From Fat Protocols to Chain Abstraction, How Will the Application Layer Reshape Crypto Value Capture?

TechFlow Selected TechFlow Selected

From Fat Protocols to Chain Abstraction, How Will the Application Layer Reshape Crypto Value Capture?

Cryptocurrency applications are primary beneficiaries of the shift in how infrastructure is built.

Author: Adrian

Translation: TechFlow

Alt L1s – Accelerating Again?

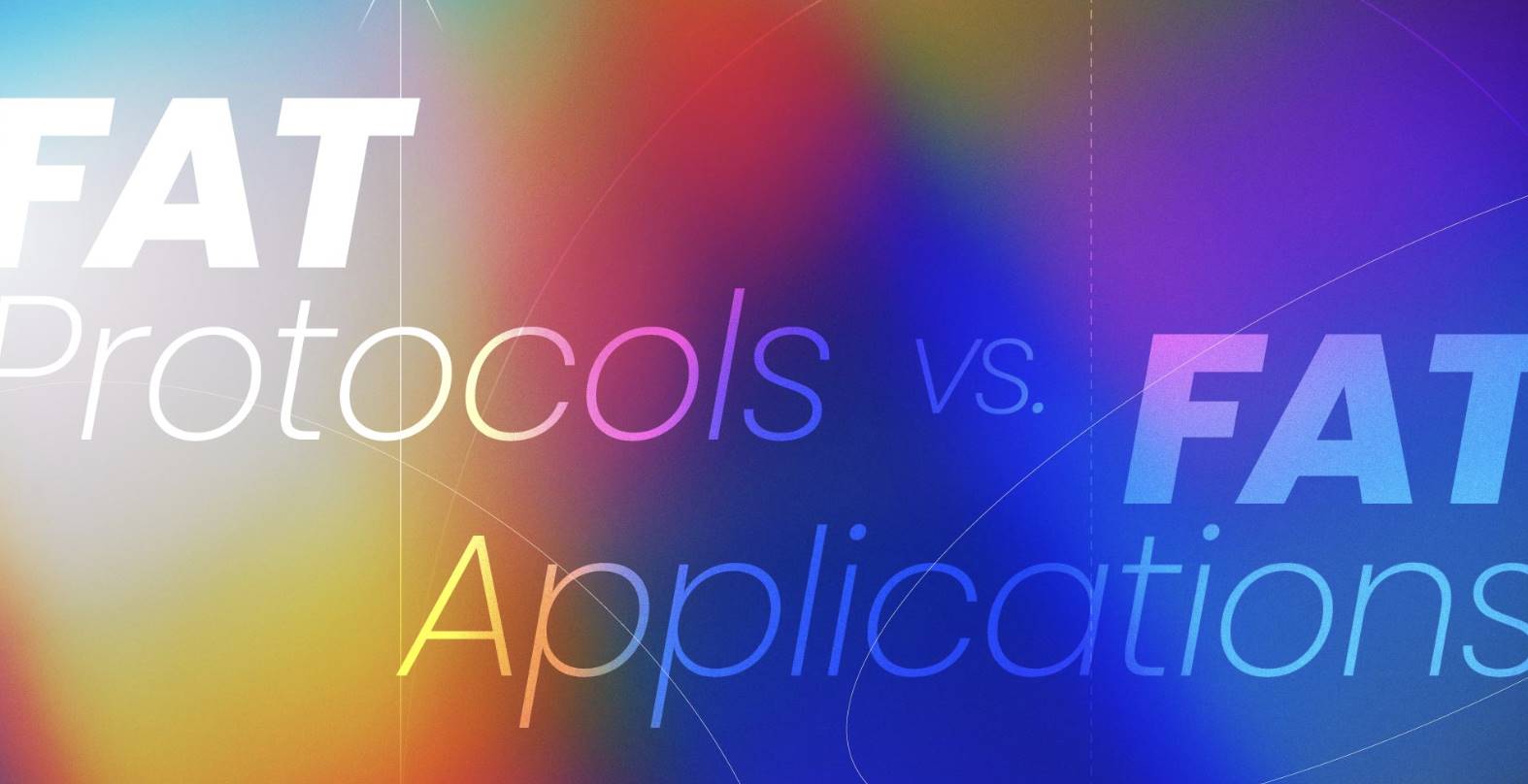

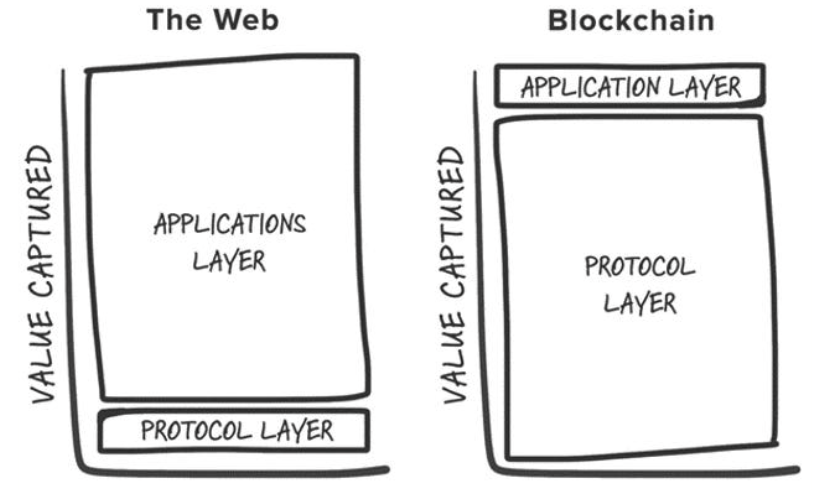

In every crypto cycle, the most successful investments have often been early bets on new foundational layer infrastructure primitives (e.g., PoW, smart contracts, PoS, high throughput, modularity, etc.). Looking at the top 25 assets on Coingecko, only two tokens are not native tokens of L1 blockchains (excluding pegged assets): Uniswap and Shiba Inu. Joel Monegro first explained this phenomenon in 2016 with his "Fat Protocols Theory," which posits that the key difference between Web3 and Web2 in value accrual is that cryptographic base layers accumulate more value than all applications built atop them combined. This value stems from:

1. Blockchains provide a shared data layer for transaction settlement, enabling positive-sum competition and permissionless composability.

2. A virtuous cycle driven by token appreciation: token gains > attract speculators > convert speculators into users > increased users and token value attract more developers and users, creating an expanding ecosystem.

Original fat protocols theory

By 2024, the original fat protocols theory has undergone multiple industry debates and faces challenges due to structural shifts in the landscape:

1. Commoditization of blockspace— As infrastructure premiums are realized, successful alternative L1s (like Solana in high throughput or Celestia in data availability) emerge as "category definers," attracting builders and investors into alt-L1 investments each cycle. Each cycle brings new blockchains differentiated enough to excite investors and users, but many may ultimately become "ghost chains" (e.g., Cardano)—blockchains lacking real users and applications. Overall, this results in oversupply of blockspace without sufficient users and apps to utilize it.

2. Modularization of the base layer— With increasing specialized modular components, defining the "base layer" becomes more complex, let alone decomposing how value accumulates across each stack layer. However, I believe one thing is clear amid this shift:

-

In modular blockchains, value is dispersed across the stack. For any single component (e.g., Celestia) to be valued higher than an integrated base layer, that component (e.g., data availability, DA) must become the most valuable part of the stack, and the "applications" (modular blockchains) built atop it must generate greater usage and fees than integrated systems;

-

Competition among modular solutions drives more economical execution and data availability options, further reducing user costs.

