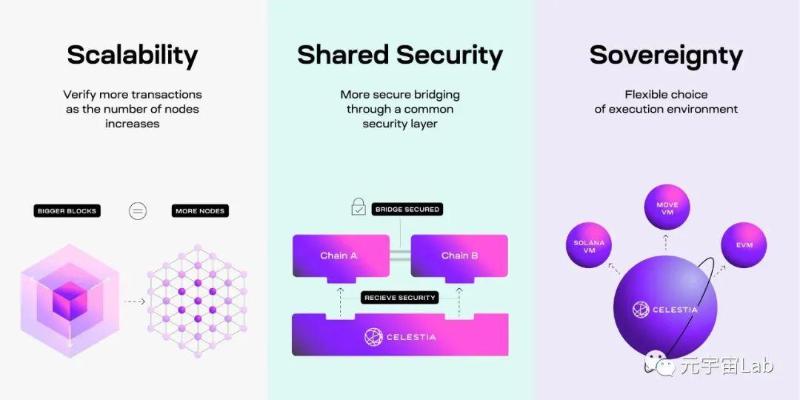

In Celestia’s modular architecture, developers can plug into its consensus layer and build their own execution layers on top. This allows for highly customizable and flexible applications under the security umbrella of Celestia’s consensus. Compared to shared-security models like Polkadot and Cosmos, Celestia offers better scalability. Projects like Polkadot rely on state execution, which is inherently expensive and creates high cost barriers — especially for long-tail chains and rollups.

Mustafa Al-Bassam, CEO of Celestia Labs, published the whitepaper “LazyLedger: A Distributed Data Availability Ledger With Client-Side Smart Contracts” in 2019. This introduced the LazyLedger ledger design, simplifying block validation down to verifying data availability. Consensus participants don’t need to download, process, or validate every transaction — they only need assurance that data is available when needed. By decoupling transaction validation rules from consensus rules, the resource requirements for reaching consensus are greatly reduced.

Built upon LazyLedger, the Celestia network can store various types of data and supports code written in multiple programming languages such as Solidity, Golang, and Rust. Since Celestia does not need to interpret the content of the data, interpretation is left to light nodes — i.e., end users.

The three types of nodes in the Celestia network are storage nodes, consensus nodes, and light nodes. Storage nodes retain data from consensus nodes and distribute copies to requesting light nodes. Consensus nodes receive transactions from light nodes, validate them according to Celestia’s rules, form blocks, and send them to storage nodes. Light nodes submit transactions to consensus nodes and download required data from storage nodes.

Light nodes typically refer to servers operated by individuals or organizations, but in Celestia’s vision, even regular users’ personal computers can act as light nodes. By installing an application that communicates with the Celestia network, users can directly retrieve block content from storage nodes. Using this software, PCs also send transactions to consensus nodes, effectively becoming light nodes. Developers gain access to a low-cost, always-on dedicated server network.

The more light nodes there are, the harder it becomes for malicious actors to succeed, increasing overall network security. Within hardware limits, larger block sizes can be adopted to increase transaction throughput — achieving a balance between security, decentralization, and scalability, thus overcoming the blockchain trilemma.

Below is a summary of Celestia’s key features to help readers better understand the project:

-

Separation of Consensus and Execution Layers

Celestia provides a pluggable consensus layer, enabling developers to deploy their own execution layers on top. This grants higher customization and flexibility for applications built on Celestia.

-

Data Availability Proofs

Celestia uses a two-dimensional Reed-Solomon coding scheme to encode blockchain data. This means even a small sample of data is sufficient to probabilistically verify that the entire block’s data has been published. If encoding is invalid, data availability fraud proofs notify the network — eliminating the need for each node to download all data for verification.

