2025: A Fresh Perspective — Analysis of Chain Abstraction and the Protracted Battle for Paradigm Shift in On-Chain Trading

TechFlow Selected TechFlow Selected

2025: A Fresh Perspective — Analysis of Chain Abstraction and the Protracted Battle for Paradigm Shift in On-Chain Trading

The implementation of chain abstraction is a protracted battle, and the transformation of on-chain transaction paradigms has only just begun.

Author: HelloLydia¹³

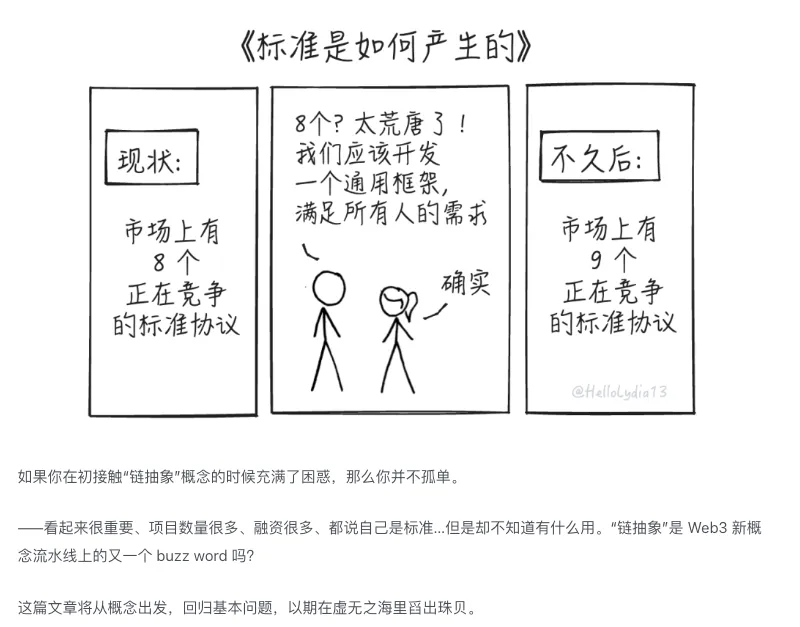

2024 was undoubtedly the inaugural year of chain abstraction. We witnessed this narrative emerge from nothing, evolve, and eventually materialize into real products. After 12 months of effort and experience, it has become clear that both the "chain abstraction is useless" camp and the "chain abstraction will win overnight" camp are wrong. The transformation of on-chain transaction paradigms will inevitably be a protracted battle.

My Journey: From Chain Abstraction Researcher to Builder

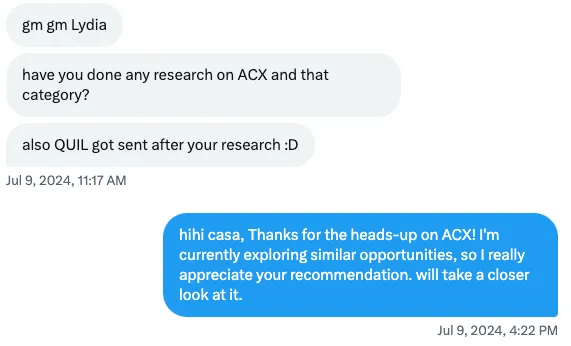

My interest in chain abstraction began in July during a conversation with @coin_casanova. At the time, I was a researcher at Mint Ventures, gaining modest attention through several research reports—this is how I connected with Casa.

One day, Casa suggested I look into $ACX (the token of Across Protocol, which listed on Binance in the final month of 2024). At first glance, it seemed like just another cross-chain bridge—an artifact from the previous cycle. But upon closer inspection, I discovered that Across uses an "intent-based architecture," delivering faster speeds and lower costs than other cross-chain solutions. The team also collaborated with Uniswap to launch ERC-7683, a cross-chain intent standard.

