From Marketing Slogan to Creating Value: Understanding the "Three-Step" Approach to Chain Abstraction

TechFlow Selected TechFlow Selected

From Marketing Slogan to Creating Value: Understanding the "Three-Step" Approach to Chain Abstraction

This article will analyze the current stage and the potential situation by the end of 2025.

Author: Austin King

Translation: TechFlow

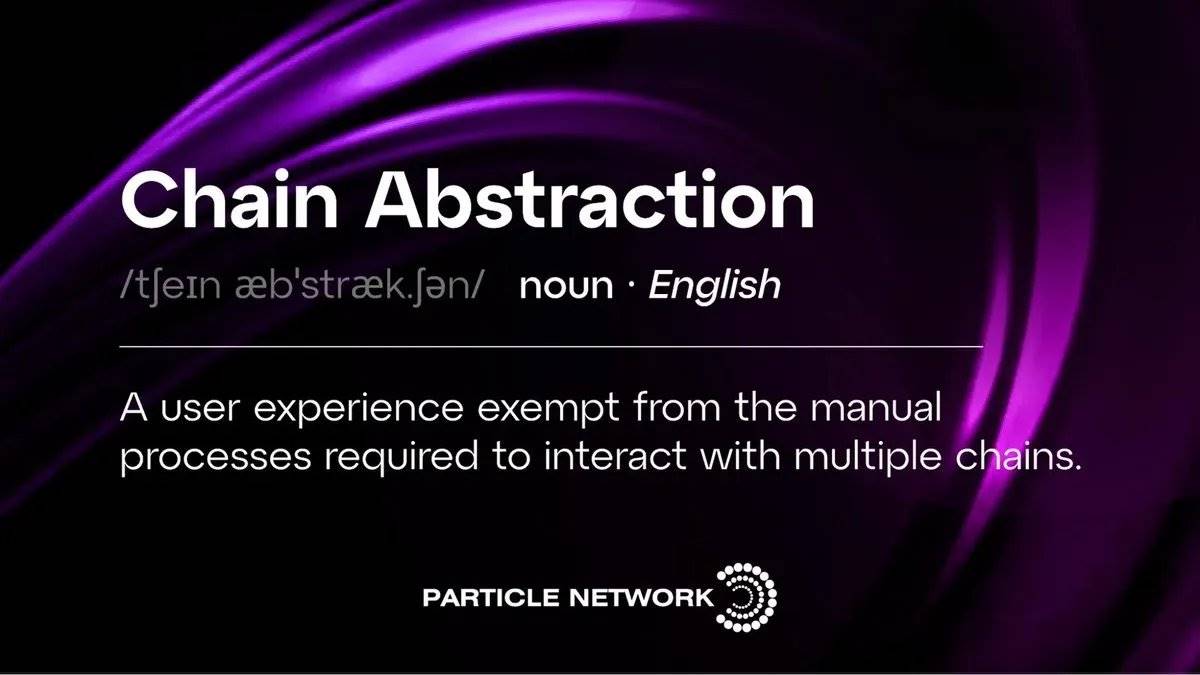

Most people still don’t quite understand what “chain abstraction” really is.

Is it just a buzzword teams use to attract VC funding, or will it genuinely have a transformative impact similar to the “modular” movement?

To be honest, it's both—but many overlook one key fact: its development will happen in stages.

In this article, I’ll break down where we are today and where we might stand by the end of 2025. I'll also explore how markets could react when retail investors realize that the dreams VCs painted for them aren’t real—and that they were merely intended as exit liquidity.

Stage 1 (Q4 2024 – Q1 2025, Stable and Non-Threatening)

Congratulations—if you’re reading this and missed out on the massive gains from Celestia’s modular wave in 2021, this is your next opportunity to get involved with projects poised to drive industry-wide transformation at a similar scale.

We are currently in the early phase of chain abstraction. In reality, only a handful of teams have a clear theory of how to build it correctly, and even fewer possess the engineering capability to actually launch it.

So, what’s real today, and what’s just hype?

The truth is, the most promising teams today are still deep in technical development, capable only of showing proof-of-concept demos. These protocols haven’t yet seen broad production use. While that may sound disappointing, are these early PoCs promising?

Right now, we're stuck in an extremely complex and difficult-to-use crypto environment. Users must juggle gas fees, seed phrases, RPC endpoints, gas on other networks, which chains hold their tokens, which chains host the apps they want to use—the complexity has already pushed the number of willing participants to its limit.

Companies focused on chain abstraction today are taking a step-by-step approach—tackling two or three user pain points at a time. These incremental solutions form the PoC projects currently being shown to the public.