-

Rollups with Off-Chain Execution

Celestia is ideal for serving as a new scaling solution for rollups, which move state execution off-chain while relying on the base layer for consensus and data availability. Data sampling light clients are a critical component for all rollup-based sidechains built atop Celestia, since rollups depend on data availability for security. Optimistic Rollups require data availability to detect fraud, while Zero-Knowledge Rollups need it to reconstruct chain state.

-

Securing Light Nodes for Interoperability

Cross-chain interoperability traditionally relies on insecure light nodes that assume an honest majority. Celestia’s light nodes do not make this assumption, unlocking truly secure cross-chain interoperability and making connecting chains as simple as deploying a smart contract.

Celestia is designed to provide consensus and data availability, not transaction execution. Similarly, Celestia’s light nodes do not validate transactions; they only check whether consensus has been reached on each block and whether block data is available. This means they do not rely on an honest majority for state validity (unlike other chains where light nodes assume honest majority), a property previously exclusive to full nodes.

Thanks to its clever block encoding scheme, a few random data samples are enough for light nodes to verify with high probability that the rest of the block has been published. If any full node detects suspicious activity, it can alert light clients via data availability fraud proofs.

Team Background

The Celestia team boasts impressive credentials, composed of accomplished scholars, researchers, and engineers in blockchain scalability, each with extensive experience in research or entrepreneurship.

Mustafa Al-Bassam, CEO of Celestia Labs, holds a PhD in blockchain scalability from University College London. He co-founded Chainspace, a sharded smart contract platform later acquired by Facebook, and authored several pioneering papers on the security of sharded blockchain systems. John Adler is a Layer 2 researcher at Celestia Labs, previously working at ConsenSys on Ethereum 2.0.

CTO Ismail leads technical development at Celestia Labs, with prior engineering roles at Tendermint (Cosmos’ parent company), Interchain Foundation, and Google, bringing deep expertise in blockchain technology. CRO John holds a PhD in Computer Engineering from the University of Toronto and previously served as a researcher and engineer at ConsenSys before co-founding Fuel Labs, the Optimistic Rollup solution. COO Nick holds a master’s degree from Stanford University and was previously a co-founder of the Harmony blockchain.

Funding Overview

In March 2021, Celestia raised $1.5 million in seed funding led by Binance Labs, with participation from Interchain Foundation, Maven 11, KR1, Signature Ventures, Divergence Ventures, Dokia Capital, P2P Capital, Tokonomy, Cryptium Labs, Michael Ng, Simon Johnson, Michael Youssefmir, and Ramsey Khoury.

On October 20, 2022, Celestia Labs announced $55 million in Series A and B funding led by Bain Capital Crypto and Polychain Capital. Participants included Placeholder, Galaxy, Delphi Digital, Blockchain Capital, NFX, Protocol Labs, Figment, Maven 11, Spartan Group, FTX Ventures, Jump Crypto, W3.Hitchhiker, and a number of angel investors. According to a source cited by Coindesk, this round valued Celestia at $1 billion, making it a unicorn, and saw four times oversubscription.

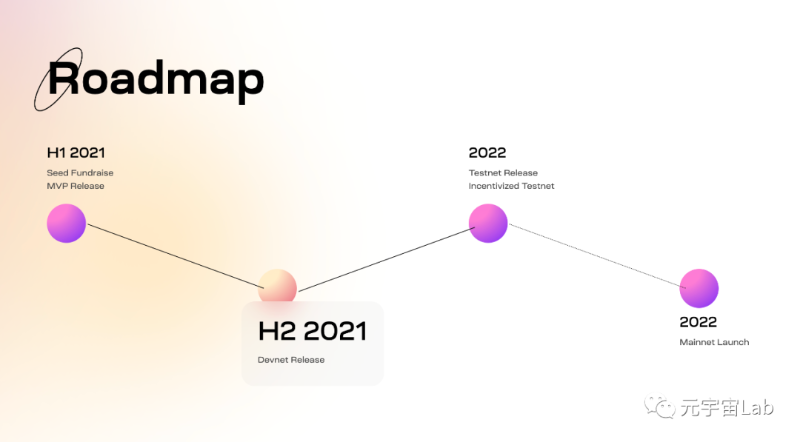

Roadmap

According to the roadmap and official blog posts about funding, Celestia launched its testnet Mamaki in May this year. Mamaki introduced a new data availability API, unlocking a powerful and simple primitive for building blockchains: ordered and available data. An upgrade to Mamaki is scheduled for late October 2022, although this testnet does not offer rewards.