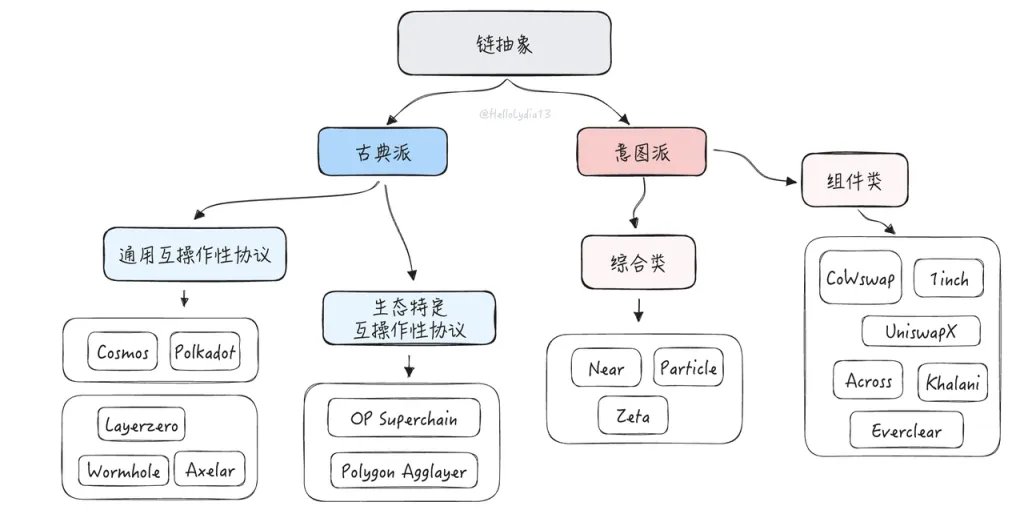

As my research into $ACX deepened, I found myself falling down a rabbit hole of new concepts: cross-chain bridges, cross-chain communication, interoperability, intents, chain abstraction… all deeply confusing. As a researcher, I’m very particular about terminology, yet I couldn’t find any articles—neither in Chinese nor English—that clarified the relationships between these ideas. So I decided to write one myself: "Framing Problems as Method: A New Framework for Understanding Chain Abstraction."

I chose to focus on "chain abstraction" rather than terms like cross-chain or interoperability because in my classification, chain abstraction is a high-dimensional narrative encompassing many specific technical paths. Thus, I included cross-chain and interoperability within the broader scope of chain abstraction. In that report, I emphasized my support for intent-based architectures and user-facing chain abstraction solutions—following this thread leads you upward to Across Protocol and downward to UniversalX, launched less than a month ago @UseUniversalX.

Interestingly, while writing the report, I noticed that Particle Network’s blog (@CarlosCanCab, @TABASCOweb3) contained extensive, highly professional research on chain abstraction. Combined with Li.Fi’s blog (@arjunnchand), they helped me fill in the foundational knowledge gap—from classical cross-chain bridges to the latest developments in chain abstraction. I happily included Particle Network in my diagram of chain abstraction projects.

In October, Particle Network’s CEO @0xpengyu reached out to me through a mutual contact. After some genuinely stimulating and unconventional discussions, my enthusiasm for the chain abstraction mission grew so intense that I felt compelled to dive in headfirst. With fate’s gears clicking into place, I joined Particle Network as a researcher and took charge of building its Chinese-speaking community.

Two Refutations: Chain Abstraction Is Neither Useless Nor Imminent

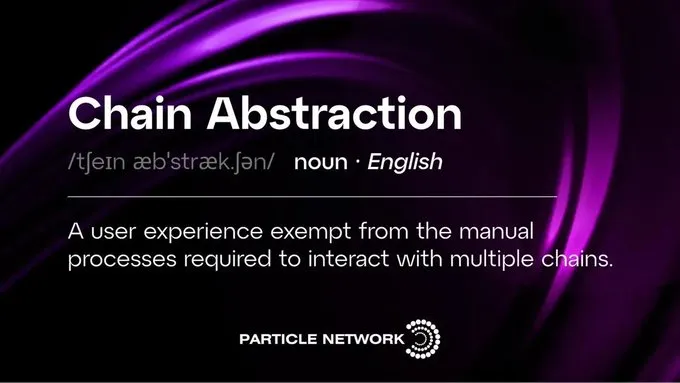

My research journey at Particle Network began with a series called “Clarifying Misconceptions.” Although chain abstraction is already a mature field in the West, much of the research hasn't been systematically introduced to Chinese audiences. This led to numerous misunderstandings derived purely from surface-level interpretations. To address this, I wrote four consecutive articles identifying nine common misconceptions about chain abstraction (vs. cross-chain bridges, intents, multi-chain wallets, etc.) and offered a formal definition:

