Dynamic Blockchain Value Capture: Fat Applications or Fat Protocols?

TechFlow Selected TechFlow Selected

Dynamic Blockchain Value Capture: Fat Applications or Fat Protocols?

Fat Protocol or Fat App? The answer might be Both.

Author: Franklin Templeton Digital Assets

Translation: Alex Liu, Foresight News

Since the emergence of smart contracts, value accumulation within distributed networks has been a topic of ongoing debate. Generally, there are two prevailing perspectives on this issue:

-

Belief that value is primarily generated by protocols

-

Belief that value is created by applications built on top of protocols

This study aims to comprehensively evaluate mechanisms of value accumulation by examining the history of Web2 and fundamental differences unique to crypto-based economies.

Web2 Value Capture

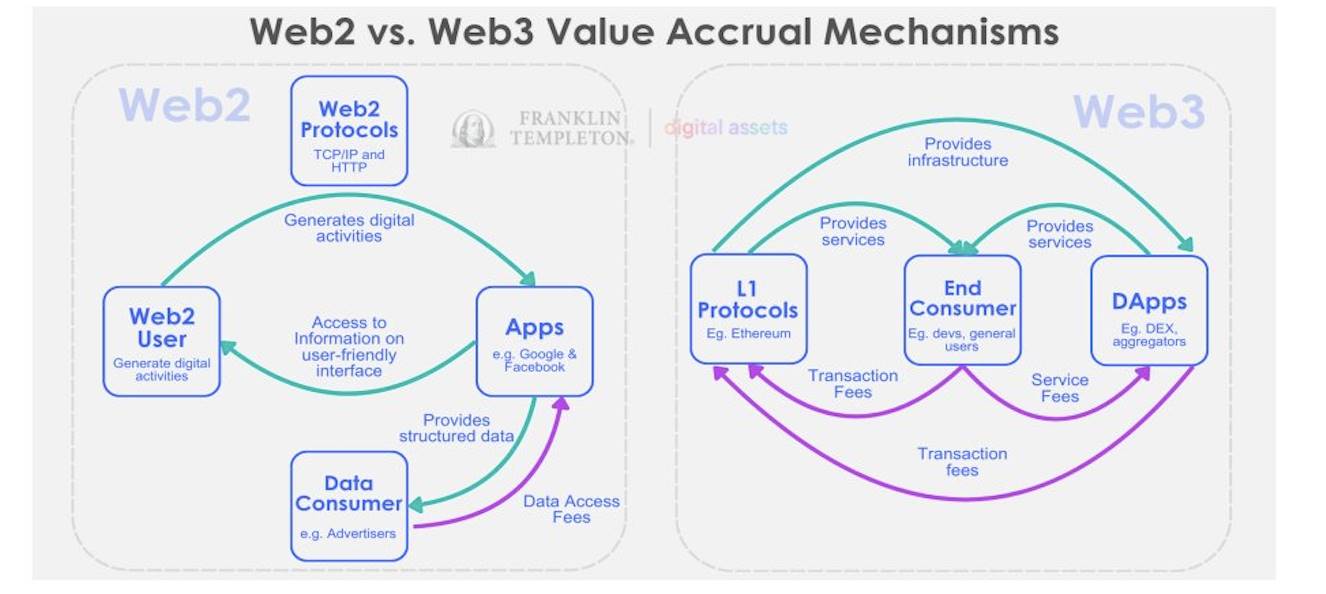

To understand value capture in the Web, we must first examine the precedents set by Web2—the first digital economy. In Web2, protocols such as TCP/IP and HTTP provided the essential infrastructure for data transmission, greatly expanding global access to information through shared communication standards.

However, users initially faced limitations in utilizing this data due to a lack of effective processing tools.

Applications like Google—the world’s most widely used search engine—exploited this asymmetry by building and facilitating digital information consumption through simple user interfaces and experiences for ordinary web users. In doing so, they created value by enabling users to interact with the emerging data economy. Furthermore, by controlling their proprietary ecosystems, these applications could monetize their data assets by packaging and selling analyses and insights into digital behavior.

Notably, these protocols were excluded from monetization because they lacked control over consumer data flows.

As a result, applications became known as “fat,” while core protocols were considered “thin.” This distinction gave rise to the “Fat App” thesis, which argues that applications capture greater value by building upon and leveraging digital activity rather than merely enabling basic data transfer. Essentially, Web2’s value proposition centers on information dissemination; by providing easy access to content, applications captured nearly all value creation.

Web3 Value Capture

Web3 represents a significant departure from historical value capture mechanisms in Web2. Unlike Web2, where value generation stemmed largely from consumer-friendly products developed atop foundational protocols, Web3 derives value directly from the base-layer protocols themselves. Layer 1 (L1) protocols facilitate the inclusion of transactions into blocks, allowing them to monetize this process by collecting transaction fees users are willing to pay for execution.

Additionally, decentralized applications (dApps) built on top of these L1 protocols must also pay fees to use this infrastructure. This ability for protocols to capture substantial value—driven by robust transaction flows from both end users and dApps—led to the emergence of the Fat Protocol thesis, which posits that protocols generate more value than applications in Web3.

The Resurgence of the Fat App Thesis

While blockchain introduced a potentially transformative shift in how value accumulates at the protocol level, the concept of fat applications has not disappeared entirely. In Web3, the open-source nature of L1 blockchains fosters a highly competitive yet collaborative environment for dApps, allowing developers free access to, modification of, and innovation upon these underlying protocols. Like in Web2, dApps continue to attract users by offering user-friendly services and interfaces. Compared to Web2, however, this creates a more nuanced tug-of-war over value capture.

This trend is particularly evident in decentralized finance (DeFi), where dApps capture significant fees by providing specialized, user-friendly financial services. A prominent example is Pump.Fun, a Solana-based dApp that achieved a record $5.3 million in daily fees in August 2024—surpassing even the L1 Solana network it operates on. By enabling retail users to create tokens, especially meme coins, it capitalized on surging demand to drive revenue growth, demonstrating how tailored services can outperform the blockchains they rely on.

As shown in the figure above, Web3 introduces a shift in value accumulation, where both protocol and application layers capture value in distinct ways. Protocols, such as L1 blockchains, generate fees not only from direct user interactions but also from dApp activity built atop them. On the other hand, dApps derive value from direct engagement with end users—often through specialized services.

Although protocols may access broader revenue streams, the potential for dApps to charge higher fees for dedicated products adds complexity to determining which layer captures more value.

Outlook and Conclusion

In conclusion, while the Fat Protocol thesis originally suggested that value in Web3 would reside predominantly within foundational L1 protocols, recent developments reveal a shift toward a more integrated model. Similar to Web2, where applications independently captured substantial value apart from their underlying protocols, Web3 now sees decentralized applications (dApps) effectively leveraging retail demand and managing complex transactions. Both the Fat Protocol and Fat App arguments have merit, and treating either as the dominant model remains debatable. The future of the network will likely be defined by collaboration between foundational technologies and innovative applications built upon them, suggesting that value will emerge from their interaction.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News