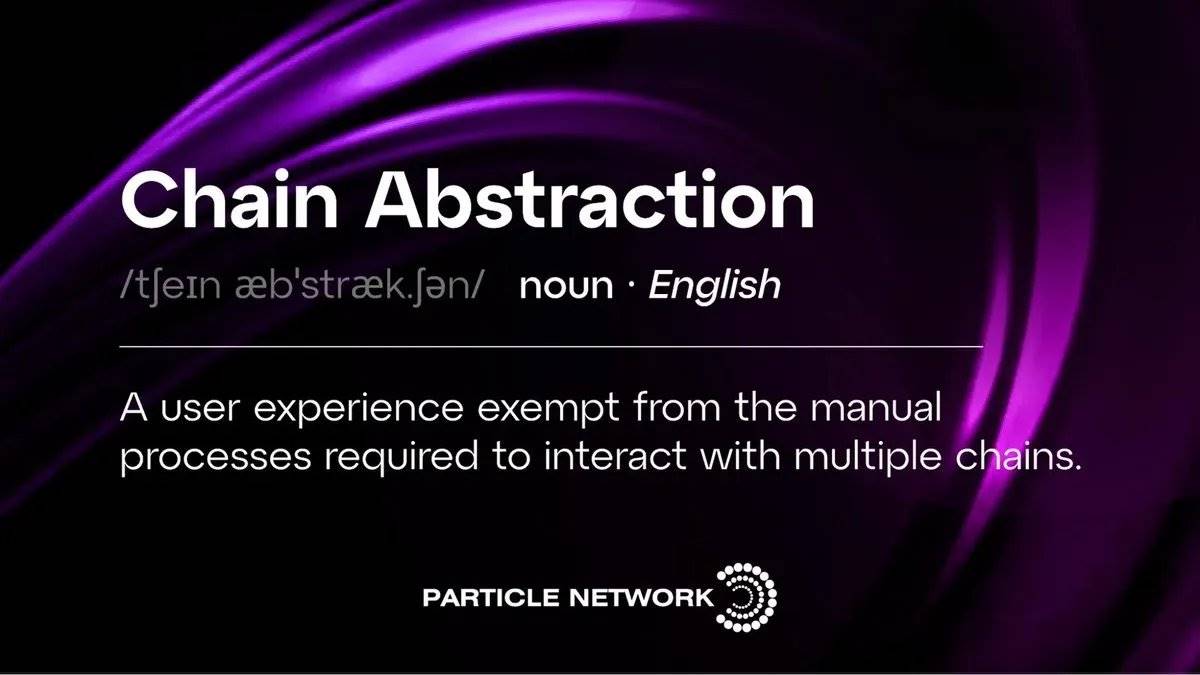

3. Moving toward a “chain abstraction” future— Modularity leads to ecosystem fragmentation, complicating user experience. For developers, this means too many choices about where to deploy their apps; for users, jumping from app A on chain X to app B on chain Y involves numerous hurdles. Fortunately, many smart people have recognized this issue and are building toward a future where users interact with crypto applications without needing to know which blockchain powers them underneath. This vision, known as "chain abstraction," excites me. The key question now is: how will value accrue in a chain-abstraction future?

I believe crypto applications are the primary beneficiaries of shifting infrastructure paradigms. Specifically, intent-centric transaction supply chains, along with intangible assets like order flow exclusivity, user experience, and brand, will increasingly serve as competitive moats, allowing these applications to monetize more effectively than existing models.

Order Flow Exclusivity

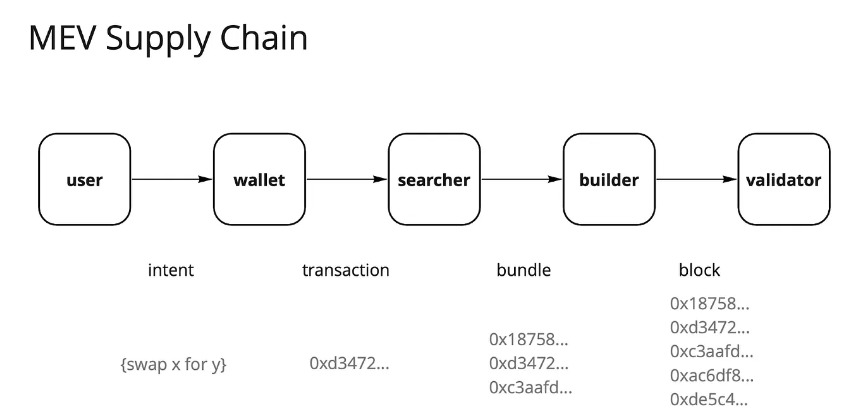

Since Ethereum's merge and the introduction of Flashbots and MEV-Boost, its MEV (Maximal Extractable Value) landscape has significantly evolved. The once-searcher-dominated "dark forest" has transformed into a commoditized order flow market. Today, the MEV supply chain is largely validator-controlled, who receive approximately 90% of generated MEV through bid structures from participants across the supply chain.

Ethereum’s MEV supply chain

Validators capturing most extractable value leaves many participants dissatisfied. Users want compensation for generating order flow, decentralized applications (dapps) wish to retain value from user orders, while searchers and builders aim to increase profits. Consequently, value-hungry actors are experimenting with various strategies to capture excess returns—one being searcher-builder integration. The core idea is that increasing certainty of inclusion for searcher bundles enables higher profit margins. Abundant data and literature show that in competitive markets, exclusivity is key to value capture, and applications with the most valuable traffic gain pricing power.