Refuting the “Chain Abstraction Is Useless” Argument

These articles became my entry point into broader discussions around chain abstraction. Predictably, when pushing a new narrative amid overall market apathy, the first response was skepticism—voices claiming chain abstraction is redundant: “It’s just xxx under a new name… no real need…” exactly the kinds of arguments I had dissected in my three-part series.

The “chain abstraction is useless” view is flawed because it stems from a narrow, mechanical, and static understanding—equating chain abstraction with familiar past concepts without acknowledging the evolution of the space or recognizing its innovations and progress.

This can be further broken down into two types of errors:

The first is fundamental error—a systemic bias and blindness. The most representative example is the belief that Web3 will converge onto only one or two chains. Responding to this is simple: you cannot build all of Web3 on a single state machine. However, correcting this view is difficult because those who hold it fundamentally reject any possibility beyond their own portfolio.

The second is incidental error, such as conflating chain abstraction with multi-chain wallets, cross-chain bridges, or intents. These misconceptions are largely resolved by reading explanatory content like mine—which underscores the importance of ongoing educational efforts in the chain abstraction space.

Refuting the “Chain Abstraction Will Win Overnight” Argument

As the chain abstraction narrative gained momentum—and with major players like Near, Uniswap, Safe, and Particle Network making tangible product advances—it successfully attracted attention from more CEXs and their users, sparking a wave of enthusiasm by the end of 2024. Suddenly, chain abstraction being the future seemed like a universal consensus. Yet beneath the hype, we spotted another danger: the “chain abstraction will win overnight” mindset.

Specifically, some underestimate the objective technical challenges involved, failing to see chain abstraction as a complex, systemic engineering effort requiring re-architecture and optimization across infrastructure, middleware, and application layers. They still cling to outdated notions like “chain abstraction is just repackaged xxx,” leading to unrealistic optimism: “xxx project could do it too—they just haven’t yet—but once they start, it’ll happen fast.”

Others acknowledge the difficulty of the space but grow overly pessimistic about current players, instead pinning hopes on exchange wallet teams to “enter the arena” and “deliver a decisive blow,” quickly unifying the market. They fail to understand that chain abstraction isn’t an isolated infra narrative or a mere stack of features, but a naturally evolving sector built upon maturing foundations like account abstraction (AA), modularity, solver networks, AltVMs, and appchains—where top players have deep-rooted expertise.

To summarize:

Is chain abstraction useless? — No. That’s short-sighted thinking—missing the forest for the trees. Chain abstraction will ultimately succeed.

Can chain abstraction achieve rapid victory? — No. That’s long-sighted overconfidence—thinking you’re above it all. The paradigm shift represented by chain abstraction is a protracted battle.

Phase Analysis: Why Is the On-Chain Transaction Paradigm Shift a Protracted Battle?

Universality and Specificity of Contradictions

Let’s begin with the universality of contradictions. Like all transitions between old and new, the adoption of chain abstraction applications takes time, as does the migration of on-chain transaction paradigms. During this process, we’ll see the unsustainable nature of fragmented, siloed multi-chain ecosystems and the increasingly apparent bottlenecks faced by applications built atop them. Meanwhile, more dApps adopting chain abstraction architectures will gradually emerge. Before we realize it, chain abstraction will become the default configuration across nearly all on-chain scenarios—and there will surely come a moment when the potential of chain abstraction + dApp explodes in a specific use case.

Now let’s discuss the specificity of chain abstraction in on-chain transactions. Why do we believe trading is the catalyst for chain abstraction’s breakout? Because, much like the adult industry in Web2, trading serves as the first landing ground for every emerging technology (VR, AR, mobile internet, AI). The重构 of Web3 trading is the most anticipated native narrative of 2025, and the biggest opportunity here lies in the possibility of a fully on-chain CEX enabled by chain abstraction. Permissionless DEX assets + self-custodied accounts + CEX-level liquidity experience = next-generation on-chain trading platforms. All three elements are indispensable.