The much-anticipated incentivized testnet is expected to begin in Q1 next year, with mainnet launch projected around Q3 or Q4 of 2023 — making it a promising early-stage project worth watching.

After reading the above, many users should now have a relatively concrete understanding of Celestia. Next, let’s turn to Fuel Labs (Fuel Network), another modular blockchain founded by Celestia’s CRO.

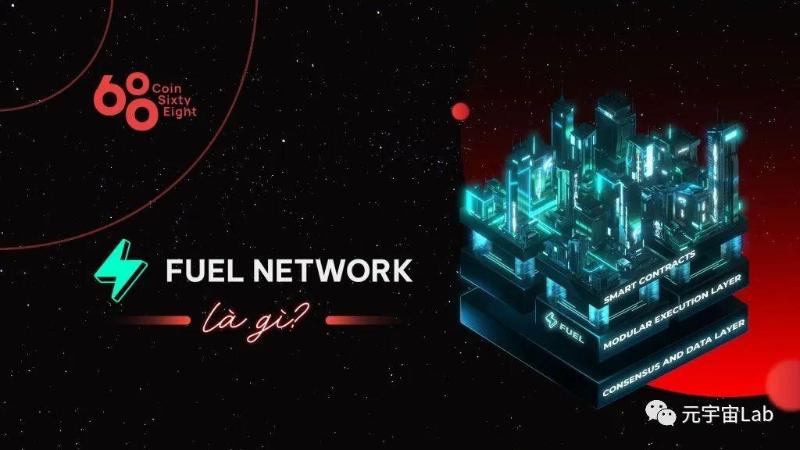

Fuel Network

Website: https://www.fuel.network

Twitter: https://twitter.com/fuellabs_

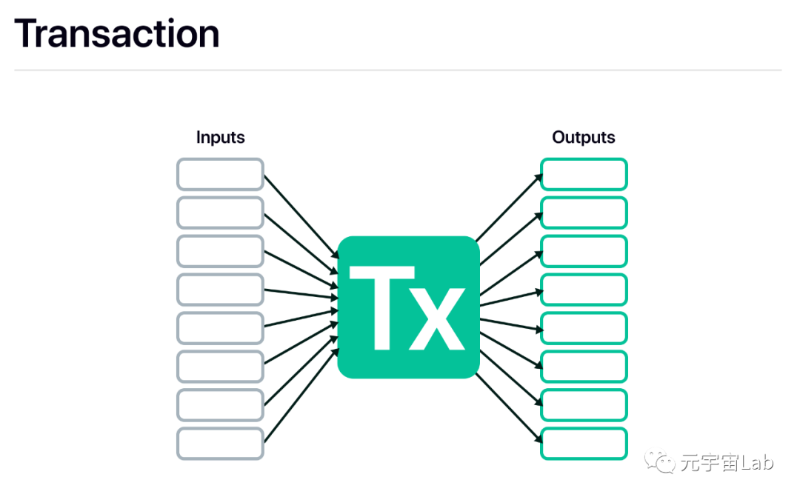

Fuel Network is a modular execution layer for Ethereum. That is, Fuel does not implement consensus nor store blockchain data on its own chain. To function as a complete blockchain, Fuel interacts with other chains — such as Ethereum or Celestia — to obtain consensus and data availability. Fuel v1 was initially deployed at the end of 2020 as an Ethereum scaling solution using the Optimistic Rollup (ORU) model for payments. Fuel v1 used the UTXO model, allowing faster transaction processing through parallel validation on user hardware. Currently, Fuel is advancing its v2 plan for a high-speed modular execution layer, aiming for true scalability.