This dynamic is mirrored in retail stock trading via brokers like Robinhood. Robinhood maintains "zero-fee" trading by selling order flow to market makers, profiting from rebates. Market makers like Citadel pay for this flow because they can profit via arbitrage and information asymmetry.

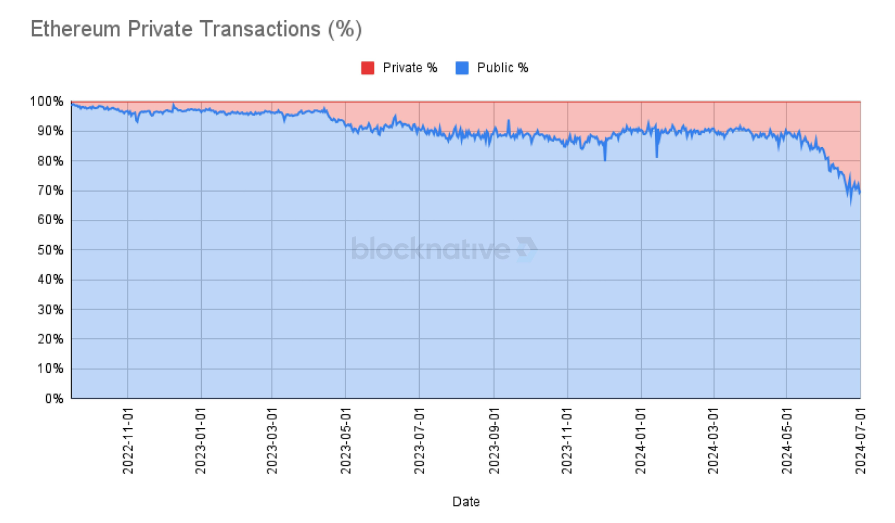

Additionally, an increasing share of transactions now occur through private mempools, reaching a record high of 30% on Ethereum. Dapps recognize that the value of user order flow is being extracted and leaked into the MEV supply chain, while private transactions offer greater opportunities for customization and monetization around sticky user flows.

(Chart source: X)

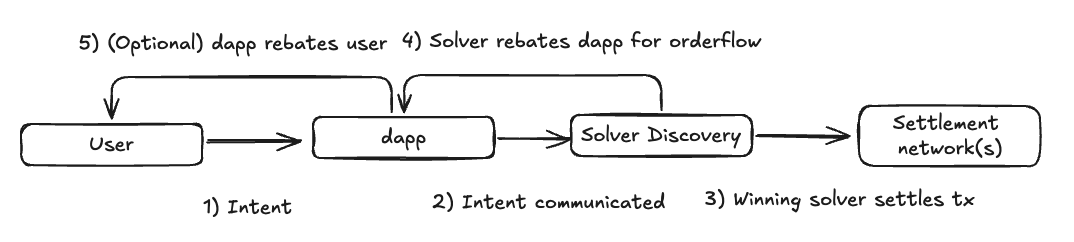

As we move toward a chain-abstraction future, I expect this trend to continue. Under intent-centric execution models, the transaction supply chain could become even more fragmented, with applications restricting their order flow to solver networks offering the most competitive execution—intensifying competition among solvers and compressing margins. Yet, I believe most value capture will shift from the base layer (i.e., validators) to user-facing layers. Middleware components may hold value but likely at lower margins—that is, frontends and applications capable of generating valuable order flow will hold pricing power over searchers and solvers.

On future modes of value accumulation

We’re already seeing this trend manifest in specific types of order flow leveraging application-specific ordering mechanisms, such as Oracle Extractable Value (OEV) auctions (e.g., Pyth, API3, UMA Oval), which allow lending protocols to reclaim liquidation bids that would otherwise go to validators.