Basis and Phases of the Protracted Battle

You might ask: How long will this protracted battle last? Given how logically sound chain abstraction seems, when will it finally break out? — No one can give an exact prediction, but we can analyze the various forces involved and observe how their power dynamics shift.

We must first acknowledge that transforming on-chain transaction paradigms depends on the continuous growth of new on-chain assets and users. Since the rise of Pump.fun in this cycle, on-chain assets have exploded—memes and AI agents providing ample speculation and wealth creation opportunities, driving users from CEXs toward on-chain activity. The primary contradiction now becomes: the surge in people’s trading demand following the asset explosion versus centralized exchanges’ curated listing models, which cannot promptly or broadly cover trending assets. In terms of spot trading appeal, tools like trading bots, DEX aggregators, and in-wallet trading features have already captured significant market share from Tier-2 and below CEXs.

Yet declaring the death of exchanges and claiming DEXs will fully replace CEXs remains premature. Tier-1 exchanges still enjoy listing credibility and deep liquidity in spot markets, and perpetual futures remain a key revenue source for most CEXs. Clearly, Binance Square users don’t all need to turn into on-chain degens for profits to flow—that’s point one.

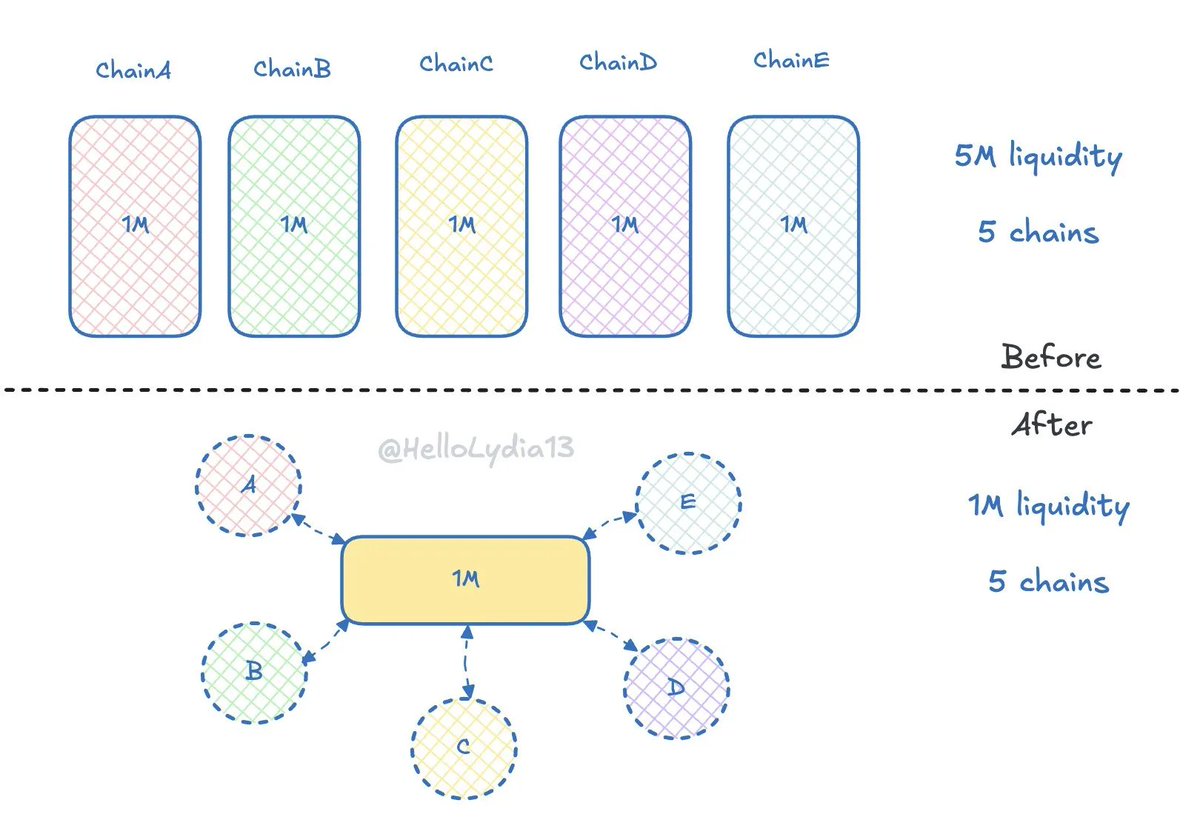

Secondly, as fat apps gradually replace fat protocols, more and more applications will opt for appchains or app rollups, making a multi-chain future inevitable. However, today’s fragmented, broken multi-chain environment severely hinders users’ ability to explore and manage multi-chain assets. Despite progress in account abstraction and ecosystem-specific interoperability protocols, user education, developer education, and product adoption take time—this is point two.