Fuel uses the UTXO model to create strict access lists — controlling access to the same state within a block. This model builds upon canonical transaction ordering, where transaction sequencing within blocks greatly simplifies detection of dependencies between transactions. To realize this architecture, Fuel Labs developed a new virtual machine called Fuel VM and a new programming language named Sway.

Fuel VM is a compatible yet streamlined implementation of the EVM, facilitating developer adoption into the Fuel ecosystem. Moreover, since Fuel focuses on modular blockchain stacks, Fuel smart contract execution can be settled on Ethereum’s mainnet. This approach aligns with post-merge Ethereum’s vision of being a rollup-centric solution and data availability layer. In this architecture, Fuel supports high-throughput execution that is batched and settled on Ethereum.

Through the new virtual machine, Fuel VM improves upon the inefficient and resource-wasteful execution environment of the EVM. Fuel VM approaches scalability from the perspective of a modular execution layer rather than focusing solely on scaling a specific base layer (like Ethereum) via rollups. It emphasizes computation over data and minimizes state usage.

Thus, Fuel achieves high performance through two key aspects: first, parallel transaction execution based on the UTXO model, enabling greater computation, state access, and transaction throughput compared to single-threaded designs; second, the Fuel VM (Fuel Virtual Machine).

As a proof of concept, the Fuel team created an AMM called Swayswap, running on a testnet to demonstrate the improved performance of Fuel VM compared to the EVM, styled similarly to Uniswap. The AMM currently supports Swap and Pool functions, offering a smooth experience with low gas fees and fast confirmation times.

Below is a summary of Fuel Network’s characteristics to help readers better understand its advantages:

Fuel’s technical advantages can be summarized in three keywords: parallel transaction execution, the improved Fuel VM, and the developer-friendly native programming language Sway.

-

Parallel Transaction Execution: Instead of using an account-based model like Ethereum, Fuel uses the UTXO model mentioned earlier, enabling faster transaction processing through parallel validation on user hardware.

-

Fuel Network Virtual Machine (Fuel VM): Fuel VM aims to reduce wasteful processing inherent in traditional blockchain VM architectures while significantly expanding the design space available to developers.

-

Sway Language & Toolchain Forc: Fuel Network has its own development language — Sway, a Rust-based language, and Forc (Fuel Network Orchestrator), a toolkit supporting developers on Fuel Network.

There are already ten projects built on Fuel Network, with continued expansion underway.

Team Background

Fuel Labs has over 60 engineers dedicated to delivering blockchains for the Ethereum ecosystem with maximum security and high flexible throughput. Founders include Nick Alexander, Samuel Borin, and John Adler — the latter also being a co-founder of Celestia Labs. Emily Herbert is a computer scientist and Sway language expert at Fuel Labs.

Funding News

On September 7, 2022, Fuel Labs announced an $80 million funding round led by Blockchain Capital and Stratos Technologies, with participation from Alameda Research, CoinFund, Bain Capital Crypto, TRGC, Maven 11 Capital, Blockwall, Spartan, Dialectic, and ZMT.

Roadmap

Currently, Fuel has announced a grant program and launched a testnet, though the testnet remains in demo status and the devnet has not yet gone live. Mainnet launch is expected no earlier than early 2023. Those following public chains shouldn’t miss this — there are plenty of opportunities to get involved.

Modularity is becoming one of the most cutting-edge trends in the industry. We look forward to seeing both projects shine in the coming days. That concludes this edition. Interested readers are welcome to add the Metaverse Lab assistant on WeChat for further consultation. Please like and share if you enjoyed the content. Additionally, users passionate about exploring Web3 and metaverse projects are encouraged to join our community via WeChat to connect with fellow crypto enthusiasts.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News