User Experience and Brand as Sustainable Moats

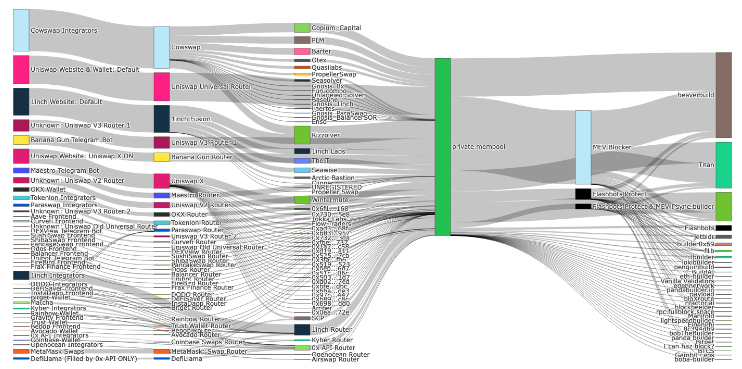

Analyzing the sources of those 30% private transactions reveals most originate from frontends like Telegram bots, decentralized exchanges (DEXs), and wallets:

Breakdown of sources for transactions via private mempools

Though crypto users are often seen as fickle, we're finally observing meaningful user retention. Applications demonstrate that brand and user experience can serve as powerful moats—

-

User Experience: Alternative frontend formats introduce entirely new experiences—starting from wallet connections on web apps—which naturally attract users seeking specific interactions. A strong example is Telegram bots like Bananagun and bonkbot, which have generated over $150 million in fees, enabling seamless meme trading within Telegram chats.

-

Brand: In crypto, trusted brands can charge premium prices by earning user trust. Wallet-integrated swap features, notorious for high fees, remain a successful business model because users pay for convenience. For instance, MetaMask’s swap feature generates over $200 million in annual fees. Similarly, Uniswap Labs’ frontend fee switch has netted $50 million since launch. Transactions via unofficial frontends interacting with Uniswap Labs’ contracts aren’t charged this fee, yet revenue continues to grow.

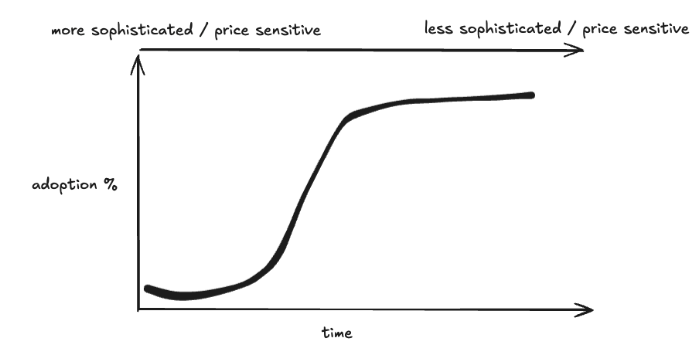

This suggests Lindy effects exist within applications—and may even be stronger than in infrastructure. Typically, technology adoption—including crypto—follows an S-curve. As we transition from early adopters to broader mainstream users—the next wave may be less tech-savvy and thus less price-sensitive—enabling brands that reach critical scale to profit creatively (or simply).

Crypto’s S-curve

Conclusion

As someone primarily focused on infrastructure research and investment, this article isn’t meant to diminish infrastructure’s role as an investable asset class in crypto. Rather, it aims to shift thinking when considering new infrastructures supporting next-generation applications—applications serving users further along the S-curve. New infrastructure must showcase novel use cases at the application level to gain attention. Meanwhile, there’s already ample evidence at the application layer that user ownership directly enables sustainable, value-accruing business models. Unfortunately, we may have passed the era where every new hyped L1 delivers exponential returns—yet projects with meaningful differentiation may still deserve attention and valuation.

Instead, I spend more time thinking about and understanding “infrastructure” in the following forms:

-

AI: This includes the agent economy (AI Agent Economy), automating and improving end-user experiences; compute and inference markets continuously optimizing resource allocation; and verification technologies expanding blockchain VM computational capacity.

-

CAKE Stack: Many of my prior views suggest we should move toward a chain-abstraction future, and design choices for most components in the stack remain wide open. As infrastructure supports chain abstraction, application design space will naturally expand—potentially blurring the lines between applications and infrastructure.

-

DePIN: I’ve long believed DePIN is crypto’s killer real-world use case after stablecoins, and that view hasn’t changed. DePIN leverages crypto’s strengths: permissionless coordination of resources via incentives, market creation, and decentralized ownership. While each network type still faces unique challenges, significant progress has been made in solving cold-start problems. I’m excited to see founders with deep domain expertise launching products using crypto.

If you’re building projects related to the above, feel free to reach out—I’d love to chat. I also welcome all feedback or counterarguments, because frankly, if I’m completely wrong, investing would be much simpler.

“The most exciting applications on Ethereum might be ones we haven’t even thought of yet.” — Vitalik Buterin, 2014

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News