The impact of this stage will be limited. The industry will likely remain here through Q4 this year and into Q1 next year (based on in-depth conversations with leading teams and their roadmaps).

It’ll be interesting—but many will still view chain abstraction as just another buzzword or marketing tactic used to raise funds. Even with tangible mainnet progress, it won’t yet be enough to shift the entire industry toward this new design paradigm. On the bright side, if you dig deeper, you’ll start seeing a few companies emerge as potential leaders in this space—giving you a chance to position yourself before most others notice.

Stage 2 (Q2–Q3 2025, The Start of L1 Psychological Warfare)

By next year’s second quarter, people will begin encountering chain abstraction more naturally within the apps they already use—without actively seeking out “chain abstracted” projects. User experience will improve in ways compatible with existing systems.

You might hear a friend mention using a wallet with a “universal account” design that lets them access funds anywhere. You might deposit collateral into a perpetuals trading protocol, only later realizing it runs on Arbitrum—even though you deposited from Optimism, without ever needing to think about it.

This will be the moment when a new wave of users starts grasping what’s actually happening. If you’re a founder, this could be the ideal time to seriously raise capital. VC researchers will begin recognizing, “There’s a huge untapped opportunity here,” having seen the design pattern work on mainnet—but they’ll also realize it’s still early, with high-leverage opportunities still available.

As we approach the end of Q3, nearly everyone will have to acknowledge that chain abstraction is fundamentally changing how end users access these networks. We’ll start seeing:

App usage becoming significantly easier. Many applications will attract far more capital than today’s infrastructure projects—which are often funded by VCs but lack real user traction.

By then, only two or three infrastructure companies may have adopted this design pattern early, positioning themselves as dominant players in the chain abstraction space.

This will trigger one of the most fascinating cultural clashes I’ve witnessed in my seven years in crypto. Almost every participant holds large amounts of L1 tokens. Right now, we live in a culture where people strongly identify with specific smart contract platforms—like Ethereum or Solana. This shift will first emerge within the Ethereum ecosystem, under slogans like “Make Ethereum a single network again”—but it will quickly expand across all blockchains.

Psychologically speaking—if you hold crypto, your primary investment is almost certainly BTC, ETH, SOL, or another L1 token. Moreover, L1 teams are among the best-funded entities in the industry, backed by vast networks of key opinion leaders (KOLs) who promote their narratives. Add to that the fact that top-tier VCs have poured hundreds of millions into L1 projects and need outsized returns for their limited partners (LPs), or else risk severe damage to their reputations.

Initially, when chain abstraction is framed as “making Ethereum whole again,” these stakeholders will welcome it. But once it begins threatening the status of L1s as centers of value accrual, the industry’s most well-funded players will coordinate a massive psychological campaign to convince you that L1s are still where you should invest.

Stage 3 (Q4 2025 and Beyond, Major Decoupling)

This year’s end will be tough for many investors. Their opposition to chain abstraction isn’t because they doubt its potential or believe it harms the industry—it’s because they have hundreds of millions of dollars at stake. They need to convince retail investors that the L1 projects they’ve championed will deliver the best returns.

This stage will be especially fascinating—it will become a battle between well-funded, biased major VCs and emerging empirical data showing that revenue is increasingly tied not to base L1s (like Ethereum, Solana, Sui, etc.), but to the originators of order flow.

In the first half of 2025, participating in chain abstraction will seem straightforward and positive. But over time, expect increasingly heated debates across the industry, with people inventing all sorts of arguments for why L1s will still capture value—and why chain abstraction is a scam.

What does this mean for the average person active in crypto Twitter? For now, putting your money into the most talked-about projects still makes sense. That’s the reality of today’s market—where nearly everything is narrative-driven, not fundamentals-based. However, as next year unfolds, you’ll need to take a broader view of where the space is headed. You might see data suggesting, “Wow, chain abstraction is real—I should shift my investments toward the apps and protocols handling order flow origins, since they generate the most revenue.” But adjusting your portfolio at that point wouldn’t be rational.

If you’re someone who follows me and digs deeply into where the industry is going, you must recognize—you’re not part of the mass retail group that will shift investments later. You need to interpret the data through this lens: “Will this growing evidence of revenue in chain abstraction protocols make retail investors realize that big VCs are using biased, self-serving narratives to treat them as exit liquidity?”

When retail finally wakes up to this, the industry will undergo unprecedented upheaval. We’ll finally be learning how to evaluate crypto networks properly. Incumbents will do everything they can to obscure this reality—to preserve retail as exit liquidity. But it will become increasingly clear that they’ve overinvested in infrastructure with no real use cases. They’ll grow desperate, panicking as they lose access to the retail exit liquidity they counted on—because frankly, their entire careers depend on it.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News