Therefore, while the enrichment of on-chain assets, user migration to chain, and the multi-chain trajectory are certain, the path forward remains dynamic. Nevertheless, by analyzing these trends, we can clearly identify the foundation of chain abstraction products: seamlessly connecting and unlocking the potential of the multi-chain world—including liquidity, users, and developers. For instance, UniversalX’s core competitive advantage lies at the liquidity layer. By securing this, we can capture the most promising segment of multi-chain traders and convert them into loyal UniversalX users (guess how many times I’ve recently heard users say things like “Once you use UniversalX, you can’t go back”?)

The Chain Abstraction Exchange as the Endgame

So why will time ultimately favor chain abstraction exchanges like UniversalX, rather than multi-chain wallets, trading bots, or aggregators?

First, non-custodial nature—in contrast to custodial trading bots. We’re not saying custodial wallets should disappear or won’t exist, but they cannot stand alone. Users will eventually need to move assets into non-custodial wallets. As on-chain security awareness grows, we believe more products will adhere to non-custodial principles.

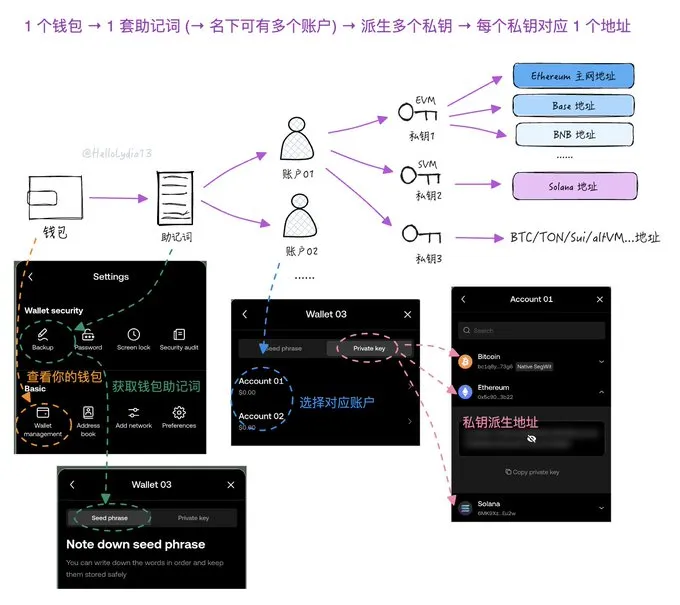

Second, chain abstraction capability—compared to multi-chain wallets and aggregators. Current multi-chain wallets merely “connect” multiple chains, serving a basic aggregation function. While some offer gas payment optimizations, users’ assets remain scattered across chains, requiring manual switching and bridging. We can’t expect every user to master everything from private key management to cross-chain bridging—I once made a guide on multi-chain wallets, and even as a self-proclaimed expert, I found the complexity overwhelming. As for aggregators, most currently support only single chains, and even multi-chain ones cover a very limited range of assets—far from achieving true “multi-chain integration.”

Finally, let’s examine actual competition. The on-chain trading product market will likely follow a three-stage pattern: 1) feature/demand competition; 2) fee competition; 3) business model competition.

The constant emergence of new tools confirms we’re still in stage one—the demand competition phase. Yet features like smart money tracking, address monitoring, and position analysis are already showing signs of commoditization. Once existing products satisfy most user demands, the market will enter stage two: fee competition. Products will engage in price wars until reaching a relatively stable equilibrium. The final stage—business model competition—will be the ultimate test of long-term operational capability.

We’ve already analyzed what UniversalX delivers: it firmly anchors itself in seamless multi-chain liquidity while remaining open to integrating increasingly commoditized advanced data features.

The more multi-chain trends are confirmed, the clearer UniversalX’s demand becomes; the clearer the demand, the stronger the confirmation of multi-chain trends. This positive feedback loop gives UniversalX pricing power distinct from non-chain-abstraction products, offering a competitive edge in the fee war phase.

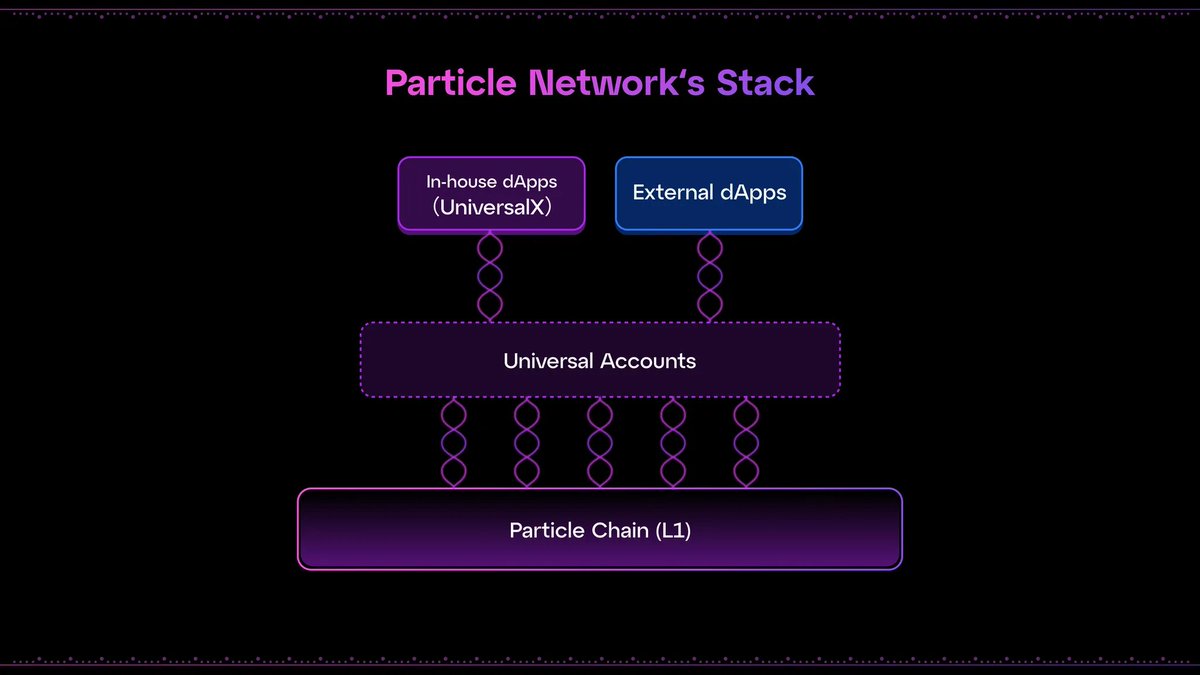

And in the final business model competition phase, UniversalX’s answer is equally clear: L1 + infrastructure + flagship application. L1 Particle Chain follows a public chain business model; chain abstraction infrastructure Universal Account adopts a B2B2C model; and UniversalX represents a classic 2C exchange model. Each layer is well-defined and mutually reinforcing.

Conclusion

By now, my argument is largely complete. This is a long article, but not a fanboy piece. I simply want to convey two points:

1) As builders, we never lack struggle or doubt—but we always choose to believe and move forward.

2) Achieving chain abstraction is a protracted battle. The transformation of on-chain transaction paradigms has only just begun.

My research and views are imperfect, and I welcome your corrections and additions.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News